- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Amir Chand Jagdish Kumar Exports IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Amir Chand Jagdish Kumar Exports IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Amir Chand Jagdish Kumar Exports Limited

Amir Chand Jagdish Kumar (Exports) Limited processes and exports basmati rice and FMCG products through integrated operations covering procurement, storage, processing, marketing, and sales. Its portfolio includes rice varieties like basmati, kolam, sona masuri, idli, and ponni, along with FMCG staples such as aata, maida, sooji, besan, salt, and sugar. Marketed under the flagship brand “AEROPLANE” with 40+ sub-brands, the company holds 100 trademarks and exports to 37+ countries. It operates two manufacturing facilities in Punjab, Haryana, and a packaging unit in New Delhi.

Amir Chand Jagdish Kumar Exports Limited IPO Overview

Amir Chand Jagdish Kumar (Exports) Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 2, 2025, to raise ₹550 crore through an Initial Public Offer (IPO). The issue is a complete fresh issue of shares, with no offer for sale component. The equity shares are proposed to be listed on both NSE and BSE. While the book running lead manager is yet to be announced, Kfin Technologies Ltd. has been appointed as the registrar of the issue. Important details such as IPO dates, price band, and lot size are yet to be declared. As per the DRHP, the face value of each share is ₹10, and the total issue size aggregates up to ₹550 crore through a book-building process. Before the issue, the company had 8,20,41,028 shares outstanding, with promoters Jagdish Kumar Suri, Rahul Suri, and Ramnika Suri holding 99.44% stake.

Amir Chand Jagdish Kumar Exports Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹550 crore |

| Fresh Issue | ₹550 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,20,41,028 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Amir Chand Jagdish Kumar Exports Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

OR

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Amir Chand Jagdish Kumar Exports Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.71 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 10.27% |

| Net Asset Value (NAV) | ₹38.09 |

| Return on Equity (RoE) | 10.27% |

| Return on Capital Employed (RoCE) | 10.41% |

| EBITDA Margin | 7.08% |

| PAT Margin | 1.96% |

| Debt to Equity Ratio | 2.50 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of the Company | 5000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

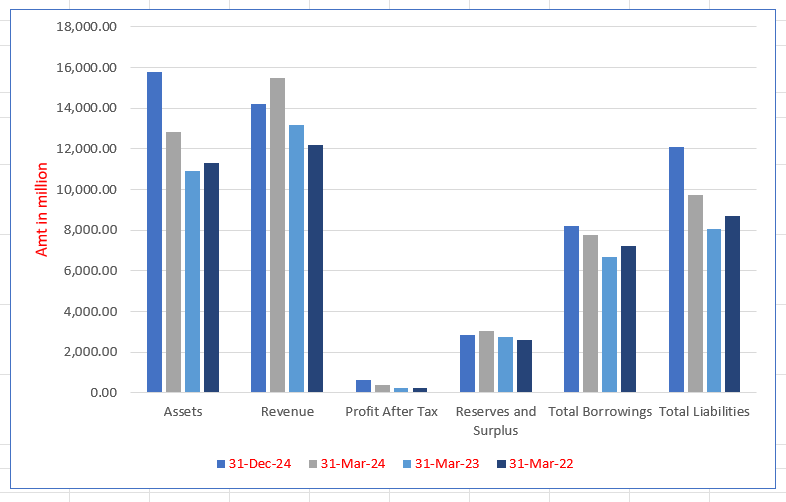

Amir Chand Jagdish Kumar Exports Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 15,759.29 | 12,835.29 | 10,890.63 | 11,319.61 |

| Revenue | 14,213.06 | 15,495.24 | 13,158.48 | 12,203.71 |

| Profit After Tax | 641.16 | 393.23 | 232.44 | 226.97 |

| Reserves and Surplus | 2852.60 | 3060.39 | 2754.03 | 2579.06 |

| Total Borrowings | 8187.01 | 7776.21 | 6675.30 | 7246.32 |

| Total Liabilities | 12,086.28 | 9720.51 | 8082.21 | 8686.17 |

Financial Status of Amir Chand Jagdish Kumar Exports Limited

SWOT Analysis of Amir Chand Jagdish Kumar Exports IPO

Strength and Opportunities

- Strong, legacy-rich “Aeroplane” brand with broad market recall and premium positioning.

- Integrated value-chain: procurement to distribution ensures quality control and cost efficiency

- Strategic mill locations in Punjab and Haryana ensure raw material access and lower freight.

- Strong domestic and export distribution networks across India and international markets.

- Healthy export order book worth over ₹800 crore provides revenue visibility

- Financial performance improving with growing scale, rising margins, and positive outlook

- Positive analyst outlook following DRHP filing and operational growth

- Opportunity to expand FMCG segment beyond rice, tapping rising urban demand

- Untapped capacity with low utilisation offers scalability without immediate capital expenditure.

Risks and Threats

- Intense competition from both organized and unorganized players limits pricing power

- Working-capital intensive operations due to seasonal procurement and ageing of basmati, leading to a high operating cycle

- Dependence on basmati paddy subjects business to price volatility and supply risks.

- High working-capital needs drive up financing requirements.

- Leverage remains high with notable gearing and moderate debt protection metrics

- Exposure to foreign exchange fluctuations due to high export exposure

- Reliance on key distributors and agents, creating concentration risk

- Regulatory and export-policy changes pose business risks

- Dependence on Middle Eastern exports makes revenue vulnerable to geopolitical shifts.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Amir Chand Jagdish Kumar Exports Limited

Amir Chand Jagdish Kumar Exports Limited IPO Strengths

Leading Branded Basmati Rice Company

Amir Chand Jagdish Kumar Exports Limited is a top branded basmati rice company in India, with over 40 years of market presence through its flagship “Aeroplane” brand and 40+ sub-brands. Its strong brand recognition, premium product positioning, FMCG diversification, D2C operations, and pricing power over unbranded varieties enable customer retention, market expansion, and sustained revenue growth.

Strong Procurement Capabilities and Strategic Location

The company leverages a vast network of procurement agents across northern India, enabling timely acquisition of high-quality basmati paddy at competitive prices. Strategically located manufacturing units in Punjab, Haryana, and a packaging facility in Delhi reduce transportation costs, ensure steady raw material supply, and support operational efficiency, scalability, and cost-effective logistics.

Integrated Operations and Advanced Quality Control

Amir Chand Jagdish Kumar Exports Limited operates fully integrated processes across procurement, storage, processing, packaging, branding, marketing, and distribution. A robust quality control system, ISO 22000:2018 compliance, HACCP accreditation, and modern automated machinery ensure consistent rice quality, reduce waste, optimize yield, and improve efficiency, providing competitive advantage and sustainable long-term growth in domestic and international markets.

Wide Distribution Network in India

The company maintains an extensive pan-India sales and distribution network, serving general trade, modern retail, e-commerce, and direct-to-consumer channels. This network enables efficient market penetration, strong brand presence, inventory optimization, and responsive customer service, while fostering strategic relationships with distributors and retail partners, which enhances product visibility, pricing stability, and customer loyalty across key regions.

Strong International Presence

Recognized as a Three Star Export House, the company generates significant revenue from exports, focusing on the Middle East while expanding to other global markets. Established overseas distributor relationships, consistent quality, timely delivery, and capacity to handle large orders result in repeated orders, robust market presence, and enhanced global brand recognition, strengthening the company’s competitive position internationally.

Healthy Financial Performance

The company demonstrates strong financial performance through revenue growth, efficient working capital management, and disciplined cost control. EBITDA and profit margins remain stable, supported by prudent procurement, effective supply chain practices, and strategic distributor relationships. A resilient financial model allows sustainable growth, inventory efficiency, and operational stability in a competitive rice and FMCG market.

Experienced and Visionary Management Team

Promoters Jagdish Kumar Suri, Rahul Suri, and Ramnika Suri bring decades of industry experience, overseeing procurement, production, marketing, exports, and strategic growth. Supported by a skilled senior management team, their expertise ensures operational excellence, strategic decision-making, and long-term business continuity, enabling the company to leverage market opportunities, maintain brand strength, and execute growth strategies effectively.

More About Amir Chand Jagdish Kumar Exports Limited

Amir Chand Jagdish Kumar Exports Limited is a leading processor and exporter of basmati rice and other FMCG products in India. Leveraging over four decades of experience of its promoters, the company ranks among the top players in the Indian branded rice segment and has diversified into FMCG staples, offering products such as aata, maida, sooji, besan, salt, and sugar.

The company markets its products under the flagship trademarked brand “AEROPLANE”, with more than 40 sub-brands including “Aeroplane La-Taste”, “Aeroplane Classic”, “Ali Baba”, “World Cup”, and “Jet”. It has registered 100 trademarks, comprising 70 in India and 30 across 26 countries, along with 22 copyrights.

Product Segments

The company operates through two main segments:

- Rice: Basmati rice and specialty varieties such as kolam, sona masuri, idli, and ponni rice. Basmati, a premium aromatic rice, contributes the majority of revenue and has been granted Geographical Indication (GI) status. Export destinations include over 37 countries, primarily in the Middle East. Rice products are categorized into premium, medium, value, and HORECA segments.

- FMCG: Kitchen staples including wheat flour, refined flour, semolina, gram flour, sugar, and salt. Products target domestic consumers and are marketed through established distribution channels.

Operations & Manufacturing

The company operates three strategically located units in India:

- Unit I – Amritsar, Punjab: Rice milling, processing, and packaging

- Unit II – Safidon, Haryana: Rice milling, processing, and packaging

- Unit III – Delhi: Rice and FMCG packaging

All units are ISO 22000:2018 certified and HACCP accredited. Installed capacity for rice production is 550,800 MT, with capacity utilisation ranging between 32–37% over recent years.

Distribution & Procurement

Amir Chand Jagdish Kumar Exports Limited sells rice domestically and internationally, while FMCG products are distributed within India. The company has over 425 domestic distributors and 50 international distributors. Procurement of basmati paddy is carried out through a network of 325 agents across northern India, ensuring a consistent supply of high-quality raw material.

Promoter Expertise

Promoters Jagdish Kumar Suri and Rahul Suri bring over four and three decades of experience, respectively. Jagdish Kumar Suri manages procurement, domestic sales, strategic growth, and finance, while Rahul Suri oversees production, export sales, quality control, and marketing. Ramnika Suri manages marketing and administrative functions, contributing significantly to the company’s growth trajectory

Industry Outlook

Basmati Rice Market

- Market Size & Growth: India’s basmati rice market was valued at INR 495 billion in 2024 and is projected to reach INR 537 billion by 2033, growing at a CAGR of 0.9% from 2025 to 2033.

- Export Dynamics: In the 2024-25 fiscal year, India’s basmati rice exports rose by Rs 1,923 crore compared to the previous year, reaching Rs 50,312 crore (approximately $5.87 billion), despite geopolitical disruptions.

- Challenges: Recent international tariffs on Indian basmati rice have affected exporters and farmers, creating pressure on margins and competitiveness.

FMCG Sector

- Market Size & Growth: The Indian FMCG market is projected to reach USD 220 billion by 2025, growing at a CAGR of 14.9% from 2020.

- Rural Demand: Consumer demand in rural India continues to outpace urban consumption, indicating a strong growth opportunity for FMCG staples such as wheat flour, sugar, salt, and gram flour.

- Challenges: Supply chain complexities and evolving consumer expectations remain key challenges for FMCG manufacturers and distributors.

Both the basmati rice and FMCG sectors in India show promising growth, driven by strong domestic demand and export opportunities. However, external challenges like international tariffs and supply chain issues require strategic planning to sustain growth.

How Will Amir Chand Jagdish Kumar Exports Limited Benefit

- The company can leverage rising domestic and international demand for basmati rice to expand export volumes and strengthen global presence.

- Growth in the Indian FMCG market provides opportunities to increase sales of staples like wheat flour, sugar, salt, and gram flour through established distribution networks.

- Strong rural consumption trends allow the company to target untapped markets, enhancing market penetration and brand visibility.

- The premium positioning of the “Aeroplane” brand enables capturing higher margins in both rice and FMCG segments.

- Strategic procurement through a network of 325 agents ensures consistent quality and supply, supporting scale-up in production to meet growing demand.

- Diversified product portfolio reduces dependency on a single segment, mitigating risks from international tariffs or supply chain disruptions.

- Established trademarks and copyrights strengthen brand recognition, helping the company maintain competitive advantage.

Peer Group Comparison

| Name of the Company | Face Value (₹) | P/E Ratio | Revenue FY24 (₹ million) | EPS (₹) | NAV (₹) | RoNW (%) |

| Amir Chand Jagdish Kumar Exports Ltd | [●] | [●] | 15,495.24 | 3.75 | [●] | 10.27% |

| Peer Groups | ||||||

| LT Foods Limited | 1.00 | 27.87 | 77,724.07 | 17.09 | 98.68 | 19.20% |

| KRBL Limited | 1.00 | 14.48 | 53,846.90 | 25.69 | 212.28 | 12.48% |

| Chaman Lal Setia Exports Limited | 2.00 | 16.28 | 13,556.28 | 22.36 | 138.01 | 17.49% |

| GRM Overseas Limited | 2.00 | 28.87 | 13,124.42 | 10.12 | 55.45 | 19.98% |

| Sarveshwar Foods Limited | 1.00 | 43.28 | 8,695.93 | 5.14 | 2.58 | 7.19% |

Key Strategies for Amir Chand Jagdish Kumar Exports Limited

Promotion of Brand Visibility and Marketing Initiatives

Amir Chand Jagdish Kumar Exports Limited focuses on strengthening brand visibility through advertising, celebrity endorsements, digital and traditional campaigns, social media engagement, and global exhibitions. These initiatives aim to enhance brand recall, customer loyalty, and demand for its basmati rice and FMCG products.

Geographical Expansion in the Indian Market

The company plans to expand its presence across tier 3 and tier 4 cities, while increasing market share in tier 1 and tier 2 regions. Appointing additional distributors and partnering with retail and HORECA players supports broader reach and improved penetration nationwide.

Expansion into FMCG Products

Leveraging existing market presence, distribution networks, and brand recognition, the company plans to grow its FMCG portfolio, introducing essential kitchen commodities and value-added products. This diversification enhances revenue potential, creates cross-selling opportunities, and strengthens the company’s presence across multiple price segments and demographics.

Improving Operational Efficiency and Unit Utilization

Amir Chand Jagdish Kumar Exports Limited aims to optimize manufacturing operations by improving capacity utilization across its processing units. Higher production volumes enable better use of equipment and human resources, lowering costs, achieving economies of scale, and enhancing profit margins while supporting expansion strategies.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Amir Chand Jagdish Kumar Exports

How can I apply for Amir Chand Jagdish Kumar Exports Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total issue size of the IPO?

The IPO aims to raise ₹550 crore entirely through a fresh issue of shares.

Which stock exchanges will list the shares?

The company’s shares are proposed to be listed on both NSE and BSE

Who are the promoters of the company?

Jagdish Kumar Suri, Rahul Suri, and Ramnika Suri hold 99.44% pre-IPO stake.

What is the face value of each share?

Each equity share of the company has a face value of ₹10 per share.

How will the IPO proceeds be utilised?

Proceeds will mainly fund working capital requirements and general corporate purposes of the company.