- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Annu Projects IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Annu Projects IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Annu Projects Limited

Annu Projects Limited is an EPC (engineering, procurement, and construction) company specialising in the design, development, implementation, and maintenance of critical overhead and underground utility infrastructure. Its operations span three main verticals: telecom infrastructure, sewerage infrastructure, and gas pipelines. In telecom, it surveys, designs, and installs cabling and tower systems for communication, automation, and security, serving clients like BSNL and Bharat Broadband Network. In sewerage, it handles pipe laying, manholes, treatment plants, pumping stations, and related structures. In gas pipelines, it installs MDPE pipelines and GI house connections for domestic and commercial supply, catering to companies such as Indraprastha Gas, Gujarat Gas, and GAIL India.

Annu Projects Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 2.20 crore equity shares |

| Fresh Issue | 2.20 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,78,09,670 shares |

| Shareholding post -issue | 6,98,09,670 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Annu Projects Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Annu Projects Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.07 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.23% |

| Net Asset Value (NAV) | ₹22.63 |

| Return on Equity (RoE) | 25.23% |

| Return on Capital Employed (RoCE) | 30.07% |

| EBITDA Margin | 18.58% |

| PAT Margin | 11.29% |

| Debt to Equity Ratio | 0.29 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements of our Company for purchase of machinery or equipment | 140.29 |

| Funding working capital requirements of our Company | 1,150.00 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

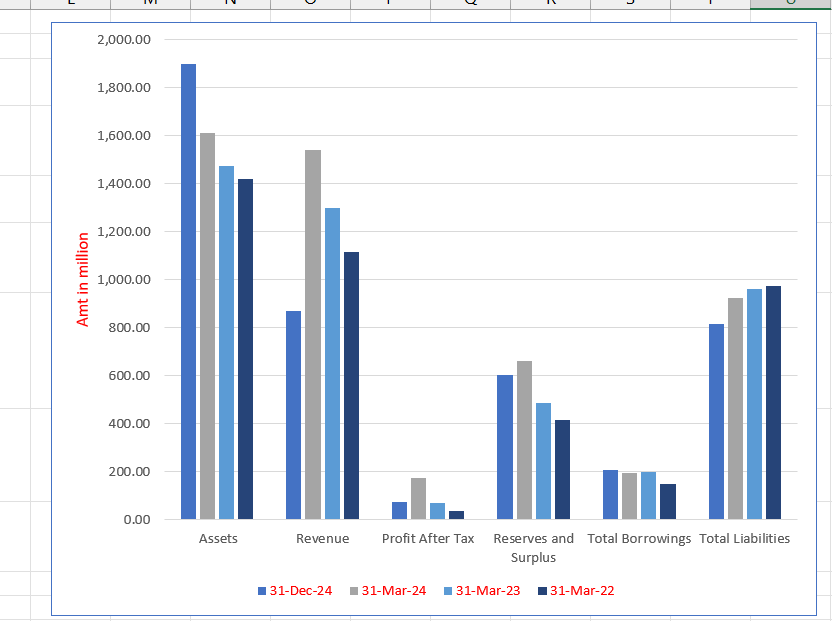

Annu Projects Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 1,898.96 | 1,613.39 | 1,474.76 | 1,420.34 |

| Revenue | 870.10 | 1,539.82 | 1,298.08 | 1,115.62 |

| Profit After Tax | 72.73 | 173.87 | 71.85 | 35.20 |

| Reserves and Surplus | 603.86 | 663.96 | 487.86 | 416.93 |

| Total Borrowings | 207.84 | 196.84 | 197.89 | 148.90 |

| Total Liabilities | 817.00 | 923.50 | 959.92 | 975.46 |

Financial Status of Annu Projects Limited

SWOT Analysis of Annu Projects IPO

Strength and Opportunities

- Established expertise in engineering, procurement, and commissioning projects.

- Strong order book with Rs 377.38 crore as of Dec 2024, providing revenue visibility.

- Consistent revenue growth with a CAGR of ~15% from FY21 to FY24.

- Diversified revenue streams across telecom, sewerage, and gas pipeline sectors.

- Experienced promoters with over two decades in the industry.

- Comfortable financial risk profile with low gearing ratios and strong debt protection metrics.

- Presence in 10 states, with plans for further expansion.

- Reputation for reliability and integrity in infrastructure development.

- Participation in significant projects like BharatNet and BSNL network maintenance.

Risks and Threats

- High receivables leading to elongated debtor period of 182 days in FY24.

- Tender-based business model exposes the company to execution risks.

- Competition from other infrastructure and EPC companies.

- Dependency on government contracts, which may be subject to policy changes.

- Potential delays in project execution affecting cash flows.

- Exposure to fluctuations in raw material costs impacting margins.

- Regulatory challenges in different regions may affect operations.

- Vulnerability to economic downturns affecting infrastructure spending.

- Challenges in maintaining consistent project quality across diverse locations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Annu Projects Limited

Annu Projects Limited IPO Strengths

Expertise in EPC Projects

Annu Projects Limited possesses deep expertise in engineering, procurement, and commissioning projects, focusing on underground and overhead utilities. Leveraging two decades of experience, the company efficiently executes complex telecom, sewerage, and gas pipeline projects, overcoming geographical, environmental, and technical challenges while maintaining high standards of quality and timely delivery.

Project Management and Execution Capabilities

The company employs a systematic project management approach with integrated execution capabilities. Experienced personnel optimise resources, control costs, and manage timelines, ensuring successful delivery of complex projects. Strong coordination with vendors, local partners, and suppliers enhances efficiency, enabling Annu Projects Limited to achieve operational excellence across multiple infrastructure sectors.

In-House Design and Engineering Capabilities

Annu Projects Limited maintains skilled engineers across its verticals, enabling project-specific design modifications and technical solutions. This in-house expertise ensures compliance with tender specifications, optimises costs, and addresses geographical complexities, allowing customised engineering solutions for telecom, sewerage, and gas pipeline projects, strengthening its reputation as a reliable infrastructure partner.

Ownership of Modern Equipment Fleet

The company owns over 400 advanced machinery and equipment, including drilling, splicing, and welding machines. This selective ownership reduces dependency on third parties, ensures flexibility in deployment, supports simultaneous project execution, maintains high quality, and mitigates contractual risks, giving Annu Projects Limited a competitive advantage in complex infrastructure projects.

Quality Control and Assurance Framework

Annu Projects Limited follows a rigorous quality control and assurance framework. All materials and processes undergo strict inspections to meet technical and regulatory standards. By maintaining consistent quality throughout project execution, the company builds customer trust, ensures compliance, and delivers reliable infrastructure solutions across telecom, sewerage, and gas pipeline verticals.

Adoption of Technology

The company leverages advanced technologies such as trenchless methodology, horizontal directional drilling, and splicing machines to enhance project efficiency. Technology adoption minimizes environmental disruption, accelerates timelines, ensures operational precision, and strengthens Annu Projects Limited’s ability to deliver complex infrastructure projects with high reliability, quality, and speed across diverse geographical terrains.

Strong Order Book

Annu Projects Limited maintains a robust and diversified order book across telecom, sewerage, and gas pipeline projects. This provides predictable future revenue streams, strengthens financial planning, enhances profitability, and reinforces its market position. High-value projects like BharatNet Phase III highlight its credibility and ongoing capacity to secure strategic infrastructure contracts.

Financial Performance

The company demonstrates consistent financial growth, with increasing revenue, gross profit, and margins over recent years. Strong return metrics and disciplined cost management reflect its operational efficiency, enabling Annu Projects Limited to sustain profitability, support expansion, and reinforce its position as a financially stable EPC infrastructure leader.

Experienced Leadership and Management Team

Led by seasoned promoters with over two decades of civil sector experience, Annu Projects Limited benefits from strategic guidance and operational expertise. The management team anticipates market trends, strengthens customer relationships, and drives growth, providing a competitive advantage and positioning the company for geographic expansion and diversified infrastructure opportunities.

More About Annu Projects Limited

Established in 2003, Annu Projects Limited is a diversified EPC company engaged in the design, development, implementation, operations, and maintenance of essential overhead and underground utilities infrastructure. Its operations span the telecom infrastructure, sewerage infrastructure, and gas pipeline verticals, delivering projects ranging from fibre optic networks to sewerage systems and domestic gas pipelines (Source: CARE Report). Over the years, the company has developed expertise in laying and maintaining complex infrastructure networks across multiple states in India.

Key Achievements

- Telecom Infrastructure: Laid over 25,000 km of optical fibre cables (OFCs) and maintained more than 50,000 km of OFC networks across eight states and two union territories, including West Bengal, Bihar, Jharkhand, Odisha, Sikkim, Delhi, Uttar Pradesh, Haryana, and Andaman and Nicobar Islands.

- Sewerage Infrastructure: Installed more than 125 km of sewerage pipes (160 mm–900 mm), constructed and maintained sewage treatment plants of 4 MLD capacity, pumping stations, and house service connections across Goa, Jharkhand, Madhya Pradesh, and Bihar.

- Gas Pipeline: Completed over 460 km of MDPE pipelines (20 mm–125 mm) and 38,300 GI house connections for domestic gas in Bihar, Uttar Pradesh, Odisha, Gujarat, and Jharkhand.

Business Verticals

Telecom Infrastructure: Engaged in surveying, designing, and installing cabling and tower infrastructures, primarily serving PSUs and private parties. Key clients include Bharat Sanchar Nigam Limited, A2Z Infra Engineering Limited, and Bharat Broadband Network Limited.

Sewerage Infrastructure: Specialises in pipe laying, construction of manholes, pumping stations, stormwater drainage systems, and treatment plants, executing projects funded by the World Bank, ADB, and various government schemes such as Namami Gange and Swachh Bharat Mission.

Gas Pipeline: Provides MDPE pipeline laying and GI house connections for domestic and commercial gas supply, with ongoing projects for Indraprastha Gas Limited, Gujarat Gas Limited, and GAIL India Limited.

Project Execution and Capabilities

Annu Projects Limited maintains a fleet of over 400 machines and equipment, ensuring efficient project execution with minimal dependence on third parties. Its integrated project management, engineering capabilities, and skilled workforce allow delivery from conceptualization to completion, achieving a PAT margin of 11.29% and return on equity of 25.23% in FY2024. The company complements operations with ISO certifications (ISO 9001:2015 and ISO 45001:2018) and adheres to strict health, safety, and regulatory standards.

Management and Workforce

The company is supported by an experienced Board of Directors, seasoned management team, and 265 permanent employees as of December 31, 2024. Promoters bring extensive industry experience, enabling the company to capitalise on growth opportunities across infrastructure sectors.

Industry Outlook

The Indian infrastructure sector is experiencing robust growth, driven by significant government investments and rapid urbanization. Valued at approximately USD 231 billion in 2024, the sector is projected to reach USD 487 billion by 2032, reflecting a compound annual growth rate (CAGR) of 9.8%.

Growth Drivers

- Government Initiatives: Programs like the National Infrastructure Pipeline (NIP) and the Smart Cities Mission are pivotal in driving infrastructure development.

- Urbanization: Rapid urbanization increases demand for modern infrastructure, including utilities, transportation, and housing.

- Private Sector Participation: Public-private partnerships (PPPs) facilitate large-scale projects, leveraging private investment and expertise.

Sector-Specific Insights

Telecom Infrastructure

- Market Size & Growth: Valued at USD 35.1 billion in 2024, expected to reach USD 71.3 billion by 2033, growing at a CAGR of 7.8%.

- Drivers: 5G rollout, increasing smartphone penetration, and demand for high-speed connectivity drive optical fiber networks and telecom towers.

Sewerage Infrastructure

- Market Size & Growth: Wastewater treatment market valued at USD 4.33 billion in 2024, expected to reach USD 7.35 billion by 2033, CAGR 6.0%.

- Drivers: Government initiatives like Namami Gange and Swachh Bharat Mission, along with urban population growth, are accelerating investments in sewerage systems.

Gas Pipeline Infrastructure

- Market Size & Growth: India’s gas pipeline network is expanding significantly, with plans to extend approximately 9,630 miles and investments of $67 billion over five years.

- Drivers: Policies promoting natural gas adoption aim to reduce dependence on oil imports and improve energy security.

How Will Annu Projects Limited Benefit

- Annu Projects Limited can capitalise on the robust growth of India’s infrastructure sector, expanding its project portfolio across telecom, sewerage, and gas pipeline verticals.

- Increasing demand for optical fiber networks and telecom towers positions the company to secure high-value contracts and long-term partnerships.

- Government initiatives like the National Infrastructure Pipeline, Namami Gange, and Swachh Bharat Mission provide consistent project opportunities and funding support.

- Urbanization and rising utility needs create new opportunities for laying and maintaining sewerage systems and gas pipeline networks.

- Expansion of the natural gas network allows the company to grow its gas pipeline business, catering to both domestic and commercial connections.

- Public-private partnerships (PPPs) and private sector participation enhance collaboration possibilities, enabling Annu Projects Limited to leverage its EPC expertise and technical capabilities.

- The company’s established track record, in-house machinery fleet, and skilled workforce position it to efficiently execute complex projects and maintain competitive margins.

Peer Group Comparison

| Name of the Company | Face Value (₹) | P/E | Revenue (₹ million) | EPS) (₹) | RoNW (%) | NAV (₹) |

| Annu Projects Limited | 10 | 1,539.82 | 4.07 | 4.07 | 16.13 | |

| Peer Group | ||||||

| Likhitha Infrastructure Limited | 530 | 18.17 | 4,216.81 | 16.74 | 20.99 | 7.88 |

| Bondada Engineering Limited | 244 | 21.09 | 8,007.22 | 21.01 | 27.58 | 7.77 |

| EMS Limited | 105 | 19.74 | 7,933.11 | 29.38 | 19.07 | 15.43 |

| Vishnu Prakash R Punglia Limited | 10 | 15.21 | 14,738.65 | 10.95 | 16.95 | 6.46 |

| Suyog Telematics Limited | 10 | 15.96 | 1666.14 | 59.38 | 21.22 | 27.99 |

Key Strategies for Annu Projects Limited

Strengthening Presence and Expanding Across India

Annu Projects Limited actively enhances its addressable markets through offices in multiple Indian cities. The company executes projects like BharatNet Phase III, collaborates in consortiums, and explores partnerships to enter new geographies, targeting both government and private sector clients for sustained market expansion.

Leveraging Core Competencies and Expanding Verticals

The company diversifies beyond telecom infrastructure into gas pipelines and sewerage projects, leveraging expertise in EPC execution. By bidding strategically and building experience across multiple infrastructure sectors, Annu Projects Limited strengthens its industry position while preparing for future growth in transformative and high-demand areas.

Entering Transformative Sectors: Railway Signalling

Recognising modernization and safety needs in railways, Annu Projects Limited pursues strategic opportunities in signalling projects. Participation in competitive bids demonstrates its intent to expand into high-potential sectors, applying its engineering and project execution expertise to contribute to advanced, safe, and efficient railway infrastructure.

Focus on Efficient Cost Management

Annu Projects Limited emphasises stringent cost management throughout project execution. Through budgeting, monitoring expenditures, optimising resources, and leveraging a reliable vendor network, the company ensures financial discipline, cost efficiency, and high-quality delivery across projects, maximising value while maintaining alignment with strategic and operational objectives.

Building Skilled Workforce and Mechanised Capacity

The company invests in human capital and mechanised equipment to enhance project execution. With a growing employee base and a fleet of advanced machinery, Annu Projects Limited efficiently handles complex infrastructure projects, fostering collaboration, innovation, and optimal utilisation of resources for successful outcomes.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Annu Projects Limited IPO

How can I apply for Annu Projects Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the purpose of Annu Projects Limited IPO?

Annu Projects Limited plans to raise funds through a fresh issue of equity shares to support business growth.

How can investors apply for the Annu Projects IPO?

Investors can apply via SEBI-registered brokers using UPI-based ASBA once IPO dates are announced.

On which stock exchanges will Annu Projects shares be listed?

The equity shares are proposed to be listed on both NSE and BSE post-IPO.

What is the total size of the IPO?

The IPO comprises a fresh issue of up to 2.20 crore equity shares, aggregating to ₹[.] crore.

Who are the IPO’s lead manager and registrar?

Mefcom Capital Markets Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the issue registrar.