- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aastha Spintex IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Aastha Spintex IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Aastha Spintex Limited IPO

Aastha Spintex Ltd. is engaged in manufacturing and trading carded, combed, and compact combed cotton yarns along with cotton bales. Its cotton bales are used for in-house yarn production and supplied to other spinning units. The yarns serve both knitting and weaving applications, catering to diverse products such as denim, shirting, terry towels, sweaters, socks, home textiles, and industrial fabrics. The company operates a semi-automated, integrated spinning and ginning facility at Halvad, Morbi, Gujarat, producing cotton bales and reusing cotton yarn waste effectively within the textile ecosystem.

Aastha Spintex Limited IPO Overview

Aastha Spintex Ltd. submitted its Draft Red Herring Prospectus (DRHP) to SEBI on September 30, 2025, with the intention of raising ₹160.00 crores through an Initial Public Offering (IPO). The proposed IPO will be a Book Build Issue consisting entirely of a fresh issue of shares, with no offer-for-sale component. The company plans to list its equity shares on both the NSE and BSE. BOI Merchant Bankers Ltd. has been appointed as the book running lead manager for the issue, while Bigshare Services Pvt. Ltd. will act as the registrar. Details such as the IPO dates, price band, and lot size are yet to be disclosed. Interested investors can refer to the Aastha Spintex IPO DRHP for comprehensive information.

According to the draft document, the IPO will have a face value of ₹10 per share and will be issued through the bookbuilding route. The total issue size will amount to ₹160.00 crores, comprising new equity shares. The company currently has a pre-issue shareholding of 3,16,42,190 shares. The promoters of Aastha Spintex Ltd. include Patel Divyang Jashwantbhai, Rasiklal Valjibhai Patel, Gothi Vivek Rasiklal, and Jashwantbhai Valjibhai Patel. Their collective shareholding stands at 74.23% before the issue, which will be diluted post-IPO.

Aastha Spintex Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹160 crore |

| Fresh Issue | ₹160 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,16,42,190 shares |

| Shareholding post-issue | TBA |

Aastha Spintex Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Aastha Spintex Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Aastha Spintex Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.50 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 19.32% |

| Net Asset Value (NAV) | ₹44.01 |

| Return on Equity (RoE) | 23.73% |

| Return on Capital Employed (RoCE) | 19.12% |

| EBITDA Margin | 13.37% |

| PAT Margin | 6.69% |

| Debt to Equity Ratio | 0.78 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Part Payment of the purchase consideration for the acquisition of Falcon Yarns Private Limited | 1115.1 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

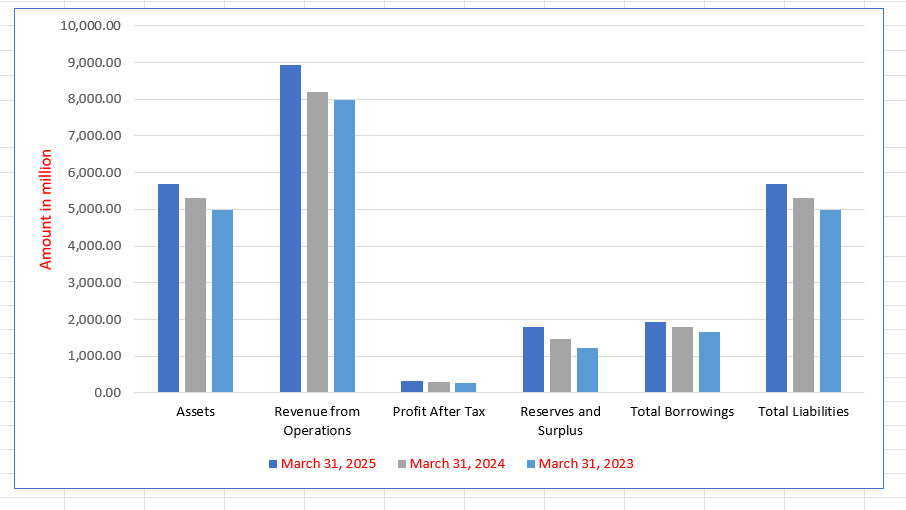

Aastha Spintex Limited Financials (in million)

| Particulars | March 31, 2025 | March 31, 2024 | March 31, 2023 |

| Assets | 5,680.42 | 5,314.78 | 4,987.26 |

| Revenue from Operations | 8,945.63 | 8,210.54 | 7,986.31 |

| Profit After Tax | 325.87 | 289.15 | 256.74 |

| Reserves and Surplus | 1,785.42 | 1,459.26 | 1,213.64 |

| Total Borrowings | 1,924.56 | 1,782.33 | 1,654.47 |

| Total Liabilities | 5,680.42 | 5,314.78 | 4,987.26 |

Financial Status of Aastha Spintex Limited

SWOT Analysis of Aastha Spintex IPO

Strength and Opportunities

- Integrated in-house ginning and spinning enables strong input quality control.

- Modern infrastructure with advanced compact spinning machinery supports premium yarn production.

- Strong sustainability initiatives (solar & wind energy) reduce operational cost and improve eco‐credentials.

- Ability to cater to both knitting and weaving applications broadens end-use market reach.

- Emphasis on sustainable cotton yarn (BCI/organic) taps into growing global demand for eco-friendly textiles.

- Opportunity to scale up exports leveraging global textile supply-chain shifts.

- Strong local employment & women-empowered workforce enhance social brand value and operational stability.

- Linkages across the textile value chain give strategic flexibility (raw material to yarn).

- Government incentives for textile/sustainable manufacturing can support expansion and CAPEX.

Risks and Threats

- High volatility in key raw-material (cotton) prices can squeeze margins.

- The textile industry is highly cyclical and subject to demand swings.

- Fragmented textile market and intense competition limit pricing power.

- Dependence on export markets exposes the company to currency and trade‐policy risks.

- High debt or borrowing levels may affect financial flexibility in downturns.

- Regulatory and compliance issues (environment, labour) could increase costs or restrict operations.

- Technological change in textile manufacturing may render older equipment less competitive if not upgraded timely.

- Environmental risks (such as water use, energy) remain high in the textile sector and may attract scrutiny.

- Global economic slowdown or reduced clothing demand could weaken order books and revenue growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Aastha Spintex Limited

Aastha Spintex Limited IPO Strengths

Vertically Integrated Manufacturing

Aastha Spintex Limited operates a fully integrated cotton spinning facility, centralizing all production stages from raw cotton to finished yarn. This integration minimizes material handling and optimizes process control, resulting in enhanced operational efficiency and consistent, high-quality output. The facility utilizes modern compact ring spinning technology, producing smoother, stronger yarns adaptable for various textile applications.

Long-Standing Customer Relationships

With over a decade in the textile sector, the company has cultivated strong, long-standing relationships with key domestic and international customers. Its customer-centric approach focuses on delivering yarns precisely aligned with client specifications, a commitment that has strengthened its market presence. As of Fiscal 2025, the company served over 231 customers, including numerous long-term clients.

Strategic Location and Expansion Potential

The manufacturing facility is strategically located in Gujarat’s major cotton-growing region, ensuring direct access to raw materials and logistics networks near key ports. The site includes substantial vacant land for future expansion and features adequate storage infrastructure to manage inventory efficiently and preserve cotton quality, optimizing the supply chain.

Sustainable, Cost-Efficient Energy Infrastructure

The company utilizes strong renewable energy infrastructure, comprising solar and wind power plants totaling 7.7 MW of capacity. These facilities collectively supply approximately 80% of the plant’s total power requirement, significantly reducing operating costs and carbon footprint. This commitment enhances energy security, provides insulation against price volatility, and strengthens the firm’s ESG profile.

Consistent Financial and Operating Metrics

Aastha Spintex Limited has demonstrated strong organic growth and improving profitability. Revenue from operations increased by 15.19% between Fiscal 2024 and 2025. Restated Profit After Tax (PAT) margin consistently grew, reaching 6.69% in Fiscal 2025. This track record reflects disciplined financial management and an efficient operational model.

Experienced Promoters and Management

The company is led by strong, experienced promoters and senior management with deep expertise in the textile industry. This seasoned leadership team is instrumental in formulating business strategies, driving modernization, and maintaining a customer-centric approach. The collective, function-driven expertise ensures efficient operations and proactive responses to changing market demands.

More About Aastha Spintex Limited

Aastha Spintex Limited is engaged in the manufacturing and trading of carded, combed, and compact combed cotton yarns and cotton bales. In Fiscal 2025, the company recorded the highest ROCE and RONW among its selected peers, showcasing strong operational efficiency and financial performance. Its semi-automated, integrated spinning and ginning facility, located in Halvad, Morbi (Gujarat), produces 100% cotton yarns in counts ranging from Ne 26 to Ne 40.

Manufacturing Operations

Aastha Spintex operates a modern facility spanning approximately 65,762 sq. m, equipped with 25,920 spindles and 28 ginning machines. The unit produces 12,000 MT of cotton bales and 7,700 MT of cotton yarn annually. The manufacturing process is semi-automated to ensure consistency and quality, supported by a dedicated in-house quality control team and laboratory.

- Cotton Bales: Produced through ginning, where raw cotton is cleaned and separated into lint and seeds.

- Cotton Yarn: Used in knitting and weaving for diverse applications including denim, shirting, towels, socks, and home textiles.

- By-products: Cotton seeds and waste are sold to other industries, creating additional revenue streams.

Business Operations and Market Reach

Operating exclusively in the B2B segment, Aastha Spintex supplies its products to textile manufacturers, yarn exporters, and fabric processors. The company’s sales are primarily concentrated in Gujarat, supported by reseller M/s 7 Seas Impex. This dual-channel approach ensures extensive market reach with minimal logistical challenges.

Customer Base and Supplier Network

The company serves over 250 customers across India, maintaining long-term relationships with 14 clients for more than five years. Its ginning unit operates seasonally, sourcing cotton from reliable suppliers across Gujarat. Strategic procurement and buffer stock management help stabilise margins and ensure uninterrupted production.

Leadership and Sustainability

Aastha Spintex is led by experienced promoters, including Divyang Jashwantbhai Patel and Vivek Rasik Gothi, whose focus on quality and technological advancement drives growth. The company is also committed to sustainability, operating solar and wind power plants with a combined capacity of 7.7 MW, significantly reducing its carbon footprint and energy costs.

Industry Outlook

The Indian textiles and apparel market is projected to grow at a 10% CAGR, reaching a value of US$ 350 billion by 2030. Exports from India’s textile sector are expected to touch US$ 100 billion by 2030. The industry currently contributes about 2.3% to India’s GDP, around 13% of industrial production, and 12% of total exports. Key growth drivers include rising domestic consumption, urbanisation, digital retail expansion, and export opportunities driven by the “China + One” sourcing shift.

Cotton Yarn and Cotton Bale Segment

India’s cotton yarn industry is expected to record 7–9% revenue growth in FY26, recovering from a slower pace in the previous year. Cotton yarn production grew nearly 9% in FY2024, with exports rising by 83% year-on-year. Globally, the cotton yarn market was valued at around US$ 80.1 billion in 2024, projected to reach US$ 133.8 billion by 2033, growing at a CAGR of about 5.6%. In India, the cotton yarn market is estimated at US$ 2.3 billion in 2024, likely expanding at an 8% CAGR in the near term.

Major growth drivers for this segment include:

- Rising demand from apparel, home textiles, and industrial fabric sectors.

- Export opportunities as global supply chains diversify beyond China.

- Increasing adoption of high-value varieties such as combed and compact yarns.

- Vertical integration (ginning to spinning) ensuring cost efficiency and better margins.

Key Figures and Future Prospects

India remains the world’s second-largest producer and consumer of cotton. For cotton yarn manufacturers, margins are expected to improve by 50–100 basis points, supported by stable cotton supply and balanced pricing. However, volatility in raw cotton prices, fluctuating global demand, and trade barriers may pose short-term challenges.

Relevance for Companies like Aastha Spintex Limited

For companies manufacturing carded, combed, and compact combed yarns, the outlook is promising. Consistent domestic demand, export potential, and the shift toward sustainable, quality-driven production create a favourable environment. Firms with integrated operations, modern technology, and energy-efficient setups are expected to gain a competitive edge and sustain steady growth in the coming years.

How Will Aastha Spintex Limited Benefit

- Aastha Spintex Limited is well-positioned to benefit from the growing demand for cotton yarn driven by India’s expanding textile and apparel market.

- Its focus on manufacturing carded, combed, and compact combed yarns aligns with the rising preference for high-value, quality-driven products.

- The company’s integrated ginning and spinning facility enables better cost efficiency, supporting higher margins as the industry’s profitability improves.

- Increasing export opportunities, supported by the global “China + One” sourcing trend, can enhance its market reach.

- Rising domestic consumption of fabrics such as denim, shirting, and home textiles will create steady demand for its yarns.

- Energy-efficient operations, including renewable power generation, will reduce production costs and improve sustainability credentials.

- The company’s strong financial performance and scalability position it to capitalise on expected 7–9% industry growth.

- Stable cotton supply and balanced pricing trends will further strengthen its competitiveness and profitability.

Peer Group Comparison

| Name of Company | Face Value (₹ per share) | Revenue from Operations (₹ in Lacs) | EPS (₹ per share) | NAV (₹ per share) | P/E | RONW (%) |

| Aastha Spintex Limited | 10 | 35,116.02 | 8.50 | 44.01 | [●] | 19.32% |

| Peer Group | ||||||

| Ambika Cotton Mills Ltd. | 10 | 70,207.04 | 114.83 | 1,579.14 | 12.75 | 7.27% |

| Lagnam Spintex Limited | 10 | 60,556.46 | 7.28 | 68.41 | 11.62 | 10.64% |

| Pashupati Cotspin Limited | 10 | 63,670.28 | 8.31 | 97.78 | 85.43 | 8.35% |

Key Strategies for Aastha Spintex Limited

Focus on Strategic Acquisitions

Aastha Spintex Limited is committed to organic and inorganic growth through strategic acquisitions that enhance product offerings and market reach. The recent acquisition of Falcon Yarns Private Limited boosted annual spinning capacity from 7,700 MT to 17,457 MT. This move is designed to drive revenue growth, broaden the customer base, and improve operational efficiency.

Expand Customer Base and Geographic Reach

The company’s strategy is to expand its direct sales operations beyond its current primary concentration in Gujarat into other Indian states and international markets. This expansion aims to secure a wider customer base, diversify market risks, increase sales volumes, and strengthen the company’s competitive position and brand recognition across India and abroad.

Operational Efficiency and Manufacturing Excellence

Aastha Spintex Limited is committed to continuous operational efficiency by investing in modern spinning infrastructure and advanced quality control systems. The firm focuses on streamlining manufacturing processes to reduce waste, optimize resource use, and lower production costs without sacrificing product quality. This ensures consistent delivery and high customer satisfaction.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Aastha Spintex Limited IPO

How can I apply for Aastha Spintex Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Aastha Spintex Limited IPO?

The IPO aims to raise ₹160 crore through a fresh issue of equity shares.

When was the DRHP for Aastha Spintex Limited IPO filed?

Aastha Spintex Limited filed its Draft Red Herring Prospectus with SEBI on September 30, 2025.

On which exchanges will Aastha Spintex shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE.

Who are the lead manager and registrar for the IPO?

BOI Merchant Bankers Ltd. is the lead manager, and Bigshare Services Pvt. Ltd. is the registrar.

What are the objectives of the Aastha Spintex IPO?

Funds will be used for acquiring Falcon Yarns Pvt. Ltd. and for general corporate purposes.