- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aequs Limited IPO

IPO Details

03 Dec 25

05 Dec 25

₹14,880

120

₹118 to ₹124

NSE, BSE

₹670 Cr

10 Dec 25

Aequs Limited IPO Timeline

Bidding Start

03 Dec 25

Bidding Ends

08 Dec 25

Allotment Finalisation

05 Dec 25

Refund Initiation

09 Dec 25

Demat Transfer

09 Dec 25

Listing

10 Dec 25

About Aequs Limited IPO

Aequs is a diversified contract manufacturing company that enables large-scale, timely production of complex products, meeting the exacting standards of global Original Equipment Manufacturers (OEMs) in aerospace and consumer sectors. Operating through three engineering-driven, vertically integrated precision manufacturing ecosystems in India, the company offers comprehensive “one-stop-shop” solutions. This integrated approach enhances quality control, optimizes costs and working capital, reduces lead times, and lowers the overall global carbon footprint, positioning Aequs as a reliable partner for precision manufacturing with sustainable and efficient operations.

Aequs Limited IPO Overview

The Aequs IPO is a book-built issue worth ₹921.81 crore, comprising a fresh issue of 5.40 crore shares amounting to ₹670.00 crore and an offer for sale of 2.03 crore shares totalling ₹251.81 crore. The subscription window will remain open from December 3 to December 5, 2025, with the allotment expected on December 8, 2025. The shares are proposed to list on the BSE and NSE, with the tentative listing date set for December 10, 2025. The IPO price band is fixed between ₹118 and ₹124 per share, and the application lot size is 120 shares. For retail investors, the minimum investment stands at ₹14,880, while the sNII category requires a minimum of 14 lots (1,680 shares) amounting to ₹2,08,320, and the bNII category requires 68 lots (8,160 shares) amounting to ₹10,11,840. JM Financial Ltd. is the book-running lead manager for the issue, and Kfin Technologies Ltd. will serve as the registrar.

Check Aequs IPO DRHP for detailed information

Aequs IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹921.81 crore |

| Fresh Issue | ₹670 crore |

| Offer for Sale (OFS) | 2.03 crore equity shares (₹251.81 crore) |

| IPO Dates | Dec 3–5, 2025 |

| Price Bands | ₹118–₹124 |

| Lot Size | 120 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 61,66,17,677 shares |

| Shareholding post-issue | 67,06,49,935 shares |

Aequs IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 120 | ₹14,880 |

| Retail (Max) | 13 | 1,560 | ₹1,93,440 |

| S-HNI (Min) | 14 | 1,680 | ₹2,08,320 |

| S-HNI (Max) | 67 | 8,040 | ₹9,96,960 |

| B-HNI (Min) | 68 | 8,160 | ₹10,11,840 |

Aequs Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Aequs Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹(1.80) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (14.47%) |

| Net Asset Value (NAV) | ₹12.47 |

| Return on Equity (RoE) | (14.30) |

| Return on Capital Employed (RoCE) | 0.87% |

| EBITDA Margin | 11.68% |

| PAT Margin | (11.07%) |

| Debt to Equity Ratio | 0.99 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment in full or in part, of certain outstanding borrowings and prepayment penalties, as applicable, availed by the company and two of its wholly-owned Subsidiaries, ASMIPLand ACPPLthrough investment in such Subsidiaries | 4192.43 |

| Funding capital expenditure to be incurred on account of purchase of machinery and equipment by the compnay and its wholly-owned Subsidiaries, ASMIPL, through investment in such Subsidiary | 674.46 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

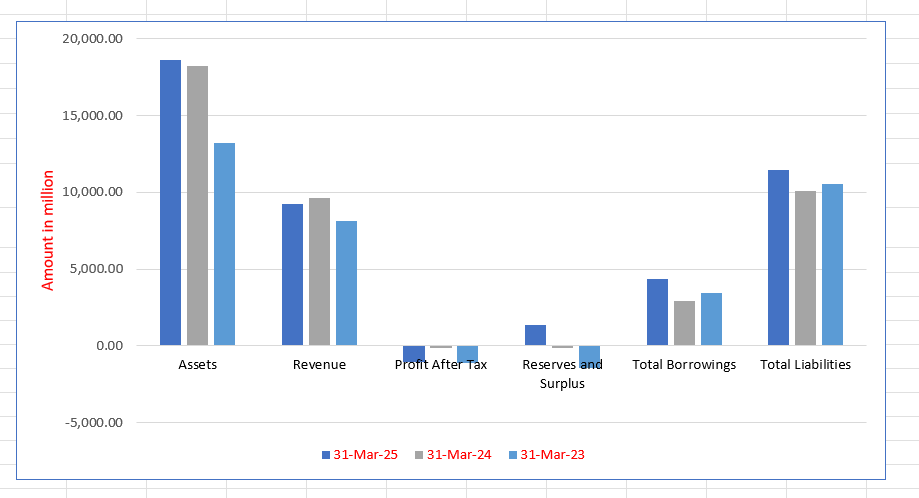

Aequs Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 18,598.40 | 18,229.83 | 13,216.91 |

| Revenue | 9,246.06 | 9,650.74 | 8,121.32 |

| Profit After Tax | (1,023.46) | (142.44) | (1,094.95) |

| Reserves and Surplus | 1,350.90 | (153.14) | (1,461.50) |

| Total Borrowings | 4,370.62 | 2,918.81 | 3,461.39 |

| Total Liabilities | 11,438.62 | 10,073.63 | 10,544.39 |

Financial Status of Aequs Limited

SWOT Analysis of Aequs Limited IPO

Strength and Opportunities

- Globally integrated precision manufacturing ecosystem serving aerospace and consumer sectors.

- Vertically-integrated value chain from forging to assembly enhances quality and cost control.

- Established long-term supply agreements with global OEMs boost order visibility.

- Presence across India, US and France enabling global supply-chain reach.

- Entry into growing toy and consumer goods manufacturing segment adds diversification.

- Planned IPO up to ₹720 crore potentially funds growth and strengthens balance sheet.

- Advanced manufacturing infrastructure and SEZ facility support scalability and export-orientation.

- Strong promoter and institutional backing improve capital access and strategic execution.

- Opportunity to service rising demand for precision manufacturing in India under “Make in India” impetus.

Risks and Threats

- Significant losses in recent years with continuing profit-after-tax decline.

- High working-capital intensity due to large inventory and lengthy receivables.

- Business exposed to customer concentration risk, especially in certain segments.

- Dependent on cyclical aerospace and consumer markets vulnerable to slowdowns.

- Competitive global landscape with margin pressure from low-cost producers.

- Large borrowing and lease liabilities increase financial risk exposure.

- Loss-making operations may challenge investor confidence and valuation.

- External risks such as regulatory changes, supply-chain disruptions and geo-political issues.

- Rapid technological change may require heavy capex; failure to upgrade could erode competitiveness.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Aequs Limited IPO

Aequs Limited IPO Strengths

Advanced and Vertically Integrated Precision Manufacturing

Aequs Limited is a leading company in a single Indian Special Economic Zone for end-to-end aerospace manufacturing capabilities (machining, forging, surface treatment, and assembly). Its three Indian and two international facilities boast vast machining capacity and over 200 CNC machines for aerospace components. This extensive, advanced manufacturing capability, including 3/4/5-axis milling and metal forming, enables the large-scale production of critical and complex products for both aerospace and consumer segments.

Unique, Engineering-Led Vertically Integrated Ecosystems

The company operates unique, engineering-led, vertically integrated precision manufacturing “ecosystems” in Belagavi, Hubballi, and Koppal, India, a structure that is singular within a single Indian SEZ for the Aerospace Segment. These co-located facilities allow Aequs Limited to offer fully integrated, end-to-end solutions to global OEMs, producing over 4,500 aerospace products. This model ensures timely delivery, high quality, and sustainability benefits like reduced logistics costs and carbon footprint, giving it a key competitive advantage.

Manufacturing Presence Across Three Continents

Aequs Limited is one of the few Indian Aerospace Segment companies with a manufacturing presence in India, the U.S., and France. This strategic global footprint, developed through organic growth and acquisitions like T&K Machine and SIRA Group, provides strategic proximity to global OEMs like Boeing and Safran. This allows the company to develop closer customer relationships, access a skilled, diverse workforce, and offer a competitive global manufacturing platform that caters to broad customer bases.

Comprehensive Precision Product Portfolio

The company maintains one of India’s largest aerospace product portfolios, comprising over 4,500 products for programs like the A320 and B737 commercial aircraft. Aequs Limited is a Tier-1 supplier focusing on high-value-added components across engine systems, landing systems, and assemblies. Furthermore, it has successfully leveraged these core precision capabilities to manufacture high-barrier consumer products, including components for portable computers, smart devices, and consumer durables, demonstrating a diversified and resilient portfolio.

Long-Standing Relationships with Global Customers

Aequs Limited has established long-standing relationships with high-entry-barrier global customers, including major OEMs like Airbus, Boeing, and Collins Aerospace (in Aerospace) and Hasbro and Wonderchef (in Consumer). Its three largest customer groups have an average tenure of 15 years, demonstrating high client stickiness due to collaborative manufacturing, stringent quality standards, and its “one-stop-shop” capabilities. This has resulted in recognition, including multiple Airbus “Detailed Parts Partner” awards.

Experienced Founder-Led Business and Qualified Team

The company is a founder-led business benefiting from an experienced management team with extensive industry expertise. The CEO, Mr. Aravind Shivaputrappa Melligeri, has over 25 years of aerospace experience, supported by a senior team with long tenure. This leadership provides stability and deep institutional knowledge. Additionally, a qualified employee base of over 3,780, including 825 engineers, along with regular training and proximity to engineering colleges, ensures high product quality and business growth effectiveness.

More About Aequs Limited

Aequs Limited stands as India’s only precision component manufacturer within a single Special Economic Zone offering fully vertically integrated manufacturing in the aerospace segment. This unique position distinguishes the company from peers that operate with selective manufacturing capabilities.

Aerospace Capabilities

The company holds one of the largest aerospace product portfolios in India as of March 2025, covering components for engine systems, landing systems, cargo interiors, and assemblies. During FY2025, Aequs reported net external revenue of ₹8,246.41 million from its aerospace segment. Its advanced facilities allow the production of over 4,500 aerospace products for commercial aircraft models such as A320, B737, and A350.

Diversified Product Portfolio

While aerospace remains its primary focus, Aequs has diversified into consumer electronics, plastics, and consumer durables, offering products such as cookware, home appliances, toy vehicles, and electronic components. This expansion leverages its existing engineering expertise to serve a broader customer base.

Vertically Integrated Ecosystem

Operating across three precision manufacturing ecosystems in India, Aequs collaborates with suppliers and joint ventures to deliver end-to-end production—covering machining, forging, surface treatment, and assembly. This integration reduces lead times, optimises working capital, and strengthens sustainability by lowering the carbon footprint.

Advanced Capabilities and Quality Excellence

Aequs is among the few Indian manufacturers with niche metallurgy capabilities, particularly in high-end alloys such as titanium. The company’s rigorous quality assurance framework, ISO 9001:2015 and AS9100D certifications, and advanced inspection systems ensure compliance with global standards.

Strategic Growth and Global Presence

Since 2009, Aequs has expanded through strategic acquisitions in North America and France, strengthening its footprint and technological capabilities. Its joint ventures—such as SQuAD Forging India Pvt. Ltd. and Aerospace Processing India Pvt. Ltd.—enhance expertise in forging, surface treatment, and consumer product innovation.

Clientele and Recognition

Aequs maintains strong relationships with global OEMs including Airbus, Boeing, Safran, and Honeywell, achieving consistent client retention due to quality, reliability, and performance. The company received the ‘Ramp-up Champion Award’ from Airbus in 2024 for operational excellence and resilience in a dynamic global environment.

Industry Outlook

The Indian precision engineering and aerospace manufacturing sectors are experiencing rapid growth, fueled by increasing global integration, government initiatives, and India’s strategic focus on self-reliance. The aerospace parts manufacturing market is projected to reach USD 21.48 billion by 2030, growing at a CAGR of approximately 6.8% from 2024 to 2030. Similarly, the broader precision engineering market is expected to expand from around USD 500 million in 2024 to USD 930 million by 2033, representing a CAGR of roughly 7.2%.

Aerospace & Precision Products Segment

Within the aerospace component segment—which includes engine systems, landing gear, sub-assemblies, and precision-machined parts—the Indian market is expected to grow from USD 398.8 million in 2024 to USD 637.3 million by 2030, achieving a CAGR of 8.3%. Exports of aerospace components from India have crossed USD 2 billion annually, supported by increasing global OEM sourcing.

Key Growth Drivers

- Rising global air travel and expanding aircraft fleets drive demand for structural, engine, and interior components.

- Government initiatives like “Make in India,” PLI schemes for electronics and components, and self-reliance programs boost domestic manufacturing.

- India’s cost competitiveness and skilled engineering talent enhance its global supply chain presence.

- Diversification into consumer electronics, plastics, and small appliances creates additional growth avenues beyond aerospace.

Challenges & Outlook

- Intense international competition, certification requirements, and long lead times for aerospace components remain key challenges.

- High capital expenditure requirements for advanced manufacturing may constrain smaller players

How Will Aequs Limited Benefit

- Aequs Limited, with its fully vertically integrated manufacturing ecosystems, is well-positioned to meet growing domestic and global aerospace demand.

- The company’s large portfolio of precision-engineered aerospace components allows it to capture a larger share of India’s expanding aerospace parts market.

- Government initiatives like PLI schemes and Make in India enhance Aequs’ cost competitiveness and support capacity expansion in electronics and precision components.

- Advanced metallurgy and 5-axis machining capabilities enable Aequs to serve complex OEM requirements efficiently, creating a barrier to new entrants.

- Diversification into consumer electronics, plastics, and durable goods allows Aequs to leverage existing engineering expertise for additional revenue streams.

- Strategic joint ventures and acquisitions in North America and Europe strengthen technological capabilities and expand global market access.

- Strong quality assurance frameworks and internationally recognized certifications support the company’s ability to maintain client trust and long-term contracts.

- Reduced lead times and co-located operations improve operational efficiency and working capital management.

Peer Group Comparison

| Name of the Companies | Revenue from Operations (₹ million) | Face Value (₹) | P/E as on 26 Sep 2025 | EPS (Basic) (₹) | EPS (Diluted) (₹) | Return on Net Worth (%) | Net Asset Value (₹) |

| Aequs Limited | 9,246.06 | 10 | [●] | (1.80) | (1.80) | (14.47%) | 12.47 |

| Peer Group | |||||||

| Azad Engineering Limited | 4,573.54 | 21.55 | 106.19 | 14.66 | 14.66 | 6.21% | 234.06 |

| Unimech Aerospace and Manufacturing Limited | 2,429.26 | 5 | 59.30 | 17.59 | 17.59 | 12.48% | 141.01 |

| Amber Enterprises India Limited | 99,730.16 | 10 | 113.89 | 72.01 | 71.67 | 10.99% | 672.61 |

| Kaynes Technology India Limited | 27,212.52 | 10 | 161.70 | 45.82 | 45.40 | 10.33% | 439.85 |

| Dixon Technologies (India) Limited | 3,88,601.00 | 2 | 86.44 | 205.70 | 202.58 | 47.50% | 494.74 |

| PTC Industries Limited | 3,080.74 | 10 | 368.96 | 41.37 | 41.33 | 4.40% | 940.03 |

Key Strategies for Aequs Limited

Expand Aerospace Wallet Share

Aequs Limited aims to increase its share of business with existing aerospace customers by moving up the manufacturing value chain. By focusing on more critical components such as engine and landing systems, and leveraging credibility with OEMs, the company strengthens client relationships and captures higher-value contracts.

Diversify Aerospace Customer Base

The company seeks to broaden its aerospace clientele by exploring new relationships and securing long-term master service agreements. Engagements at conferences, airshows, and D2P partnerships with Airbus provide access to multiple programs, allowing Aequs Limited to secure work orders and expand its presence in the aerospace segment.

Grow Consumer Electronics Portfolio

Aequs Limited leverages its aerospace manufacturing expertise to scale production in consumer electronics. The company has commenced mass production of portable computer and smart device components, investing in plant, machinery, and capacity, to strengthen relationships with global OEMs and capture a larger share of the consumer electronics market.

Expand Consumer Durables Offerings

Through strategic joint ventures, including Tramontina, Aequs Limited plans to grow its consumer durables portfolio. It focuses on cookware, kitchenware, and other household products, while exploring additional collaborations to manufacture premium items such as aluminium, ceramic, and triply-coated cookware, enhancing market share and product diversity.

Enhance Margins and Operational Efficiency

The company targets higher profitability by improving asset utilization, pursuing operational efficiencies, and focusing on high-value components in aerospace and consumer segments. Initiatives include local sourcing, streamlining manufacturing, and expanding higher-margin consumer electronics, enabling better cost management and improved margins across segments.

Leverage Capabilities for Sector Adjacencies

Aequs Limited plans to replicate its advanced aerospace engineering and precision manufacturing capabilities into related sectors. By strategically investing, forming partnerships, and engaging with global OEMs, the company aims to increase market share in precision-driven industries while capitalizing on favorable government initiatives and industry growth trends.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs Aequs Limited IPO

How can I apply for Aequs Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Aequs Limited’s IPO?

The IPO aims to raise up to ₹720 crore through fresh issuance and Offer-for-Sale shares.

When was Aequs Limited’s IPO approved by SEBI?

SEBI granted approval for the IPO around mid-September 2025 after filing the updated DRHP.

On which stock exchanges will Aequs Limited list?

Aequs IPO opens for subscription on Dec 3, 2025 and closes on Dec 5, 2025. The allotment for the Aequs IPO is expected to be finalized on Dec 8, 2025. Aequs IPO will list on BSE, NSE with a tentative listing date fixed as Dec 10, 2025.

What is the purpose of the IPO?

Aequs IPO is a book build issue of ₹921.81 crores. The issue is a combination of fresh issue of 5.40 crore shares aggregating to ₹670.00 crores and offer for sale of 2.03 crore shares aggregating to ₹251.81 crores.

Does the IPO include an Offer-for-Sale component?

Yes, the IPO includes an Offer-for-Sale of approximately 2.03 crore equity shares alongside the fresh issue.