- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Advit Jewels IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Advit Jewels IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Advit Jewels Limited

Advit Jewels, a Jaipur-based jewellery company, specialises in handcrafted fine jewellery under the brand name “Rambhajo.” Known for its expertise in Kundan, Polki, Diamond, and Studded designs, the company blends traditional craftsmanship with modern aesthetics. Its diverse range includes necklaces, earrings, rings, bangles, and customised pieces in 14K and 18K gold with diamonds and coloured stones. Operating mainly on a B2B model, it also caters to B2C clients. Its fully equipped 6,450 sq. ft. Jaipur facility ensures in-house production, quality, and nationwide reach.

Advit Jewels Limited IPO Overview

Advit Jewels Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, proposing to raise funds through an Initial Public Offering (IPO). The Advit Jewels IPO will be a Book Built Issue consisting entirely of a fresh issue of up to 1.38 crore equity shares. The equity shares are proposed to be listed on both the NSE and BSE. Holani Consultants Pvt. Ltd. has been appointed as the Book Running Lead Manager, while Bigshare Services Pvt. Ltd. will act as the Registrar to the issue. Key details such as the IPO opening and closing dates, price band, and lot size are yet to be announced.

As per the DRHP, the issue will have a face value of ₹10 per share, and the total issue size will comprise 1,38,00,000 equity shares aggregating up to ₹[.] crore. This will be a book-building IPO, offering fresh capital to the company. The total shareholding will increase from 3,20,10,000 shares before the issue to 4,58,10,000 shares post-issue.

The company’s promoters include Mr. Nitin Gilara, Mr. Prateek Gilara, Mr. Vipul Gilara, and Mr. Krishna Vardhan Gilara, who collectively hold 100% of the company’s shares before the IPO. The filing of the DRHP with SEBI on September 30, 2025, marks an important milestone for Advit Jewels Ltd. as it prepares to enter the public market. Investors can refer to the Advit Jewels IPO DRHP for detailed information about the offering.

Advit Jewels Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | 1.38 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,20,10,000 shares |

| Shareholding post-issue | 4,58,10,000 shares |

Advit Jewels IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Advit Jewels Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Advit Jewels Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | |

| Net Asset Value (NAV) | ₹ |

| Return on Equity (RoE) | |

| Return on Capital Employed (RoCE) | |

| EBITDA Margin | |

| PAT Margin | |

| Debt to Equity Ratio |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding incremental working capital requirements of our Company | 650 |

| Repayment/pre-payment, in full or in part, of certain outstanding borrowings availed by Our Company from scheduled commercial banks | 650 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

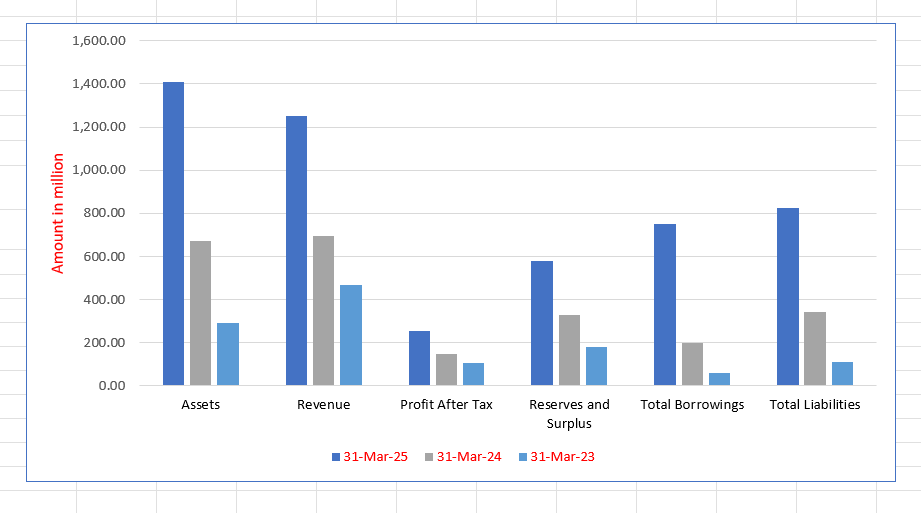

Advit Jewels Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,408.54 | 672.09 | 290.11 |

| Revenue | 1,249.47 | 694.53 | 466.05 |

| Profit After Tax | 253.67 | 147.10 | 103.90 |

| Reserves and Surplus | 581.24 | 327.93 | 180.68 |

| Total Borrowings | 750.98 | 197.95 | 58.38 |

| Total Liabilities | 827.20 | 344.06 | 109.33 |

Financial Status of Advit Jewels Limited

SWOT Analysis of Advit Jewels IPO

Strength and Opportunities

- In-house manufacturing facility ensures superior quality control and efficient production.

- Established expertise in traditional craftsmanship such as Kundan and Polki, combined with modern design aesthetics.

- Strong brand identity under “Rambhajo” with an expanding national presence across India.

- Consistent revenue growth and improving profit margins indicate sound operational management.

- Balanced business model with growing B2C custom jewellery segment alongside strong B2B presence.

- Rising demand for customised and handcrafted fine jewellery presents strong expansion potential.

- Growing e-commerce and digital platforms offer wider customer reach and visibility.

- Opportunities for export expansion and entry into the luxury premium jewellery segment.

- Increasing consumer preference for heritage and artisanal jewellery supports sustainable growth.

Risks and Threats

- Heavy dependence on top customers, with over 50% of revenue from key clients, increases business risk.

- High inventory levels and large working-capital requirements reduce financial flexibility.

- Seasonality of demand during wedding and festive periods causes uneven revenue flow.

- Reliance on skilled artisans creates vulnerability if craftsmanship resources become limited.

- Concentration of manufacturing in Jaipur exposes the company to regional risks.

- Volatility in gold, diamond, and gemstone prices poses risks to profit margins.

- Fierce competition from branded, unbranded, and online jewellery players.

- Stringent regulatory compliance and labour-law challenges may impact operations.

- Economic slowdown or reduced discretionary spending can affect jewellery demand.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Advit Jewels Limited

Advit Jewels Limited IPO Strengths

Centralized Manufacturing & Technological Integration

Advit Jewels Limited operates a state-of-the-art manufacturing facility that merges traditional Kundan and Polki craftsmanship with cutting-edge technology like laser systems and 3D printing. This centralized production model allows the company to transform intricate designs into finely finished pieces efficiently and entirely in-house. This ensures stringent quality control, greater operational efficiency, enhanced security, and optimized costs for all products, from delicate components to elaborate bridal sets.

Diverse Portfolio Driven by Design & Innovation

The company follows a design philosophy that successfully blends cultural heritage with modern innovation, catering to a wide and ever-evolving customer base. Advit Jewels offers a diversified product portfolio, including Antique, Bridal, Contemporary, and Fusion styles, covering various price points and occasions. Strong market research and expert in-house capabilities enable the firm to regularly introduce unique collections and maintain a vast inventory for robust B2B relationships and customer growth.

Robust Operational Systems and Risk Management

Advit Jewels Limited is built on strong internal systems to ensure consistency, compliance, and protection across all operations. The company sources gold exclusively from authorized bullion suppliers to guarantee purity. Comprehensive security measures, including 24/7 CCTV surveillance, fire safety systems, secure storage, and trained staff, are in place. Furthermore, the firm maintains comprehensive insurance coverage against various risks, including theft and natural disasters, to safeguard assets and operations.

Experienced and Capable Leadership Team

The company is guided by promoters with decades of experience and a strong understanding of the jewellery market, supported by a skilled senior management team. This leadership brings a valuable mix of vision, operational strength, and financial discipline. Their deep industry experience shapes product development, ensuring it meets real customer needs and market demand. A dedicated purchase team with expert knowledge in gem procurement further enhances the firm’s proven execution capability and steady growth.

Unwavering Commitment to Product Quality

Advit Jewels Limited has a deep-rooted legacy of over 100 years in the jewellery industry, with quality being the central tenet of its offerings. Every piece, whether custom or standard, is meticulously crafted and rigorously checked at multiple production stages before delivery. This unwavering focus on quality is paramount to building enduring customer trust, reinforcing the firm’s premium brand image, and strengthening its long-term reputation in the competitive market.

More About Advit Jewels Limited

Advit Jewels Limited, headquartered in Jaipur, Rajasthan—the heart of India’s gemstone and jewellery hub—is a distinguished manufacturer and seller of handcrafted fine jewellery. Operating under its heritage brand “Rambhajo”, the company specialises in Kundan, Polki, Diamond, and Studded jewellery, offering a blend of traditional craftsmanship and contemporary design.

Heritage and Legacy

The “Rambhajo” brand traces its roots to 1921, founded by Late Shri Kishan Gilara as a local jewellery brokerage in Jaipur. Over time, it evolved into a trusted name in the jewellery manufacturing and retail sector. To carry forward this century-old legacy, Advit Jewels Limited was incorporated in 2019, reflecting a seamless fusion of traditional artistry and corporate structure.

Craftsmanship and Design Excellence

Advit Jewels combines age-old craftsmanship with modern aesthetics to create timeless and elegant jewellery. Each piece—crafted in 14K or 18K gold with diamonds and coloured stones—is designed uniquely and never repeated. The company’s portfolio includes necklaces, rings, bangles, earrings, and bespoke creations, catering to both B2B dealers and B2C clients seeking exclusive, made-to-order pieces.

Manufacturing Capabilities

The company operates a 6,450 sq. ft. manufacturing facility in Jaipur, equipped with advanced tools such as 3D printers, casting units, and polishing machines. This integrated setup allows full control of production—from gold melting to final polishing—ensuring efficiency, quality, and security. Customized or high-value orders are typically completed within 25–30 days.

Skilled Artisans and Quality Control

Advit Jewels’ workforce comprises highly skilled artisans trained over generations, creating 100% handmade masterpieces. A dedicated Quality Control (QC) team oversees every step, checking for design precision, purity, and finish before dispatch, ensuring each product meets premium standards.

Business Model and Growth

The company primarily operates on a B2B model (81.63% of FY 2025 revenue) while strengthening its B2C segment (18.37%). Despite rising gold prices in 2025, Advit Jewels achieved a 38.92% volume growth, supported by its leadership team—Mr. Nitin Gilara, Mr. Prateek Gilara, and Mr. Vipul Gilara—who continue to uphold the legacy of excellence and innovation in fine jewellery.

Industry Outlook

India’s gems and jewellery market is on a robust expansion path. The sector is projected to reach approximately USD 128 billion by 2029, growing at a compound annual growth rate (CAGR) of around 9.5%. Another forecast estimates the market to hit USD 168.62 billion by 2030, translating to a CAGR of about 8.9%.

Drivers of Growth

- Rising disposable incomes across urban and semi-urban India are increasing demand for fine jewellery.

- A cultural affinity for jewellery during weddings, festivals, and social occasions continues to sustain demand for both traditional and contemporary designs.

- The shift from unorganised to organised retail is accelerating, with organised jewellery players recording stronger growth and expanding store networks.

- Government measures such as reductions in import duties, mandatory hallmarking, and greater transparency have improved consumer confidence.

- Digital commerce and online retail channels are increasingly being adopted for jewellery purchases—especially among younger consumers seeking modern designs.

Segment Outlook: Traditional & Studded Fine Jewellery

Within the broader industry, fine-jewellery segments such as gold-traditional (e.g., Kundan, Polki) and studded diamond pieces show particular promise. Traditional gold jewellery is expected to grow revenue by 14–18% in FY25, driven by premiumisation and festive/wedding demand. Studded and diamond-embedded jewellery command higher margins (30–35%) compared to plain gold (10–14%), reflecting growing demand for intricate craftsmanship and luxury appeal.

Key Figures

- In FY23, fine jewellery accounted for nearly 90% of India’s total jewellery market, valued at approximately USD 63 billion.

- Gold continues to dominate, accounting for about 86% of overall sales in the gems and jewellery market.

Summary

The prospects for India’s jewellery industry remain strong. The combination of cultural significance, rising aspirations, growing formalisation, and design innovation creates a favourable environment for handcrafted fine-jewellery makers. Companies specialising in Kundan, Polki, Diamond, and Studded jewellery are well-positioned to benefit from increasing premiumisation, brand-driven growth, and expanding domestic and export opportunities.

How Will Advit Jewels Limited Benefit

- Advit Jewels Limited stands to gain from India’s growing preference for premium handcrafted jewellery, aligning perfectly with its expertise in Kundan, Polki, Diamond, and Studded designs.

- The company’s strong heritage brand, Rambhajo, positions it well to attract customers seeking authenticity and craftsmanship.

- Rising disposable incomes and wedding-driven demand will boost sales of its traditional fine jewellery collections.

- Increasing formalisation in the jewellery sector will help Advit Jewels expand its organised retail and B2C footprint.

- Its modern manufacturing unit and in-house design capabilities enable faster delivery of customised, high-value pieces.

- The trend toward digital jewellery retail provides new channels for brand visibility and direct customer engagement.

- Export potential for Indian handcrafted jewellery can open new markets for the company’s luxury segment.

- Overall, Advit Jewels is well-placed to leverage India’s strong jewellery market growth and premiumisation trend.

Peer Group Comparison

| Name of the Company | Face Value (₹/share) | Total Revenue FY2025 (₹ million) | EPS (₹) | NAV (₹) | P/E (Based on Diluted EPS) | RONW (%) |

| Basic | Diluted | |||||

| Advit Jewels Limited | 10 | 12,49.34 | 7.92 | 7.92 | 18.16 | [●] |

| Peer Group | ||||||

| Bluestone Jewellery and Lifestyle Limited | 1 | 1,82,99.2 | -78.86 | -78.86 | 363.96 | NA |

| RBZ Jewellers Limited | 10 | 53,07.52 | 9.70 | 9.70 | 61.26 | 14.32 |

| Radhika Jeweltech Limited | 2 | 64,76.60 | 11.63 | 11.63 | 27.34 | 16.34 |

Key Strategies for Advit Jewels Limited

Enhance Financial Capabilities for Expansion

Advit Jewels plans to strengthen its financial resources to efficiently manage its working capital-intensive business. As gold procurement requires immediate cash while customer sales are on a credit cycle, greater liquidity is crucial. Raising additional funds will allow the firm to scale up operations, diversify its product range, and seize timely growth opportunities.

Continued Focus on Creative Designs

The company’s strategy is to maintain a sharp focus on fresh and innovative designs to attract discerning customers and stand apart. The in-house design team continuously develops original collections, staying updated through active participation in major trade exhibitions. This commitment to design variety helps Advit Jewels connect with diverse tastes and strengthen market presence.

Geographic Expansion: Scaling Across India

Advit Jewels aims to expand its national footprint by focusing on high-potential regions through a strategic franchise model. This approach facilitates accelerated growth and market entry into Tier 1 and Tier 2 cities with lower capital outlay. Concurrently, the firm is establishing a flagship store and strengthening its online and global trade fair presence for increased visibility.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Advit Jewels Limited IPO

How can I apply for Advit Jewels Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Advit Jewels Limited IPO?

Advit Jewels Limited IPO is a book-built issue comprising a fresh issue of up to 1.38 crore equity shares.

Where will Advit Jewels Limited shares be listed?

The equity shares of Advit Jewels Limited are proposed to be listed on both NSE and BSE exchanges.

What is the purpose of Advit Jewels Limited IPO?

The IPO aims to fund working capital requirements and repay or prepay certain outstanding borrowings from banks.

Who are the lead manager and registrar for the IPO?

Holani Consultants Pvt. Ltd. is the book-running lead manager, and Bigshare Services Pvt. Ltd. is the registrar.

Who are the promoters of Advit Jewels Limited?

The company’s promoters are Mr. Nitin Gilara, Mr. Prateek Gilara, Mr. Vipul Gilara, and Mr. Krishna Vardhan Gilara.