- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Allied Engineering Works IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Allied Engineering Works IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Allied Engineering Works Limited

Allied Engineering Works Ltd (AEW) is among India’s top five smart metering and advanced system solution providers, with an annual installed manufacturing capacity of 7.29 million meters as of March 31, 2025, according to CRISIL. Its portfolio includes smart energy meters, wires and cables, advanced automation systems, and AMI solutions. AEW has supplied 2.92 million smart meters across six states and holds confirmed orders for 5.79 million meters worth ₹18,535.98 million. The company operates three state-of-the-art manufacturing facilities and a tool room in Delhi.

Allied Engineering Works Limited IPO Overview

Allied Engineering Works Ltd. has filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 4, 2025, to raise funds through an Initial Public Offer (IPO). The IPO will be a book-building issue, comprising a fresh issue of shares worth ₹400.00 crores and an offer for sale of up to 0.75 crore equity shares. Before the issue, the promoters—Ashutosh Goel, Nidhi Goel, Aew Infratech Private Limited, and RP Goel Family Trust—hold 100% of the company’s shares. The equity shares are proposed to be listed on both NSE and BSE. Axis Capital Ltd. will act as the book-running lead manager, while Kfin Technologies Ltd. will serve as registrar. Key details such as IPO dates, price bands, and lot size are yet to be announced

Allied Engineering Works Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹400 crore |

| Offer for Sale (OFS) | 0.75 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Allied Engineering Works Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Allied Engineering Works Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹12.75 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 65.69% |

| Net Asset Value (NAV) | ₹19.41 |

| Return on Equity (RoE) | 65.69% |

| Return on Capital Employed (RoCE) | 71.47% |

| EBITDA Margin | 28.87% |

| PAT Margin | 19.56% |

| Debt to Equity Ratio | 0.42 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Part financing the capital expenditure requirements for setting up manufacturing facilities for the production of: (a) smart gas meters, smart water meters, IoT solutions at the Kundli Facility | 1167.47 |

| Part financing the capital expenditure requirements for setting up manufacturing facilities for the production of: (b) smart electricity meters at the Rai Facility | 997.14 |

| Funding future working capital requirements of the Company | 1200 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

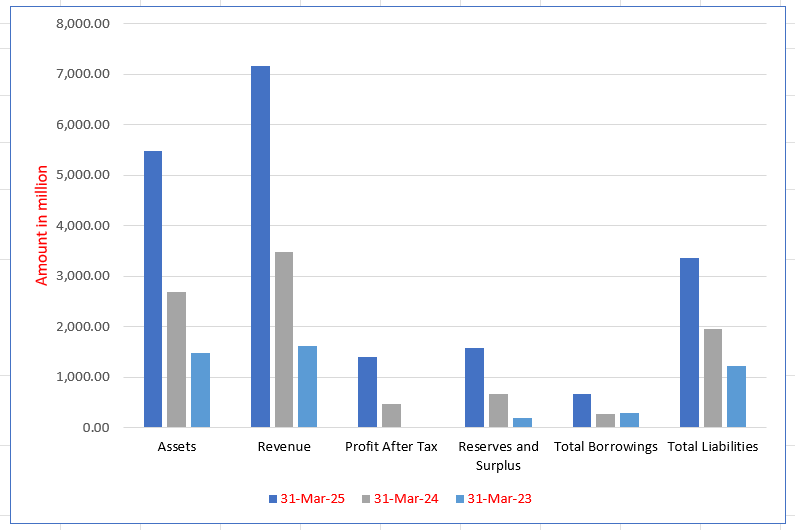

Allied Engineering Works Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,489.86 | 2,691.79 | 1,482.32 |

| Revenue | 7,171.11 | 3,484.82 | 1,629.90 |

| Profit After Tax | 1,402.60 | 474.12 | 10.17 |

| Reserves and Surplus | 1,585.20 | 677.53 | 202.85 |

| Total Borrowings | 669.05 | 281.44 | 304.00 |

| Total Liabilities | 3,354.66 | 1,959.26 | 1,224.47 |

Financial Status of Allied Engineering Works Limited

SWOT Analysis of Allied Engineering Works IPO

Strength and Opportunities

- Leading provider of smart energy meters and advanced automation solutions.

- Vertically integrated operations with in-house design, manufacturing, and R&D

- Large installed production capacity: millions of meters and kilometres of cables per year

- Strong financial performance: explosive CAGR in revenue (~110%) and PAT (~1,074%) FY23–25

- R&D capabilities: CMMI Level 3 and DSIR-recognized, with innovative IoT/IIoT products

- Recognition through awards and presence at key industry exhibitions

- Strategic alignment with India’s smart grid thrust and massive smart meter market growth

- Strong leadership with experienced founders and management team.

Risks and Threats

- Capacity utilization of only ~28% in FY 2025 could indicate inefficiencies

- Heavy dependence on a few major clients like DISCOMs and large infrastructure groups

- Rising raw material and component costs could pressure margins

- Competition from established incumbents and new entrants in the smart metering market

- Capital-intensive expansion may increase debt if not managed prudently

- Regulatory shifts or policy delays (e.g., RDSS rollout) could slow demand

- Any delays or underperformance in scaling new facilities may hamper growth delivery

- Initial low utilization of new capacities may lead to under-recovery on investments

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Allied Engineering Works Limited

Allied Engineering Works Limited IPO Strengths

Leading Smart Energy Meter Provider

Allied Engineering Works Limited has established itself as one of India’s largest and fastest-growing smart energy meter solution providers. The company is well-positioned to capitalize on significant industry growth, ranking among the top five providers in manufacturing capacity and achieving a remarkable 109.76% Compound Annual Growth Rate (CAGR) from Fiscal 2023 to Fiscal 2025.

Innovation-Driven Product Development

Driven by strong in-house R&D capabilities, Allied Engineering Works Limited takes an innovation-led approach to product development. This is evidenced by their progressive product journey, from introducing their first static meter in 2002 to developing advanced smart meters with two-way communication and anti-tamper features. Their innovative solutions have earned them industry recognition, like the ‘Best Product Developed by Indian Exhibitor’ award for their Distribution Transformer Monitoring System

Advanced Manufacturing and Quality Control

Allied Engineering Works Limited operates three integrated manufacturing facilities and a tool room, all equipped with advanced machinery and technology. These facilities allow for in-house design, manufacturing, and testing, ensuring high-quality products. With ISO certifications and a NABL-certified testing unit, the company maintains rigorous quality control measures across its operations.

Strong Financial Performance

The company has a track record of consistent and healthy financial growth. Allied Engineering Works Limited demonstrated strong profitability and efficiency in Fiscal 2025 with a profit margin of 19.56%, a return on capital employed of 71.47%, and a return on equity of 65.69%. The company’s revenue from operations has also shown significant growth, from ₹1,629.90 million in Fiscal 2023 to ₹7,171.11 million in Fiscal 2025.

Diverse Technology Offerings and Strong Customer Relationships

Allied Engineering Works Limited serves a wide range of customers, including electricity utilities and AMISPs, fostering strong relationships through diverse technology offerings and after-sales support. Their technology-agnostic approach and flexibility in providing customized solutions have resulted in repeat business and a substantial order book. As of March 31, 2025, they had confirmed orders for 5.79 million smart energy meters, amounting to ₹18,535.98 million.

Experienced Leadership and Management

Allied Engineering Works Limited benefits from an experienced team of promoters and managers with deep industry knowledge. The leadership team has a strong track record in various aspects of the smart metering industry, including operations, business development, and customer relationships. The company’s commitment to talent retention and employee training further strengthens its operational capabilities.

More About Allied Engineering Works Limited

Allied Engineering Works Limited is a technology-driven solutions provider that focuses on supporting utilities in India with smart metering infrastructure. By leveraging fully integrated manufacturing operations and in-house electronics manufacturing services (EMS), the company delivers a wide portfolio of products, including consumer smart meters, distribution transformer meters, feeder meters, and boundary meters, along with automation and IoT-based solutions. This positioning enables the company to serve as a one-stop destination for smart energy metering requirements.

Market Position

- As of March 31, 2025, Allied Engineering Works Limited ranks among the top five smart meter solutions providers in India with an installed capacity of 7.29 million meters per annum.

- The company is also the fastest-growing in its sector, with a revenue CAGR of nearly 110% between Fiscal 2023 and Fiscal 2025.

- It has supplied 2.92 million smart meters to one utility and 13 advanced metering infrastructure service providers (AMISPs) across six states, accounting for around 10% of installations nationwide.

Experience and Expansion

Having started operations in 1986 and entered energy meter manufacturing in 2002, Allied Engineering Works Limited has built strong expertise in utility operations, compliance, and implementation challenges. This experience has allowed the company to deliver more than 0.26 million distribution transformer meters, representing over 25% of installations under the Revamped Distribution Sector Scheme.

The company is now extending its portfolio to include smart gas and water meters, non-utility multifunction meters, and is also developing an Industrial Internet of Things (IIoT) automation stack called NEMORA.

Global Reach

In April 2025, the company expanded internationally by acquiring a 49% stake in Advance Technology and Electronics Co., Ltd., Thailand. This acquisition provides access to local utility tenders and strengthens its presence in South East Asia.

Growth Prospects

- India’s smart meter market is expected to grow significantly under the Government’s Smart Meter National Programme, creating large-scale opportunities.

- The company is well-positioned with a strong order book of 5.79 million smart meters worth ₹18,535.98 million.

- With robust R&D, quality certifications, and experienced leadership, Allied Engineering Works Limited aims to sustain growth and expand globally in the smart utilities ecosystem.

Industry Outlook

Robust Growth Trajectory

The Indian smart electricity meter market is witnessing substantial expansion:

- The market is projected to grow from USD 256.3 million in 2024 to USD 1,189.1 million by 2032, at a CAGR of 21.3%.

- Alternative estimates suggest an even sharper growth, forecasting the market to reach USD 1,568 million by 2031—implying a CAGR of 34.1%.

This surge is primarily driven by the government’s push under the Revamped Distribution Sector Scheme (RDSS) to modernize power distribution, reduce losses, and deploy smart meters nationwide. Utilities are investing heavily in time-of-day (ToD) meters—e.g., Maharashtra is spending over ₹ 6,200 crore to deploy 5.2 million such devices.

Emerging Segments: Gas & Water Smart Meters

- The smart gas meter market is forecasted to grow from USD 129.75 million in 2024 to USD 198.75 million by 2035, at a modest CAGR of ~3.95%.

- While exact figures for smart water meters in India are limited, localized projects—such as the NDMC’s ₹ 31 crore smart water meter rollout—highlight rising adoption.

Growth Drivers

- Government initiatives like SMNP/RDSS and urban electrification schemes are central to demand generation.

- Technological advancements—IoT, two-way communication, and real-time analytics—are enhancing utility efficiency and consumer responsiveness.

- Urbanization and rising energy consumption are increasing the need for smarter infrastructure.

- Public–private partnerships and TOTEX models are enabling scalable deployments and investment efficiency.

How Will Allied Engineering Works Limited Benefit

- With India’s smart electricity meter market expected to grow at a CAGR of over 21%, the company is well-placed to capture rising demand through its large manufacturing capacity and proven delivery record.

- Its strong presence under the Revamped Distribution Sector Scheme ensures direct alignment with government-led initiatives, creating sustained opportunities for large-scale projects.

- By diversifying into gas and water meters, Allied Engineering Works Limited can tap emerging segments and build a multi-utility solutions portfolio, strengthening long-term revenue streams.

- The company’s focus on IoT, automation, and analytics positions it to deliver advanced solutions that match the industry’s shift toward digitalisation and real-time monitoring.

- Expansion into international markets, especially Southeast Asia, provides access to new tenders and reduces reliance on domestic demand cycles.

- A strong order book and established AMISP relationships secure visibility of future revenues and steady growth.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (₹ million) | EPS (₹) | P/E | RoNW (%) | NAV (₹) |

| Allied Engineering Works Limited | 5 | 7,171.11 | 12.75 | TBD | 65.69 | 19.41 |

| Peer Groups | ||||||

| Genus Power Infrastructures Limited | 1 | 24,420.13 | 11.27 | 32.30 | 16.67 | 61.45 |

| HPL Electric & Power Limited | 10 | 17,002.44 | 14.58 | 39.90 | 10.27 | 142.32 |

Key Strategies for Allied Engineering Works Limited

Expanding Presence in India

Allied Engineering Works Limited seeks to expand its footprint across India by leveraging government initiatives under SMNP and RDSS. With a strong supply record and local technical teams, it aims to enhance market share by introducing IoT-enabled solutions and engaging additional utilities and AMISPs nationwide.

Focus on IIoT and Automation

Allied Engineering Works Limited is developing its ‘NEMORA’ platform to strengthen IIoT and automation offerings. By integrating smart meters, gateways, and advanced analytics, it intends to deliver end-to-end solutions for utilities, factories, and facilities, enabling predictive maintenance, asset management, and enhanced operational efficiency across sectors.

Expansion into Smart Gas and Water Metering

Allied Engineering Works Limited aims to diversify into smart gas and water metering, leveraging ultrasonic technologies and its NEMORA platform. With planned launches by Fiscal 2026, it will provide complete solutions including data management, billing, and CRM, aligning with India’s smart city and sustainability goals.

Setting up New Manufacturing Facilities

Allied Engineering Works Limited plans to establish new facilities at Kundli and Rai, Haryana, enhancing production of smart meters, IoT devices, and components. This expansion, backed by backward integration, will strengthen quality control, reduce external dependence, and scale capacity to meet growing demand across domestic and global markets.

Exporting Smart Meters Globally

Allied Engineering Works Limited intends to expand exports by targeting Southeast Asia, the Middle East, and Central Asia. With prior export experience, a Thailand-based acquisition, and focus on international certifications, it seeks to leverage India’s cost competitiveness and open architecture standards to capture emerging global smart metering markets.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Allied Engineering Works Limited IPO

How can I apply for Allied Engineering Works Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When was the DRHP of Allied Engineering Works Limited filed with SEBI?

The company filed its Draft Red Herring Prospectus with SEBI on July 4, 2025.

What is the total size of the Allied Engineering Works Limited IPO?

The IPO comprises a fresh issue of ₹400 crore and an offer for sale of 0.75 crore equity shares.

Where will the shares of Allied Engineering Works Limited be listed?

The equity shares are proposed to be listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Who are the promoters of Allied Engineering Works Limited

Promoters include Ashutosh Goel, Nidhi Goel, AEW Infratech Private Limited, and the RP Goel Family Trust.

How will the IPO proceeds of Allied Engineering Works Limited be utilised?

Proceeds will be used to finance new facilities, fund working capital requirements, and meet general corporate purposes.