- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aggcon Equipments International IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Aggcon Equipments International IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Aggcon Equipments International Limited

Aggcon Equipments International Ltd is one of India’s leading and fastest-growing infrastructure equipment rental companies, offering a wide range of rental services for earthmoving, road construction, material handling, foundation, concrete, and aerial work platforms. Its fleet includes top OEM brands such as Volvo, Wirtgen, ACE, Schwing Stetter, SANY, JCB, Tata Hitachi, and more. As a member of industry bodies like ASSOCHAM, FICCI, CERA, COAOI, and CIDC, Aggcon has served over 500 customers across 27 states, operating 337 fleets and four subsidiaries

Aggcon Equipments International Limited IPO Overview

AggconEquipments International Ltd. has filed for an IPO as a Book Build Issue comprising a fresh issue of shares worth ₹332.04 crores along with an Offer for Sale (OFS) of up to 0.94 crore equity shares. The equity shares are proposed to be listed on both NSE and BSE. Motilal Oswal Investment Advisors Ltd. is acting as the book running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar to the issue. Important details such as IPO opening and closing dates, price band, and lot size are yet to be announced. For further information, investors may refer to the Draft Red Herring Prospectus (DRHP)

Aggcon Equipments International Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹332.04 crore |

| Offer for Sale (OFS) | 0.94 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,03,35,000 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Aggcon Equipments International Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Aggcon Equipments International Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.40 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 24.73% |

| Net Asset Value (NAV) | ₹15.46 |

| Return on Equity (RoE) | 24.73% |

| Return on Capital Employed (RoCE) | 15.05% |

| EBITDA Margin | 61.32% |

| PAT Margin | 18.60% |

| Debt to Equity Ratio | 2.73 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or part, of certain borrowings availed by the Company | 1680.03 |

| Capital expenditure towards purchase of equipment | 840.35 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

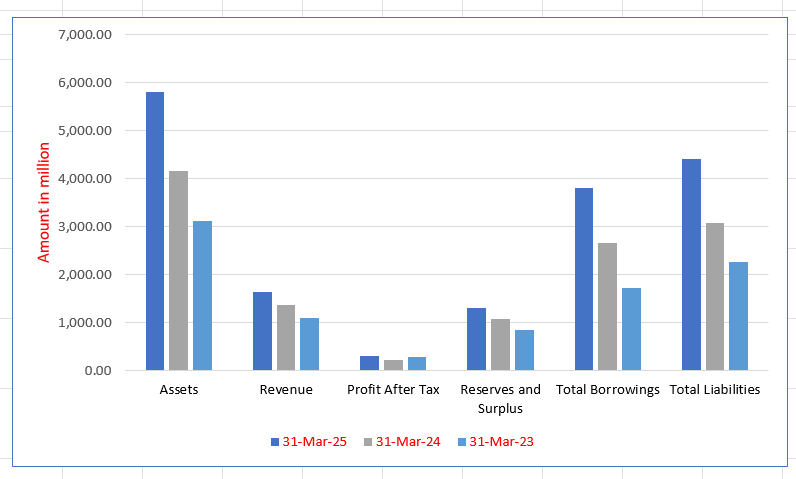

Aggcon Equipments International Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,807.29 | 4,159.92 | 3,120.50 |

| Revenue | 1,640.22 | 1,372.86 | 1,110.06 |

| Profit After Tax | 307.15 | 226.44 | 279.24 |

| Reserves and Surplus | 1,305.82 | 1,075.08 | 848.17 |

| Total Borrowings | 3,815.78 | 2,659.15 | 1,724.00 |

| Total Liabilities | 4,411.13 | 3,071.93 | 2,259.42 |

Financial Status of AggconEquipments International Limited

SWOT Analysis of Aggcon Equipments International IPO

Strength and Opportunities

- Leading and fast-growing infrastructure equipment rental company in India.

- Extensive and modern fleet with more than 300 units and low average age

- Pan-India integrated operations network across states and union territories

- Associations with top infrastructure clients such as Afcons, Tata Projects, and others

- Strong brand legacy since 2003 with over two decades of experience

- Membership in industry bodies like ASSOCHAM, FICCI, and CIDC, enhancing credibility

- Opportunity to expand fleet and services using IPO proceeds for debt reduction or new investments

- Increasing infrastructure push by Government of India offers sustained demand potential

- Growth opportunities in specialized segments like cranes for wind energy projects

Risks and Threats

- Heavy reliance on infrastructure and road construction sectors poses concentration risk

- Operating in a highly competitive and cyclical industry sensitive to government spending fluctuations

- Significant dependence on raw material availability and price fluctuations

- Project delays or cancellations can severely impact cash flows

- As an SME-level IPO, post-listing liquidity and investor reach may be limited

- Status as an unlisted company may limit access to broader capital and transparency

- High leverage and borrowings could strain financial stability

- Emerging new players in equipment rental pose rising competitive threats

- Training and retaining skilled operators and maintenance staff remains a challenge

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Aggcon Equipments International Limited IPO

Aggcon Equipments International Limited IPO Strengths

Extensive and Modern Equipment Fleet

Aggcon Equipments International Limited offers an extensive and diverse fleet of modern, high-quality equipment sourced from global manufacturers. With a low average fleet age of 2.91 years, the company ensures operational efficiency and minimal maintenance costs. The company’s comprehensive selection covers various infrastructure segments, positioning them as a one-stop solution for clients.

Pan-India Service Delivery

Aggcon Equipments International Limited provides seamless equipment rental solutions across India, serving customers in diverse sectors like infrastructure, construction, and mining. The company’s pan-India presence and strong supply chain network ensure prompt delivery, with an average mobilization time of 7-10 days for equipment redeployment. This responsiveness has led to strong customer relationships and positive feedback.

Exclusive Focus on Equipment Leasing

The company’s singular focus on equipment leasing and rentals provides a key competitive advantage. This specialization allows Aggcon Equipments International Limited to offer flexible, cost-effective solutions that help clients optimize capital deployment and improve liquidity. This business model allows them to leverage bulk purchasing power to secure competitive pricing, passing cost efficiencies on to customers.

Strong Customer and Supplier Relationships

Aggcon Equipments International Limited has cultivated strong, long-term relationships with both customers and suppliers. Their ability to make bulk purchases from reputable manufacturers ensures competitive pricing and access to the latest technologies. This, combined with their focus on customer satisfaction, has resulted in a steady increase in repeat customers and robust market acceptance.

Experienced Leadership and Management

The company benefits from the extensive experience of its promoters, Jitender Aggarwal and Renu Aggarwal, who have over 40 years of collective experience in the infrastructure equipment rental industry. This strong leadership, supported by a qualified senior management team, enables the company to anticipate market trends, maintain relationships, and make timely strategic decisions that contribute to sustained growth.

Robust Financial Performance

Aggcon Equipments International Limited has demonstrated strong financial performance, with impressive growth in revenue and profitability. The company reported the highest EBITDA and EBIT margins among its listed peers in Fiscal 2025 and the highest average blended yield per month in both Fiscal 2024 and Fiscal 2025. This strong financial position supports future growth initiatives.

More About Aggcon Equipments International Limited

Aggcon Equipments International Limited is among the leading and fastest-growing infrastructure equipment rental companies in India. Between FY 2023 and FY 2025, the company recorded a revenue growth of 21.56% CAGR, with an impressive EBITDA margin of 61.32% and EBIT margin of 41.11% in FY 2025 (Source: 1Lattice Report). With more than 22 years of experience, it operates an integrated network across India, offering one of the most diverse rental fleets in the industry.

Fleet and Services

Aggcon provides a comprehensive range of infrastructure equipment, including:

- Earthmoving Equipment

- Road Construction Equipment

- Material Handling Equipment

- Concrete Equipment

- Foundation Equipment

- Aerial Workspace Platforms

As of March 31, 2025, the company had a fleet of 337 units with an average age of 2.91 years, catering to industries such as road construction, railways, power, mining, and waterways.

Key Clients and Projects

The company serves major industry leaders, including:

- Afcons Infrastructure Limited

- Tata Projects Limited

- Monte Carlo Limited

- G.R. Infraprojects Limited

Aggcon’s equipment has supported landmark projects like the Mumbai Trans Harbour Link (MTHL PKG-1), INS Varsha Naval Facility, Kudankulam Nuclear Power Plant, and the Dhubri-Phulbari Bridge.

Industry Position

Aggcon is among the few Indian companies focused exclusively on construction equipment rental (Source: 1Lattice Report). Its operations are further strengthened through memberships in key organisations, such as ASSOCHAM, FICCI, CERA, COAOI, and CIDC.

Subsidiaries

The company has four subsidiaries—Savbri International Pvt. Ltd., RJSP Logistics Pvt. Ltd., Remodelers Buildcon Pvt. Ltd., and Max Rentals Pvt. Ltd.—which play a vital role in executing large-scale projects like the Rishikesh-Karanprayag Tunnel and High-Speed Rail C4 Vapi.

Leadership and Vision

Founded in 2003, Aggcon is led by its promoters, Jitender Aggarwal and Renu Aggarwal, who collectively bring over 40 years of expertise. Guided by their leadership, the company aims to serve India’s expanding infrastructure sector with sustainable, modern rental solutions, positioning itself as a trusted partner for national development.

Industry Outlook

Market Size & Growth Prospects

The Indian construction equipment industry is witnessing rapid expansion, supported by the government’s infrastructure agenda and rising private investments. The market is estimated at around USD 8.5 billion in 2025 and is projected to grow to USD 12.7 billion by 2030, registering a CAGR of about 8–9%. Other estimates suggest growth from USD 14.3 billion in 2024 to USD 29.5 billion by 2033, reflecting a CAGR of nearly 7.6%, while more optimistic projections indicate an 11.9% CAGR until 2032.

Growth Drivers

- Government Push: National Infrastructure Pipeline, Smart Cities, PMAY housing, and highway development projects.

- Urbanisation & Industrialisation: Growing demand for real estate, railways, power, and mining equipment.

- Technology & Sustainability: Increasing adoption of electric machinery, automation, and telematics solutions.

Equipment Rental Market Outlook

The Indian construction equipment rental market is on a stable growth path, expected to expand at a CAGR of 5.1% between 2025 and 2030. Renting has become a preferred option due to cost savings, flexibility, and the inclusion of operator and maintenance services. The material handling segment, particularly cranes, dominates rental demand, driven by mega projects such as bullet trains, freight corridors, metro rail, and expressways.

How Will Aggcon Equipments International Limited Benefit

- Rising infrastructure investments will drive consistent demand for Aggcon’s equipment across highways, metros, and industrial projects.

- Growth in the rental market at a steady 5% CAGR aligns directly with Aggcon’s business model, ensuring recurring revenue opportunities.

- Increasing reliance on material handling and earthmoving equipment places Aggcon’s fleet in a strong demand category.

- Urbanisation and industrialisation will expand project pipelines, enabling Aggcon to strengthen its partnerships with leading construction firms.

- Adoption of modern, sustainable equipment in the industry complements Aggcon’srelatively young fleet, enhancing operational efficiency.

- Government-backed mega projects create long-term visibility, positioning Aggcon as a trusted partner in India’s growth story.

Peer Group Comparison

| Name of the Company | Total Income (₹ mn) | Face Value (₹/share) | EPS (₹) | NAV per Share (₹) | P/E | RoE (%) |

| Aggcon Equipments International Limited | 1,651.01 | 1.00 | 3.40 | 15.46 | NA | 24.73% |

| Peer Groups | ||||||

| Sanghvi Movers Limited | 8,228.64 | 1.00 | 18.08 | 131.97 | 15.19 | 14.53% |

| Vision Infra Equipments Solution Limited | 4,548.08 | 10.00 | 15.97 | 66.95 | 10.08 | 36.12% |

| Tara Chand Infralogistic Solutions Limited | 2,540.49 | 2.00 | 3.15 | 15.40 | 23.88 | 22.99% |

Key Strategies for Aggcon Equipments International Limited

Continue to Focus on Building Current Fleet with Quick Equipment Turnover

We follow a structured approach to equipment lifecycle management to ensure our fleet remains modern, efficient, and aligned with operational demands. Our strategy involves acquiring new machinery, using it for a defined period of eight to ten years, and then replacing it with upgraded models. This proactive replacement cycle minimises risks of obsolescence and excessive maintenance while ensuring efficiency. We also monitor emerging technologies and market trends to integrate innovations that improve productivity and align with evolving industry standards. Regular fleet upgrades strengthen long-term customer relationships and improve project execution. Furthermore, we are committed to investing ₹840.35 million from the Net Proceeds of this Offer towards capital expenditure for new equipment purchases.

Expand Geographical Footprint and Sectoral Presence

Our expansion strategy focuses on entering high-growth regions, strengthening existing footholds, and forming partnerships with regional players and government agencies. We aim to diversify beyond traditional infrastructure projects into renewable energy, warehousing, and smart cities, supported by tailored leasing solutions and innovative models. International expansion is also a priority, leveraging relationships with global suppliers and customers. Participation in global conventions enhances credibility and opens new opportunities abroad. Regional diversification will improve business resilience and mitigate risks from economic fluctuations.

Strengthen Supplier and Customer Relationships

We recognise the importance of reliable supplier and customer relationships for long-term growth. With suppliers, we plan to establish strategic alliances, diversify sourcing, and implement performance-based metrics to improve quality and timeliness. On the customer side, we aim to strengthen service frameworks by introducing dedicated account managers, feedback mechanisms, and flexible leasing solutions. Technology-driven CRM systems will help manage contracts, track equipment, and resolve issues more efficiently, supported by predictive analytics for demand planning. A user-friendly digital platform will further enhance customer experience, satisfaction, and retention.

Use of Technology for Fleet Optimisation and Customer Engagement

We intend to leverage advanced technologies to optimise fleet utilisation through predictive maintenance, reducing downtime and enhancing performance. Our focus includes developing a digital application to simplify leasing, provide real-time updates, and improve customer interactions. A seamless digital platform will enable clients to manage contracts and access support services with ease. These initiatives will drive operational excellence, increase customer satisfaction, and give us a competitive edge in the infrastructure equipment rental industry.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Aggcon Equipments International Limited IPO

How can I apply for Aggcon Equipments International Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the offer size of AggconEquipments International IPO?

The IPO comprises a fresh issue of ₹332.04 crores and an OFS of up to 0.94 crore shares.

How will the IPO proceeds be utilised?

Proceeds will primarily fund debt repayment, equipment purchase, and general corporate purposes.

Where will AggconEquipments International IPO be listed?

The equity shares are proposed to be listed on both NSE and BSE mainboard platforms.

Who are the promoters of AggconEquipments International Ltd?

The promoters of the company are Jitender Aggarwal and Renu Aggarwal, holding 99.92% pre-issue.