- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Advance Agrolife IPO

₹14,250/150 shares

Minimum Investment

IPO Details

30 Sep 25

03 Oct 25

₹14,250

150

₹95 to ₹100

NSE, BSE

₹192.86 Cr

08 Oct 25

Advance Agrolife IPO Timeline

Bidding Start

30 Sep 25

Bidding Ends

03 Oct 25

Allotment Finalisation

06 Oct 25

Refund Initiation

07 Oct 25

Demat Transfer

07 Oct 25

Listing

08 Oct 25

Advance Agrolife Limited

Incorporated in 2002, Advance Agrolife Limited manufactures a wide range of agrochemical products that support crop lifecycles across cereals, vegetables, and horticultural crops in Kharif and Rabi seasons. Its portfolio includes insecticides, herbicides, fungicides, plant growth regulators, micro-nutrient and bio-fertilizers, and technical grade ingredients used in agrochemical formulations. Operating on a B2B model, the company serves clients in 19 states, 3 union territories, and exports to multiple countries. It runs three integrated manufacturing facilities located in Jaipur, Rajasthan.

Advance Agrolife Limited IPO Overview

Advance Agrolife IPO is a book-built issue worth ₹192.86 crores, comprising a fresh issue of 1.93 crore shares. The subscription window opens on September 30, 2025, and closes on October 3, 2025, with allotment expected on October 6 and listing on BSE and NSE scheduled for October 8, 2025. The price band is fixed between ₹95 and ₹100 per share, with a lot size of 150 shares. Retail investors can apply with a minimum investment of ₹15,000, while higher categories require larger applications. Choice Capital Advisors Pvt. Ltd. is the book-running lead manager, and Kfin Technologies Ltd. acts as the registrar.

Advance Agrolife Limited IPO Details

| Particulars | Details |

| IPO Date | 30 September 2025 to 3 October 2025 |

| Listing Date | 8 October 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹95 to ₹100 per share |

| Lot Size | 150 Shares |

| Total Issue Size | 1,92,85,720 shares (aggregating up to ₹192.86 Cr) |

| Fresh Issue | 1,92,85,720 shares (aggregating up to ₹192.86 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 4,50,00,000 shares |

| Share Holding Post Issue | 6,42,85,720 shares |

| Employee Discount | ₹5.00 |

Advance Agrolife Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Advance Agrolife Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 150 | ₹15,000 |

| Retail (Max) | 13 | 1,950 | ₹1,95,000 |

| S-HNI (Min) | 14 | 2,100 | ₹2,10,000 |

| S-HNI (Max) | 66 | 9,900 | ₹9,90,000 |

| B-HNI (Min) | 67 | 10,050 | ₹10,05,000 |

Advance Agrolife Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 99.84% |

| Post-Issue | [To be updated] |

Advance Agrolife Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.70 (Pre IPO) / ₹3.99 (Post IPO) |

| Price/Earnings (P/E) Ratio | 17.55 (Pre IPO) / 25.07 (Post IPO) |

| Return on Net Worth (RoNW) | 29.11% |

| Net Asset Value (NAV) | ₹22.42 |

| Return on Equity (ROE) | 25.42% |

| Return on Capital Employed (ROCE) | 27.02% |

| EBITDA Margin | 9.61% |

| PAT Margin | 5.10% |

| Debt to Equity Ratio | 0.80 |

Objectives of the Proceeds

- Funding working capital requirements of the company – ₹1,350 million

- General corporate purposes – amount not disclosed

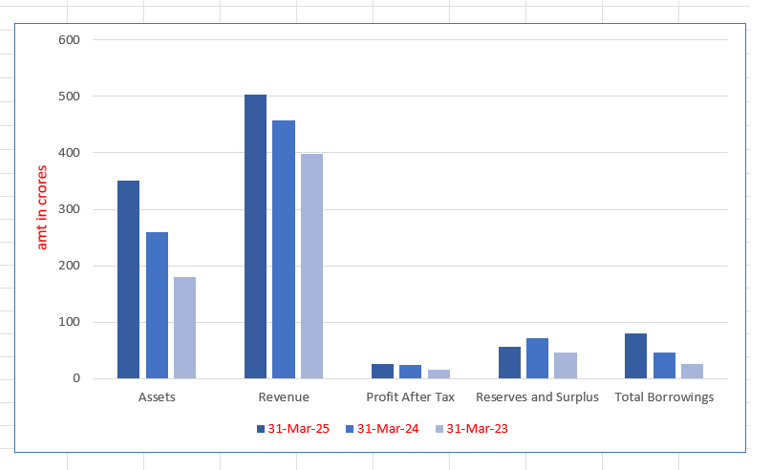

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 351.47 | 259.56 | 179.47 |

| Revenue | 502.88 | 457.21 | 397.97 |

| Profit After Tax | 25.64 | 24.73 | 14.87 |

| Reserves and Surplus | 55.87 | 70.76 | 46.10 |

| Total Borrowings | 80.45 | 45.46 | 25.29 |

SWOT Analysis of Advance Agrolife IPO

Strength and Opportunities

- Established manufacturing setup at a strategic location.

- Diversified product portfolio of agrochemical products.

- Strong customer base and long-standing relationships.

- Experienced management team with industry expertise.

- Track record of healthy growth and expansion.

- Potential for increased market share through innovation.

- Opportunities for export expansion and international partnerships.

- Growing demand for agrochemicals in India and abroad.

- Favorable government policies supporting agrochemical industry.

Risks and Threats

- Dependence on a limited number of customers for revenue.

- Geographical concentration risks due to operations in Jaipur.

- Dependence on a few suppliers for raw materials.

- Stringent technical specifications and quality requirements.

- Limited production history in technical grade agrochemical products.

- Sensitivity to weather patterns, seasonal factors, and climate change.

- Heavy reliance on formulation-grade agrochemical products.

- Lack of ownership of some operational premises.

- Vulnerability to fluctuations in credit ratings affecting capital access.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Advance Agrolife Limited IPO Strengths

Advance Agrolife IPO Strengths

- Promoters and management team have extensive experience in the agrochemical sector.

- Diversified agrochemical portfolio including insecticides, herbicides, fungicides, and fertilizers.

- Integrated manufacturing facilities located strategically in Jaipur, Rajasthan.

- Long-term relationships with corporate customers across India and global markets.

- Strong domestic presence with growing exports to Asia, Africa, and Middle East.

- Track record of consistent revenue growth and improving financial performance.

Advance Agrolife IPO Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Advance Agrolife Ltd. | 5.70 | 5.70 | 22.42 | 25.07 | 29.11 | 4.55 |

| Peer Group | ||||||

| Dharmaj Crop Guard Ltd. | 10.68 | 10.30 | 116.70 | 34.60 | 9.24 | – |

| Insecticides (India) Ltd. | 48.38 | 48.38 | 372.74 | 16.99 | 13.55 | – |

| Heranba Industries Ltd. | 0.77 | 0.77 | 210.15 | – | 0.37 | – |

| Pi Industries Ltd. | 109.44 | 109.22 | 668.22 | 34.29 | 17.58 | – |

| Sharda Cropchem Ltd. | 33.74 | 33.74 | 277.21 | 30.33 | 12.85 | – |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Advance Agrolife Limited IPO

How can I apply for Advance Agrolife Limited IPO?

You can apply using UPI-based ASBA through HDFC Sky’s IPO platform.

What is the lot size and minimum investment for this IPO?

The lot size is 150 shares, requiring a minimum investment of ₹15,000.

When will Advance Agrolife Limited IPO allotment be finalised?

The IPO allotment is expected to be finalised on 6 October 2025.

On which exchanges will Advance Agrolife Limited IPO be listed?

The IPO will be listed on both BSE and NSE.