- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Anand Rathi Share and Stock Brokers IPO

₹14,148/36 shares

Minimum Investment

IPO Details

23 Sep 25

25 Sep 25

₹14,148

36

₹393 to ₹414

NSE, BSE

₹745 Cr

30 Sep 25

Anand Rathi Share and Stock Brokers IPO Timeline

Bidding Start

23 Sep 25

Bidding Ends

25 Sep 25

Allotment Finalisation

26 Sep 25

Refund Initiation

29 Sep 25

Demat Transfer

29 Sep 25

Listing

30 Sep 25

Anand Rathi Share and Stock Brokers Limited

Established in 1994, AnandRathi is a financial services group in India, offering Wealth Management, Investment Banking, Brokerage, and Distribution services across Equities, Commodities, Mutual Funds, Structured Products, Corporate Deposits, and Bonds. It serves both retail and high-net-worth individuals and families. With a strong presence in 54 cities through 90 owned branches and in 333 cities via 1,123 authorised persons, the firm has built an extensive national footprint. Its offerings are backed by robust research teams, ensuring diverse financial needs are met with precision and expertise.

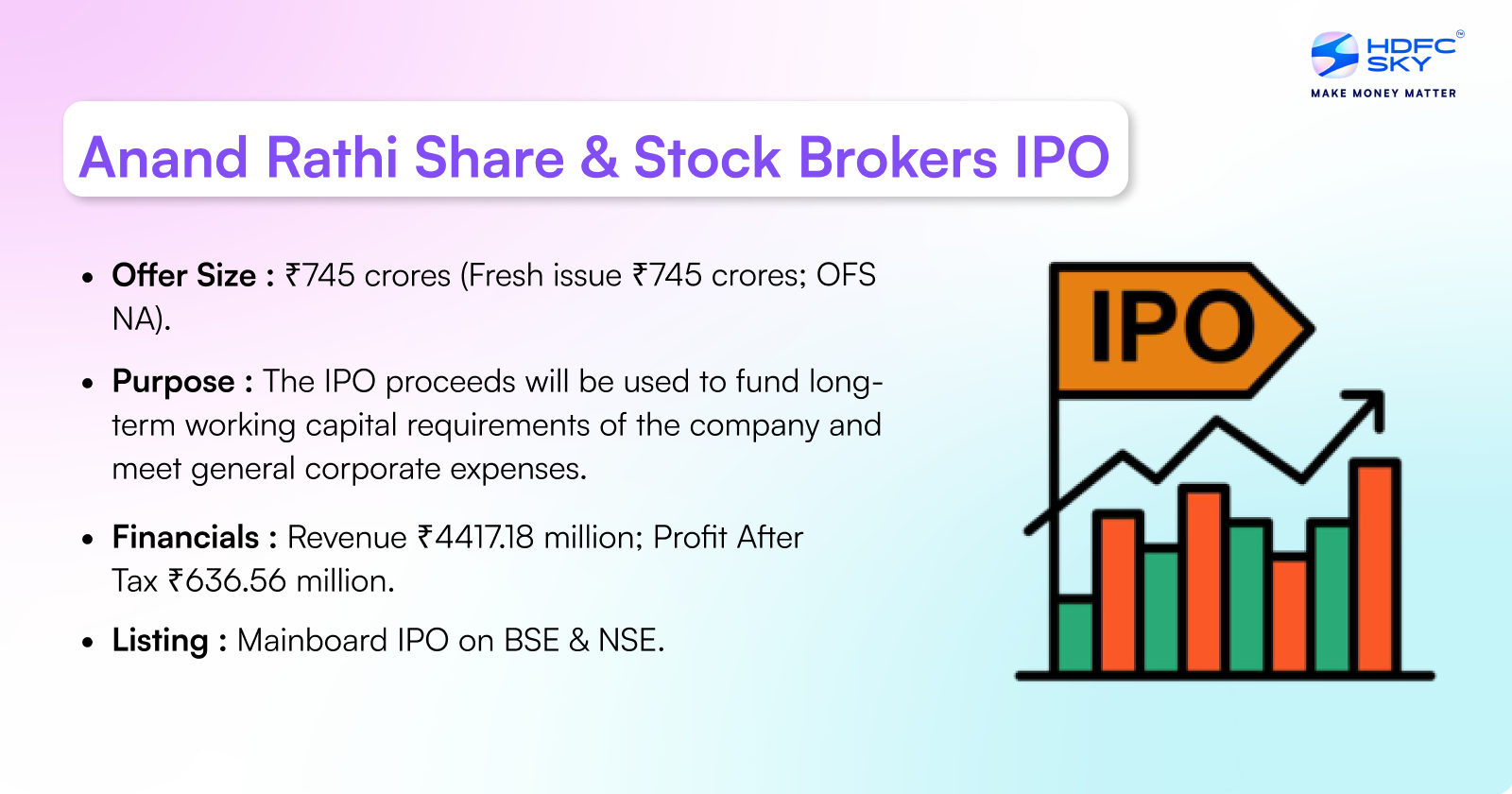

Anand Rathi Share and Stock Brokers Limited IPO Overview

Jaro Institute IPO is a book-built issue worth ₹450.00 crores, comprising a fresh issue of 0.19 crore shares aggregating to ₹170.00 crores and an offer for sale of 0.31 crore shares aggregating to ₹280.00 crores. The IPO opens for subscription on September 23, 2025, and closes on September 25, 2025, with the allotment expected to be finalized by September 26, 2025. The shares are scheduled to list on BSE and NSE, with a tentative listing date of September 30, 2025.

The IPO price band is set between ₹846.00 and ₹890.00 per share, with a lot size of 16 shares. For retail investors, the minimum investment required is ₹14,240 based on the upper price band. For small non-institutional investors (sNII), the lot size is 15 lots (240 shares), amounting to ₹2,13,600, while for big non-institutional investors (bNII), it is 71 lots (1,136 shares), amounting to ₹10,11,040.

Nuvama Wealth Management Ltd. is appointed as the book-running lead manager, and Bigshare Services Pvt. Ltd. serves as the registrar for the issue.

Anand Rathi Share and Stock Brokers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1,79,95,169 shares (aggregating up to ₹745.00 Cr)

Offer for Sale (OFS): NA |

| IPO Dates | 23 September 2025 to 25 September 2025 |

| Price Bands | ₹393 to ₹414 per share |

| Lot Size | 36 Shares |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,47,14,558 shares |

| Shareholding post -issue | 6,27,09,727 shares |

Anand Rathi Share and Stock Brokers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 36 | ₹14,904 |

| Retail (Max) | 13 | 468 | ₹1,93,752 |

| S-HNI (Min) | 14 | 504 | ₹2,08,656 |

| S-HNI (Max) | 67 | 2,412 | ₹9,98,568 |

| B-HNI (Min) | 68 | 2,448 | ₹10,13,472 |

Anand Rathi Share and Stock Brokers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Anand Rathi Share and Stock Brokers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 15.05 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.66% |

| Net Asset Value (NAV) | 88.53 |

| Return on Equity | 23.50% |

| Return on Capital Employed (ROCE) | 21.48% |

| EBITDA Margin | 33.82% |

| PAT Margin | 11.31% |

| Debt to Equity Ratio | 2.20 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding long-term working capital requirements of the company | 5500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

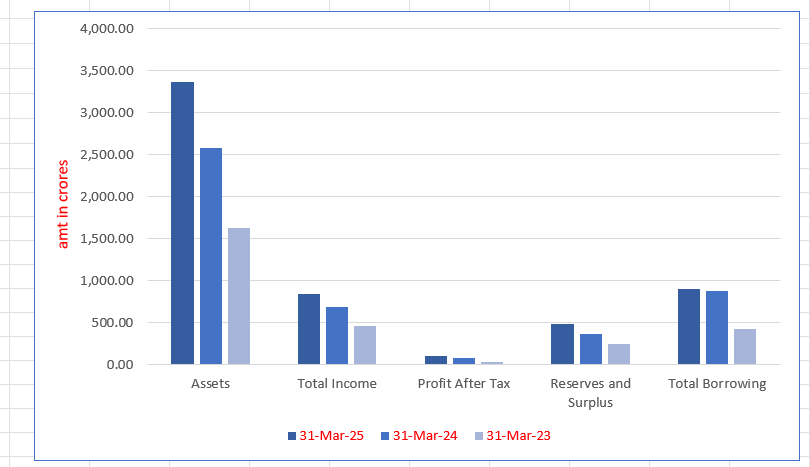

Anand Rathi Share and Stock Brokers Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,365.00 | 2,585.10 | 1,628.78 |

| Total Income | 847.00 | 683.26 | 468.70 |

| Profit After Tax | 103.61 | 77.29 | 37.75 |

| Reserves and Surplus | 481.58 | 370.48 | 245.07 |

| Total Borrowing | 905.57 | 879.24 | 423.00 |

Financial Status of Anand Rathi Share and Stock Brokers Limited

SWOT Analysis of Anand Rathi Share and Stock Brokers IPO

Strength and Opportunities

- Experienced leadership with over 30 years in the financial services industry.

- Strategic importance within the Anand Rathi Group, benefiting from shared brand and resources.

- Diversified product offerings, including equities, commodities, and mutual funds.

- Growing active client base, indicating expanding market presence.

- Focus on retail clientele, providing personalized investment services.

- Expansion into digital platforms to enhance client engagement and service delivery.

- Opportunities to tap into emerging markets with increasing demand for financial services.

- Potential for strategic partnerships or acquisitions to broaden service offerings.

- Commitment to compliance and regulatory adherence, building client trust.

Risks and Threats

- Modest scale of operations with limited market share in the brokerage industry.

- High reliance on brokerage income, making revenues susceptible to market volatility.

- Exposure to intense competition from discount brokers offering zero-commission trades.

- Increasing operational costs, including interest and employee expenses, affecting profitability.

- Vulnerability to regulatory changes impacting business operations and compliance costs.

- Declining market position in terms of active clients on NSE due to competition.

- Dependence on market activities for revenue generation, leading to income volatility.

- Challenges in maintaining diversified revenue streams amidst market fluctuations.

- Threats from evolving regulatory landscape requiring continuous adaptation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Anand Rathi Share and Stock Brokers Limited IPO

The Highest ARPC Amongst Peer Set

Anand Rathi Share and Stock Brokers Limited recorded the highest Average Revenue Per Client (ARPC) during Fiscal 2024 (₹30,922), driven by strong client vintage, a mature client age profile, and personalised management. Over 60% of active clients have relationships exceeding three years, with 85% above 30 years old, reflecting deep client trust and engagement.

Strategic Use of MTF Business to Drive Higher ARPC

Anand Rathi’s Margin Trading Facility (MTF) enhances client flexibility and returns, contributing to significantly higher ARPC for users versus non-users. With a rapidly growing MTF book (₹7,714.66 million as of Sept 2024) and zero non-performing assets, the firm strategically leverages MTF to boost revenue while managing risks effectively.

Full-Service Brokerage House with Diversified Revenue Streams

Anand Rathi’s revenue comprises broking and non-broking segments, with non-broking growing faster at a 35.54% CAGR (Fiscal 2022–24). Assets under management rose to ₹49,045.90 million, and Margin Trading Facility book grew at 42.34% CAGR, reflecting diversified income from equity trading, mutual funds, and margin trading.

Nationwide Reach with Strong Digital Infrastructure

Anand Rathi Share and Stock Brokers Limited operates across 333 cities via 90 branches and 1,123 Authorised Persons, supported by robust digital platforms. With 55.80% clients in Tier 3 and beyond and 37.24% brokerage income from digital channels, the firm ensures seamless acquisition and servicing of clients pan-India through web and mobile technologies.

Legacy-Driven Leadership with Proven Expertise

Anand Rathi Share and Stock Brokers Limited, part of the renowned Anand Rathi Group, leverages a 30-year legacy in financial services. Guided by seasoned promoters, long-serving directors, and a skilled management team, the company benefits from brand strength, strategic synergies, and deep industry expertise across broking, wealth, lending, insurance, and asset management.

Strong Financial Growth Backed by Consistent Performance

Anand Rathi Share and Stock Brokers Limited has shown consistent financial growth, with revenue from operations rising from ₹507.99 million in FY22 to ₹772.90 million in FY24 at a 23.35% CAGR. Supported by rising client numbers, growing assets under distribution, and improving margins, the company demonstrates operational efficiency and robust business expansion.

More About Anand Rathi Share and Stock Brokers Limited

Anand Rathi Share and Stock Brokers Limited is a well-established full-service brokerage house in India with over 30 years of experience. Operating under the brand ‘Anand Rathi,’ the company offers broking services, margin trading facilities, and distribution of financial products to a diverse clientele that includes retail investors, high net worth individuals (HNIs), ultra-high net worth individuals (UHNIs), and institutional clients.

Wide Range of Investment Offerings

The firm’s investment portfolio spans multiple asset classes, including:

- Equity

- Derivatives

- Commodities

- Currency markets

As of September 30, 2024, 146,029 active clients, representing nearly 85% of the total active client base, were above 30 years of age. This key demographic focus, combined with a strong three-decade track record, positions Anand Rathi for sustained growth.

Extensive Network and Presence

Anand Rathi operates through a comprehensive network:

- 90 branches across 54 cities in India

- 1,123 authorised persons spanning 333 cities

- Robust online and digital platforms

This multi-channel presence allows the company to serve clients across Tier 1, Tier 2, Tier 3, and other cities efficiently.

Core Services

Broking Services: These cater to retail clients, HNIs, UHNIs, and institutions, enabling trading in equities (cash delivery and intraday), futures and options, commodities, and currency segments. The company also provides:

- Algorithmic trading services

- Assistance with initial public offerings (IPOs)

- Securities lending and borrowing

Margin Trading Facility: Anand Rathi offers margin trading facilities that allow clients to leverage their eligible collaterals to finance trades, adhering to stock exchange margin requirements.

Distribution of Financial Products: The company distributes third-party investment products such as mutual funds, alternative investment funds, structured products, corporate fixed deposits, non-convertible debentures, bonds, and portfolio management services via its relationship managers and digital platforms.

Technological Edge and Client Engagement

Digitisation and technological innovation remain key priorities, with proprietary platforms like Trade Mobi, AR Invest, MF Client, and Trade Xpress enhancing client experience by offering seamless trading and investment processes.

Financial Performance Highlights

- Revenue from operations grew at a CAGR of 26.90% from ₹4,233.65 million in Fiscal 2022 to ₹6,817.88 million in Fiscal 2024.

- Profit after tax increased at a CAGR of 23.35%, from ₹507.99 million to ₹772.90 million in the same period.

Industry Outlook

India’s financial services industry is poised for robust growth in 2025, driven by digital adoption, rising financial literacy, and expanding retail participation. This environment presents significant opportunities for full-service brokerage firms like Anand Rathi Share and Stock Brokers Limited.

Stock Broking & Securities Market

- Market Size & Growth: The Indian security brokerage market is projected to reach USD 4.25 billion in 2025, expanding at a CAGR of 7.89% to USD 6.21 billion by 2030.

- Growth Drivers:

- Increased digital adoption and mobile trading platforms.

- Rising financial literacy and retail investor participation.

- Supportive government policies and regulatory frameworks.

Margin Trading Facility (MTF)

- Market Expansion: The MTF book size grew from approximately ₹50,000 crore in March 2024 to a peak of ₹85,000 crore in September 2024.

- Growth Drivers:

- Investor interest in leveraging positions for higher returns.

- Bullish stock market trends and increased market participation.

Mutual Fund & Investment Product Distribution

- Assets Under Management (AUM): India’s mutual fund industry crossed ₹70 trillion in AUM as of March 2025, marking a 22.25% year-on-year growth.

- Growth Drivers:

- Surge in direct mutual fund plans driven by tech-savvy investors.

- Regulatory initiatives promoting small-ticket investments to deepen equity reach

How Will Anand Rathi Share and Stock Brokers Limited Benefit

- Anand Rathi will benefit from India’s growing financial literacy and retail investor base by offering diversified products tailored to informed individuals.

- Its strong presence across 333 cities ensures accessibility in emerging Tier 2 and Tier 3 markets, aligning with retail expansion trends.

- The surge in margin trading facilities complements Anand Rathi’s well-regulated MTF services, helping clients maximise market opportunities.

- A broad asset class offering—equity, derivatives, commodities, and currency—aligns well with investors’ increasing appetite for diversified portfolios.

- Rising mutual fund AUM enhances opportunities for Anand Rathi’s distribution services through its relationship managers and digital platforms.

- Robust proprietary platforms like Trade Mobi and AR Invest meet the demand for tech-enabled investing among younger, digital-savvy investors.

- Its consistent financial growth (26.90% revenue CAGR and 23.35% PAT CAGR) highlights operational strength in a rapidly expanding industry.

- A focused demographic (85% above 30 years) positions the firm to serve serious long-term investors amid market maturity.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue

(₹ mn) |

EPS (₹) | NAV (₹) | P/E | RONW (%) |

| Anand Rathi Share and Stock Brokers Limited | 5.00 | 6,817.88 | 19.03 | 88.53 | [●] | 23.50% |

| Peer Groups | ||||||

| Motilal Oswal Financial Services | 1.00 | 70,677.70 | 164.63 | 397.04 | 10.61* | 32.50% |

| IIFL Capital Services Ltd (formerly IIFL Securities) | 2.00 | 22,312.87 | 16.73 | 52.24 | 11.86 | 32.72% |

| Geojit Financial Services | 1.00 | 6,141.34 | 6.06 | 28.38 | 10.96 | 17.48% |

| ICICI Securities Limited | 5.00 | 50,492.10 | 52.51 | 120.38 | 16.02 | 50.09% |

| Angel One Limited | 10.00 | 72,716.84 | 134.21 | 357.06 | 14.82 | 43.29% |

Key Strategies for Anand Rathi Share and Stock Brokers Limited

Enhancing Revenue per Client through Cross-Selling and Margin Funding

Anand Rathi Share and Stock Brokers Limited focuses on increasing average revenue per client by cross-selling diverse investment solutions, including broking, margin funding, and distribution products. The company plans to scale its Margin Trading Facility (MTF) business to boost client retention and strengthen investment consolidation.

Expanding Investment Solutions to Deepen Client Wallet Share

To meet varied investor needs, Anand Rathi Share and Stock Brokers Limited aims to become a comprehensive solutions provider. It plans to grow its distribution business by leveraging machine learning, upskilling relationship managers, and offering research-driven advisory to cross-sell investment products and increase client wallet share.

Broadening Client Base via Geographical and Digital Expansion

Anand Rathi Share and Stock Brokers Limited seeks to grow its client base in Tier 2, Tier 3 cities through digital platforms and strategic partnerships. The company also plans to target high-income, tech-savvy investors by enhancing mobile apps, social media outreach, and increasing its physical network.

Leveraging Technology for Operational Excellence and Client Engagement

The company is committed to digital transformation, investing in IT to improve efficiency, client experience, and risk management. Anand Rathi Share and Stock Brokers Limited explores Generative AI for intelligent recommendations, aiming to empower teams and enhance decision-making through data analytics, automation, and cutting-edge technologies

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Anand Rathi Share and Stock Brokers Limited IPO

How can I apply for Anand Rathi Share and Stock Brokers Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Anand Rathi Share and Stock Brokers Limited IPO?

The IPO size is ₹745 crores, comprising a 100% fresh issue. There is no offer-for-sale component. Funds raised will support growth and operational enhancement across the firm’s financial services business.

When is the Anand Rathi Share and Stock Brokers IPO opening and closing?

The IPO open and close dates are 23 September 2025 to 25 September 2025

Where will Anand Rathi Share and Stock Brokers Limited IPO be listed?

The shares of Anand Rathi Share and Stock Brokers Limited will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), as per the IPO filing.

What is the minimum investment and lot size for the Anand Rathi IPO?

The minimum investment is ₹14,904 and lot size is 36 shares. Once announced, retail investors must apply in lot multiples based on the finalised price band and allocation norms.

Who are the lead managers and registrar for the Anand Rathi IPO?

Lead managers are Nuvama Wealth, DAM Capital, and Anand Rathi Securities. MUFG Intime India Private Limited (Link Intime) is the appointed registrar, handling allotment, refund, and demat credit processes