- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Alcobrew Distilleries India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Alcobrew Distilleries India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Alcobrew Distilleries India Limited

Alcobrew Distilleries India Limited is an Indian IMFL manufacturer with a strong presence in whisky, vodka, gin, rum, and brandy, mainly in the prestige and above segments. It produces over 13 brands across popular, prestige, premium, and luxury categories, with a total bottling capacity of 6.40 million cases. The company operates a bottling plant in Dera Bassi, Punjab, and a distillery in Gamber Valley, Solan, Himachal Pradesh. Key brands include White & Blue Whisky, Golfer’s Shot Whisky, White Hills Whisky, and Alcobrew Single Oak Whisky.

Alcobrew Distilleries India Limited IPO Overview

Alcobrew Distilleries India Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 25, 2025, to raise capital through an Initial Public Offering (IPO). The IPO is structured as a book-building issue, comprising a fresh issue worth ₹258.26 crores and an Offer for Sale (OFS) of up to 1.80 crore equity shares. The company plans to list its shares on both the NSE and BSE. Kfin Technologies Ltd. will act as the registrar, while the book running lead manager is yet to be appointed. Key details such as the IPO dates, price band, and lot size are yet to be announced. Prior to the IPO, the promoters—Romesh Pandita, Veena Pandita, and the Romesh Pandita Family Trust—hold 100% of the company’s equity. The issue will follow a fresh capital-cum-OFS structure with a face value of ₹10 per share.

Alcobrew Distilleries India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹258.26 crore |

| Offer for Sale (OFS) | 1.80 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 15,40,00,000 shares |

| Shareholding post-issue | TBA |

Alcobrew Distilleries India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Alcobrew Distilleries India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Alcobrew Distilleries India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.50 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 23.99% |

| Net Asset Value (NAV) | ₹21.05 |

| Return on Equity (RoE) | 23.99% |

| Return on Capital Employed (RoCE) | 24.80% |

| EBITDA Margin | 15.21% |

| PAT Margin | 8.76% |

| Debt to Equity Ratio | 0.42 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or part, of certain borrowings availed by the Company | 1400 |

| Construction of visitor centre and new maturation hall in Gamber Valley, Solan, Himachal Pradesh; | 289.14 |

| Market expenses for new product launches | 247.80 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

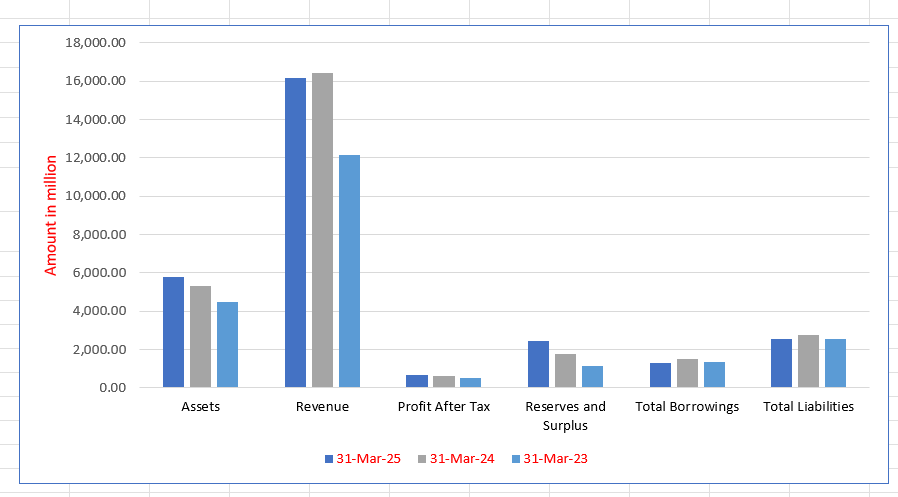

Alcobrew Distilleries India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,804.61 | 5,320.78 | 4,455.55 |

| Revenue | 16,150.13 | 16,401.14 | 12,168.66 |

| Profit After Tax | 694.50 | 625.54 | 523.02 |

| Reserves and Surplus | 2,470.99 | 1,777.81 | 1,153.12 |

| Total Borrowings | 1,298.58 | 1,483.16 | 1,335.46 |

| Total Liabilities | 2,563.62 | 2,772.97 | 2,532.43 |

Financial Status of Alcobrew Distilleries India Limited

SWOT Analysis of Alcobrew Distilleries India IPO

Strength and Opportunities

- Established market position with over a decade in manufacturing and bottling Indian-made foreign liquor (IMFL).

- Extensive pan-India distribution network and established brands across premium and sub-premium categories.

- Strong financial risk profile with low gearing and stable debt protection metrics.

- Diversified product portfolio catering to various consumer segments, including whisky, vodka, and rum.

- Growing global footprint with exports to over 20 countries across Africa, Asia, and the Middle East.

- Commitment to quality and innovation, enhancing brand recognition and consumer loyalty.

- Strategic partnerships and contract manufacturing arrangements to expand market reach.

- Focus on sustainability and environmental compliance in manufacturing processes.

- Ongoing investment in brand development and marketing to strengthen market presence.

Risks and Threats

- Dependence on two primary brands, Golfer’s Shot and White & Blue, which constitute a significant portion of revenue.

- Moderate scale of operations with limited brand diversity in revenue streams.

- Presence in a highly regulated alcoholic beverages industry, subject to changing policies and regulations.

- Large working capital requirements due to delayed receivables and excise duty payments.

- High bank limit utilization, with some months exceeding 100%, indicating liquidity pressures.

- Vulnerability to raw material price volatility, impacting operating profitability.

- Exposure to economic downturns and shifts in consumer preferences affecting demand.

- Potential challenges in maintaining consistent product quality across diverse markets.

- Competitive pressures from established players in the alcoholic beverages industry.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Alcobrew Distilleries India Limited

Alcobrew Distilleries India Limited IPO Strengths

Extensive and Diverse Product Portfolio

Alcobrew Distilleries India Limited boasts a diversified portfolio of 13 Indian-Made Foreign Liquor (IMFL) products, spanning whisky, vodka, gin, rum, and brandy. These offerings cover popular, prestige, premium, and luxury segments with varying price points, demonstrated by multiple product recognitions. This breadth allows the company to effectively drive sales across numerous consumer categories and price segments.

Innovation-Driven Product Development

The company’s focus on innovation ensures its product development remains relevant to evolving consumer tastes, such as the increasing demand for flavoured spirits. A prime example is the successful launch of the One More Vodka brand, which has become a significant growth engine and diversified its revenue away from traditional brown spirits, showcasing its ability to capture emerging market trends.

Strategic Manufacturing and Backward Integration

Alcobrew operates strategically located manufacturing facilities in Punjab and Himachal Pradesh, complemented by contractual arrangements in other states. Critically, the Solan facility provides backward integration for malt spirit distillation, reducing dependency on third-party procurement and securing a supply of aged malt for high-end single malt whisky production, optimizing both cost and quality.

Expertise in Navigating Regulatory Barriers

Alcobrew has established a well-established framework and a dedicated team to efficiently handle the complex and fragmented regulatory landscape of the Indian alcohol beverage market. Its existing licenses, deep-rooted distribution networks, and experience with high excise duties, advertising restrictions, and state-level controls act as significant structural entry barriers against new market entrants.

Strong Distribution Footprint in Key Markets

The company has built a strong and extensive distribution network, particularly throughout North India (including states like Delhi, Haryana, and Uttar Pradesh), which accounts for a significant portion of its total revenue. Additionally, Alcobrew maintains a substantial Pan-India footprint through the Canteen Stores Department (CSD) and Paramilitary Forces (PMF), ensuring a secure and widespread reach.

Experienced and Promoter-Led Management

Alcobrew is led by a highly experienced management team, including its Promoter and Managing Director, Romesh Pandita, who brings 44 years of industry knowledge. The leadership’s extensive expertise in operations, finance, and business development has been instrumental in building the diverse portfolio and extensive distribution network, enabling the company to effectively identify and capitalize on market opportunities.

More About Alcobrew Distilleries India Limited

Alcobrew Distilleries India Limited is a leading Indian IMFL manufacturer with a strong presence across whisky, vodka, gin, rum, and brandy categories, primarily operating in the prestige and above segments. Established in 2002, the company commenced bottling operations in 2006 at its Dera Bassi plant, Punjab, and gradually expanded its footprint across Delhi, Punjab, Chandigarh, Uttarakhand, Chhattisgarh, Jharkhand, Leh, Jammu & Kashmir, Uttar Pradesh, Himachal Pradesh, Haryana, Odisha, Telangana, Goa, DDS, Andaman Nicobar, and Tripura. As of FY 2025, Alcobrew holds a 3.79% market share in North India’s whisky segment and 11.02% in Delhi by volume.

To enhance operations, the company set up its distillery at the scenic Gamber Valley, Solan, Himachal Pradesh in 2022. With a total bottling capacity of 6.40 million cases, Alcobrew manufactures and sells over 13 premium and luxury brands nationwide.

Brand Portfolio

Alcobrew’s portfolio includes:

- Flagship whisky brands: White & Blue, Golfer’s Shot, White Hills, Alcobrew Single Oak, and Golfer’s Shot 18 Hole.

- Vodka: One More Vodka, including flavored variants.

- Rum: Lion’s Daddy Dark Rum and Old Smuggler Rum.

- Brandy: Victorio Reserve.

- Luxury launches in FY 2025: Golden Circle Whisky and Bhrum Lemon Flavored White Rum.

The company has partnered with Davide Campari Milano N.V. since 2010 to manufacture and sell Old Smuggler Scotch and Rum in India. Its brands have consistently demonstrated strong growth—Golfer’s Shot achieved a 23% CAGR over four years, One More Vodka grew at 101% CAGR, and Alcobrew Single Oak rose 315% since launch.

Production and Distribution

Alcobrew operates two modern facilities:

- Dera Bassi Bottling Plant: 11 bottling lines with a 4.62 million cases annual capacity.

- Gamber Valley Distillation & Bottling Plant: 2 bottling lines, 0.90 million liters distillation capacity, and 0.60 million cases bottling capacity.

These facilities leverage Himalayan water, climate, and natural humidity for premium spirit maturation. The company also utilizes contractual manufacturing through GOL and KBPL for strategic distribution in Uttar Pradesh and Odisha.

Marketing and Leadership

The company invests heavily in marketing and brand-building initiatives, including digital campaigns, retail visibility, and awards recognition such as Drinks International’s Fastest Growing Millionaire Brand. Its senior management, led by MD Romesh Pandita, brings extensive experience in manufacturing, consumer goods, sales, marketing, and finance, ensuring effective implementation of business strategies and continued brand growth.

Industry Outlook

The Indian alcoholic beverage industry is poised for substantial growth, driven by evolving consumer preferences, premiumization trends, and expanding market access.

Market Size and Growth Projections

- Market Value: The Indian alcohol market is projected to reach USD 200 billion by 2025, with an estimated CAGR of 7.2% from 2025 to 2035.

- Premium Segment: The premium spirits category is experiencing robust growth, with sales expected to rise by 20% during festive periods, reflecting a strong shift toward higher-quality products.

Industry Growth Drivers

- Premiumization Trend: Consumers are increasingly opting for premium and luxury alcoholic beverages, resulting in higher margins and brand loyalty.

- Urbanization and Disposable Income: Rising urbanization and disposable incomes are expanding the consumer base, particularly in metropolitan areas.

- Regulatory Reforms: Policy changes and excise duty adjustments in various states are influencing pricing strategies and market dynamics.

- Festive Seasons and Events: Cultural events and festivals significantly boost alcohol sales, creating seasonal spikes in demand.

Market Challenges

- Excise Duty Hikes: Recent increases in excise duties in certain states have led to product shortages and shifts in consumer purchasing patterns.

- Regulatory Compliance: Navigating the complex regulatory landscape across states can affect production and distribution strategies.

- Supply Chain Constraints: Logistical challenges and inventory management issues can impact product availability and retailer margins.

How Will Alcobrew Distilleries India Limited Benefit

- Alcobrew can capitalise on the growing premium and luxury spirits segment to increase market share and margins.

- Rising urbanisation and higher disposable incomes in key markets can drive demand for Alcobrew’s whisky, vodka, rum, and brandy brands.

- Expansion of festive and seasonal sales presents opportunities to boost volumes and revenue across its product portfolio.

- Regulatory reforms and excise duty rationalisation in certain states can enhance pricing flexibility and profitability.

- Increasing consumer preference for high-quality, authentic spirits aligns with Alcobrew’s focus on premium and luxury offerings.

- Strategic distribution and strong regional presence, particularly in North India and Delhi, positions Alcobrew for sustained growth.

- Its Solan distillery enables in-house production of malt spirit, reducing dependency on external sources and improving cost efficiency.

- A diverse product portfolio allows Alcobrew to cater to shifting consumer tastes while mitigating category-specific risks.

- Marketing and brand-building initiatives can strengthen brand recall and foster long-term customer loyalty.

Peer Group Comparison

| Name of Company | Total Income (₹ million) | Face Value (₹ per share) | Closing Price on 24 Sep 2025 (₹) | EPS (₹) | Diluted NAV (₹ per share) | P/E (Based on Diluted EPS) | RoE (%) |

| Alcobrew Distilleries India Limited | 16,150.13 | 10 | NA | 4.50 | 21.05 | NA | 23.99% |

| Peer group | |||||||

| United Spirits Limited | 272,760.00 | 2 | 1,350.90 | 22.28 | 111.42 | 60.63 | 20.78% |

| Radico Khaitan Limited | 170,985.36 | 2 | 2,969.30 | 25.82 | 205.80 | 115.00 | 13.31% |

| Allied Blenders & Distillers Limited | 80,731.55 | 2 | 535.30 | 7.19 | 55.88 | 74.45 | 19.78% |

| Tilaknagar Industries Limited | 31,746.15 | 10 | 462.20 | 11.81 | 45.56 | 39.14 | 29.89% |

| Piccadily Agro Industries Limited | 8,862.57 | 10 | 714.35 | 10.84 | 72.09 | 65.90 | 20.07% |

Key Strategies for Alcobrew Distilleries India Limited

Introduction of Premium and Luxury Brands

Alcobrew Distilleries India Limited intends to expand its offerings by launching more products in the premium and luxury categories, such as the newly introduced GOLDEN CIRCLE craft whisky. This strategy is a direct response to rising consumer disposable income and the ‘drink less, but better’ trend. Focusing on higher quality and refined tastes is expected to increase profitability per unit and enhance overall financial performance.

Targeted Expansion in Focus Markets

The company is focused on deepening its market penetration in five identified high-growth states: Maharashtra, Telangana, Himachal Pradesh, Odisha, and Tripura. Alcobrew plans to leverage its North Indian success, strengthen distribution networks, and deploy region-specific marketing and sales teams. This expansion will utilize its unutilized capacity, diversifying sales and reducing reliance on limited regional performance.

Innovation in Single Malts and Product Portfolio

Alcobrew is committed to strengthening its business through continuous product innovation and launches, particularly by capitalizing on the growing single malts market. The company is maturing over two million liters of malt spirit to develop high-end single malt whiskies, intending to create a flagship ‘halo brand.’ This focus aims to increase consumer wallet share and capture shifts in customer preference.

Establishing Himalayan Malt Tourism Hub

Alcobrew plans to significantly strengthen its brand equity by establishing India’s first Himalayan malt tourism hub at its Solan plant. This initiative involves investing in infrastructure for a visitor center and maturation hall. The hub will offer an immersive, experiential engagement to attract high-value consumers, elevate the brand’s premium positioning, and support the long-term growth of the malt business.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Alcobrew Distilleries India Limited IPO

How can I apply for Alcobrew Distilleries India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Alcobrew Distilleries India Limited IPO?

Alcobrew IPO is a Book Building issue with fresh shares worth ₹258.26 crore and an Offer for Sale.

When will Alcobrew IPO be listed?

The IPO will be listed on NSE and BSE; exact listing date and price band are yet to be announced.

Q3. What is the face value and lot size of the IPO shares?

The face value is ₹10 per share; lot size and issue price band are not yet declared.

How will Alcobrew utilise the IPO proceeds?

Funds will repay borrowings, expand Gamber Valley facilities, support new product launches, and cover general corporate purposes.

Who are the promoters of Alcobrew Distilleries India Limited?

Promoters include Romesh Pandita, Veena Pandita, and Romesh Pandita Family Trust, holding 100% pre-IPO shares.