- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aditya Infotech IPO

₹14,080/22 shares

Minimum Investment

IPO Details

29 Jul 25

31 Jul 25

₹14,080

22

₹640 to ₹675

NSE, BSE

₹1 Cr

05 Aug 25

Aditya Infotech IPO Timeline

Bidding Start

29 Jul 25

Bidding Ends

31 Jul 25

Allotment Finalisation

01 Aug 25

Refund Initiation

04 Aug 25

Demat Transfer

04 Aug 25

Listing

05 Aug 25

About Aditya Infotech Limited

Aditya Infotech Limited (AIL), under the brand ‘CP Plus’, manufactures and delivers a wide range of video surveillance products, solutions, and services. Its offerings include smart home IoT cameras, HD analog systems, network and thermal cameras, long-range IR cameras, and AI-driven features such as number plate recognition and people counting. Catering to both commercial and residential segments, the company distributed 2,986 SKUs across 550+ Indian cities in FY25. AIL operates through 41 branches, 13 RMA centres, 1,000+ distributors, 2,100+ system integrators, 10 nationwide warehouses, and a manufacturing unit in Kadapa, Andhra Pradesh.

Aditya Infotech Limited IPO Overview

Aditya Infotech IPO is a book-building issue worth ₹1,300 crore, comprising a fresh issue of 0.74 crore shares aggregating ₹500 crore and an offer for sale of 1.19 crore shares totalling ₹800 crore. The IPO opens for subscription on July 29, 2025, and closes on July 31, 2025. Allotment is expected on August 1, 2025, with a tentative listing date of August 5, 2025, on BSE and NSE. The price band is ₹640 to ₹675 per share, with a lot size of 22 shares. Retail investors must invest a minimum of ₹14,080, while the minimum application amount for sNII and bNII investors stands at ₹2,07,900 and ₹10,09,800 respectively.

Aditya Infotech Limited IPO Details

| Particulars | Details |

| IPO Date | 29 July 2025 to 31 July 2025 |

| Listing Date | 5 August 2025 |

| Face Value | ₹1 per share |

| Issue Price Band | ₹640 to ₹675 per share |

| Lot Size | 22 Shares |

| Total Issue Size | 1,92,59,258 shares (₹1,300.00 Cr) |

| Fresh Issue | 74,07,407 shares (₹500.00 Cr) |

| Offer for Sale | 1,18,51,851 shares (₹800.00 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 10,98,05,805 shares |

| Share Holding Post Issue | 11,72,13,212 shares |

| Market Maker Portion | Not Applicable |

Aditya Infotech Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Net Issue |

| Retail | Not more than 10% of the Net Issue |

| NII (HNI) | Not more than 15% of the Net Issue |

Aditya Infotech Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 22 | ₹14,850 |

| Retail (Max) | 13 | 286 | ₹1,93,050 |

| HNI (sNII Min) | 14 | 308 | ₹2,07,900 |

| HNI (bNII Min) | 68 | 1,496 | ₹10,09,800 |

Aditya Infotech Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 92.58% |

| Post-Issue | 76.7% |

Aditya Infotech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share | ₹29.98 |

| Price/Earnings (P/E) Ratio | 22.52 |

| Return on Net Worth | 34.53% |

| Net Asset Value | Not specified |

| Return on Equity | 34.53% |

| Return on Capital Employed | 33.27% |

| EBITDA Margin | 8.27% |

| PAT Margin | 11.25% |

| Debt to Equity Ratio | 0.41 |

Objectives of the Proceeds

- Repayment or prepayment of certain borrowings – ₹375 Crores

- General corporate purposes – Remaining amount

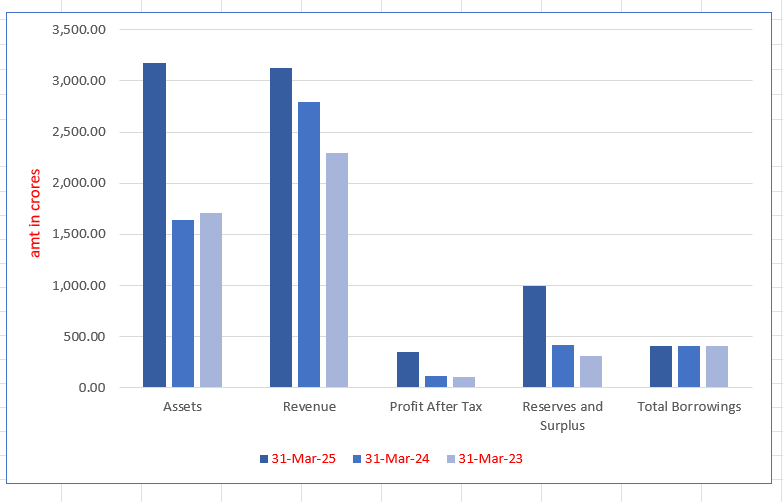

Key Financials (₹ in Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,174.54 | 1,644.18 | 1,708.76 |

| Revenue | 3,122.93 | 2,795.96 | 2,295.56 |

| Profit After Tax | 351.37 | 115.17 | 108.31 |

| Reserves and Surplus | 994.49 | 421.33 | 308.65 |

| Total Borrowings | 412.84 | 405.45 | 409.60 |

SWOT Analysis of Aditya Infotech IPO

Strength and Opportunities

- Strong brand recall in India's growing security and surveillance market.

- Broad product portfolio including AI and IoT-powered solutions.

- Wide distribution & support network across tier I–III cities.

- Advanced R&D and manufacturing infrastructure in Kadapa.

- Robust revenue growth and improved profitability metrics.

Risks and Threats

- Dependence on external distributors for reach.

- Highly competitive electronic security space.

- Regulatory challenges and import reliance for certain components.

- Technology becoming obsolete rapidly in surveillance industry.

- Currency fluctuations impacting cost of imported components.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Aditya Infotech Limited

Aditya Infotech IPO Strengths

- Recognised as India’s leading player in the expanding security and surveillance market with strong presence in both commercial and consumer sectors.

- Operates a robust sales, distribution, and service network across India, serving a wide and varied customer base.

- Offers an extensive range of security and surveillance products and services, delivering complete solutions across multiple industries.

- Equipped with advanced manufacturing infrastructure and R&D capabilities, maintaining a strong emphasis on product quality.

- Led by a seasoned leadership team supported by a dedicated and skilled workforce.

Peer Group Comparison

As per the DRHP, there are no comparable listed peer of the company and therefore information related to peer is not provided

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Aditya Infotech Limited IPO

How can I apply for Aditya Infotech Limited IPO?

You can apply via HDFC Sky using the UPI-based ASBA payment system.

What is the minimum investment in Aditya Infotech IPO?

The minimum investment for retail investors is ₹14,850 for one lot (22 shares).

When will Aditya Infotech IPO be listed?

The tentative listing date for Aditya Infotech IPO is 5 August 2025.

What is the price band of Aditya Infotech IPO?

The IPO price band is set between ₹640 to ₹675 per equity share.