- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

All Time Plastics IPO

₹14,040/54 shares

Minimum Investment

IPO Details

07 Aug 25

11 Aug 25

₹14,040

54

₹260 to ₹275

NSE, BSE

₹400.60 Cr

14 Aug 25

All Time Plastics IPO Timeline

Bidding Start

07 Aug 25

Bidding Ends

11 Aug 25

Allotment Finalisation

12 Aug 25

Refund Initiation

13 Aug 25

Demat Transfer

13 Aug 25

Listing

14 Aug 25

All Time Plastics Limited

Established in 1971, All Time Plastics Limited (ATPL) is an Indian manufacturer of plastic houseware products. It caters to B2B white-label clients and also markets its own B2C brand, “All Time Branded Products.” As of March 31, 2025, the company offered 1,848 SKUs across eight categories, including kitchen tools, food containers, hangers, cleaning and bathroom products. ATPL maintains strong global ties with retailers like IKEA, Asda, Michaels, and Tesco, and distributes across 23 Indian states through modern retailers, super distributors, and direct distributors.

All Time Plastics Limited IPO Overview

All Time Plastics IPO is a book-built issue worth ₹400.60 crores. The offering comprises a fresh issue of 1.02 crore shares, aggregating to ₹280.00 crores, and an offer for sale of 0.44 crore shares, aggregating to ₹120.60 crores. The IPO will open for subscription on August 7, 2025, and close on August 11, 2025. The allotment is expected to be finalised on Tuesday, August 12, 2025, with the shares proposed to be listed on both BSE and NSE on Thursday, August 14, 2025.

The price band for the IPO has been set between ₹260 and ₹275 per share. The minimum application lot size is 54 shares, translating to a retail investment of ₹14,040. For small non-institutional investors (sNII), the minimum application is 14 lots (756 shares) costing ₹2,07,900, while for big non-institutional investors (bNII), the minimum application is 68 lots (3,672 shares) amounting to ₹10,09,800. Intensive Fiscal Services Private Limited is acting as the book-running lead manager for this IPO, and Kfin Technologies Limited is appointed as the registrar.

All Time Plastics Limited IPO Details

| Particulars | Details |

| IPO Date | 7 August 2025 to 11 August 2025 |

| Listing Date | 14 August 2025 |

| Face Value | ₹2 per share |

| Issue Price Band | ₹260 to ₹275 per share |

| Lot Size | 54 Shares |

| Total Issue Size | 1,45,67,380 shares (₹400.60 Cr) |

| Fresh Issue | 1,01,81,818 shares (₹280.00 Cr) |

| Offer for Sale | 43,85,562 shares (₹120.60 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 5,53,22,580 shares |

| Share Holding Post Issue | 6,55,04,398 shares |

All Time Plastics IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

All Time Plastics IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 54 | ₹14,850 |

| Retail (Max) | 13 | 702 | ₹1,93,050 |

| sHNI (Min) | 14 | 756 | ₹2,07,900 |

| sHNI (Max) | 67 | 3,618 | ₹9,94,950 |

| bHNI (Min) | 68 | 3,672 | ₹10,09,800 |

All Time Plastics IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 90.98% |

| Post-Issue | To be updated |

All Time Plastics IPO Valuation Overview

| KPI | Value |

| Earnings Per Shar(EPS) | ₹8.55 |

| Price/Earnings (P/E) Ratio | 32.17 |

| Return on Net Worth (RoNW) | 19.01% |

| Net Asset Value (NAV) | ₹38.46 |

| Return on Equity (RoE) | 19.01% |

| Return on Capital Employed (RoCE) | 16.99% |

| EBITDA Margin | 18.16% |

| PAT Margin | 8.46% |

| Debt to Equity Ratio | 0.88 |

Objectives of the Proceeds

- Repay or prepay certain outstanding borrowings – ₹143 crore

- Purchase of machinery and equipment for Manekpur facility – ₹113.71 crore

- General corporate purposes – Remaining amount

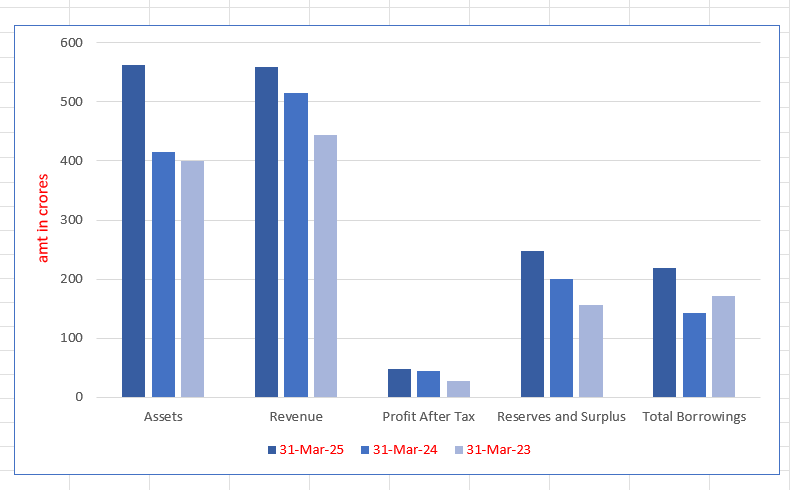

Key Financials (in ₹ Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 562.32 | 415.46 | 400.48 |

| Revenue | 559.24 | 515.88 | 443.76 |

| Profit After Tax | 47.29 | 44.79 | 28.27 |

| Reserves and Surplus | 247.73 | 200.87 | 156.60 |

| Total Borrowings | 218.51 | 142.35 | 171.74 |

SWOT Analysis of All Time Plastics IPO

Strength and Opportunities

- Long-standing partnerships with global and domestic retail giants.

- Wide product portfolio across 8 functional categories.

- Strategic focus on sustainability and eco-friendly practices.

- In-house design capabilities enhancing innovation and speed to market.

Risks and Threats

- Significant debt on books impacting financial flexibility.

- Limited brand awareness in direct-to-consumer market.

- Competition from unorganised and low-cost plastic manufacturers.

- Raw material cost fluctuations may affect profit margins.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About All Time Plastics Limited

All Time Plastics IPO Strengths

- Manufacturing units are strategically positioned and integrated, supporting efficient, high-volume, and cost-effective production of quality plastic products.

- The company offers a diverse and expanding range of plastic products, supported by in-house design and mould development teams.

- Maintains enduring partnerships with renowned global and domestic retailers such as IKEA, Asda, Michaels, Tesco, and others.

- Prioritises eco-conscious practices with a consistent commitment to sustainability and environmental responsibility in operations.

- Delivers steady financial growth with robust performance indicators and healthy financial fundamentals across recent fiscal years.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) |

| All Time Plastics Limited | 8.53 | 8.53 | 38.46 | 32.17 | 22.18 |

| Peer Group | |||||

| Shaily Engineering Plastics | 12.49 | 12.49 | 100.11 | 83.49 | 12.48 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On All Time Plastics IPO

How can I apply for All Time Plastics IPO?

You can apply via HDFC Sky using the UPI-based ASBA facility.

What is the minimum investment in All Time Plastics IPO?

The minimum investment for retail investors is ₹14,850 for one lot (54 shares).

When will All Time Plastics IPO get listed?

The IPO is tentatively scheduled to be listed on 14 August 2025.

Is there any employee discount in All Time Plastics IPO?

Yes, a discount of ₹26 per share is offered to eligible employees.