- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

7 common trading mistakes and how you can avoid them

By HDFC SKY | Updated at: Apr 3, 2025 01:49 PM IST

Summary

We have often heard saying ‘human error’, meaning it is human tendency to make mistakes. This applies to the investors and traders in the financial markets as well and sometimes such mistakes can cause huge financial losses or restrict the capabilities to generate returns.

Not just new traders, even seasoned hands can make errors in their trades. But rather than getting intimidated you must learn from these mistakes and try to avoid them to be successful in the markets. Here’s a list of such common mistakes that you can avoid.

1. Lack of a Plan

The most important thing before commencing trading is to have a proper trading plan. As a trader you must begin to plan by setting up goals, considering capital to invest, risk appetite, time period, and types of trades, among other things.

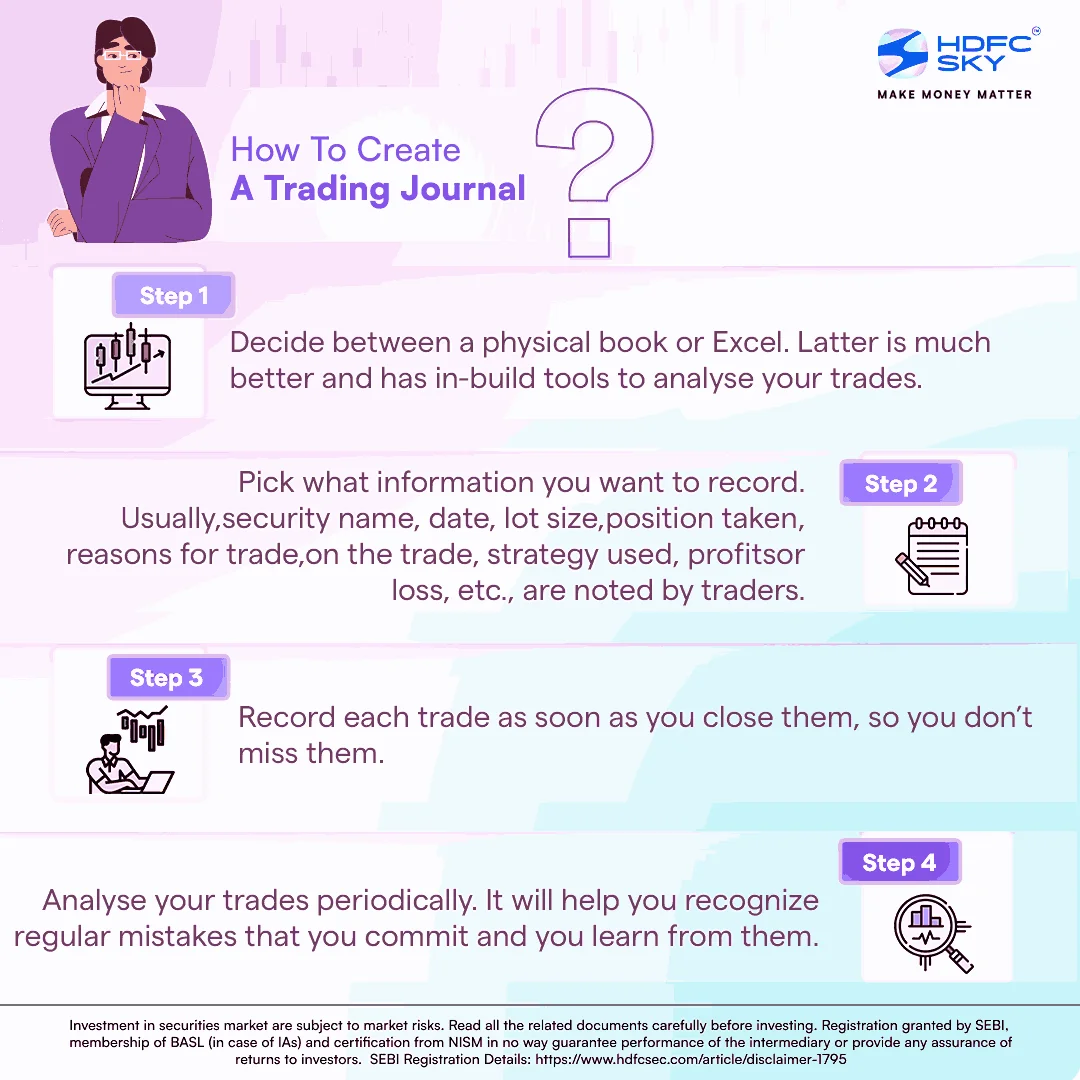

A well-defined trading plan acts as your blueprint. You must keep a record of the successful and unsuccessful trades and try to fully understand why a particular decision went wrong. This will not just help you figure out where you went wrong but will keep you cautious in future.

2. Less Research

Another mistake that you can make as a trader is starting off without proper research. It is very essential to understand the market you are trading in. Before investing in stocks or any other financial instruments, you have thoroughly research them.

Taking a position in a stock should be done only after understanding its historical performance/chart reading and researching the company’s fundamentals. This will help you make informed decisions and avoid unsafe bets.

3. Trading with emotions

Humans are emotional beings. You may sometimes get overexcited or overconfident due to several profitable trades or feel devastated by minor losses. Bringing emotions into trading can be harmful and may impact decisions.

Hence, trading behaviour should not be dictated by emotions. Just because you feel like doing so, you should not rush into taking some market positions that you would not normally take. You must think objectively before making any trading decisions and avoid emotional investments.

4. Keeping all eggs in one basket

Naïve traders generally fall prey to this mistake of investing heavily in one asset or a stock. Over exposure or investing all your capital in just one particular asset or market can be highly risky.

In the stock market, a trader needs to diversify his investment and create a strong portfolio of multiple stocks from different sectors which will protect him from market volatility and help normalise returns when different asset classes perform different.

5. Not placing stop losses

Some traders make a grave mistake of letting their losing trades run in hope that the trend will change and they will ultimately make a profit. However, they may end up wiping out all their profit from other trades if they fail to cut losses at an appropriate time.

Hence, it is advisable you trade with a stop-loss order that squares off a position at a predetermined price when the trade moves against the required direction. This minimises the risks and caps the losses before they become sizable. Stop loss orders are better explained in chapter number 10.9 – Trailing Stop Loss.

6. High leverage

Leverage means taking loans to raise positions in the market. You can gain higher exposure in the market with less money through leveraging. However, it is known that leverage is a double-edged sword. It may amplify gains but can also make huge losses.

Traders taking overexposure in the market with high leverage can suffer heavy losses if the market does not move in the desired direction. Hence, it becomes very important to understand the implications of a leveraged position.

7. Blindly following the crowd

New or inexperienced traders generally make the common mistake of blindly following the crowd and then making bad trading decisions for themselves. They might run after hot stocks or stocks which are trending for no solid reasons. Jumping into some trades just because other people doing so and that too without proper fundamental or technical research may prove to be fatal.