- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Alpine Texworld IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Alpine Texworld IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Alpine Texworld Limited

Incorporated in 2016, Alpine Texworld Ltd. specialises in fabric dyeing and processing, with a focus on delivering high-quality textiles. The company operates two manufacturing units equipped for specialised dyeing and finishing, catering to a diverse range of products for garment manufacturers and traders. Together, these facilities have an annual installed capacity of 6,000 MT of cotton and blended yarn. Beyond textiles, Alpine Texworld has also ventured into renewable energy, commissioning an 820 KW rooftop solar plant at Unit 1 in January 2024, followed by a 5.4 MW ground-mounted solar project in Banaskantha in March 2025.

Alpine Texworld Limited IPO Overview

Alpine Texworld Ltd. has submitted its Draft Red Herring Prospectus (DRHP) to SEBI on 26 September 2025, signalling its plans to raise capital through an Initial Public Offering (IPO). The IPO is structured as a Book Building Issue and comprises entirely a fresh issue of up to 1.50 crore equity shares. These shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). D&A Financial Services Pvt. Ltd. has been appointed as the book running lead manager, while Kfin Technologies Ltd. will act as the registrar for the issue. Key details such as the IPO dates, price band, and lot size are yet to be disclosed.

The IPO will have a face value of ₹10 per share, and the total issue will consist of 1,50,00,000 shares, aggregating to a capital raise of ₹[.] crore. Following the IPO, the company’s shareholding structure is expected to increase from 2,62,23,000 shares pre-issue to 4,12,23,000 shares post-issue. The promoters of Alpine Texworld Ltd.—Sumit Champalal Agarwal, Sandeep Santkumar Agarwal, and Sachinkumar Santkumar Agarwal—currently hold 100% of the company’s equity, with their post-issue holding yet to be finalised.

Alpine Texworld Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | 1.50 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,62,23,000 shares |

| Shareholding post-issue | 4,12,23,000 shares |

Alpine Texworld Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Alpine Texworld Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Alpine Texworld Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.27 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 16.78% |

| Net Asset Value (NAV) | ₹19.50 |

| Return on Equity (RoE) | 18.08% |

| Return on Capital Employed (RoCE) | 12.18% |

| EBITDA Margin | 11.38% |

| PAT Margin | 3.63% |

| Debt to Equity Ratio | 3.14 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Proposing to finance the cost of setting up a new weaving unit at Proposed Manufacturing Unit 3 to expand its production capabilities to produce Grey Fabric at Ahmedabad, Gujarat, India | 320.8 |

| Prepayment or repayment, in part or full of certain outstanding borrowings | 522 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

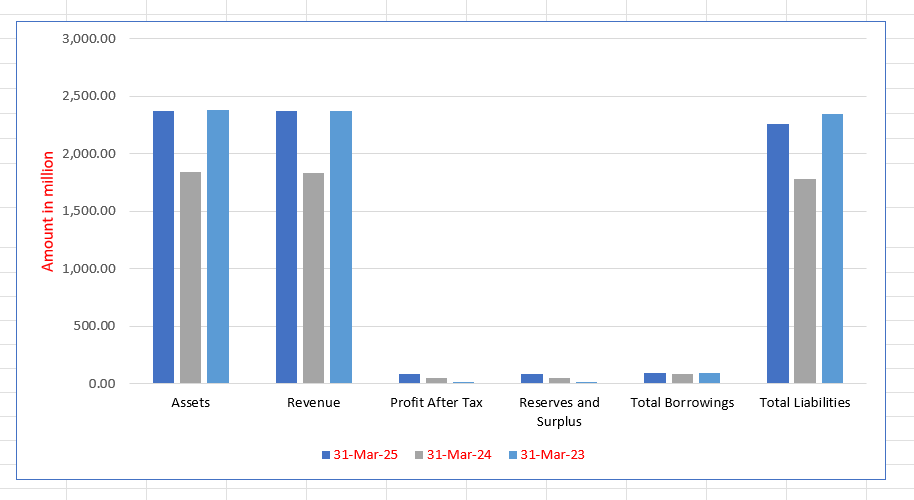

Alpine Texworld Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,376.61 | 1,844.36 | 2,385.41 |

| Revenue | 2,373.24 | 1,836.03 | 2,368.71 |

| Profit After Tax | 86.26 | 48.81 | 15.07 |

| Reserves and Surplus | 86.24 | 48.82 | 15.56 |

| Total Borrowings | 90.78 | 85.07 | 91.15 |

| Total Liabilities | 2,258.24 | 1,777.63 | 2,343.89 |

Financial Status of Alpine Texworld Limited

SWOT Analysis of Alpine Texworld IPO

Strength and Opportunities

- Vertically integrated manufacturing (weaving, spinning, sizing)

- Use of advanced technology such as high-speed looms and open-end spinning

- Commitment to sustainability and renewable energy (solar projects)

- Diversified product range (denim, shirting, industrial fabrics)

- Located in textile manufacturing hub (Gujarat) with infrastructure advantage

- Growth opportunity from India’s expanding apparel and textile market

- Ability to cater to both domestic and global markets through scalable infrastructure

- Opportunity to leverage green credentials in export markets seeking sustainable fabrics

- Benefits from government support and incentives for Indian textile sector

Risks and Threats

- Operating in a highly competitive textile sector with pricing pressure

- Raw material price volatility (cotton, blended yarn) typical for the industry

- High working capital requirement in textile processing operations

- Dependence on export/domestic demand cycles which can be unpredictable

- Environmental compliance and dyeing wastewater treatment may increase costs and regulatory risk

- Capacity utilisation risk if demand weakens or global supply chain disruptions occur

- Labour cost increases and attrition risks in textile operations may erode margins

- Threat from lower-cost international competitors (Bangladesh, Vietnam, China)

- Exchange rate fluctuations and export duty changes can impact profitability

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Alpine Texworld Limited

Alpine Texworld Limited IPO Strengths

Integrated Manufacturing and Backward Integration

Alpine Texworld Limited operates two adjacent manufacturing units in Ahmedabad, Gujarat, which strategically include both a weaving unit (Unit 1) and a spinning unit (Unit 2). The establishment of the spinning unit as a backward integration enables the Company to manage the yarn production process in-house, ensuring a stable supply of raw material for its existing weaving operations and contributing to enhanced logistical efficiency and reduced procurement costs.

High-End Automated Machinery and Production Capacity

The Company utilizes automated machinery from globally recognized brands, including Toyota, Karl Mayer, Itema, and Picanol, enhancing efficiency and precision in production. Its extensive installed capacity includes 112 high-speed air jet looms for 180 Lakh meters of Grey Fabric annually, a high-speed sizing machine, and a spinning facility capable of 6,000 tonnes of cotton and blended yarn annually.

Strategic Acquisition and Expanded Weaving Capacity

Alpine Texworld Limited expanded its capabilities through the strategic acquisition of a 97% stake in Alpine Cottweave LLP, now a subsidiary. This move significantly increased the group’s aggregate weaving capacity to 276 Lakh meters per annum, incorporating an additional 72 Picanol airjet looms. This expansion supports the Company’s growth strategy and market positioning.

Experienced Promoters and Industry Expertise

The Company’s growth and operational success are significantly attributed to its experienced Promoters. The Promoters possess extensive, long-standing expertise in the textile industry—over 25 years for two Promoters and over 14 years for the third. Their deep industry knowledge strengthens stakeholder relationships and strategically positions the Company to navigate the textile market and drive sustained growth.

Commitment to Renewable Energy and Cost Efficiency

Alpine Texworld Limited demonstrates a commitment to environmental sustainability and cost optimization by operating its own solar power generation units. The Company has implemented an 820 KW rooftop solar project and a 5.4 MW ground-mounted solar project. The electricity generated offsets the Company’s power consumption, reducing dependency on grid power and promoting significant cost efficiency.

Demonstrated Track Record of Healthy Financial Performance

The Company has a strong track record of healthy financial performance, which is a testament to its focus on operational and functional excellence. Over the last three fiscal years, Alpine Texworld Limited has consistently grown its total revenue from operations, and notably, it has shown a strong upward trend in both its EBITDA and Profit After Tax.

More About Alpine Texworld Limited

Incorporated in February 2016, Alpine Texworld Limited commenced production in April 2017 with its weaving unit, including a sizing plant at Paldi, Ahmedabad, Gujarat (“Manufacturing Unit 1”). Initially, the company installed 48 high-speed Toyota Shuttleless airjet looms, later expanding by 64 additional looms in August 2018 to enhance operational efficiency and capacity.

In March 2025, the company further expanded by establishing a spinning unit (“Manufacturing Unit 2”) equipped with four open-end rotor spinning machines, located adjacent to Manufacturing Unit 1. This leasehold facility from Alpine Weaving Private Limited creates operational synergies, enabling integrated management across both units. Collectively, the manufacturing units include main sheds, effluent treatment plants, boiler foundations, office spaces, raw material storage, and auxiliary structures.

Operations and Capabilities

Alpine Texworld is now a vertically integrated textile manufacturer with capabilities in both weaving and spinning. Processed cotton is converted into yarns of varying thickness through open-end spinning, which are then woven into grey fabric. Key machinery includes:

- 112 high-speed Toyota Shuttleless airjet looms with 180 lakh metres annual weaving capacity.

- One multi-cylinder sizing machine with 6,650 metric tonnes annual yarn sizing capacity.

- Four open-end rotor spinning machines with 6,000 metric tonnes annual spinning capacity.

Renewable Energy Initiatives

The company has invested in renewable energy, installing an 820 KW rooftop solar plant at Manufacturing Unit 1 in January 2024 and a 5.4 MW ground-mounted solar project in Banaskantha in March 2025. These initiatives reduce dependency on grid power, improve cost efficiency, and support sustainable operations.

Subsidiary and Expansion

Alpine Texworld acquired a 97% stake in Alpine Cottweave LLP in October 2024, making it a subsidiary. Alpine Cottweave operates a weaving unit with 72 high-speed Picanol NV Airjet looms, producing approximately 96 lakh metres of grey fabric annually.

Products and Revenue

The company primarily produces grey fabric, yarn, and offers yarn sizing services. For fiscal years 2023–2025, revenue from operations ranged from ₹2,368.71 million to ₹2,373.24 million, supported by a strong presence in Gujarat, Punjab, Uttar Pradesh, and Telangana. Grey fabric remains a key indicator of upstream textile activity, with demand linked to garment production cycles and sustainable manufacturing practices.

Industry Outlook

The Indian textile industry continues to present a promising growth trajectory, driven by rising domestic demand and export potential. The textiles and apparel market is projected to grow at around a 10% CAGR and reach approximately US $350 billion by 2030.

Key Growth Drivers

- Growing urbanisation, rising disposable incomes, and changing lifestyle preferences are fuelling demand for fabrics, yarns, and finished textiles.

- Government initiatives such as the PM MITRA Textile Park Scheme and Production Linked Incentive (PLI) schemes aim to strengthen the entire value chain (spinning → weaving → processing) and enhance competitiveness.

- Focus on sustainability and green manufacturing (e.g., solar power, eco-textiles) is creating new opportunities, particularly for grey fabrics and yarns.

- Upstream segments such as grey fabrics and yarns are benefiting from integration and value addition.

Market Size & Projections

- The Indian textile market was estimated at US $146.6 billion in 2024, projected to reach US $213.5 billion by 2033, implying a CAGR of around 3.85%.

- The textile manufacturing market was valued at US $128.28 billion in 2024, forecasted to grow to US $190.57 billion by 2033, with a CAGR of approximately 4.15%.

- The textile fabric market was valued around US $40.35 billion in 2021, expected to reach about US $69.32 billion by 2029, growing at roughly 7% CAGR.

Outlook for Yarn & Grey Fabric

- The yarn segment, particularly cotton and blended yarns, is expected to grow at 3–4% CAGR between 2024 and 2028.

- Grey fabric, a key upstream product for weaving and finishing, remains closely tied to garment manufacturing and export orders, offering mid- to high-single-digit growth in the near term.

Industry Challenges

Raw material price volatility, global supply chain disruptions, and competition from low-cost manufacturing nations may temper growth. Companies with vertical integration and sustainable operations are better positioned to capitalise on the industry’s favourable outlook.

How Will Alpine Texworld Limited Benefit

- Increasing domestic and export demand for textiles and apparel will drive sales of grey fabric and yarn.

- Government initiatives like PM MITRA Textile Parks and PLI schemes can support capacity expansion and operational efficiency.

- Growth in sustainable and green textiles aligns with Alpine Texworld’s renewable energy investments, enhancing cost efficiency and market positioning.

- Vertical integration in spinning and weaving allows the company to capture higher margins and respond quickly to market demand.

- Expansion of domestic and international markets presents opportunities for increased revenue and client diversification.

- Rising urbanisation and lifestyle-driven fabric consumption will boost the company’s product volumes.

- Grey fabric demand, as an upstream textile indicator, offers steady growth linked to garment manufacturing cycles.

- Strategic presence in Gujarat ensures strong supply chain access and skilled workforce availability

Peer Group Comparison

| Company | Revenue (₹ million) | Face Value (₹) | P/E Ratio | EPS (₹) | RoNW (%) | NAV (₹) |

| Alpine Texworld Limited | 2,373.24 | 10.00 | Not Applicable | 3.27 | 16.78% | 19.50 |

| Peer Group | ||||||

| United Polyfab Gujarat Limited | 6,022.18 | 10.00 | 52.01 | 7.71 | 18.18% | 42.40 |

| Ken Enterprises Limited | 4,828.01 | 10.00 | 7.92 | 6.42 | 11.04% | 45.43 |

| Pashupati Cotspin Limited | 6,374.91 | 10.00 | 85.85 | 8.31 | 8.35% | 97.78 |

Key Strategies for Alpine Texworld Limited

Expanding Weaving Capacity

Alpine Texworld Limited proposes to increase its weaving capacity by installing 48 additional looms at a Proposed Manufacturing Unit 3. This significant expansion initiative is designed to enhance operational efficiency, achieve greater value chain integration, and align with the Company’s long-term growth objectives for improved competitiveness and market presence.

Strategic Acquisition of Land Parcels

The Company has strategically acquired four separate land parcels in Ahmedabad. These properties were purchased as part of the Company’s forward-looking strategy to scale operations. The acquisitions ensure operational flexibility, allowing the Company to be ready to establish new manufacturing units when market conditions and industry trends become favorable.

Investment in Renewable Energy Sources

Alpine Texworld Limited is proactively converting to alternative sources of energy by investing in Solar Unit 1 and Solar Unit 2. This strategic adoption of renewable energy aligns with the Company’s sustainability goals, reduces its dependency on conventional power, and is a key measure to effectively lower the costs associated with power consumption for the business.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Alpine Texworld Limited IPO

How can I apply for Alpine Texworld Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Alpine Texworld IPO?

Alpine Texworld IPO is a fresh issue of up to 1.50 crore equity shares via book building.

When will the Alpine Texworld shares be listed?

The equity shares are proposed to be listed on NSE and BSE; the listing date is yet to be announced.

Who are the lead managers and registrar of the IPO?

D&A Financial Services Pvt. Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar.

How is the IPO portioned among investors?

Not more than 50% for QIBs, at least 35% for retail investors, and minimum 15% for non-institutional investors.

What will the IPO proceeds be used for?

Funds will expand a new weaving unit, repay borrowings, and support general corporate purposes for Alpine Texworld.