- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Anlon Healthcare IPO

₹14,280/119 shares

Minimum Investment

IPO Details

01 Sep 25

03 Sep 25

₹14,280

119

₹120 to ₹126

NSE, BSE

₹126 Cr

09 Sep 25

Anlon Healthcare IPO Timeline

Bidding Start

01 Sep 25

Bidding Ends

03 Sep 25

Allotment Finalisation

04 Sep 25

Refund Initiation

08 Sep 25

Demat Transfer

08 Sep 25

Listing

09 Sep 25

Anlon Healthcare Limited

Anlon Healthcare, a research-driven manufacturer of pharmaceutical bulk drugs and intermediates, is globally recognised for its commitment to quality. Based in Rajkot, it adheres to stringent regulatory standards, including FDA, PMDA, KFDA, cGMP, and WHO-GMP. With advanced API manufacturing, strong R&D capabilities, and global accreditations, Anlon is a trusted API partner. The company offers comprehensive technical and regulatory support, ensuring precision at every production stage. Constantly innovating, Anlon remains competitive by upgrading its products to meet evolving global pharmaceutical demands.

Anlon Healthcare Limited IPO Overview

Anlon Healthcare IPO is a book-built issue worth ₹121.03 crores, comprising a complete fresh issue of 1.33 crore equity shares. The subscription window opened on August 26, 2025, and will close on August 29, 2025. The allotment is likely to be finalised on September 1, 2025, with a tentative listing date set for September 3, 2025, on both BSE and NSE. The IPO price band has been fixed between ₹86 and ₹91 per share, with a lot size of 164 shares. For retail investors, the minimum investment required stands at ₹14,924 (based on the upper price band). For sNII investors, the lot size is 14 lots (2,296 shares) with an investment of ₹2,08,936, while for bNII investors, it is 68 lots (11,152 shares) requiring ₹10,14,832. Interactive Financial Services Ltd. is acting as the book-running lead manager, and Kfin Technologies Ltd. has been appointed as the registrar for the issue.

Anlon Healthcare Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.4 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | 26 August 2025 to 29 August 2025 |

| Price Bands | ₹86 to ₹91 per share |

| Lot Size | 164 Share |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,98,51,500 shares |

| Shareholding post -issue | 5,31,51,500 shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | 26 August 2025 |

| IPO Close Date | 29 August 2025 |

| Basis of Allotment Date | 1 Sept 2025 |

| Refunds Initiation | 2 Sept 2025 |

| Credit of Shares to Demat | 2 Sept 2025 |

| IPO Listing Date | 3 Sept 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 164 | ₹14,924 |

| Retail (Max) | 13 | 2,132 | ₹1,94,012 |

| S-HNI (Min) | 14 | 2,296 | ₹2,08,936 |

| S-HNI (Max) | 67 | 10,988 | ₹9,99,908 |

| B-HNI (Min) | 68 | 11,152 | ₹10,14,832 |

Anlon Healthcare Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Anlon Healthcare Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.07 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 56.92% |

| Net Asset Value (NAV) | 13.14 |

| Return on Equity | 0.98% |

| Return on Capital Employed (ROCE) | 16.29% |

| EBITDA Margin | 23.35% |

| PAT Margin | 14.50% |

| Debt to Equity Ratio | 3.55 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Re-payment/ pre-payment, in full or in part, of certain outstanding borrowings availed by our Company | 500 |

| Funding capital expenditure requirements for the expansion of the manufacturing facility | 3071.95 |

| Funding working capital requirement | 4315 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

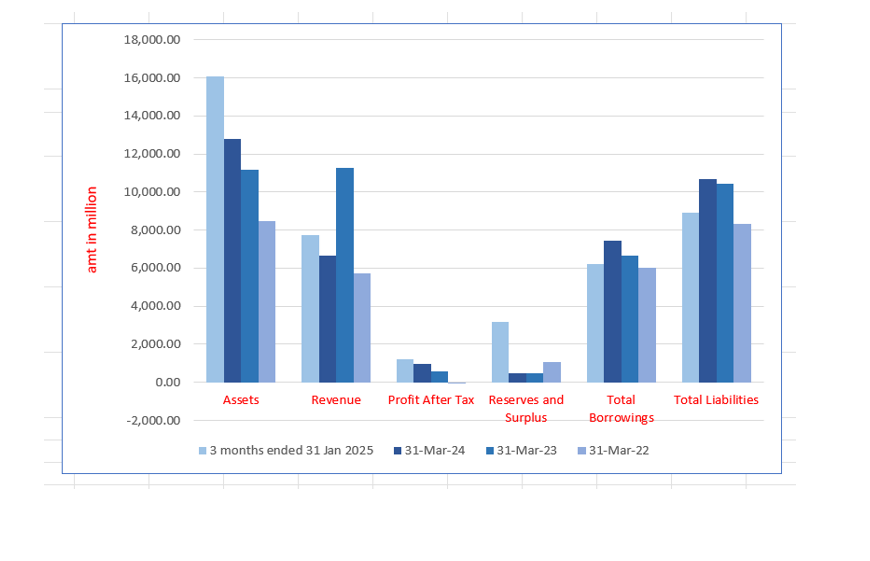

Anlon Healthcare Limited Financials (in lakhs)

| Particulars | 3 months ended 31 Jan 2025 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 16,095.94 | 12,800.08 | 11,154.79 | 8497.22 |

| Revenue | 7724.84 | 6658.37 | 11,287.74 | 5714.27 |

| Profit After Tax | 1196.08 | 965.71 | 582 | (10.77) |

| Reserves and Surplus | 3201.30 | 503.14 | 462.57 | 1044.57 |

| Total Borrowings | 6238.86 | 7456.31 | 6638.67 | 6032.30 |

| Total Liabilities | 8909.49 | 10,696.94 | 10,417.37 | 8341.79 |

Financial Status of Anlon Healthcare Limited

SWOT Analysis of Anlon Healthcare IPO

Strength and Opportunities

- Advanced R&D capabilities enabling innovation in complex chemistry.

- Compliance with international regulatory standards such as FDA, PMDA, KFDA, cGMP, and WHO-GMP.

- State-of-the-art manufacturing facilities supporting high-quality production.

- Strong global presence across Europe, Asia, and other regions, enhancing market reach.

- Expertise in Active Pharmaceutical Ingredients (APIs) and intermediates, strengthening market position.

- Commitment to sustainability and corporate social responsibility, enhancing brand reputation.

- Potential to capitalize on India's emergence as a hub for clinical trials, expanding service offerings.

- Opportunities to develop generic versions of high-demand drugs, tapping into lucrative markets.

- Prospects for partnerships with global pharmaceutical companies investing in India, fostering growth.

- Ability to meet the increasing global demand for affordable medications, expanding market opportunities.

Risks and Threats

- Dependence on global supply chains for raw materials, leading to potential disruptions.

- Challenges in maintaining consistent quality and safety standards, as highlighted by industry concerns.

- Lower investment in R&D compared to global pharmaceutical leaders, limiting innovation.

- Exposure to stringent price controls in domestic markets, affecting profit margins.

- Talent shortages and skill gaps in advanced research roles, impacting innovation.

- Regulatory hurdles and slower approval processes compared to competitors like China, affecting competitiveness.

- Intense competition from both domestic and international pharmaceutical companies, challenging market share.

- Vulnerability to geopolitical factors and global economic fluctuations, impacting operations.

- Rapid technological advancements requiring continuous adaptation, posing operational challenges.

- Potential impact of global health crises on supply chains and demand, affecting stability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Anlon Healthcare Limited IPO

Anlon Healthcare Limited IPO Strengths

- Strong Product Portfolio and Scalable Business

Anlon Healthcare Limited manufactures pharma intermediates and APIs, serving pharmaceutical, nutraceutical, personal care, and veterinary sectors. As one of India’s few producers of loxoprofen sodium dihydrate, its diverse portfolio, global regulatory approvals, and custom manufacturing expertise provide a competitive edge and scalable growth opportunities.

- Strong Promoters and Experienced Management Team

Anlon Healthcare Limited is led by a dedicated management team and experienced promoters who have been integral to its growth. Their expertise in strategy, innovation, and market expansion drives the company’s success. A collaborative leadership approach, industry knowledge, and in-house training initiatives strengthen operational efficiency, customer relationships, and adaptability to market trends. The senior management’s deep understanding of pharmaceutical chemical manufacturing enables the company to capture opportunities, scale operations globally, and maintain a competitive edge in a dynamic industry.

- High Entry and Exit Barriers Due to Stringent Approval Cycles

Anlon Healthcare Limited’s manufacturing process adheres to strict domestic and international standards, requiring extensive regulatory approvals and customer audits. Long approval cycles create high entry barriers, fostering customer retention. With expertise in regulatory compliance, the company secures repeat orders, ensuring stability and competitive advantage in the industry.

- In-House Testing, Quality Control, and Assurance

Anlon Healthcare Limited ensures stringent quality control through four advanced testing laboratories and a skilled 34-member team. Rigorous testing, process optimisation, and impurity reduction enhance product purity. Continuous improvements, regulatory compliance, and custom manufacturing capabilities strengthen the company’s competitive edge in the pharmaceutical industry.

- Focus on Quality, Environment, Health, and Safety (QEHS)

Anlon Healthcare Limited upholds strict quality standards with robust manufacturing checks, multiple quality certifications, and customer-approved facilities. Its zero-liquid discharge plant ensures sustainable operations, while third-party partnerships enhance waste management. Employee health remains a priority through regular check-ups and well-being initiatives.

More About Anlon Healthcare Limited

Anlon Healthcare Limited is a chemical manufacturing company specialising in the production of:

- High-purity advanced pharmaceutical intermediates (Pharma Intermediates): These serve as raw materials and key starting materials for active pharmaceutical ingredient (API) manufacturing.

- Active pharmaceutical ingredients (APIs): Essential raw materials used in pharmaceutical formulations, including tablets, capsules, ointments, syrups, and nutraceuticals, as well as personal care and veterinary health products.

The company’s product portfolio spans multiple categories, including pharmaceutical intermediates, APIs, nutraceutical APIs, personal care ingredients, and veterinary APIs.

Manufacturing Standards and Expertise

Anlon Healthcare Limited ensures its API products adhere to Indian and international pharmacopeia standards, including:

- Indian Pharmacopoeia (IP)

- British Pharmacopoeia (BP)

- European Pharmacopoeia (EP)

- Japanese Pharmacopoeia (JP)

- United States Pharmacopoeia (USP)

The company is among the few manufacturers of Loxoprofen Sodium Dihydrate in India, a widely used API for treating pain and inflammation associated with:

- Rheumatoid arthritis

- Osteoarthritis

- Lower back pain

- Frozen shoulder

- Neck-shoulder-arm syndrome

- Post-surgical pain, injury, or tooth extraction

Custom Manufacturing and API Development

Anlon Healthcare Limited has expanded its operations to include custom manufacturing services for complex and novel chemical compounds. This includes:

- Tailored production processes to meet specific client needs.

- Exceeding industry purity standards.

- Reducing impurities for higher-quality formulations.

Additionally, the company engages in API development, preparation, and Drug Master File (DMF) filing for the Indian and global markets.

Regulatory Approvals

Anlon Healthcare Limited has received approvals from various international regulatory agencies:

- Brazilian Health Regulatory Agency (ANVISA, Brazil) for Loxoprofen Sodium Dihydrate.

- National Medical Products Administration (NMPA, China) for Loxoprofen Sodium Dihydrate.

- Pharmaceuticals and Medical Devices Agency (PMDA, Japan) for Loxoprofen Sodium Dihydrate and Loxoprofen Acid.

The company has also filed 21 DMFs with regulatory authorities in the European Union, Russia, Japan, South Korea, Iran, Jordan, Pakistan, and others. Upcoming DMF filings include:

- Ketoprofen with the USA regulatory authority.

- Dexketoprofen Trometamol with regulatory bodies in Spain, Italy, Germany, and Slovenia.

Product Portfolio

As of the latest records, the company’s product portfolio consists of:

- 65 commercialised products

- 28 products at the pilot stage

- 49 products under laboratory testing

Expansion and Market Reach

Anlon Healthcare Limited continues to expand its product offerings to meet evolving industry demands. In recent years, the company has achieved significant production volumes:

- Fiscal 2022: 214 MT

- Fiscal 2023: 316 MT

- Fiscal 2024: 153 MT

- First ten months of Fiscal 2025: 154 MT

The company’s customer base has grown steadily, with 32 to 63 clients served across different fiscal periods.

Industry Outlook

Growth Prospects of the Pharmaceutical Industry

Pharmaceuticals

- India ranks as the third-largest pharmaceutical manufacturer globally in terms of volume and the thirteenth-largest in value.

- The country is the leading supplier of cost-effective generic drugs, contributing nearly 20% to the global generic drug trade.

- Strong expertise in organic chemical synthesis and process engineering has strengthened India’s position in the global market.

- Between FY 2019 and FY 2024, the industry’s annual turnover grew at a CAGR of 9.9%, reaching INR 2,585 Bn.

- By FY 2030, revenue is expected to grow at a CAGR of 10%, reaching INR 7,300 Bn.

- Growth drivers include:

- Increasing geriatric population

- Higher healthcare expenditure

- Expanded health insurance coverage

- Rising disease incidence

- Government incentives such as the Production-Linked Incentive (PLI) scheme for exports

Active Pharmaceutical Ingredients (APIs)

- Account for 35% of the pharmaceutical market.

- India is the third-largest producer, holding 8% of the global market with 500+ API types.

- Expected to grow at a CAGR of 13.7%, enhancing global supply chain presence.

- Challenges: Chinese competition, strict regulations, price volatility.

- Despite challenges, government support and contract manufacturing drive 7-8% CAGR growth by 2029.

Nutraceuticals / Dietary Supplements

- Increasing health-conscious consumers boost demand for nutraceuticals and functional foods.

- Offer nutritional and pharmaceutical benefits, supporting immunity, digestion, and cognitive health.

- Higher nutraceutical demand drives API market growth.

- Market expected to grow at a CAGR of 10-12%.

Personal Care

- Skincare, haircare, and cosmetics demand is rising with increased grooming trends.

- APIs play a key role in personal care formulations.

- Growth driven by consumer awareness and higher disposable income.

How Will Anlon Healthcare Limited Benefit

- Expanding API Market: With the API sector growing at 13.7% CAGR, Anion gains opportunities across pharmaceuticals, nutraceuticals, personal care, and veterinary health industries.

- Strong API Expertise: Anion specialises in high-purity pharmaceutical intermediates, ensuring superior raw materials for drug formulations, enhancing quality, and supporting advanced pharmaceutical innovations globally.

- Global Regulatory Approvals: Certifications from ANVISA, PMDA, and NMPA enhance Anion’s credibility, allowing expansion into regulated international markets and strengthening its competitive position worldwide.

- Custom Manufacturing: Offers tailored API production, exceeding purity standards, meeting diverse client requirements, and ensuring high-quality formulations for pharmaceutical and healthcare industries globally.

- Growing Product Portfolio: With 65 commercialised products and multiple under development, Anion continues expanding its offerings to meet evolving market and industry demands effectively.

- Expanding Market Reach: Increasing production volumes, growing customer base, and steady revenue growth position Anion as a strong player in the global API market.

- Veterinary and Personal Care Growth: Rising demand for APIs in veterinary and personal care segments strengthens Anion’s presence, increasing revenue streams and long-term sustainability.

- Government Support: India’s Production-Linked Incentive (PLI) scheme and healthcare initiatives provide financial and operational advantages, fueling Anion’s long-term growth strategy.

- Advanced Manufacturing Standards: Compliance with global pharmacopeias ensures Anion delivers high-quality, internationally competitive pharmaceutical ingredients for diverse medical and healthcare applications.

Peer Group Comparison

| Company | EPS (Basic) (₹) | PE Ratio | RONW (%) | NAV (Per Share) (₹) | Face Value (₹) | Total Income (₹ in Lakhs) |

| Anlon Healthcare Limited | 6.68 | [●] | 45.92 | 13.14 | 10.00 | 6,669.19 |

| Peer Groups | ||||||

| Kronox Lab Sciences Ltd | 5.81 | 26.72 | 32.51 | 17.87 | 10.00 | 9,144.03 |

| AMI Organics Ltd | 11.91 | 185.14 | 6.47 | 183.05 | 10.00 | 70,136.87 |

| Supriya Lifescience Ltd | 14.80 | 43.49 | 14.61 | 101.31 | 2.00 | 58,100.50 |

Key Insights

- Earnings Per Share (EPS): Anlon Healthcare’s EPS of ₹6.68 is higher than Kronox Lab Sciences but lower than AMI Organics and Supriya Lifescience, indicating moderate earnings potential in comparison to its peers in the pharmaceutical industry.

- Price-to-Earnings (PE) Ratio: Anlon Healthcare’s PE Ratio is unavailable, but its peers range from 26.72 (Kronox) to 185.14 (AMI Organics). A higher PE Ratio reflects stronger investor confidence, but it also depends on the company’s growth prospects and profitability.

- Return on Net Worth (RONW): With a 45.92% RONW, Anlon Healthcare surpasses its listed peers, demonstrating strong profitability and efficient use of shareholder funds, which enhances investor trust and indicates robust financial performance compared to competitors in the market.

- Net Asset Value (NAV): Anlon Healthcare’s NAV per share is ₹13.14, lower than its competitors, indicating a comparatively smaller asset base or retained earnings. A higher NAV often reflects strong financial health and better asset-backed valuation for investors.

- Face Value: Anlon Healthcare’s face value is ₹10.00, which matches Kronox and AMI Organics but is higher than Supriya Lifescience’s ₹2.00, suggesting a different equity structuring approach affecting stock liquidity and market perception.

- Total Income: Anlon Healthcare reports ₹6,669.19 lakhs in total income, significantly lower than its peers, with AMI Organics at ₹70,136.87 lakhs. This indicates a smaller market presence and revenue scale compared to industry competitors.

Key Strategies for Anlon Healthcare Limited

- Expansion of Manufacturing Capacity

Anlon Healthcare Limited plans to expand production by establishing a new manufacturing plant in Pipaliya, Rajkot, increasing capacity by 700 MTPA. This expansion will support the growing demand for Pharma Intermediaries and APIs, enhancing operational efficiency and market reach.

- Expanding Customer Base and Strengthening Relationships

Anlon Healthcare Limited aims to increase wallet share with existing customers by leveraging strong relationships, cross-selling opportunities, and timely delivery. The company also plans to expand its domestic and international customer base, benefiting from the growing “China +1” strategy.

- Expanding Product Portfolio and Enhancing Operational Efficiency

Anlon Healthcare Limited plans to diversify its product portfolio beyond its existing 65 commercial products by targeting high-growth segments. The company also focuses on cost management, process optimisation, and debt reduction to strengthen financial stability and support future expansion.

- Commitment to Health, Safety, and Sustainability

Anlon Healthcare Limited prioritises health, safety, and environmental responsibility by minimising operational impact and ensuring a safe workplace. The company promotes employee training, efficient resource utilisation, and regulatory compliance to foster a sustainable and secure working environment.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the Anlon Healthcare Limited IPO?

Anlon Healthcare Limited’s IPO is an initial public offering of equity shares, allowing investors to purchase ownership in the company.

How can I apply for the Anlon Healthcare Limited IPO?

Investors can apply online through their Demat account using UPI or ASBA payment methods.

What is the lot size for the Anlon Healthcare Limited IPO?

The lot size is 164 shares with a rice band of ₹86 to ₹91 per share

Who is the registrar for the Anlon Healthcare Limited IPO?

KFin Technologies Ltd is the registrar managing the IPO allotment and refund processes.

When will the Anlon Healthcare Limited IPO be listed?

The IPO open date is 26 August 2025 to 29 August 2025 and the listing date is 3 Sept 2025