- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aegis Vopak Terminals IPO

₹14/63 shares

Minimum Investment

IPO Details

26 May 25

28 May 25

₹14

63

₹223 to ₹235

NSE, BSE

₹2 Cr

02 Jun 25

Aegis Vopak Terminals IPO Timeline

Bidding Start

26 May 25

Bidding Ends

28 May 25

Allotment Finalisation

29 May 25

Refund Initiation

30 May 25

Demat Transfer

30 May 25

Listing

02 Jun 25

Aegis Vopak Terminals Limited

Incorporated in 2013, AVTL owns and operates storage terminals for LPG and various liquid products. The company ensures safe storage and infrastructure for petroleum, chemicals, vegetable oils, lubricants, and gases like propane and butane. As of June 30, 2024, it manages 1.50 million cubic meters of liquid storage and 70,800 MT of LPG capacity. AVTL operates through two divisions: Gas Terminal (LPG handling) and Liquid Terminal (petroleum, chemicals, oils). It runs 2 LPG and 16 liquid terminals across five Indian ports.

Aegis Vopak Terminals Limited IPO Overview

Aegis Vopak Terminals is set to launch its IPO through a book-building process, aiming to raise ₹2,800.00 crores. The entire issue consists of a fresh offering of 11.91 crore equity shares. The IPO will open for subscription on May 26, 2025, and close on May 28, 2025. The allotment of shares is expected to be finalised on Thursday, May 29, 2025, and the shares are proposed to be listed on the BSE and NSE, with a tentative listing date of Monday, June 2, 2025.

The IPO price band is fixed between ₹223 and ₹235 per share. Retail investors are required to apply for a minimum of one lot, comprising 63 shares, which amounts to ₹14,049. However, to enhance the chances of allotment and avoid the risk of oversubscription, it is recommended to bid at the cutoff price, raising the minimum investment to ₹14,805. For small non-institutional investors (sNII), the minimum application is 14 lots (882 shares), amounting to ₹2,07,270, while for big non-institutional investors (bNII), the minimum bid is 68 lots (4,284 shares), amounting to ₹10,06,740.

The book-running lead managers for the Aegis Vopak Terminals IPO are ICICI Securities Limited, BNP Paribas, IIFL Securities Ltd, Jefferies India Private Limited, and HDFC Bank Limited. Link Intime India Private Ltd has been appointed as the registrar for the issue.

Aegis Vopak Terminals Limited IPO Details

| Particulars | Details |

| IPO Date | 26 May 2025 to 28 May 2025 |

| Listing Date | 2 June 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹223 to ₹235 per share |

| Lot Size | 63 Shares |

| Total Issue Size | 11,91,48,936 shares (aggregating up to ₹2,800.00 Cr) |

| Fresh Issue | 11,91,48,936 shares (aggregating up to ₹2,800.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE BSE |

| Share Holding Pre Issue | 98,88,42,553 shares |

| Share Holding Post Issue | 1,10,79,91,489 shares |

Aegis Vopak Terminals Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Net Issue |

| Retail | Not more than 10% of the Net Issue |

| NII (HNI) | Not more than 15% of the Net Issue |

Aegis Vopak Terminals Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 63 | ₹14,805 |

| Retail (Max) | 13 | 819 | ₹1,92,465 |

| S-HNI (Min) | 14 | 882 | ₹2,07,270 |

| S-HNI (Max) | 67 | 4,221 | ₹9,91,935 |

| B-HNI (Min) | 68 | 4,284 | ₹10,06,740 |

Aegis Vopak Terminals Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 97.41% |

| Post-Issue | 85.93% |

Aegis Vopak Terminals Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.00 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 7.51% |

| Net Asset Value (NAV) | 13.27 |

| Return on Equity | 8.68% |

| Return on Capital Employed (ROCE) | 8.39% |

| EBITDA Margin | 71.19% |

| PAT Margin | 15.18% |

| Debt to Equity Ratio | 2.59 |

Objectives of the Proceeds

- Repayment or prepayment of all or a portion of certain outstanding borrowings availed by the Company – ₹20,159.53 million

- Funding capital expenditure towards contracted acquisition of the cryogenic LPG terminal at Mangalore – ₹6,713.00 million

- General corporate purposes

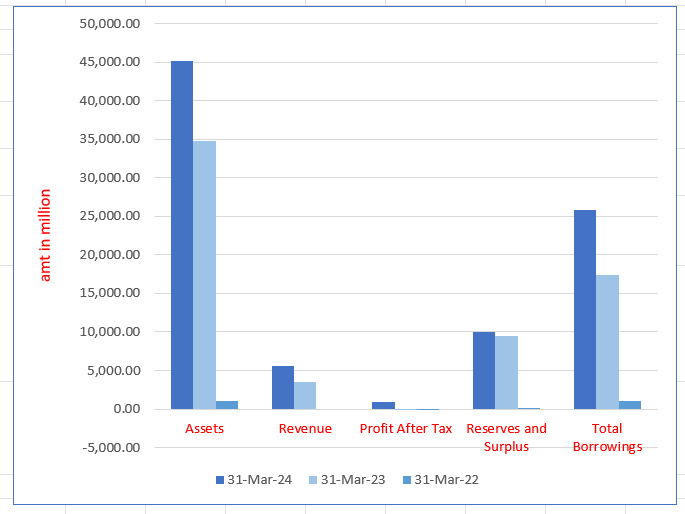

Key Financials (in ₹ million)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 45,234.01 | 34,814.82 | 1025.56 |

| Revenue | 5617.61 | 3533.32 | – |

| Profit After Tax | 865.44 | (0.75) | (10.92) |

| Reserves and Surplus | 9960.65 | 9519.91 | 12.79 |

| Total Borrowings | 25,864.17 | 17,451.67 | 981 |

SWOT Analysis of Aegis Vopak Terminals IPO

Strength and Opportunities

- Strategic joint venture between Aegis Group and Royal Vopak enhances global expertise.

- Extensive terminal network across five major Indian ports ensures strategic market presence.

- Diversified storage portfolio including LPG, chemicals, and edible oils.

- Ongoing expansion into green energy storage, such as green ammonia, aligns with sustainability goals.

- Strong financial backing facilitates large-scale infrastructure projects.

Risks and Threats

- Exposure to commodity price volatility affecting profitability.

- Regulatory and environmental compliance challenges in a highly regulated industry.

- High capital expenditure requirements for infrastructure expansion and maintenance.

- Dependence on a limited number of key customers for significant revenue streams.

- Potential delays in project execution due to logistical and bureaucratic hurdles.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Aegis Vopak Terminals Limited IPO

IPO Strengths

- The company is India’s largest third-party owner and operator of tank storage terminals for LPG and liquid products by capacity.

- It operates a strategically located network of terminals across key Indian ports, enhancing nationwide reach and cost-efficient logistics.

- Its advanced infrastructure supports safe, large-scale storage and handling of over 40 critical products.

- The company consistently expands capacity through efficient project execution without incurring direct construction risks.

- It benefits from the expertise, financial support, and proven credibility of its established promoters, Aegis and Vopak.

Peer Group Comparison

| Name of the Company | Revenue (in ₹ million) | Face Value (₹) | P/E (x) | EPS (₹) | RoNW (%) | NAV(₹) |

| Aegis Vopak Terminals Limited | 5,617.61 | 10 | [•] | 1.00 | 7.51% | 13.27 |

| Peer Groups | ||||||

| Adani Ports and Special Economic Zone Ltd | 267,105.60 | 2 | 37.48 | 37.55 | 15.32% | 245.10 |

| JSW Infrastructure Limited | 37,628.90 | 2 | 49.02 | 6.01 | 14.40% | 41.77 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Aegis Vopak Terminals Limited IPO

How can I apply for Aegis Vopak Terminals Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Aegis Vopak Terminals Limited IPO open and close?

The IPO will open for subscription on May 26, 2025, and close on May 28, 2025. Investors can bid within these dates before allotment finalisation on May 29, 2025.

What is the minimum investment required for retail investors?

Retail investors must apply for at least one lot, which includes 63 shares, requiring a minimum investment of ₹14,805 if bidding at the cutoff price of ₹235 per share.

What is the price band for the Aegis Vopak IPO?

The IPO price band is set between ₹223 and ₹235 per share. Bidding at the cutoff price is advised to increase chances of allotment, especially in case of oversubscription.

How many shares are being issued in the IPO?

A total of 11.91 crore equity shares are being offered through a fresh issue, aggregating to ₹2,800 crore, with no offer-for-sale component included in this IPO.

On which stock exchanges will Aegis Vopak be listed?

The equity shares of Aegis Vopak Terminals Limited are proposed to be listed on both the BSE and NSE, with a tentative listing date of June 2, 2025.