- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aarvee Engineering Consultants IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Aarvee Engineering Consultants IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Aarvee Engineering Consultants Limited

Aarvee Engineering Consultants Limited is a technology-driven, multi-disciplinary infrastructure consultancy with a global footprint. The company offers end-to-end services across the project lifecycle, including feasibility studies, detailed project reports, design, project management consultancy, supervision, third-party inspection, and lenders engineering services. Serving both public and private clients, Aarvee has worked with entities such as NHAI, MoRTH, Indian Railways, Tata Projects, and Greenko Energies. With over 2,750 projects completed across 20 countries, including 98 overseas projects in the past three years, it operates through three Indian and two international subsidiaries.

Aarvee Engineering Consultants Limited IPO Overview

Aarvee Engineering Consultants Ltd. has submitted its Draft Red Herring Prospectus (DRHP) to SEBI on 25 September 2025, signalling its intention to raise capital through an Initial Public Offering (IPO). The proposed IPO will follow the Book Building route and comprises a fresh issue worth ₹250 crore along with an Offer for Sale (OFS) of up to 0.68 crore equity shares. The company plans to list its shares on both the NSE and BSE. While Kfin Technologies Ltd. has been appointed as the registrar of the issue, the book running lead manager is yet to be announced. Key IPO details, including the price band, dates, and lot size, are currently pending.

The equity shares have a face value of ₹10 each, and the IPO will involve a combination of fresh capital and an OFS. The company’s pre-issue shareholding stands at 4,30,94,812 shares, with promoters Venkatachala Chakrapani Redla and Sneha Redla holding 95.33% before the IPO. Post-issue promoter holding details will be available once the IPO is launched. For complete information, interested investors can refer to the Aarvee Engineering Consultants IPO DRHP.

Aarvee Engineering Consultants Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹250 crore |

| Offer for Sale (OFS) | 0.68 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,30,94,812 shares |

| Shareholding post-issue | TBA |

Aarvee Engineering Consultants IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Aarvee Engineering Consultants Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Aarvee Engineering Consultants Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹12.28 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.05% |

| Net Asset Value (NAV) | ₹56.76 |

| Return on Equity (RoE) | 24.08% |

| Return on Capital Employed (RoCE) | 34.54% |

| EBITDA Margin | 16.65% |

| PAT Margin | 8.98% |

| Debt to Equity Ratio | 0.24 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment and/ or pre-payment, in full or in part, of certain outstanding borrowings availed by the Company | 760 |

| Investment in SRA OSS | 219.7 |

| Investment in Overseas Subsidiaries: Investment in Aarvee Engineering Consultants Pty Ltd | 348.1 |

| Investment in Aarvee Associates Limited | 208.8 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

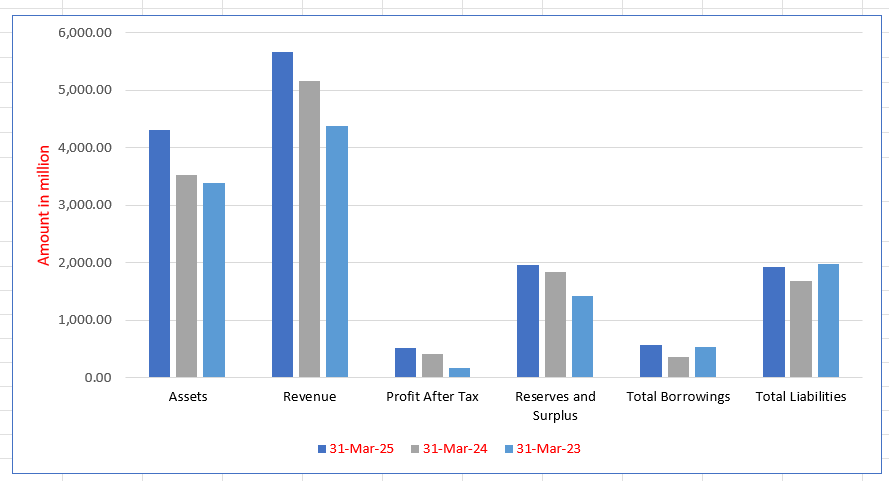

Aarvee Engineering Consultants Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,305.71 | 3,534.58 | 3,394.55 |

| Revenue | 5,671.32 | 5,170.01 | 4,381.42 |

| Profit After Tax | 515.95 | 408.55 | 180.81 |

| Reserves and Surplus | 1,963.76 | 1,841.74 | 1,419.58 |

| Total Borrowings | 565.49 | 365.83 | 539.87 |

| Total Liabilities | 1,922.95 | 1,692.84 | 1,975.00 |

Financial Status of Aarvee Engineering Consultants Limited

SWOT Analysis of Aarvee Engineering Consultants IPO

Strength and Opportunities

- Strong domain expertise across infrastructure sectors such as railways, roads and environment.

- Established track record with a diversified service portfolio and geographies including UK, Australia and Middle East.

- Healthy orderbook giving medium term revenue visibility.

- Use of advanced technologies (digital engineering, smart infrastructure) offers opportunity for differentiation.

- Expansion into international markets offers growth and diversification potential.

- Strong human capital and technical teams capable of high quality project delivery.

- Sustainability and ESG focus align with future infrastructure priorities and government policy.

- Strategic use of IPO proceeds to expand subsidiaries and service offerings gives future growth runway.

- Strong brand reputation in the infrastructure consulting domain enhances client confidence and bids.

Risks and Threats

- Heavy client concentration: top 10 clients accounted for ~57%77% of revenue in recent years.

- Dependence on sectoral growth in infrastructure; downturns or policy shifts could hit business.

- Intense competition from established players in infrastructure consultancy may pressure margins.

- Working capital cycle pressures and receivable risks due to long gestation projects.

- Foreign business operations expose the company to currency, regulatory and geopolitical risks.

- Leverage and borrowings pose risk if order execution slows or cash flows weaken.

- Potential project cancellations or delays (especially in public sector contracts) could materially affect performance.

- Dependency on a limited number of infrastructure segments (e.g., railways & metro) leads to exposure to sector specific risks.

- Regulatory changes, stricter prequalification criteria or government policy shifts may reduce bidding opportunities.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Aarvee Engineering Consultants Limited

Aarvee Engineering Consultants Limited IPO Strengths

Comprehensive Multidisciplinary Project Execution

Aarvee Engineering Consultants Limited demonstrates deep, progressive experience in project execution nationally and internationally, providing a keen understanding of client needs, regulatory environments, and implementation challenges across the project lifecycle. This capability allows the firm to successfully undertake complex, high-value, multi-disciplinary infrastructure projects such as smart cities and high-speed rail corridors, reflecting extensive domain knowledge from planning and feasibility to construction supervision.

Integrated Vertical Capabilities and Quality Control

Aarvee’s strength is magnified by cross-sector experience, facilitating the delivery of innovative, holistic, and resilient cross-functional designs. A key differentiator is the strategic decision to build robust in-house capabilities for critical field investigations, like topographic and geotechnical surveys. This vertical integration, combined with advanced digital tools, ensures superior data integrity, expedited design translation from raw field data, and utmost control over project quality and timelines.

End-to-End Technical Expertise and Field Proficiency

The company has meticulously focused on developing its technical expertise to provide end-to-end consultancy services across diverse sectors and disciplines. A strong capability in advanced field expertise, including aerial surveying (LiDAR and drone-based data acquisition), is vital for large-scale planning. Furthermore, Aarvee operates an NABL-accredited material testing laboratory, facilitating speed and efficiency in operations by ensuring timely and reliable testing of materials and soil samples.

Strong Track Record and Marquee Project Delivery

Aarvee Engineering Consultants Limited boasts a proven history of executing varied design and Project Management Consultancy (PMC) contracts across multiple infrastructure sectors, including Rail & Metro Rail, Roads & Bridges, and Water Resources, spanning India and 16 international countries. The firm’s acknowledged domain knowledge has secured unique, marquee projects such as the high-speed rail network and the Amaravati Capital city project, validating its ability to deliver complex, large-scale projects with precision.

Investment in Deep Technical Talent Pool

Aarvee has a strong foundation of technical expertise across civil, structural, geotechnical, and digital engineering, developed through a meticulous talent development strategy. As of June 2025, 74.83% of its 3,505 employees possessed engineering expertise, including 11 PhDs and over 2,200 post-graduate or bachelor’s degree holders. The company utilizes a rigorous hiring process and continuous learning ecosystem to nurture and upskill professionals, ensuring high-quality, multidisciplinary solutions.

Long-Standing Relationships with Government Clients

The company attributes its success and repeat orders to the consistent quality of its work and demonstrated expertise, fostering long-standing relationships with key government and government-related entities like NHAI, MoRTH, and RVNL. Aarvee has worked for these critical clients for up to 27 years. This successful execution track record, generating goodwill and favorable pre-qualification credentials, positions the firm advantageously in technical-score-based competitive bidding.

Experienced and Technical Promoters and Leadership

Aarvee’s operations are guided by experienced Promoters and a competent Management team with deep domain knowledge. The founding promoter, an IIT Madras alumnus, leads strategic growth and innovation, while other Executive and Whole-Time Directors, many with post-graduate technical degrees and over 16 years of tenure, oversee different business verticals. This strong, technically-qualified leadership team drives the company’s evolution and delivery excellence.

Consistent Financial Performance and Growth

Aarvee Engineering Consultants Limited has demonstrated a track record of consistent financial performance and growth. The company’s revenue from operations has grown at a CAGR of 14.22% between Fiscal 2023 and Fiscal 2025. Over the same period, its Profit After Tax (PAT) has significantly grown at a CAGR of $68.91\%$, reflecting its efficiency and core strength in delivering at scale while maintaining quality, time, and cost optimization.

More About Aarvee Engineering Consultants Limited

Aarvee Engineering Consultants Limited is a technology-driven, multi-sectoral, and multi-disciplinary infrastructure consultancy with a strong global presence. As of June 30, 2025, the company had successfully executed over 2,750 projects, including those from the proprietorship firm acquired in 2007, spanning multiple sectors and 20 countries across Asia, Africa, Australia, and Europe.

Comprehensive Service Portfolio

Aarvee provides end-to-end services across the entire project lifecycle, including:

- Feasibility studies and detailed project reports (DPR)

- Pre-bid services and detailed design

- Project management consultancy (PMC)

- Supervision of operations and maintenance

- Third-party inspection and lenders engineering services

The company’s multidisciplinary approach, combined with advanced technologies and industry best practices, enables innovative and sustainable solutions for complex infrastructure projects.

Sector Expertise

- Railways & Metro Rail: Consulting solutions cover passenger and freight rail, high-speed rail, metro, light rail, and rapid transit systems, including civil engineering, structural engineering, signalling, telecommunication, electrification, and operational simulations. Projects have been executed in India, Australia, Bangladesh, Nepal, Saudi Arabia, and the UK.

- Roads & Bridges: Services encompass design, supervision, operations, and maintenance of highways, expressways, rural and urban roads, elevated corridors, and signature bridges. Projects include PPP, BOT, DBFOT, HAM, EPC, and performance-based contracts, with overseas work in Botswana, Kenya, Mozambique, and Zambia.

- Environment, Water Supply & Sanitation: Provides consulting for water supply, wastewater management, stormwater drainage, solid waste management, environmental impact assessments, and climate adaptation.

- Water Resources & Irrigation: Engaged in planning, design, and project management for irrigation, flood management, command area development, and hydrological modeling. Projects extend to Uganda and Bangladesh.

Other sectors include geospatial, power, ports, urban planning, architecture, airports, ropeways, and digital engineering.

Operational Highlights and International Presence

As of June 30, 2025, Aarvee’s order book stood at ₹22,748.66 million, with the top 10 ongoing projects valued at ₹10,709.79 million. International operations span 20 countries, executed directly or via subsidiaries in Australia and the UK. The company also undertakes joint ventures for high-value projects such as the Chennai Metro Rail Project-Phase 2 and the Mumbai-Ahmedabad High-Speed Rail Project.

Leadership and Financial Performance

Aarvee is led by founders Venkatachala Chakrapani Redla and Sneha Redla, supported by experienced executive directors and a skilled management team. From Fiscal 2023 to Fiscal 2025, revenue grew at a CAGR of 14.22% to ₹5,671.32 million, while profit after tax rose at a CAGR of 68.91% to ₹515.95 million.

Industry Outlook

India’s overall infrastructure sector is expected to expand significantly in the coming years. The market is forecast to grow from approximately US$190.7 billion in 2025 to US$280.6 billion by 2030, registering a CAGR of around 8.0%. For the broader construction market, growth is projected from US$1.04 trillion in 2024 to US$2.13 trillion by 2030, at a CAGR near 12.1%.

Specific Outlook for Consultancy / Engineering Services

Within this landscape, engineering, procurement, and construction management (EPCM) and infrastructure consultancy services offer higher growth potential:

- The Indian EPCM market is valued at about US$69.3 billion in 2025, projected to reach US$105.96 billion by 2030 (CAGR ~8.9%).

- Infrastructure maintenance & repair services had a size of US$202.36 billion in 2024, expected to hit US$538.81 billion by 2033, growing at a CAGR of ~10.6%.

- The engineering consultancy component may grow at a CAGR of ~9.4%, from around US$3.9 billion in 2021 to US$5.8 billion by 2031.

Growth Drivers

Key factors driving the sector include:

- Strong government investment through the National Infrastructure Pipeline, encompassing thousands of projects across roads, rail, urban infrastructure, water, and sanitation.

- Transportation-led infrastructure: the transport segment (roads, rail) accounts for ~38% share of the market, with railways projected to grow fastest (~8.4% CAGR to 2030).

- Urbanisation and smart-city initiatives increase demand for design, supervision, and consulting services.

- Growing role of public-private partnerships and private capital in infrastructure boosts consultancy opportunities.

Key Figures and Values

- Over 9,142 projects under the National Infrastructure Pipeline, nearly half in transportation and roads & bridges.

- Transportation construction segment: market size ~US$74.33 billion in 2025, expected to reach ~US$108.01 billion by 2030 (CAGR ~7.8%).

- Smart infrastructure services: market size in India was US$6.81 billion in 2024, forecast to reach US$48.35 billion by 2033 (CAGR ~22.5%).

Implications for Consultancy Players

Companies operating in multi-sector infrastructure consultancy—covering roads, rail, water, and environment—are well-positioned to benefit from increasing project pipelines, higher demand for end-to-end design and supervision services, and technology-enabled consulting solutions. The relative premium growth in consultancy services (8–10%+) compared to general construction (~6–8%) highlights a promising growth opportunity.

How Will Aarvee Engineering Consultants Limited Benefit

- Increased government spending on infrastructure projects will expand the pipeline for consultancy services.

- Growth in transportation infrastructure, including roads, railways, and metro projects, aligns with Aarvee’s core service offerings.

- Rising demand for smart-city and urban infrastructure initiatives creates opportunities for technology-enabled design and supervision services.

- Expansion of public-private partnership projects provides higher-value contracts and long-term engagements.

- International and cross-border projects are likely to grow with India’s participation in global infrastructure initiatives, supporting Aarvee’s overseas operations.

- Strong CAGR in engineering consultancy indicates potential for revenue and profit growth in core services like PMC, DPR, and supervision.

- Increasing focus on water, sanitation, and irrigation projects enhances opportunities in environmental and water resources consultancy.

- Adoption of digital and sustainable infrastructure solutions allows Aarvee to differentiate its offerings.

Peer Group Comparison

| Name of Company | Face Value (₹) | Total Income (₹ million) | EPS (₹ per share) Basic | EPS (₹ per share) Diluted | NAV (₹ per share) | P/E | ROE (%) |

| Aarvee Engineering Consultants Limited | 105,743.08 | 12.28 | 12.28 | 56.76 | [●] | TBD | 21.23% |

| Peer Group | |||||||

| RITES Limited | 10 | 23,235.20 | 8.01 | 8.01 | 57.20 | 33.03 | 15.49% |

| Engineers India Limited | 10 | 32,478.44 | 10.32 | 10.32 | 47.49 | 20.12 | 23.59% |

Key Strategies for Aarvee Engineering Consultants Limited

Strategic International Expansion and Revenue Augmentation

Aarvee Engineering Consultants Limited is pursuing a dual-market approach to deepen its international presence and revenue. The firm targets high-growth Asian and African economies by pursuing multilateral-funded infrastructure work and expanding into new sectors. In mature economies like Australia and the UK, the strategy focuses on building strong local teams and partnerships to ensure compliance and multi-sectoral growth.

Prioritizing High-Value and Technically Complex Projects

The company is strategically shifting its focus toward complex, high-value, and technically demanding infrastructure projects. This includes large-scale assignments in high-speed rail, cable-stayed bridges, and pumped storage hydropower. This focus strengthens the order book with high-margin contracts, reinforces brand equity as a trusted advisor, and creates downstream opportunities across the full project lifecycle.

Enhancing Digital Solutions and Geospatial Services

Aarvee plans to expand its service range, with a particular focus on digital engineering and geospatial solutions. The strategy involves deepening capabilities in GIS, LiDAR, and BIM for data-driven planning, precision design, and asset management. This integration, including advanced 3D modeling and real-time monitoring tools, aims to enhance project efficiency, precision, and value delivery across all sectors.

Augmenting Presence in Emerging and Climate-Resilient Sectors

The firm intends to augment its presence in high-potential, emerging sectors, aligning with India’s sustainability and climate resilience goals. This includes actively pursuing renewable energy projects (solar, wind, storage) and climate-resilient infrastructure. The company also seeks to grow its client base in sectors like mining, leveraging multidisciplinary expertise for complex, sustainability-oriented projects.

Leveraging Core Relationships with Institutional Clients

A core pillar of the strategy is leveraging the company’s strong, long-standing relationships with key central and state government entities (like NHAI and RVNL) and multilateral agencies (like World Bank and ADB). Aarvee uses its proven track record and prequalification status to secure high-value assignments under national flagship programs, ensuring sustained order book visibility and revenue stability.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs Aarvee Engineering Consultants Limited IPO

How can I apply for Aarvee Engineering Consultants Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Aarvee Engineering Consultants IPO?

It is a book-building IPO with fresh issue and Offer for Sale of equity shares.

When will the Aarvee IPO be listed?

The IPO is proposed to be listed on BSE and NSE; exact listing dates are yet to be announced.

How much is Aarvee raising through the IPO?

The company plans to raise ₹250 crore through fresh issue and 0.68 crore shares via OFS

What are the objectives of the Aarvee IPO?

Funds will be used for debt repayment, investments in subsidiaries, and general corporate purposes.

Who are the promoters of Aarvee Engineering Consultants?

Venkatachala Chakrapani Redla and Sneha Redla are the promoters, holding 95.33% pre-IPO shareholding.