- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Advanced Sys-Tek IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Advanced Sys-Tek IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Advanced Sys-Tek Limited

Advanced Sys-tek (AST) excels in Instrumentation Automation, Terminal Automation, and Metering systems, with 300+ global installations. For 30 years, AST has provided turnkey solutions, including design, engineering, procurement, installation, software development, commissioning, and support. Specialising in automating terminals, AST upgrades manual systems with minimal downtime. Its internationally certified solutions ensure precise measurement, automation, and distribution. Based in Vadodara, Gujarat, AST operates a 153,000 sq. ft. facility with a 40,000 sq. ft. office space, serving both public and private sector industries across India.

Advanced Sys-Tek Limited IPO Overview

Advanced Sys-tek Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on Monday, February 10, 2025. However, the offer document was withdrawn on Thursday, February 27, 2025. Advanced Sys-Tek Ltd has submitted preliminary documents to SEBI for an IPO, consisting of a ₹115 crore fresh issue and an offer for sale (OFS) of 15.27 lakh shares by promoters. It will be listed on the NSE and BSE. Promoters Mukesh R Kapadia and Umed Amarchand Fifadra each plan to sell up to 7.64 lakh shares through the OFS. Before the issue, the promoters held 82.57% of the company’s shares. The post-issue shareholding percentage will be determined through equity dilution, calculated as the difference between the pre-issue and post-issue holdings.

Advanced Sys-Tek Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹115 crore

Offer for Sale (OFS): 15.27 lakhs equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,92,28,068 shares |

| Shareholding post -issue | TBA |

Advanced Sys-Tek IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Advanced Systek Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Advanced Sys-Tek Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 10.20 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 10.27 |

| Net Asset Value (NAV) | 99.30 |

| Return on Equity | 12.23% |

| Return on Capital Employed (ROCE) | 17.43% |

| EBITDA Margin | 12.51% |

| PAT Margin | 10.21% |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement | 93.09 |

| Funding long-term working capital requirement | 700 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

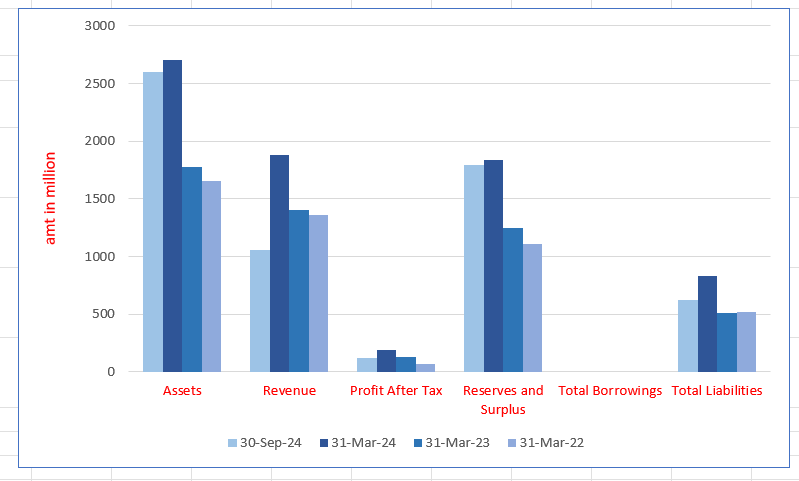

Advanced Sys-Tek Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2602.62 | 2703.63 | 1779.38 | 1656.33 |

| Revenue | 1058.43 | 1882.32 | 1404.23 | 1356.01 |

| Profit After Tax | 121.54 | 192.17 | 131.71 | 69.89 |

| Reserves and Surplus | 1789.74 | 1838.97 | 1243.18 | 1113.04 |

| Total Borrowings | – | – | – | – |

| Total Liabilities | 620.61 | 832.62 | 508.17 | 515.26 |

Financial Status of Advanced Sys-Tek Limited

SWOT Analysis of Advanced Sys-Tek IPO

Strength and Opportunities

- Established leader in instrumentation and terminal automation with over 300 installations globally.

- Comprehensive turnkey solutions including design, engineering, procurement, and commissioning.

- Expertise in upgrading manual terminals to fully automated systems with minimal downtime.

- Internationally certified products and services ensuring quality and compliance.

- Strategic location in Vadodara with extensive facilities enhancing operational capacity.

- Expansion into environmental solutions through subsidiary AST Environment Solutions Pvt. Ltd.

- Development of AI-based unmanned ground vehicles via associate company Terranomous Systems Pvt. Ltd.

- Commitment to sustainability and innovative technologies reducing energy and water consumption.

- Strong leadership team with extensive industry experience.

Risks and Threats

- High working capital intensity due to extended debtor days.

- Dependence on timely regulatory approvals and compliance.

- Exposure to foreign exchange fluctuations affecting international operations.

- Retention of skilled professionals in a competitive industry.

- Vulnerability to economic downturns affecting client investments.

- Challenges in maintaining consistent cash flow due to project-based revenue.

- Potential supply chain disruptions impacting project timelines.

- Intense competition from both domestic and international players.

- Rapid technological changes requiring continuous adaptation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Sys-Tek Limited IPO

Advanced Sys-Tek Limited IPO Strengths

- Expertise in Industrial Automation and POL Terminal Solutions

Advanced Sys-Tek Limited, with 30 years of experience, is a leading Indian player in oil and gas terminal automation. Specializing in turnkey projects, it executes automation solutions across India and internationally, ensuring efficient, customized, and timely project delivery in POL terminal and tank farm management.

- Strong Industry Relationships and Proven Project Execution

Advanced Sys-Tek Limited has built enduring relationships with marquee customers, especially public sector oil companies, for over three decades. With repeat orders and stringent project execution standards, its expertise in complex automation solutions reinforces its position as a trusted partner in India’s industrial automation landscape.

- Experienced Leadership and Strong Governance

Advanced Sys-Tek Limited is led by seasoned technocrat promoters and a skilled management team with over 100 years of cumulative experience. With a robust corporate governance framework and longstanding leadership continuity, the company is well-positioned to drive growth and execute complex automation projects efficiently.

- Strong Revenue Growth and Financial Stability

Advanced Sys-Tek Limited has achieved consistent revenue and profitability growth, with a CAGR of 17.82% in revenue and 65.82% in profit after tax from Fiscal 2022 to 2024. With no long-term debt, the company’s financial strength reflects strategic reinvestment and prudent fiscal management.

More About Advanced Sys-Tek Limited

With over three decades of experience, Advanced Sys-Tek Limited has been at the forefront of providing large-scale and complex measurement, control, and industrial automation solutions. The company specializes in terminal automation for the oil and gas sector, covering metering, loading, unloading, storage, and distribution across various industrial applications, including ports and airports.

Recognized as the only established Indian entity in the oil and gas terminal automation market, Advanced Sys-Tek Limited focuses on Industrial Automation Solutions (IA Solutions), with expertise in fully automated metering systems for oil and gas terminals and the modernization of manually operated terminals.

Extensive Project Experience

As of September 30, 2024, the company has successfully executed over 200 installations across India and international markets. Additionally, its portfolio includes anti-icing additive injection systems for aircraft jet fuel. Through its subsidiary, the company has expanded into manufacturing diesel exhaust fluid (DEF).

Industrial Automation Solutions

The company’s automation expertise encompasses:

- Terminal Automation (TA): Advanced Sys-Tek Limited offers automation solutions for petroleum, oil, and lubricants (POL) storage and distribution terminals.

- Custody Transfer Metering: The company provides metering skids that facilitate accurate gas flow measurement through pipelines, ensuring precise billing.

- LPG Bottling and Fuel Farm Automation: Automation solutions have been implemented for an LPG bottling plant, with ongoing fuel farm automation projects at Indian airports.

The company’s Control and Monitoring System integrates High Availability Redundant Computer Platforms with proprietary software, ensuring efficiency and resilience in terminal automation. Its distributed control architecture enhances reliability by preventing downtime through component redundancy.

Key Industrial Automation Solutions

- POL Terminal Automation Systems (TAS): Integrates process controls for liquid and gas movement, ensuring efficiency and security. Features include load authorization, blending, product reconciliation, and reporting through the Smart Terminal Manager (STM) software.

- Liquid and Gas Fiscal Metering Systems (Metering Skids): Pre-assembled systems enabling accurate and continuous fluid or gas measurement, including proving, filtration, and pressure reduction.

- Additive Injection and Blending Systems: Ensures precise additive dispensing into products, with real-time control using proprietary software.

Software Solutions

Advanced Sys-Tek Limited develops integrated software for automation applications, covering:

- Networking and Database Management

- SCADA (Supervisory Control and Data Acquisition)

- Embedded Systems, AI/ML, Cloud, and Web-Based Applications

Proprietary software products include AST SCADA, STM, and Asset Surveiller, offering comprehensive automation solutions backed by strategic technology partnerships.

Product Portfolio

The company manufactures and markets key products such as:

- Batch Controllers (SmartLoad)

- Smart Ground Detectors (SGD)

- Access Control Card Readers

- Pulse Transmitters

These products play a crucial role in terminal automation systems and are also utilized in industries like pharmaceuticals and paints.

Certifications and Compliance

Advanced Sys-Tek Limited holds multiple certifications, including:

- ISO 9001:2015 & ISO 45001:2018

- PESO (Petroleum and Explosives Safety Organisation) License

- ATEX and IECEx Certifications for Compliance with EU Regulations

Additionally, the company provides terminal automation system upgrades and long-term maintenance services for POL TAS and metering skids, catering to India’s leading public and private sector oil firms.

Global Presence

Since its first terminal automation project in Dahej, Gujarat, in 1999, the company has expanded its operations across nine countries, including Bangladesh, Ghana, Nigeria, Oman, Switzerland, and Saudi Arabia. Between Fiscal 2022 and September 30, 2024, the company executed 41 POL terminal automation projects globally.

Industry Outlook

The Indian industrial automation sector is experiencing significant growth, driven by technological advancements and increasing demand across various industries.

Overall Industry Outlook

The Indian industrial automation market is projected to expand from USD 14.18 billion in 2024 to USD 39.65 billion by 2033, reflecting a compound annual growth rate (CAGR) of 12.10% during the forecast period.

Growth Drivers

- Technological Advancements: The integration of the Internet of Things (IoT), Artificial Intelligence (AI), and machine learning is enhancing operational efficiency and productivity.

- Government Initiatives: Programs like “Make in India” and “Digital India” are promoting the adoption of advanced manufacturing technologies.

- Rising Demand: Industries such as oil and gas, automotive, and pharmaceuticals are increasingly adopting automation to improve processes and reduce operational costs.

Oil and Gas Terminal Automation

Within the broader industrial automation landscape, the oil and gas terminal automation market is also witnessing robust growth. The global market size was valued at USD 1.41 billion in 2024 and is anticipated to reach USD 2.55 billion by 2032, growing at a CAGR of 7.7%.

Key Market Trends

- Adoption of Advanced Technologies: The implementation of Supervisory Control and Data Acquisition (SCADA) systems and Programmable Logic Controllers (PLCs) is becoming prevalent, enhancing real-time monitoring and control.

- Focus on Safety and Efficiency: Automation solutions are increasingly being employed to improve safety standards and operational efficiency in terminal operations.

How Will Advanced Sys-Tek Limited Benefit

- Market Leadership in Oil and Gas Automation: As India’s only established terminal automation provider, the company will strengthen its dominance in the growing industry.

- Expanding Industry Demand: With increasing automation adoption, Advanced Sys-Tek Limited will gain from rising demand across oil, gas, and industrial sectors.

- Advanced Technological Integration: The company’s expertise in AI, SCADA, and cloud-based automation will enhance operational efficiency and monitoring capabilities.

- Government Initiatives Support Growth: Policies like “Make in India” and “Digital India” will accelerate automation adoption, benefiting Advanced Sys-Tek Limited’s solutions.

- Global Expansion Opportunities: With projects in nine countries, the company is well-positioned to capture international automation market growth.

- Diverse Industrial Applications: Automation solutions for POL terminals, LPG bottling, and jet fuel metering will drive revenue across multiple industries.

- Proprietary Software Enhancements: Advanced Sys-Tek Limited’s in-house software solutions, including AST SCADA and STM, provide competitive advantages in automation technology.

- Robust Project Experience: Having completed over 200 installations, the company’s industry expertise enhances credibility and client trust.

- Focus on Safety and Compliance: Compliance with ISO, ATEX, IECEx, and PESO regulations strengthens trust among global oil and gas firms.

- Expansion into Emerging Technologies: Integration of AI/ML, embedded systems, and web-based applications positions the company as an innovation leader in automation.

- Comprehensive Product Portfolio: Offering metering skids, batch controllers, and access control devices ensures diverse revenue streams across industries.

- Long-Term Service and Maintenance Revenue: Providing system upgrades and maintenance for terminal automation ensures sustained client relationships and recurring revenue.

- Strong Strategic Partnerships: Collaborations with leading technology firms enhance automation capabilities and market reach.

- Growth in Airport Fuel Farm Automation: Expanding projects in airport fuel farm automation present new business opportunities.

- Enhancing Operational Efficiency for Clients: Advanced automation solutions help clients reduce costs, improve safety, and optimize resource management.

Peer Group Comparison

| Name of Company | Total Income (₹ million) | EPS (₹ per share) Basic | NAV (₹ per share) | P/E Ratio | RoNW (%) |

| Advanced Sys-Tek Limited | 1,921.51 | 10.20 | 99.30 | N.A | 10.27 |

| Peer Groups | |||||

| Honeywell Automation India Limited | 42,010 | 567.10 | 4,078.49 | 73.98 | 13.90 |

| ABB India Limited | 107,482 | 58.61 | 280.54 | 117.94 | 23.10 |

Key insights

- Total Income: Advanced Sys-Tek Limited has a total income of ₹1,921.51 million, significantly lower than its peers. Honeywell Automation India Limited reports ₹42,010 million, while ABB India Limited leads with ₹107,482 million, showcasing its dominance in the industry.

- Earnings Per Share: EPS reflects profitability per share. Advanced Sys-Tek Limited has an EPS of ₹10.20, much lower than Honeywell’s ₹567.10 and ABB’s ₹58.61, indicating that its earnings generation per share is considerably weaker than its peers.

- Net Asset Value: NAV per share indicates a company’s intrinsic worth. Advanced Sys-Tek Limited stands at ₹99.30, significantly lower than Honeywell’s ₹4,078.49 and ABB’s ₹280.54, suggesting a smaller asset base relative to its peers.

- Price-to-Earnings (P/E) Ratio: The P/E ratio, unavailable for Advanced Sys-Tek Limited, reflects how much investors are willing to pay per ₹1 of earnings. Honeywell stands at 73.98, while ABB is at 117.94, indicating investor confidence in these firms.

- Return on Networth: RoNW measures profitability concerning shareholder equity. Advanced Sys-Tek Limited has a RoNW of 10.27%, lower than Honeywell’s 13.90% and ABB’s 23.10%, suggesting lower efficiency in generating returns on shareholders’ investments.

Key Strategies for Advanced Sys-Tek Limited

- Strengthening Leadership in Industrial Automation and Diversification

Advanced Sys-Tek Limited aims to consolidate its leadership in India’s industrial automation sector, particularly in oil and gas terminal automation. With India’s automation market projected to grow at a CAGR of 15.5% from CY24 to CY29, the company is strategically upgrading manufacturing capabilities and exploring brewery automation opportunities.

- Expanding Product Portfolio for Sustainable Growth

To diversify revenue streams beyond IA solutions, Advanced Sys-Tek Limited has ventured into Diesel Exhaust Fluid (DEF) production through AST Environmental Solutions Pvt Ltd. Additionally, the company is exploring AI-driven automation products and defense automation, reinforcing its commitment to innovation and sustainable business expansion.

- Expanding Global Presence with Focus on Emerging Markets

Historically focused on India, Advanced Sys-Tek Limited is now strengthening its international footprint, targeting Middle East, Africa, and South America. By establishing a dedicated global team and enhancing dealer networks, the company aims to capitalize on automation opportunities in high-growth international markets.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Advanced Sys-Tek Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the structure of the Advanced Sys-Tek Limited IPO?

The IPO includes a ₹115 crore fresh issue and an offer for sale of 15.27 lakh shares.

Who are the promoters selling shares in the offer for sale (OFS)?

Promoters Mukesh R Kapadia and Umed AmarchandFifadra plan to divest up to 7.64 lakh shares each.

How will the funds raised from the IPO be utilized?

Proceeds will support capital expenditure, long-term working capital, and general corporate purposes.

What are the investor quotas for the IPO?

The allocation is 35% for retail investors, up to 50% for QIBs, and at least 15% for HNIs.

On which stock exchanges will the IPO be listed?

The shares are proposed to be listed on both the NSE and BSE.