- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Allchem LIfescience IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Allchem LIfescience IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Allchem LIfescience Limited

Allchem Lifescience Pvt Ltd is a leading company in the field of pharmaceutical and chemical manufacturing. Specializing in the development and production of high-quality products, the company focuses on meeting the dynamic needs of its customers. With a strong commitment to innovation, Allchem Lifescience consistently upgrades its production facilities and expands its capacity to meet growing demand. The company is known for its strategic expansions and has built a reputation for delivering high-performance solutions in the industry, focusing on both quality and customer satisfaction.

Allchem LIfescience Limited IPO Overview

AllchemLifescience filed its Draft Red Herring Prospectus (DRHP) with SEBI on Tuesday, March 18, 2025. The offering includes a fresh issue of equity shares worth ₹190 crore and an offer for sale (OFS) of 71.55 lakh shares by promoters.The promoters of the company are Bipin Patel, Manisha Bipin Patel, Kantilal Ramanlal Patel, and Aditi Patel. As per the DRHP, the promoters currently hold 100% of the company’s shares before the issue. The post-issue shareholding will be determined based on equity dilutioncalculated by subtracting the post-issue holding from the pre-issue holding.

AllchemLIfescience Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹190 crores

Offer for Sale (OFS): 0.72 crore shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 7,65,40,230 shares |

| Shareholding post -issue | TBA |

Allchem LIfescience IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Allchem LIfescience Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.06 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 34.33% |

| Net Asset Value (NAV) | 10.44 |

| Return on Equity | 34.33% |

| Return on Capital Employed (ROCE) | 22.87% |

| EBITDA Margin | 38.05% |

| PAT Margin | 17.03% |

| Debt to Equity Ratio | 1.31 |

Allchem Lifescience Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the company | 1300 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

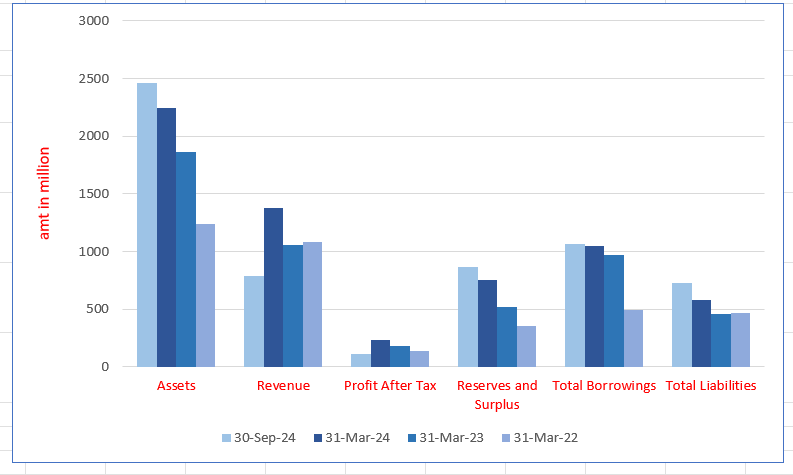

Allchem LIfescience Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2463.04 | 2246.49 | 1866.80 | 1240.21 |

| Revenue | 784.48 | 1374.21 | 1057.19 | 1081.01 |

| Profit After Tax | 108.91 | 234.09 | 179.89 | 141.39 |

| Reserves and Surplus | 864.91 | 756.37 | 522.40 | 350.76 |

| Total Borrowings | 1068.96 | 1049.66 | 971.70 | 495.33 |

| Total Liabilities | 729.04 | 576.95 | 459.83 | 466.61 |

Financial Status of AllchemLIfescience Limited

SWOT Analysis of Allchem LIfescience IPO

Strength and Opportunities

- Strong expertise in API intermediates and specialty chemicals.

- ISO and GMP certified, ensuring high standards of quality.

- Diversified product range with custom synthesis and contract manufacturing services.

- Established manufacturing capabilities, including hydrogenation and distillation plants.

- Long-standing market presence and client trust.

- Strong focus on innovation and research to develop new products.

- Global compliance with stringent quality and safety standards.

- Extensive infrastructure with state-of-the-art production facilities.

- Strategic positioning as a supplier of import substitutes.

Risks and Threats

- High reliance on a few key industries like pharmaceuticals and biotechnology.

- Vulnerability to fluctuations in the global chemical market.

- Dependency on external suppliers for raw materials.

- Intense competition from other chemical manufacturers in India.

- Regulatory challenges in international markets.

- Limited brand recognition outside the core industries.

- Potential risks from evolving environmental and safety regulations.

- Risk of market saturation in the domestic market.

- Limited geographic market reach outside India.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Allchem LIfescience Limited IPO

Allchem LIfescience Limited IPO Strengths

- Long-standing Relationships with a Stable Customer Base

Allchem LifeScience has developed enduring partnerships with prominent domestic and international customers, including Bond Chemicals, Chemosyntha, and MSN Laboratories. Their customer retention rate remains strong, with 71-64% retention across fiscal periods. The company’s focus on consistent product quality and development has enabled long-term relationships with top customers, contributing significantly to revenue

- Diversified Customer Base with Strong Export Credentials

Allchem LifeScience has successfully expanded its customer base across 13 Indian states and 22 countries, including Europe, Japan, and China. The company’s export revenues have shown a significant rise, reducing dependency on any single region. Its geographical diversification minimizes risks while enhancing market opportunities, with ongoing expansion into the United States. This broad reach boosts competitiveness and strengthens Allchem’s export credentials.

- Well-Established Manufacturing Facility with a Focus on Sustainability

Allchem’s Manufacturing Facility, with a capacity of 1,133.50 KL, features advanced equipment like hydrogenators and distillation units. The facility is ISO certified and regularly audited by customers. Recent U.S. FDA inspections aim to ensure compliance for pharmaceutical manufacturing. The facility’s sustainable practices ensure cost optimization and product efficacy testing, promoting scalability and quality.

- Focus on Developing Diverse Product Range

The Company places significant emphasis on developing new organic chemical compounds, leading to an extensive product range. As of December 31, 2024, they offer 263 products across various industries. In the 6-month period ending September 30, 2024, 35 new products were commercialised, contributing 5.41% to the revenue.

- Supply Chain Management in a High Barriers Industry

Allchem navigates significant entry barriers due to stringent regulatory approvals, capital investments, and quality control requirements. It adheres to GMP standards, regulatory bodies like US FDA and CDSCO, and environmental compliance norms. Raw material dependence and supply chain risks, especially from China, further challenge new entrants. Additionally, high competition and the complex manufacturing process in the specialty chemicals industry add to the difficulty for new players to establish themselves.

- Experienced Promoters with Domain Knowledge

Bipin Kantilal Patel, with 23 years in the pharmaceutical industry, leads product and process development. Kantilal Ramanlal Patel brings 45 years of engineering expertise, particularly in plant design and equipment installation. Aditi Patel, with an MBBS degree, focuses on marketing and export market expansion, contributing to the company’s growth.

More About Allchem LIfescience Limited

Allchem Lifescience Limited is a prominent Indian manufacturer specializing in active pharmaceutical ingredient (API) intermediates and specialty chemicals. The company focuses on producing key starting materials (KSMs), generic API intermediates, and specialty chemicals.

Market Presence

- According to the CARE Report, Allchem Lifescience had a reaction volume of 1,134 KL as of December 2024.

- The company also possesses a hydrogenation capacity of 60 KL, making it one of India’s largest manufacturers of piperazine derivatives.

- Piperazine derivatives play a crucial role in producing APIs such as Quetiapine.

Business Expansion

Allchem Lifescience has expanded its presence beyond the domestic market, developing a strong export base. The journey began in 2003 under the proprietorship of Bipin Patel as Allchem Laboratories. In 2017, the company acquired this sole proprietorship, marking a significant step in its corporate evolution.

Core Business Segments

API Intermediates

- API intermediates are essential for synthesizing active pharmaceutical ingredients used in drug formulations.

- These intermediates act as chemical building blocks, undergoing transformations to produce final APIs.

Specialty Chemicals

- Specialty chemicals, also known as performance chemicals, are manufactured for specific applications.

- Unlike commodity chemicals, they are produced in smaller quantities with a focus on quality and customization.

- In the pharmaceutical sector, they serve as catalysts for synthesizing compounds such as paracetamol and vitamin K.

Product Portfolio

Allchem Lifescience has developed 263 products, showcasing its expertise in organic chemical synthesis. Key products include:

- API Intermediates: Used in the production of drugs like Quetiapine, Labetalol, and Donepezil.

- Specialty Chemicals: Utilized across pharmaceuticals, photochemicals, agrochemicals, and cosmetic additives.

Customer Base & Revenue

The company serves leading domestic and international pharmaceutical firms, including Alembic Pharmaceuticals, Indoco Remedies, and Micro Labs. Revenue distribution indicates a balanced mix of domestic and export sales, with India contributing 78.69% as of September 2024.

Manufacturing Strength

With a production facility in Vadodara, Gujarat, Allchem Lifescience operates with a total equipment capacity of 1,133.50 KL. A skilled management team leads its operations, ensuring continued growth and innovation in the pharmaceutical sector.

Industry Outlook

Specialty Chemicals Industry in India

- Market Size and Growth: The Indian specialty chemicals market was valued at approximately USD 41.90 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.86% through 2029.

- Growth Drivers:

- Diversified End-Use Industries: Rising demand from pharmaceuticals, textiles, and personal care sectors.

- Technological Advancements: Innovations in chemical manufacturing improving quality and efficiency.

- Sustainability Focus: Increased emphasis on eco-friendly and sustainable production methods.

API Intermediates Market

- Global Outlook: The global API intermediates market is expected to reach USD 237.7 billion by 2030, growing at a CAGR of 7.2%.

- Indian Perspective: The Indian API market has grown steadily at 9% since 2015 and is projected to expand at approximately 10.2% annually until 2025.

- Growth Drivers:

- Pharmaceutical Demand: Expanding pharmaceutical sector driving API requirements.

- Advancements in Manufacturing: Improved production processes enhancing efficiency.

- Biopharmaceutical Growth: Rising demand for diverse API intermediates.

Key Figures and Projections

- Chemical Industry Contribution: The Indian chemical industry contributes about 7% to the nation’s GDP and is expected to grow from USD 178 billion in 2021 to USD 304 billion by 2025.

- Petrochemical Investments: India plans to invest USD 87 billion in the petrochemicals sector over the next decade, with the sector’s value projected to increase from USD 220 billion to USD 300 billion by 2025.

How Will Allchem LIfescience Limited Benefit

- Allchem Lifescience Limited is well-positioned to benefit from the growing Indian specialty chemicals and API intermediates market, driven by rising pharmaceutical demand and biopharmaceutical advancements.

- With India’s API market projected to expand at a CAGR of 10.2% until 2025, the company’s expertise in manufacturing API intermediates ensures sustained growth and increased market share.

- Its strong export base allows it to capitalize on global API market expansion, expected to reach USD 237.7 billion by 2030, growing at 7.2% CAGR.

- As one of India’s largest manufacturers of piperazine derivatives, the company can leverage increasing pharmaceutical production and the rising need for high-quality intermediates.

- Ongoing technological advancements in chemical synthesis and manufacturing efficiency will support cost reduction and operational scalability.

- With the Indian specialty chemicals market growing at a CAGR of 3.86%, Allchem Lifescience can expand its specialty chemicals portfolio to meet evolving industrial requirements.

- Government investments in the petrochemical sector and incentives for local manufacturing further strengthen growth prospects for the company.

Peer Group Comparison

| Name of Company | Face Value (₹) | Total Income (₹ million) | EPS (₹) | NAV (₹) | P/E | RONW (%) |

| Allchem Lifescience Limited | 10 | 1,380.66 | 3.06 | 10.44 | – | 34.33% |

| Peer Groups | ||||||

| Ami Organics Limited | 10 | 7,013.69 | 11.91 | 183.05 | 182.09 | 6.92% |

| Aether Industries Limited | 10 | 6,399.33 | 6.74 | 156.09 | 126.91 | 5.32% |

| Shree Ganesh Remedies Limited | 10 | 1,289.62 | 22.35 | 95.05 | 31.46 | 26.65% |

| Blue Jet Healthcare Limited | 2 | 7,404.58 | 9.44 | 48.73 | 79.87 | 21.45% |

Key insights

- Face Value (₹): The face value of shares across the companies is relatively uniform, with most companies having a face value of ₹10 per share. The exception is Blue Jet Healthcare, which has a face value of ₹2 per share, potentially indicating a different capital structure or pricing strategy.

- Total Income: Ami Organics and Blue Jet Healthcare lead in total income, with ₹7,013.69 million and ₹7,404.58 million respectively. Allchem Lifescience, with ₹1,380.66 million, shows a much lower income but is still competitive within its segment.

- Earnings Per Share (EPS): Shree Ganesh Remedies has the highest EPS at ₹22.35, significantly outperforming its peers. Allchem Lifescience’s EPS is relatively modest at ₹3.06, which might suggest lower profitability compared to industry leaders like Ami Organics (₹11.91).

- Net Asset Value (NAV): Ami Organics shows the highest NAV of ₹183.05, followed by Aether Industries with ₹156.09, indicating stronger asset backing. Allchem Lifescience’s NAV of ₹10.44 is lower, reflecting a less robust asset base relative to competitors.

- Price-to-Earnings Ratio (P/E): Allchem Lifescience lacks a P/E ratio, which may indicate either negative earnings or a lack of market data. In comparison, Ami Organics and Aether Industries show high P/E ratios (182.09 and 126.91), signifying investor confidence and higher market valuation.

- Return on Net Worth (RONW): Allchem Lifescience boasts the highest RONW at 34.33%, showcasing superior return generation from its equity base. Shree Ganesh Remedies follows with 26.65%, while peers like Ami Organics (6.92%) show lower efficiency in generating returns.

Key Strategies for Allchem LIfescience Limited

- Expanding Product Portfolio and Enhancing Production Efficiency

Allchem Lifescience Limited prioritises developing diverse chemistries and rigorously testing them before commercialization. With 263 products as of December 2024, the company continuously expands its portfolio while optimising production. Increasing equipment capacity and consolidating plants streamline manufacturing, ensuring efficiency and sustainable growth.

- Strengthening Contract Manufacturing and Custom Synthesis

The company enhances its custom synthesis capabilities by designing and manufacturing molecules tailored to client needs. Leveraging India’s cost-effective production and skilled workforce, it expands contract manufacturing, fostering relationships with existing customers while attracting new ones, thus solidifying its presence in the global pharmaceutical supply chain.

- Optimising Debt Management for Business Expansion

To improve financial stability, Allchem Lifescience strategically manages debt through refinancing and repayments. By reducing borrowings, it lowers debt servicing costs, enhances return on capital employed (RoCE), and reinvests internal accruals into business expansion, strengthening financial leverage for future growth and investment opportunities.

- Increasing Export Market Presence

Allchem Lifescience focuses on global market expansion, exporting to 22 countries across Asia, Europe, and the USA. By leveraging India’s pharmaceutical export growth, participating in international exhibitions, and expanding production capacity, it aims to strengthen its presence in emerging and established markets while maintaining domestic operations.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Allchem LIfescience Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Allchem Lifescience's IPO?

The IPO includes a fresh issue of equity shares aggregating up to ₹190 crore.

What is the Offer for Sale (OFS) component in the IPO?

The OFS comprises 71.55 lakh equity shares sold by promoters Kantilal Ramanlal Patel and Manisha Bipin Patel.

How will the IPO proceeds be utilized?

Approximately ₹130 crore will be used for debt repayment; the remainder for general corporate purposes.

What does Allchem Lifescience specialize in?

The company manufactures active pharmaceutical ingredient (API) intermediates and specialty chemicals.

Who are the lead managers for the IPO?

Emkay Global Financial Services is the sole book-running lead manager for the issue.