- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

A One Steels India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

A One Steels India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

A One Steels India Limited IPO

Established in 2009, A-One Steel Group has emerged as a leading steel producer in South India. Guided by the vision of ‘Rashtra Nirman Mein Samarpit’, the company strives to contribute to national development through world-class products. Strategic planning and innovation have enabled it to become an integrated organization. With a production capacity of 1.5 million tonnes, it leads in steel manufacturing while prioritizing sustainability, fulfilling over 90% of its energy needs through solar, wind, and WHRB power. Expanding globally, it now operates in over 15 countries and actively supports local communities through health and education initiatives.

A One Steels India Limited IPO Overview

A-One Steels IPO is a book-building issue of ₹650.00 crores, consisting of a fresh issue of ₹600.00 crores and an offer for sale of ₹50.00 crores. The IPO dates and price band are yet to be announced, and the allotment is expected to be finalised soon. PL Capital Markets Private Limited and Khambatta Securities Limited are the book-running lead managers, while Bigshare Services Pvt Ltd is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹10 per share. The pre-issue shareholding stands at 6,84,65,270 shares. Investors can refer to the A-One Steels IPO Draft Red Herring Prospectus (DRHP) and its addendum filed with SEBI on April 24, 2025, for detailed information. The promoters of the company are Sandeep Kumar, Sunil Jallan, and Krishnan Kumar Jalan, holding 85.86% stake before the issue.

A One Steels India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹600 crore

Offer for Sale (OFS): ₹50 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,84,65,270 shares |

| Shareholding post -issue | TBA |

One Steels India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

A One Steels India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

A One Steels India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.64 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 9.13% |

| Net Asset Value (NAV) | 72.80 |

| Return on Equity | 9.42% |

| Return on Capital Employed (ROCE) | 10.45% |

| EBITDA Margin | 5.18% |

| PAT Margin | 1.01% |

| Debt to Equity Ratio | 2.34 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Equity Investment in Indian Subsidiary of the Company, Vanya Steels Private Limited for purchase of equipment /machineries and civil works for expansion of facility | 34,437 |

| Equity Investment in Indian Subsidiary of the Company, Vanya Steels Private Limited for investment in Group Captive Companies for procurement of Solar energy | 4,000 |

| Pre-payment or partial re-payment of a portion of certain outstanding borrowings availed by the Company | 10,000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

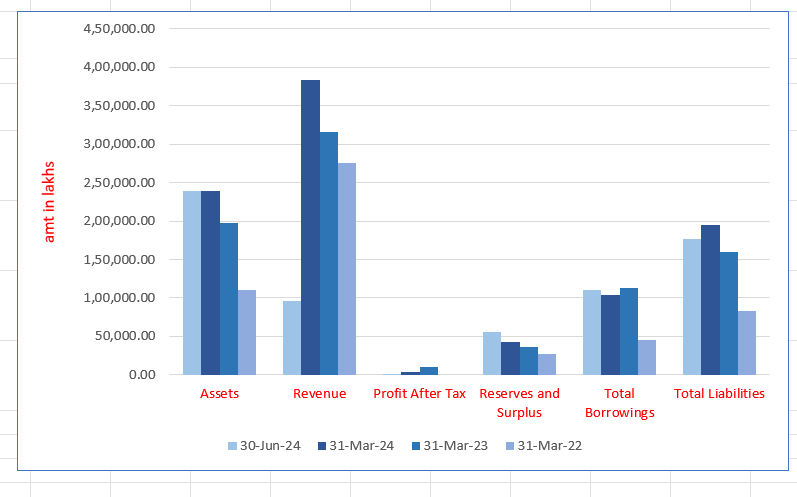

A One Steels India Limited Financials (in lakhs)

| Particulars | 30 June 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2,38,724.17 | 2,39,587.15 | 1,97,389.79 | 1,10,792.61 |

| Revenue | 95,460.78 | 3,83,421.25 | 3,16,351.92 | 2,75,683.64 |

| Profit After Tax | 1618.25 | 3891.37 | 9769.66 | 10.065.03 |

| Reserves and Surplus | 55,416.34 | 42,343.08 | 36,424.73 | 26,636.12 |

| Total Borrowings | 1,09,878.16 | 1,04,252.88 | 1,12,604.07 | 45,999.12 |

| Total Liabilities | 1,76,348.94 | 1,95,095.94 | 1,59,291.34 | 82,482.77 |

Financial Status of A One Steels India Limited

SWOT Analysis of A One Steels India IPO

Strength and Opportunities

- Leading steel producer in South India.

- State-of-the-art technology and infrastructure.

- Focus on sustainability with significant green energy generation.

- Experienced leadership driving strategic planning and innovation.

- Expansion into international markets, currently present in over 15 countries.

- Strong social responsibility initiatives in health and education.

- Increasing demand for steel in construction and infrastructure sectors.

- Potential for further expansion in renewable energy projects.

- Opportunities for collaborations and partnerships in global markets.

Risks and Threats

- Exposure to market fluctuations impacting profitability.

- High capital expenditure requirements for technological advancements.

- Dependence on raw material availability and price volatility.

- Competition from other established steel manufacturers.

- Regulatory challenges in different operational regions.

- Environmental concerns leading to stricter compliance requirements.

- Economic downturns affecting steel demand and revenue.

- Rising operational costs due to inflation and energy expenses.

- Geopolitical risks affecting international trade and supply chain.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About A One Steels India Limited IPO

More About A One Steels India Limited

A One Steels India Limited is a backward-integrated steel manufacturer based in southern India. The company offers long and flat steel products along with industrial products used in steel manufacturing.

Market Position

- Among the top five steel producers in southern India by crude steel capacity.

- The only company manufacturing 10 different steel and industrial products.

- Holds a 0.27% share in India’s crude steel production.

- Accounts for approximately 1% share in the domestic pipe market.

Product Portfolio

Flat Steel Products

- Hot Rolled (HR) Coils

- Cold Rolled (CR) Coils

- HR Pipes

- CR Pipes

- Galvanized Tubes and Pipes

Long Steel Products

- TMT Bars (Fe 550 D CRS, Fe 500 D CRS, Fe 550 CRS) in sizes 8mm to 32mm

- Certified as a Green Product by CII – Green Products and Services Council

Industrial Products

- Met Coke

- Silicon Manganese/Ferro Silicon(Source: CRISIL Report)

Energy Sourcing and Sustainability Initiatives

Green Energy Consumption

- Long-term solar and wind power purchase agreements with a fixed base tariff of ₹3.0 – ₹5.0 per KWh

- Renewable energy contribution (Fiscal 2024): 86.98%

- Setting up a 10 MW Waste Heat Recovery Boiler (WHRB) power plant (Fiscal 2025)

Manufacturing Facilities

Locations

Six plants in Karnataka (Gauribidanur, Bellary, Koppal, Chikkantapur) and Andhra Pradesh (Hindupur).

Backward Integration Advantage

- Iron ore processed into sponge iron → MS Billets → TMT Bars, HR Coils, CR Coils, HR Pipes, CR Pipes, and Galvanized Tubes & Pipes

- Ensures cost efficiency and product flexibility

Expansion Plans

- Iron Ore Beneficiation Plant (300,000 MTPA) at Koppal (Fiscal 2026)

- Stainless Steel Wire Rods Production at Koppal

- Railway Siding Line under development

Technology and Manufacturing Excellence

- Uses Thermex technology from Germany for TMT bar production

- Employs Induction Furnace Route/Electric Arc Furnace (EAF) for steel production

- Commitment to sustainable manufacturing through energy-efficient processes

Industry Outlook

India Steel Market Growth Outlook (2024-2030)

Market Size & Growth Rate

- Expected to grow from USD 102.67 billion in 2024 to USD 166.96 billion by 2030.

- CAGR (Compound Annual Growth Rate): 8.28%.

- Driven by infrastructure development, urbanization, and industrial expansion.

Production Volume Expansion

- Production to increase from 148.28 million tons (2025) to 230.03 million tons (2030).

- CAGR of 9.18% in production capacity.

- Growth led by demand in construction, automotive, and manufacturing.

Government Initiatives Boosting Demand

- National Infrastructure Pipeline (NIP): Over $1.4 trillion investment in infrastructure by 2025.

- Policies supporting Make in India and self-reliance in steel production.

- Focus on reducing steel imports and enhancing domestic production.

Sponge Iron and MS Billets

- Market Size and Growth: India’s steel market is projected to reach USD 154.75 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030.

- Demand Drivers: Infrastructure development and urbanization are key factors boosting demand for raw materials like sponge iron and MS billets.

TMT Bars

- Construction Sector Growth: The building and construction industry remains the largest consumer of steel, driven by government-backed infrastructure projects.

- Urbanization Impact: Rapid urbanization necessitates robust construction activities, increasing the demand for TMT bars.

HR and CR Coils

- Industrial Applications: Used extensively in manufacturing sectors, including automotive and heavy machinery.

- Market Expansion: The steel pipes and tubes market, reliant on HR and CR coils, is expected to grow at a CAGR of 6.43% between 2024 and 2030, reaching USD 37.69 billion by 2030.

Steel Pipes (HR, CR, GP)

- Market Size and Growth: The steel pipes and tubes market in India is projected to reach USD 17.6 billion by 2030, with a CAGR of 5.8% from 2024 to 2030.

- Sector Demand: Oil and gas, construction, and water transportation sectors are primary consumers, driving demand for various steel pipes.

Coke and Ferro Alloys

- Steel Production Dependency: Essential inputs in steel manufacturing, with demand closely tied to overall steel production volumes.

- Production Trends: India’s crude steel production increased by 4.5% to 124.9 million tons during April to January of the current financial year

How Will A One Steels India Limited Benefit

- Market Growth & Production Expansion: India’s steel market is projected to reach USD 166.96 billion by 2030, with crude steel production rising to 230.03 million tons. A One Steels can capitalize on this demand surge.

- Government Support & Infrastructure Boom: Policies like Make in India and the $1.4 trillion National Infrastructure Pipeline will boost domestic steel demand, reducing imports and enhancing A One Steels’ market position.

- TMT Bars & HR/CR Coils Demand: Rapid urbanization and infrastructure projects will increase demand for TMT bars, HR, and CR coils, ensuring strong revenue growth for A One Steels.

- Steel Pipes & Raw Material Growth: The steel pipes market, expected to hit USD 17.6 billion by 2030, and growing demand for sponge iron and MS billets will strengthen A One Steels’ supply chain and sales.

- Sustainability & Expansion: With 86.98% renewable energy usage, a WHRB power plant, and backward integration, A One Steels will achieve cost efficiency, enhanced margins, and long-term competitiveness.

Peer Group Comparison

| Name of Company | Face Value

(₹) |

Total Income (in ₹ lakhs) | EPS (₹) | NAV (₹) | P/E | RONW (%) |

| A-One Steels India Limited | 10 | 3,86,243.86 | 6.64 | 72.80 | [●] | 9.13 |

| Peer Group | ||||||

| MSP Steel and Power Limited | 10 | 2,91,226.31 | 0.37 | 13.99 | 132.00 | 2.46 |

| Jai Balaji Industries Ltd. | 10 | 6,62,886.69 | 55.80 | 89.59 | 18.25 | – |

| Shyam Metallics and Energy Ltd. | 10 | 13,35,420.00 | 39.54 | 395.63 | 18.67 | 11.52 |

Key Insights

- Face Value: All companies in the table have a uniform face value of ₹10 per share. While face value remains constant, it primarily serves as a base for valuation and does not impact market price directly.

- Total Income: A-One Steels India Limited reported a total income of ₹3,86,243.86 lakhs. Compared to its peers, it stands higher than MSP Steel but significantly lower than Jai Balaji Industries and Shyam Metallics, which lead with ₹13,35,420 lakhs.

- Earnings Per Share (EPS): A-One Steels has an EPS of ₹6.64, which is significantly higher than MSP Steel’s ₹0.37 but much lower than Jai Balaji Industries’ ₹55.80 and Shyam Metallics’ ₹39.54. A higher EPS indicates better profitability per share.

- Net Asset Value (NAV): With an NAV of ₹72.80, A-One Steels ranks higher than MSP Steel’s ₹13.99 but lower than Jai Balaji Industries’ ₹89.59 and Shyam Metallics’ ₹395.63. A higher NAV often reflects stronger asset backing.

- Price-to-Earnings Ratio (P/E): A-One Steels’ P/E ratio is not provided, but MSP Steel has an exceptionally high P/E of 132.00. Comparatively, Jai Balaji Industries and Shyam Metallics have moderate P/E ratios of 18.25 and 18.67, respectively.

- Return on Net Worth (RONW): A-One Steels’ RONW stands at 9.13%, higher than MSP Steel’s 2.46% but lower than Shyam Metallics’ 11.52%. Jai Balaji’s RONW is unavailable. A higher RONW indicates better returns for shareholders.

A One Steels India Limited IPO Strengths

- One of the largest backward integrated steel products manufacturers in southern India

The company is among the top five steel producers in southern India. It manufactures ten steel and industrial products, leveraging six facilities. Its diverse portfolio minimizes reliance on single products, ensuring stable revenue streams and market competitiveness.

- Business operations capitalizing on the strategic location advantage

The company benefits from manufacturing facilities positioned near raw material sources. This proximity lowers transportation costs, enhances logistics management, and improves operating margins. Its plants are well connected by rail and roads, ensuring efficient supply chain operations and cost-effective distribution to customers.

- Widespread, well-connected distribution network with presence across multiple channels

The company has a robust distribution network comprising over 80 authorized distributors and numerous direct customers. Its multi-channel approach enables penetration into diverse markets, ensuring widespread product availability and customer reach across various regions, strengthening market presence and competitive positioning.

- Vertically integrated manufacturing process ensuring cost efficiency and quality control

A fully integrated production model allows control from raw material procurement to final product distribution. This integration optimizes operational efficiency, ensures product quality, reduces dependency on external suppliers, and shortens delivery timelines, resulting in enhanced customer service and profitability.

- Diversified product portfolio reducing reliance on any single product category

The company manufactures a variety of long and flat steel products, alongside industrial products. This diversification mitigates market volatility risks, ensures revenue stability, and allows adaptability to changing market demands, making the business more resilient and customer-centric.

- Strategic acquisitions and expansion for increased production capacity

The company has expanded its capacity by acquiring distressed plants and revitalizing them into profitable units. These acquisitions have significantly increased production capacity for TMT bars, sponge iron, billets, and ferro alloys, supporting growth and enhancing captive power generation capabilities.

- Strong financial performance and sustainable growth strategy

The company has demonstrated consistent revenue growth, supported by increasing production capacity and operational efficiencies. With a diversified customer base, no single client contributes over 7% of revenue, ensuring reduced risk exposure and sustainable long-term financial stability.

- Commitment to innovation, quality enhancement, and brand development

By integrating customer feedback, the company drives product innovation and quality improvement. Focus on brand value, enhanced manufacturing capabilities, and a customer-centric approach strengthens its market reputation, positioning it as a preferred choice in the steel and industrial product sector.

Key Strategies for A One Steels India Limited

- Expanding Product Portfolio and Strengthening Nationwide Presence

Since its inception in 2012, the company has evolved from manufacturing two steel products to offering ten, supported by six manufacturing facilities. With expertise across the steel value chain, it plans further expansion, introducing high-margin products to capture emerging market opportunities.

- Expanding Production Capacity and Enhancing Operational Efficiency

The company operates six manufacturing facilities, with five in Karnataka and one in Andhra Pradesh. Since 2012, it has steadily expanded production capacity, reaching 14,97,100 MTPA in Fiscal 2024. Future plans include facility upgrades, advanced technology integration, and increased manufacturing capacity.

- Expanding Customer Base and Strengthening Market Presence

With India emerging as a manufacturing hub, the company aims to expand its customer base by strengthening existing relationships and acquiring new contracts. Efforts include increasing product offerings, optimizing supply chains, and enhancing backward integration. Investments in innovation and international sales growth will further drive market expansion.

- Strengthening Brand Presence

The company continues to enhance brand visibility through multi-channel marketing, including digital, print, and outdoor campaigns. Direct engagement with industry stakeholders, participation in trade fairs, and strategic branding initiatives drive market expansion and customer trust.

- Inorganic Growth Through Strategic Acquisitions

The company actively seeks opportunities to acquire financially distressed firms in the steel sector. By revitalizing underutilized assets and optimizing operations, these acquisitions enhance market presence, expand capacity, and drive profitability.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the size and structure of the A-One Steels India IPO?

The IPO aims to raise ₹650 crore, comprising a ₹600 crore fresh issue and a ₹50 crore offer-for-sale by promoters.

When are the expected IPO opening and closing dates?

The IPO is tentatively scheduled to open on April 2, 2025, and close on April 4, 2025.

What is the primary objective of the IPO proceeds?

Funds will be utilized for expanding manufacturing facilities and reducing debt.

Who are the lead managers and registrar for the IPO?

PL Capital Markets Pvt Ltd and Khambatta Securities Ltd are the lead managers; Bigshare Services Pvt Ltd is the registrar.

When is the expected listing date for A-One Steels India shares?

The shares are expected to be listed on April 9, 2025, on both BSE and NSE.