- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Amanta Healthcare IPO

₹14,280/119 shares

Minimum Investment

IPO Details

01 Sep 25

03 Sep 25

₹14,280

119

₹120 to ₹126

NSE, BSE

₹126 Cr

08 Sep 25

Amanta Healthcare IPO Timeline

Bidding Start

01 Sep 25

Bidding Ends

03 Sep 25

Allotment Finalisation

04 Sep 25

Refund Initiation

08 Sep 25

Demat Transfer

08 Sep 25

Listing

09 Sep 25

Amanta Healthcare Limited

Amanta Healthcare Limited, established in December 1994, is a pharmaceutical company specialising in the development, manufacturing, and marketing of sterile liquid products, particularly parenteral products, using Aseptic Blow-Fill-Seal (ABFS) and Injection Stretch Blow Moulding (ISBM) technologies. It also produces medical devices, including fluid therapy formulations such as IV fluids, diluents, ophthalmic solutions, and respiratory care products. The company operates through national and international sales and product partnerships, manufacturing over 45 generic products. With exports to 19 countries, it continues expanding globally. As of December 31, 2024, its team comprises 128 employees.

Amanta Healthcare Limited IPO Overview

Amanta Healthcare is launching an IPO through the book building process, raising ₹126.00 crores entirely via a fresh issue of 1 crore shares. The IPO will open for subscription on September 1, 2025, and close on September 3, 2025, with allotment expected to be finalised on September 4, 2025. The shares are set to list on BSE and NSE, with a tentative listing date of September 9, 2025. The price band for the IPO has been fixed between ₹120.00 and ₹126.00 per share, with a minimum application lot size of 119 shares, requiring a retail investment of ₹14,994 at the upper price. For non-institutional investors (NII), the lot size is 14 lots (1,666 shares) amounting to ₹2,09,916, while for qualified institutional buyers (QIB), it is 67 lots (7,973 shares) amounting to ₹10,04,598. Beeline Capital Advisors Pvt. Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar for the issue.

Amanta Healthcare Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹126 crore

Offer for Sale (OFS): NA |

| IPO Dates | 1st Sept to 3rd Sept 2025 |

| Price Bands | ₹120 to ₹126 per share |

| Lot Size | 119 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,88,29,351 shares |

| Shareholding post -issue | 4,13,29,351 shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | 1 Sept 2025 |

| IPO Close Date | 3 Sept 2025 |

| Basis of Allotment Date | 4 Sept 2025 |

| Refunds Initiation | 8 Sept 2025 |

| Credit of Shares to Demat | 8 Sept 2025 |

| IPO Listing Date | 9 Sept 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 119 | ₹14,994 |

| Retail (Max) | 13 | 1,547 | ₹1,94,922 |

| S-HNI (Min) | 14 | 1,666 | ₹2,09,916 |

| S-HNI (Max) | 66 | 7,854 | ₹9,89,604 |

| B-HNI (Min) | 67 | 7,973 | ₹10,04,598 |

Amanta Healthcare Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Amanta Healthcare Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.35 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 5.48% |

| Net Asset Value (NAV) | 24.71 |

| Return on Equity | 5.27% |

| Return on Capital Employed (ROCE) | 12.76% |

| EBITDA Margin | 20.86% |

| PAT Margin | 1.30% |

| Debt to Equity Ratio | 3.10 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements for civil construction work and towards purchase of equipment, plant and machinery for setting up new manufacturing line of Steri Portat Hariyala, Kheda, Gujarat | 700 |

| Funding capital expenditure requirements towards civil construction work, purchase of equipment, plant and machinery for setting up new manufacturing line for SVP at Hariyala, Kheda, Gujarat | 301.33 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

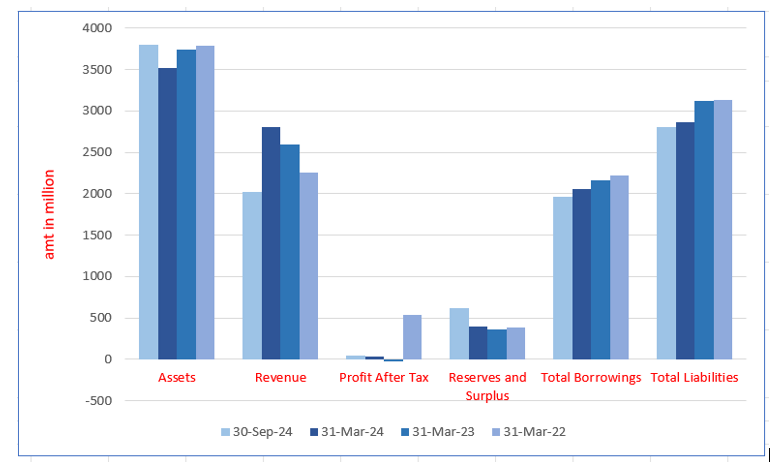

Amanta Healthcare Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 3797.05 | 3521.20 | 3740.61 | 3792.77 |

| Revenue | 2026.45 | 2803.40 | 2591.29 | 2254.13 |

| Profit After Tax | 45.41 | 36.23 | (21.11) | 538.82 |

| Reserves and Surplus | 617.54 | 394.59 | 360.54 | 381.43 |

| Total Borrowings | 1965.88 | 2052.29 | 2156.57 | 2217.04 |

| Total Liabilities | 2808.20 | 2861.00 | 3121.80 | 3135.70 |

Financial Status of Amanta Healthcare Limited

SWOT Analysis of Amanta Healthcare IPO

Strength and Opportunities

- Advanced manufacturing technologies (BFS and ISBM)

- International regulatory approvals (TGA - Australia, MCC - South Africa)

- Diverse product portfolio

- Global market presence across six continents and 77 countries

- Strategic alliances with major Indian pharmaceutical companies.

- Potential for expansion in emerging markets.

- Opportunities for product innovation in sterile dosages.

- Growing demand for sterile medical products globally.

- Capability to develop customized solutions for containers, closures, and drug delivery.

Risks and Threats

- Moderate scale of operations.

- Leveraged capital structure

- Weak debt coverage indicators

- Vulnerability to packaging material price fluctuations

- Exposure to foreign exchange rate fluctuations.

- High competition in the price-controlled intravenous fluids market.

- Capital-intensive operations.

- Risks associated with quality assurance and storage of intravenous fluids.

- Dependence on regulatory approvals for market expansion.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Amanta Healthcare Limited IPO

Amanta Healthcare Limited IPO Strengths

- Established Manufacturer with a Diverse Pharmaceutical Portfolio

Incorporated in 1994, Amanta Healthcare Limited offers a diverse portfolio across six therapeutic segments, including fluid therapy, ophthalmic, and respiratory care. With various container closure systems and 47 registered products across 112 international jurisdictions, its versatility ensures business consistency, sustainability, and a strong global market presence

- Extensive Manufacturing Capabilities with Advanced Infrastructure

Amanta Healthcare Limited integrates quality into its culture, ensuring regulatory compliance through robust systems and processes. Its manufacturing facility, spanning 66,852 sq. meters in Gujarat, houses multiple production lines for sterile liquid manufacturing, supporting diverse fill volumes and closure systems. Accredited with ISO and WHO-GMP certifications, it ensures operational excellence.

- Wide Domestic and International Marketing Network

Amanta Healthcare Limited has a strong sales and distribution network with 316 distributors and 108 sales professionals. Integrated IT systems, including Pharma Cloud and sales force automation, enhance efficiency, demand planning, and cost control. Products are sold to distributors supplying hospitals and nursing homes across India and international markets.

- Experienced Management Team with a Skilled Workforce

Led by Chairman and Managing Director Bhavesh Patel, with 30 years of experience, Amanta Healthcare Limited has a highly qualified management team. With 509 employees as of December 31, 2024, including scientists and pharmaceutical experts, the company maintains a competitive edge in product differentiation, market expansion, and business growth.

More About Amanta Healthcare Limited

Amanta Healthcare Limited is a prominent pharmaceutical company engaged in the development, manufacturing, and marketing of a wide range of sterile liquid products. These include parenteral products packed in plastic containers using advanced Aseptic Blow-Fill-Seal (ABFS) and Injection Stretch Blow Moulding (ISBM) technology. The company manufactures both large volume parenterals (LVPs) and small volume parenterals (SVPs) across six therapeutic segments, in addition to medical devices.

Product Portfolio

Amanta Healthcare’s product range spans several therapeutic areas, including:

- Fluid Therapy: IV fluids, formulations, and diluents.

- Ophthalmic and Respiratory Care: Eye lubricants and respiratory solutions.

- Medical Devices: Products such as irrigation solutions and first-aid solutions.

The company provides various closure systems, including nipple head, twist-off, leur-lock, and screw types. Container fill volumes range from 2ml to 1000ml.

Manufacturing Facilities & Technologies

Amanta Healthcare operates state-of-the-art manufacturing facilities in Hariyala, District Kheda, Gujarat. The company’s manufacturing capacity includes:

- LVP Manufacturing Lines: Four lines, two using ABFS technology for conventional single-port containers and two using ISBM technology for SteriPort products.

- SVP Manufacturing Lines: Three lines, two ABFS and one conventional three-piece container filling line.

The manufacturing facility adheres to Good Manufacturing Practices (GMP) certifications from the Food & Drugs Control Administration, Gujarat, and complies with international standards recommended by the WHO. The plant also holds GMP certifications for formulations from Cambodia, Sudan, Philippines, and Zimbabwe.

Research & Development

Amanta Healthcare operates a dedicated Formulation and Development (F&D) and quality control laboratory at its manufacturing facility. The F&D team works on the development of new formulations and the improvement of existing products, both for the company’s own brand and for product partnering with other pharmaceutical companies.

Market Presence

The company markets its products through three strategic business units:

- National Sales: Distribution across India.

- International Sales: Exports to countries in Africa, Latin America, the UK, and more.

- Product Partnering: Collaborations with both Indian and foreign pharmaceutical companies.

Amanta Healthcare’s products are registered in 19 countries, with a strong compliance track record. In fiscal 2024, the company exported branded products to 19 countries.

Management Team

The company is led by an experienced management team, with Bhavesh Patel, the Promoter and Managing Director, bringing extensive experience in the Indian pharmaceutical industry. As of December 31, 2024, Amanta Healthcare employed a skilled team of 128 professionals in its formulation and development and quality laboratory, many of whom have over 20 years of experience in the field.

Industry Outlook

The Indian pharmaceutical industry is experiencing significant growth, propelled by a combination of domestic demand and international opportunities.

Market Growth and Projections

- Overall Market Expansion: The Indian pharmaceutical market is projected to reach approximately USD 66.66 billion in 2025, with expectations to grow at a Compound Annual Growth Rate (CAGR) of 5.92%, reaching USD 88.86 billion by 2030.

- Pharmaceutical Manufacturing: The pharmaceutical manufacturing market in India was valued at around USD 17.79 billion in 2023 and is anticipated to expand at a CAGR of 10.5% from 2024 to 2030.

- Parenteral Products Segment:

- Large Volume Parenterals (LVPs): The LVP market is expected to reach approximately USD 146.2 million by 2030, growing at a CAGR of 5.3% from 2023 to 2030.

- Small Volume Parenterals (SVPs): The global SVP market is estimated to grow from USD 207.57 billion in 2025 to USD 344.37 billion by 2032, reflecting a CAGR of 7.3%.

Growth Drivers

- Rising Healthcare Demand: An aging population and the increasing prevalence of chronic diseases are driving the demand for pharmaceutical products, particularly parenterals.

- Export Opportunities: India’s robust pharmaceutical manufacturing capabilities position it well to meet global demands, especially in emerging markets.

- Technological Advancements: Innovations in manufacturing processes, such as Aseptic Blow-Fill-Seal (ABFS) and Injection Stretch Blow Moulding (ISBM) technologies, enhance product quality and efficiency.

Regulatory Landscape

- Good Manufacturing Practices (GMP): Compliance with GMP standards, including certifications from international bodies like the World Health Organization (WHO), ensures product quality and opens global markets.

- Product Registrations: Obtaining product registrations in various countries facilitates international trade and establishes a global presence.

How Will Amanta Healthcare Limited Benefit

- Growth in Parenteral Market: With the Indian pharmaceutical sector’s expected growth, especially in LVP and SVP markets, Amanta’s specialized manufacturing of both large and small volume parenterals places it in an advantageous position to benefit from increasing demand.

- Technological Edge: Amanta’s use of advanced ABFS and ISBM technologies aligns with the sector’s trend towards innovation, enhancing product quality and operational efficiency.

- Expanding Global Presence: As global demand for pharmaceuticals rises, Amanta’s strong export footprint to 19 countries and its GMP certifications from international bodies enable the company to tap into emerging markets.

- R&D and Product Diversification: Amanta’s dedicated R&D efforts and diverse therapeutic portfolio, including fluid therapy and ophthalmic care, position it to address the growing healthcare needs across different regions.

- Regulatory Compliance: Amanta’s adherence to global regulatory standards ensures the company is well-positioned for continued international expansion.

Peer Group Comparison

| Name of the Company | Total Income (₹ in million) | Face Value (₹) | P/E | EPS (₹) | RoNW (%) | NAV (₹) |

| Amanta Healthcare Limited | 2816.06 | 10.00 | [●] | 1.35 | 5.48 | 24.71 |

| Peer Groups | ||||||

| Denis Chem Lab Limited | 1692.09 | 10.00 | 18.76 | 150.85 | 8.04 | 13.88 |

Key insights

- Total Income: Amanta Healthcare Limited reported a total income of ₹28,160.6 million, significantly higher than Denis Chem Lab Limited, which earned ₹16,920.9 million. This indicates that Amanta has a larger revenue base, positioning it better in the market.

- Face Value: Both Amanta Healthcare Limited and Denis Chem Lab Limited have a face value of ₹10 per share, indicating parity in terms of their basic share value. This is a common feature among pharmaceutical companies within India.

- P/E Ratio: The P/E ratio for Amanta Healthcare is unavailable, denoted as [●], whereas Denis Chem Lab has a P/E of 18.76, suggesting the market’s valuation of its earnings. A higher P/E typically indicates higher growth expectations.

- EPS: Amanta Healthcare has an earnings per share (EPS) of ₹1.35, which reflects moderate profitability. In contrast, Denis Chem Lab’s EPS of ₹150.85 is substantially higher, indicating better earnings performance and profitability relative to its share base.

- RoNW: Amanta Healthcare has a Return on Net Worth (RoNW) of 5.48%, demonstrating a modest return on its equity. In comparison, Denis Chem Lab performs better with a RoNW of 8.04%, indicating a more efficient use of shareholder capital.

- NAV: Amanta Healthcare’s Net Asset Value (NAV) per share stands at ₹24.71, suggesting its assets are valued higher per share compared to Denis Chem Lab, which has an NAV of ₹13.88, reflecting its relatively lower asset valuation per share.

Key Strategies for Amanta Healthcare Limited

- Expansion of Manufacturing Capacities

Amanta Healthcare Limited operates four LVP manufacturing lines using ABFS and ISBM technologies and three SVP manufacturing lines. With growing demand in these segments, the company plans to expand manufacturing capacity to enhance its product offerings across six therapeutic segments and three product categories, improving business margins.

- Growth of National Sales Business

Amanta Healthcare Limited markets branded and generic products in India under the ‘SteriPort’ brand. The company focuses on providing affordable, high-quality medicines, including injectables, ophthalmic, and irrigation products, to meet India’s healthcare needs. Its generics business extends to international markets, ensuring wider accessibility and market penetration.

- Expansion of National Sales Network

Amanta Healthcare Limited aims to strengthen its national sales network by increasing distributors and stockists beyond the current 316. The company plans to enhance sales through field teams, targeted incentives, and marketing initiatives. Continuous engagement with retailers and expanded product launches will drive growth across diverse geographic regions.

- Increasing Customer Base and Market Share

Amanta Healthcare Limited seeks to expand its customer base by leveraging in-house formulation and manufacturing expertise. The company plans to introduce new products, develop complex formulations, and enhance its commercialized product portfolio. Strong customer relationships and timely deliveries will help strengthen market presence and attract new business opportunities

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Amanta Healthcare Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will Amanta Healthcare Limited's IPO open?

The IPO dates starts from 1 September 2025 to 3 September 2025

What is the size of the Amanta Healthcare Limited IPO?

IPO is a book build issue of ₹126.00 crores. The issue is entirely a fresh issue of 1.00 crore shares of ₹126.00 crore.

How can I apply for the Amanta Healthcare Limited IPO?

Investors can apply online using UPI or ASBA methods.

Who is the registrar for the Amanta Healthcare Limited IPO?

Link Intime India Private Limited is the registrar.

What is the price band for the Amanta Healthcare Limited IPO?

The price band of the issue is ₹120 to ₹126 per share.