- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Amagi Media Labs IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Amagi Media Labs Limited

Amagi Media Labs Ltd., founded in 2008 and headquartered in Bengaluru, is a global leader in cloud-based broadcast and connected TV technology. The company offers end-to-end solutions for content creation, distribution, and monetisation across TV and streaming platforms. Serving over 700 content brands with 2,000+ channel deployments in 100+ countries, Amagi powers FAST platforms like Pluto TV, Samsung TV Plus, and Roku. Its SaaS offerings—CLOUDPORT, PLANNER, THUNDERSTORM, and ON-DEMAND solutions—reduce infrastructure costs while enabling flexibility, scalability, and revenue growth worldwide.

Amagi Media Labs Limited IPO Overview

Amagi Media Labs Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 25, 2025, to raise funds through an Initial Public Offering (IPO). The IPO will be a Book Build Issue comprising only an Offer for Sale (OFS) of up to 3.42 crore equity shares, as the fresh issue component is set at ₹0.00 crore. The company’s equity shares are proposed to be listed on both NSE and BSE. Kotak Mahindra Capital Co. Ltd. is acting as the book running lead manager, while MUFG Intime India Pvt. Ltd. will serve as the registrar to the issue. Specific details such as IPO dates, price bands, and lot size are yet to be announced, and investors are advised to refer to the DRHP for further information.

As per the DRHP, the IPO will have a face value of ₹5 per share, with the issue type being Bookbuilding. The sale will include 3,41,88,542 equity shares of ₹5 each through the OFS route, aggregating to an amount yet to be disclosed. The pre-issue shareholding of the company stands at 19,37,35,066 shares, with promoters Baskar Subramanian, Srividhya Srinivasan, and Arunachalam Srinivasan Karapattu holding 15.76% before the issue. The listing will be done on BSE and NSE once the IPO concludes.

Amagi Media Labs Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹1020 crore |

| Offer for Sale (OFS) | 3.42 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 19,37,35,066 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Amagi Media Labs Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Amagi Media Labs Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (₹3.48) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (13.49%) |

| Net Asset Value (NAV) | ₹25.60 |

| Return on Equity (RoE) | (13.49%) |

| Return on Capital Employed (RoCE) | (9.88%) |

| EBITDA Margin | (0.04%) |

| PAT Margin | (5.91%) |

| Debt to Equity Ratio | 0.86 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in technology and cloud infrastructure | 6672.1 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

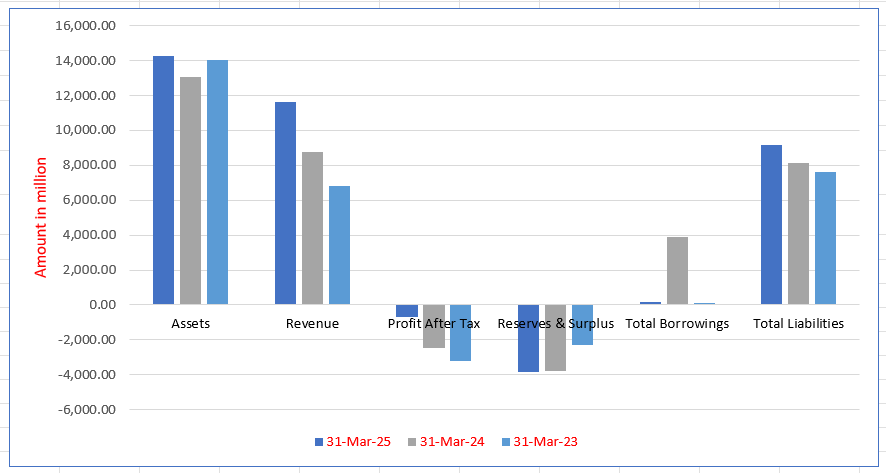

Amagi Media Labs Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 14,249.99 | 13,080.84 | 14,059.61 |

| Revenue | 11,626.37 | 8,791.55 | 6,805.58 |

| Profit After Tax | (687.14) | (2,450.01) | (3,212.68) |

| Reserves & Surplus | (3,824.43) | (3,784.86) | (2,308.02) |

| Total Borrowings | 155.36 | 3,921.10 | 94.55 |

| Total Liabilities | 9,155.47 | 8,112.81 | 7,614.74 |

Financial Status of Amagi Media Labs Limited

SWOT Analysis of Amagi Media Labs IPO

Strength and Opportunities

- Cloud-native SaaS platform offers modern, scalable solutions for broadcasters and OTT platforms

- Delivers over 7,000 channel deployments, 500K+ content hours, and 26 billion ad impressions

- High-profile clientele including NBCUniversal, Paramount, Samsung TV Plus, and Discovery

- Multiple awards such as Emmy® and NAB Product of the Year highlight innovation and industry leadership

- AI-driven tools like Smart Scheduler and THUNDERSTORM boosting ad impressions and monetisation

- Global reach across Americas, EMEA, and APAC provides strong market diversification

- Strong brand recognition in cloud modernization and connected TV advertising

- IPO funding directed towards AI and cloud expansion, enabling innovation and inorganic growth

- Pioneering server-side ad insertion and marketplace offerings strengthening OTT monetisation leadership

- Opportunity to expand with OTT players and small broadcasters seeking affordable cloud-based infrastructure solutions

Risks and Threats

- Intense competition from hyperscalers and established media technology giants

- Execution risks in maintaining margins and delivering consistent growth post-IPO

- Potential regulatory scrutiny around data usage, advertising, and streaming compliance

- Heavy reliance on the growth of FAST and CTV markets, which may face future slowdowns

- Vulnerability to rapid technology shifts, including platform fragmentation and evolving streaming standards

- Continuous need for infrastructure investments to sustain performance and reliability

- Client migration to in-house solutions or competing platforms could affect long-term contracts

- Rising operational costs and customer support expenses may put pressure on margins

- Market volatility or muted IPO reception may impact valuation and investor confidence

- Geopolitical tensions and data sovereignty regulations could complicate global expansion

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Amagi Media Labs Limited

Amagi Media Labs Limited IPO Strengths

End-to-End Media Solutions

Amagi Media Labs Limited offers comprehensive, cloud-native technology solutions that span the entire video value chain. Their “glass-to-glass” platform streamlines operations and helps media companies reduce costs by transitioning from legacy infrastructure to agile, cloud-based systems. According to the 1Lattice Report, Amagi is the only SaaS provider offering these end-to-end solutions.

Network Effect in a Three-Sided Marketplace

Amagi is strategically positioned at the intersection of content providers, distributors, and advertisers. This three-sided marketplace model creates a powerful network effect: as more content providers and distributors join, the platform attracts more advertisers, which in turn generates more ad revenue for content providers. This cycle reinforces Amagi’s competitive advantage.

Proprietary and Award-Winning Technology

Amagi has built an award-winning technology platform with a strong focus on artificial intelligence (AI) and advanced data analytics. Their R&D team, which comprises over half of their workforce, has developed solutions that automate content scheduling, optimize ad placement, and drive operational efficiency. Amagi holds ten granted patents and has received prestigious industry awards, including an Emmy.

Long-Term Customer Relationships

Amagi is a leading provider of cloud-native solutions, trusted by a diverse and global customer base of over 400 content providers. The company has a proven track record of helping media customers migrate to cloud-based workflows. Their long-term customer relationships are evident in their low churn rate among top clients and a high net revenue retention rate, indicating strong customer loyalty and growth.

More About Amagi Media Labs Limited

Amagi Media Labs Limited, founded in 2008, is a leading software-as-a-service (SaaS) company that helps media companies deliver content seamlessly to audiences worldwide. Using its cloud-native platform, Amagi enables the delivery of video through smart TVs, mobile devices, and internet applications, eliminating the need for traditional cable or set-top box services.

Unified Cloud Platform

At its core, Amagi offers a unified media operations platform. This integrates multiple workflows—production, preparation, scheduling, distribution, and monetisation—into one streamlined system. By simplifying these processes, media companies can reduce operational complexity, improve efficiency, and reach viewers faster.

Key features include:

- Uploading and organising content in one place.

- Delivering across multiple platforms such as OTT, CTVs, and mobile apps.

- Supporting both live and on-demand video streaming.

Global Content Distribution

Amagi supports international scalability by offering pre-configured delivery formats across 300+ distributors in over 40 countries. Its platform adapts content for local languages, compliance requirements, and cultural nuances, helping media companies expand their reach to diverse global markets.

Monetisation through Advertising

The platform provides advanced advertising solutions that allow brands and agencies to deliver contextual, targeted ads to specific audience groups. By improving ad relevance and performance tracking, Amagi helps increase revenue from ad-supported content, addressing the industry’s shift from pure subscription models to hybrid or free, ad-based formats.

Customers Served

Amagi caters to three primary groups:

- Content Providers – including TV networks, film studios, production houses, and sports organisations.

- Distributors – such as OTT platforms, telecom operators, and smart TV manufacturers.

- Advertisers – including agencies, brands, and digital ad platforms.

Business Divisions

Amagi structures its services under three divisions:

- Cloud Modernisation – moving media operations from legacy systems to the cloud.

- Streaming Unification – managing different OTT models (SVOD, AVOD, FAST) in one place.

- Monetisation & Marketplace – enhancing ad revenues and enabling global content syndication.

Industry Outlook

Media & Entertainment (M&E) Landscape

India’s M&E sector was valued at approximately US $30 billion in 2024 and is projected to reach US $48 billion by 2030, reflecting a CAGR of 9.8% over 2025–30. Another estimate places the industry at ₹245,000 crore in 2023, expected to rise to ₹365,000 crore by 2028, achieving a CAGR of 8.3%. Within this, OTT platforms are witnessing the fastest growth, with a standout CAGR of 14.9%, the highest among major markets.

Video Streaming & Live Media

The Indian video streaming market stood at US $4.3 billion in 2024, with a forecast to reach US $11.6 billion by 2033, growing at a CAGR of 10.8%. Meanwhile, live streaming platforms generated revenues of around US $3.45 billion in 2023, expected to surge to nearly US $20.8 billion by 2030, reflecting a remarkable CAGR of 29.3%.

SaaS & Cloud Technology Adoption

The Indian SaaS market is expanding rapidly, with growth expected at a CAGR of 18–27% between 2025 and 2032. Its value is projected to cross US $50 billion by 2030. In parallel, the cloud computing market is set to grow from US $9.98 billion in 2024 to US $48.8 billion by 2034, registering a CAGR of 17.2%.

How Will Amagi Media Labs Limited Benefit

- The rapid growth of India’s media and entertainment sector, expected to cross US $48 billion by 2030, provides Amagi with a larger market to serve with its cloud-native solutions.

- The expansion of OTT platforms, with a strong CAGR of 14.9%, directly aligns with Amagi’s expertise in streaming unification and multi-platform distribution.

- The surge in video streaming and live media, projected to touch US $11.6 billion and US $20.8 billion respectively, creates opportunities for Amagi’s unified platform to manage large-scale, real-time content delivery.

- Rising adoption of SaaS and cloud technologies, with markets set to cross US $50 billion and US $48.8 billion, strengthens demand for Amagi’s cloud-based media operations.

- Growing preference for ad-supported content allows Amagi to leverage its advanced advertising tools, driving monetisation for clients and enhancing its revenue streams

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Amagi Media Labs Limited

Continue to Invest in Product Innovation and Technology

Amagi Media Labs Limited continues to strengthen its industry cloud leadership through sustained investments in research and development. By enhancing scalability, automation, and integration capabilities, the company aims to expand its portfolio, address evolving customer needs, and reinforce its position as the preferred cloud-native platform for global media and entertainment enterprises.

Cloud Modernization

Amagi Media Labs Limited is advancing its cloud modernization strategy by introducing automation and live production tools. By supporting broadcasters’ migration from legacy infrastructure to cloud-native systems, the company leverages its modular platform to capture a larger share of the growing global market for cloud broadcasting software services, valued at $1.7 billion in 2024.

Streaming Unification

Amagi Media Labs Limited is enhancing its streaming unification capabilities by expanding third-party integrations and strengthening Amagi NOW. By delivering seamless, end-to-end media workflows and advanced analytics, the company enables customers to optimize operations, gain actionable insights, and maximize content monetization—positioning itself as a critical partner in the rapidly evolving video streaming landscape.

Monetization and Marketplace

Amagi Media Labs Limited is building a stronger monetization ecosystem by enriching Amagi THUNDERSTORM, Amagi ADS PLUS, and Amagi CONNECT. By introducing new ad formats and deepening integrations with leading platforms, the company empowers content providers and advertisers to unlock CTV revenue potential, improve yield, and strengthen engagement through innovative advertising solutions.

Harness Amagi INTELLIGENCE to Drive Innovation

Amagi Media Labs Limited is embedding AI and ML capabilities through Amagi INTELLIGENCE to streamline media operations. With features like automated scheduling, ad yield optimization, and personalized content delivery, the company improves efficiency, enhances discoverability, and drives monetization. The acquisition of Argoid.AI further strengthens its ability to deliver intelligent, scalable, and automated solutions.

Scale Profitably Through Disciplined Capital Allocation

Amagi Media Labs Limited adopts a disciplined capital allocation approach to scale profitably. By focusing on high-return opportunities, maintaining cost efficiency, and leveraging its SaaS platform’s strong gross margins, the company drives operating leverage while sustaining profitability. Strategic investments in technology and global expansion ensure long-term value creation for stakeholders.

Deepen Engagement within the Media and Entertainment Ecosystem

Amagi Media Labs Limited deepens its industry presence by offering complementary solutions that expand platform usage. Through cross-sell, advanced packaging, and customer engagement strategies, the company strengthens relationships across the video value chain. By supporting modernization, monetization, and unified workflows, Amagi ensures long-term customer success and reinforces its leadership in the ecosystem.

Leverage Domain Expertise to Expand into New Geographies

Amagi Media Labs Limited is extending its presence into high-potential regions, including Latin America, Australia, Japan, and Southeast Asia. By tailoring localized solutions, integrating with regional partners, and offering flexible commercial models, the company accelerates adoption of cloud-based media operations, enabling broadcasters worldwide to modernize their content delivery and monetization strategies.

Strategically Pursue Acquisitions and Partnerships

Amagi Media Labs Limited pursues acquisitions and collaborations to expand its solution portfolio and enhance technology leadership. Recent acquisitions, including Tellyo and Argoid.AI, strengthen live production and AI capabilities. By partnering with ecosystem players, the company accelerates growth, deepens customer reach, and positions itself as the operating system for the new video economy.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Amagi Media Labs

How can I apply for Amagi Media Labs Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Amagi Media Labs IPO?

The IPO comprises an offer for sale (OFS) of 3.42 crore equity shares, no fresh issue.

On which exchanges will Amagi IPO list?

Amagi Media Labs Limited IPO will list on both major exchanges — BSE and NSE.

What were the company’s FY2025 financials?

For FY March 2025, revenue was ₹1,223.31 Cr, with a net loss of ₹68.71 Cr.

Who are the promoters of Amagi Media Labs Limited?

The promoters are Baskar Subramanian, Srividhya Srinivasan, and Arunachalam Srinivasan Karapattu.