- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Anthem Biosciences IPO

₹14,040/26 Shares shares

Minimum Investment

IPO Details

14 Jul 25

16 Jul 25

₹14,040

26 Shares

₹540 to ₹570

NSE, BSE

₹3 Cr

21 Jul 25

Anthem Biosciences IPO Timeline

Bidding Start

14 Jul 25

Bidding Ends

16 Jul 25

Allotment Finalisation

17 Jul 25

Refund Initiation

18 Jul 25

Demat Transfer

18 Jul 25

Listing

21 Jul 25

Anthem Biosciences Limited

Anthem Biosciences, a Contract Research and Innovation Service Provider (CRISP), operates from two sites in Bangalore, India, with the capacity to accommodate over 1,000 researchers and produce novel commercial drug actives. Since its inception in 2007, Anthem has emerged as a leader in drug development and manufacturing, excelling in both biological and chemical domains. Anthem also pioneers nutritional product development and offers comprehensive analytical services, GMP testing, and regulatory support. Its world-class infrastructure enables GMP synthesis at various scales, supported by advanced labs, a cGMP kilo lab, and a versatile GMP pilot plant.

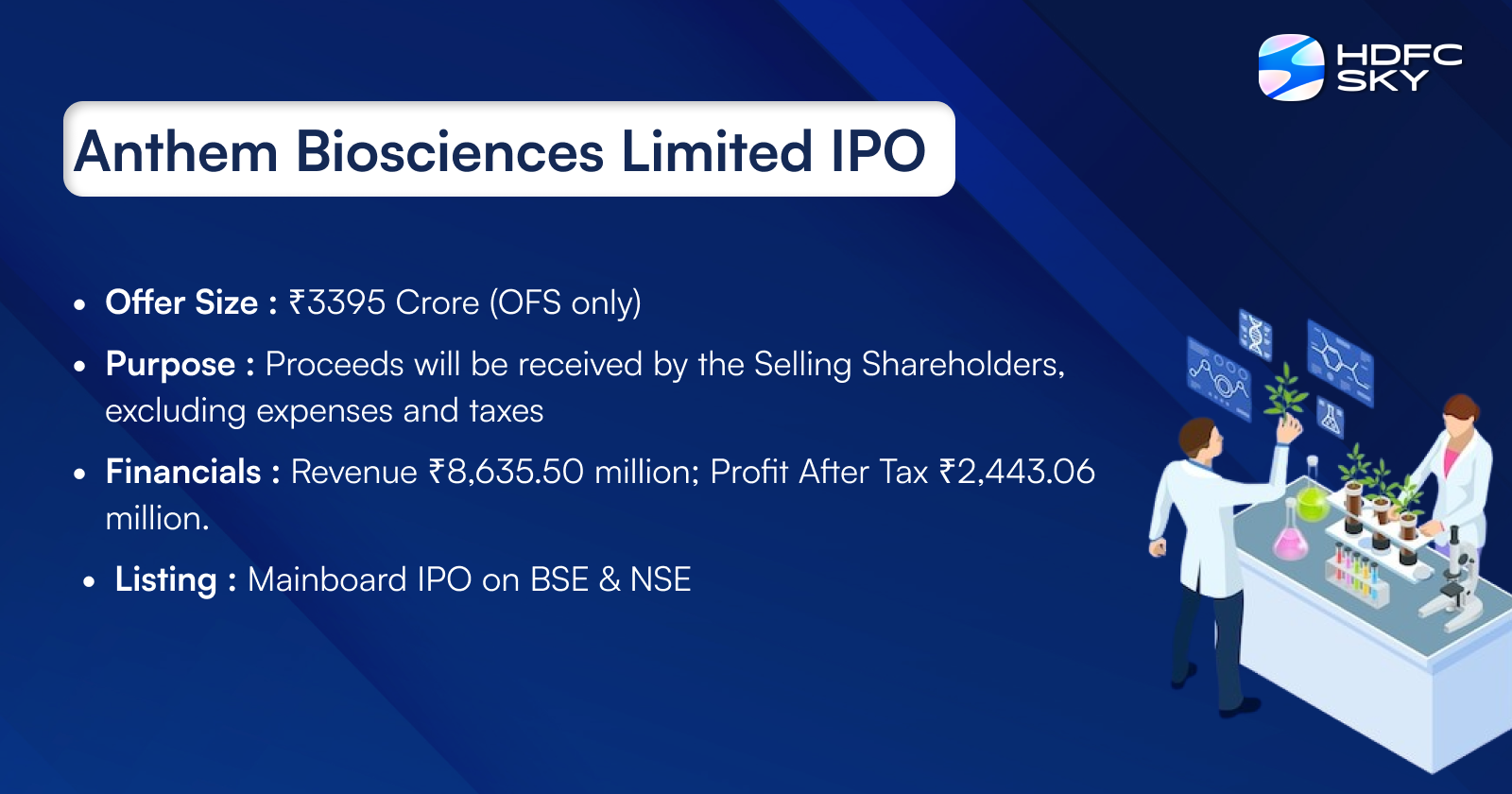

Anthem Biosciences Limited IPO Overview

Anthem Biosciences IPO is a bookbuilding issue aggregating Rs 3,395.00 crores, with the entire issue consisting of an offer for sale. The IPO dates, allotment details, and price bands are yet to be announced. The book-running lead managers for the IPO are Jm Financial Limited, Citigroup Global Markets India Private Limited, J.P. Morgan India Private Limited, and Nomura Financial Advisory And Securities (India) Pvt Ltd, while Kfin Technologies Limited is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹2 per share. The total issue size and price band details are still pending. The company’s pre-issue shareholding stands at 55,90,77,100 shares, with promoters including Ajay Bhardwaj, Ganesh Sambasivam, K Ravindra Chandrappa, and Ishaan Bhardwaj.

Anthem Biosciences Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): ₹3395 crore (5,95,61,404 shares) |

| IPO Dates | 14 July 2025 to 16 July 2025 |

| Price Bands | ₹540 to ₹570 per share |

| Lot Size | 26 Shares |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 55,90,77,100 shares |

| Shareholding post -issue | 55,90,77,100 shares |

Anthem Biosciences Limited IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | 14 July 2025 |

| IPO Close Date | 16 July 2025 |

| Basis of Allotment Date | 17 July 2025 |

| Refunds Initiation | 18 July 2025 |

| Credit of Shares to Demat | 18 July 2025 |

| IPO Listing Date | 21 July 2025 |

Anthem Biosciences Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 26 | ₹14,820 |

| Retail (Max) | 13 | 338 | ₹1,92,660 |

| S-HNI (Min) | 14 | 364 | ₹2,07,480 |

| S-HNI (Max) | 16 | 1742 | ₹9,92,940 |

| B-HNI (Min) | 68 | 1768 | ₹10,07,760 |

Anthem Biosciences Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Anthem Biosciences Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.48 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 20.03% |

| Net Asset Value (NAV) | 34.43 |

| Return on Equity | 20.03% |

| Return on Capital Employed (ROCE) | 25.22% |

| EBITDA Margin | 36.25% |

| PAT Margin | 24.77% |

| Debt to Equity Ratio | 0.12 |

Objectives of the IPO Proceeds

The Selling Shareholders will receive the full proceeds from the Offer, minus their share of expenses and applicable taxes. The company will not obtain any funds from the Offer.

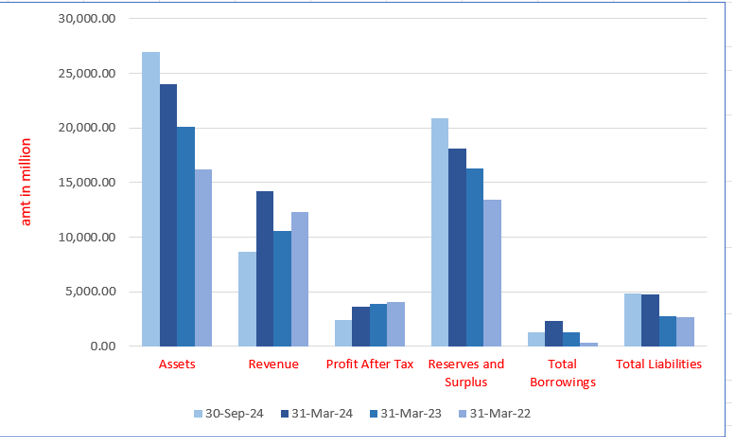

Anthem Biosciences Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 26,925.08 | 23,981.14 | 20,144.58 | 16,188.67 |

| Revenue | 8635.50 | 14,193.70 | 10,569.24 | 12,312.56 |

| Profit After Tax | 2443.06 | 3673.10 | 3851.85 | 4055.39 |

| Reserves and Surplus | 20,925.55 | 18,128.39 | 16,265.71 | 13,462.22 |

| Total Borrowings | 1312.58 | 2325.25 | 1250.64 | 354.91 |

| Total Liabilities | 4881.39 | 4734.59 | 2737.89 | 2638.68 |

Financial Status of Anthem Biosciences Limited

SWOT Analysis of Anthem Biosciences IPO

Strength and Opportunities

- Anthem has a strong R&D team of over 1,200 scientists working on various niche products, enhancing innovation.

- The company has completed capacity expansion at its Harohalli facility, increasing overall synthesis capacity to 275 kL.

- Anthem is setting up a greenfield facility under its subsidiary, Neoanthem, expected to commence operations by Q3 FY2025.

- The company has a strong promoter background with over 25 years of experience in the pharmaceutical and biotechnology industries.

- Anthem has been successfully inspected by USFDA, PMDA (Japan), and EU QPs, ensuring compliance with international standards.

- The company offers a comprehensive range of CRDMO services across NCE and NBE lifecycles, attracting diverse clientele.

- Anthem's strong financial profile is characterized by healthy margins, robust credit metrics, and strong liquidity.

- The company is committed to environmental responsibility, aiming to use resources efficiently and minimize environmental impacts.

- Anthem has a safe work environment, striving to be one of the safest companies in the pharmaceutical industry.

- The company has an Occupational Health Centre offering world-class healthcare services to its employees.

- Anthem's leadership comprises experienced professionals ready to collaborate and ensure clients receive the best solutions.

Risks and Threats

- Revenues are susceptible to demand volatility of end products and developmental risks during clinical trials phases.

- Anthem is a mid-sized player in the highly competitive CRAMS industry, facing competition from larger entities.

- Margins remain susceptible to adverse forex movements, with 75-80% of revenues derived from exports.

- Significant ongoing debt-funded capex may impact debt protection metrics and liquidity if not managed properly.

- Dependence on a few major clients poses a risk; top 10 customers contributed 75.3% of revenues in FY2023.

- External sourcing of intermediates for certain APIs has led to contraction in operating margins to ~35-36%.

- The company's revenue and margins are vulnerable to outcomes of clinical trials, affecting potential revenue streams.

- Anthem's margins remain vulnerable to adverse forex movements due to its export-oriented revenue model.

- The company is undertaking significant debt-funded capex, which may impact its financial metrics if not managed well.

- Anthem operates in a highly competitive industry, which may affect its market position and profitability.

- Regulatory changes and evolving compliance requirements may impact Anthem's operational efficiency and market strategies.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Anthem Biosciences Limited IPO

Anthem Biosciences Limited IPO Strengths

- Comprehensive End-to-End CRDMO Services

Anthem Biosciences offers integrated CRDMO services across the entire drug lifecycle, from discovery and development to commercial manufacturing, for both small and large molecules. With expertise in NCE and NBE, the company supports customers through all clinical phases and commercial production. Anthem’s ability to onboard, transfer, and deliver drug technology efficiently reduces lead times and costs, positioning it as a leading CRDMO in India with significant revenue milestones.

- Innovation-Driven Technological Capabilities

Anthem Biosciences focuses on innovation by investing in advanced technologies such as biotransformation, flow chemistry, and green chemistry techniques. The company offers a broad range of technological capabilities across five key modalities and four manufacturing processes. As a pioneer in India for advanced manufacturing techniques, Anthem’s expertise in high-potency compounds and custom synthesis positions it as a preferred partner for pharmaceutical and biotech companies worldwide.

- Strategic Industry Positioning and Partnerships

With a diverse customer base of over 300 global clients, Anthem Biosciences has built strong partnerships with leading pharmaceutical and biotech companies. The company’s differentiated business model caters to emerging biotech firms, offering tailored solutions from discovery to commercialisation. Strategic collaborations, such as with DavosPharma, provide market access and customer insights, enabling Anthem to expand its presence in the global pharmaceutical industry and achieve consistent growth.

- Strong and Diverse Customer Relationships

Anthem Biosciences Limited has built long-standing relationships with a diverse customer base, including small and emerging biotech firms, mid-sized pharmaceutical innovators, and large-scale pharmaceutical giants. With an average customer relationship of over 11 years, the company benefits from repeat business and organic growth through client testimonials. Their strategic approach ensures customer loyalty while maintaining cost-effective acquisition, positioning Anthem as a trusted partner in drug discovery and development.

- Extensive Specialty Ingredients Portfolio

Anthem Biosciences Limited offers a wide range of specialty ingredients, including GLP-1, probiotics, enzymes, and biosimilars, leveraging its expertise in biology and chemistry. Their innovative approach, such as the biotransformation process for Vitamin K2, highlights their technological capabilities. With the largest fermentation capacity among Indian CRDMOs, Anthem is well-positioned to capture market opportunities, delivering high-quality, cost-effective products while ensuring sustainable growth in niche segments.

- Advanced Manufacturing Infrastructure

Anthem Biosciences Limited operatesstate-of-the-art cGMP-compliant manufacturing facilities with a combined custom synthesis and fermentation capacity of 412 kL. Their facilities are highly automated with advanced Distributed Control Systems (DCS), ensuring minimal manual intervention and superior quality. Anthem’s commitment to regulatory compliance, with multiple international approvals and successful inspections, underscores their focus on maintaining high-quality standards and operational excellence in the pharmaceutical manufacturing landscape.

- Commitment to Innovation and Sustainability

Anthem Biosciences Limited integrates cutting-edge technologies such as green chemistry techniques, including micellar technology and biotransformation, to enhance sustainability and reduce environmental impact. Their focus on innovation extends to operational efficiencies and expansion plans, ensuring scalability and alignment with industry advancements. With a strong emphasis on sustainable practices, Anthem continues to lead the way in developing eco-friendly, efficient manufacturing solutions while meeting the evolving needs of the pharmaceutical industry.

More About Anthem Biosciences Limited

Anthem Biosciences Limited is a leading innovation-focused Contract Research, Development, and Manufacturing Organization (CRDMO) offering fully integrated services across the drug development lifecycle—from discovery to commercial manufacturing. As per the F&S Report, it is one of the few Indian companies providing end-to-end capabilities for both New Chemical Entities (NCEs) and New Biological Entities (NBEs).

Key Milestones

- Recognised globally as a one-stop CRDMO for biotech and pharmaceutical companies

- Crossed ₹10,000 million in revenue within 14 years (FY2021)

- Recorded the highest growth among Indian and global peers between FY2023 and FY2024

Innovation-First Approach

Anthem places innovation at the core of its operations, investing in next-gen drug modalities and manufacturing platforms:

- ADCs (Antibody-Drug Conjugates):

- Developed first linker in 2016 (now in Late Phase)

- Introduced payload for mAbs in 2019 (Early Phase)

- RNAi (RNA Interference):

- Pioneered glycolipids as RNAi delivery platforms since 2016

Technological Strengths

- Green Chemistry:

- Biotransformation (2014) and flow chemistry (2019) for cleaner, cost-effective synthesis

- Core Manufacturing:

- Capabilities in fermentation, custom synthesis, flow chemistry, and enzymatic processes

Strategic Expansion

- Solid-state peptide lab (2016)

- Fermentation facilities (2017)

- Custom synthesis capacity scaled to 270 kL by 2022

- Oligonucleotide lab and cGMP continuous flow facility added in 2023

Business Segments

- CRDMO Services: Customised NCE/NBE lifecycle services across RNAi, peptides, ADCs, and oligonucleotides

- Specialty Ingredients: APIs like probiotics, enzymes, and biosimilars for global markets

Market Reach & Governance

- 8,000+ projects completed with 675+ clients

- Serving 550+ customers globally

- Led by CEO Ajay Bhardwaj and a 1,500-strong team, backed by True North’s strong governance model

Industry Outlook

Global Pharmaceutical Market Outlook (2023–2034)

The global pharmaceutical market, valued at USD 1,573.20 billion in 2023, is projected to reach USD 3,033.21 billion by 2034, growing at a CAGR of 6.15%. This growth is primarily driven by the rising geriatric population and increasing healthcare needs.

Innovator vs Generic Drug Growth

Innovator drugs, which require extensive R&D, were valued at USD 737.1 billion in 2023 and are expected to grow at a 7.3% CAGR, reaching USD 1,046.2 billion by 2028. In contrast, the generic drug segment, known for its affordability, is projected to grow at a 5.0% CAGR to USD 909 billion by 2028.

India’s Pharma Industry Expansion

India’s pharmaceutical growth is supported by the “Make in India” programme, the PLI scheme, and 100% FDI allowance. Lower manufacturing costs and the China+1 strategy further enhance its global competitiveness.

CRDMO and API Market Trends

The global CRO market is expected to hit USD 142 billion, and the CDMO market USD 176.1 billion by 2028. India’s CRDMO sector is set to grow at 14.0% CAGR. Meanwhile, the global API market will reach USD 378.3 billion, driven by demand for biologics, peptides, and specialty ingredients.

How Will Anthem Biosciences Limited Benefit?

- Integrated CRDMO services from discovery to manufacturing position Anthem as a global pharmaceutical solutions provider.

- Achieved ₹10,000 million revenue milestone and rapid growth, establishing Anthem as a leading Indian CRDMO.

- Innovation-driven approach enhances capabilities in ADCs, RNAi, and advanced pharmaceutical manufacturing technologies.

- Investments in flow chemistry and biotransformation improve efficiency, sustainability, and cost-effectiveness in drug development.

- Expanded fermentation and cGMP-scale facilities enable large-scale production of complex and high-value drug products.

- Customisable CRDMO services across NCE and NBE lifecycles cater to varied pharmaceutical client requirements.

- Focus on fermentation-based APIs, including biosimilars and probiotics, strengthens Anthem’s position in specialty ingredients.

- Global clientele exceeding 550 and 8,000+ projects reflect Anthem’s trusted pharmaceutical industry reputation worldwide.

Peer Group Comparison

| Name of the Company | Total Revenue (in ₹ million) | Face Value per Share

(₹) |

P/E Ratio | EPS (Basic) | RoNW (%) | NAV

(₹ ) |

| Anthem Biosciences Limited | 14,193.70 | 2 | [●] | 6.48 | 20.03% | 34.43 |

| Syngene International Limited | 35,792.00 | 10 | 33.17 | 12.69 | 12.95% | 105.91 |

| Sai Life Sciences Limited | 14,942.69 | 1 | 50.49 | 4.53 | 8.89% | 53.83 |

| Suven Life Sciences Limited | 11,132.60 | 1 | 76.28 | 11.80 | 15.86% | 80.56 |

| Divi’s Laboratories Limited | 81,840.00 | 2 | 68.60 | 60.27 | 12.15% | 511.21 |

Key Strategies for Anthem Biosciences Limited

- Expand Technological Capabilities for Customer Acquisition

Anthem Biosciences intends to enhance its technological capabilities in both chemistry and biology, incorporating innovations like photo-chemistry and electro-synthesis. These advancements will improve synthesis procedures, making them more eco-friendly, cost-efficient, and effective, attracting new customers and bolstering existing relationships during the discovery and development phases.

- Leverage Manufacturing Capacity for Commercial and Late-Stage Molecules

The company plans to leverage its expanding manufacturing capacity to meet growing demand for commercialised and late-stage molecules. With expected market growth, Anthem will focus on increasing production capabilities through new facilities and efficient systems to support customer needs for higher quantities, particularly in emerging fields like ADCs and peptides.

- Grow Complex Specialty Ingredients Business

Focusing on specialty ingredients, Anthem aims to increase contracts with pharmaceutical companies by leveraging its technological and manufacturing strengths. They plan to target high-margin products, such as biosimilars and complex peptides, ensuring stable revenues and long-term partnerships, particularly for products like Semaglutide, which has significant market growth potential.

- Improve Operational Efficiency and Supply Chain Resilience

Anthem seeks to enhance financial performance by improving operational efficiencies and sustainability. By reducing dependency on global supply chains and diversifying to cost-effective domestic suppliers, the company aims to mitigate risks from disruptions and ensure a more stable and predictable supply chain, thus enhancing its production schedules.

- Inorganic Expansion and Sustainable Manufacturing

Anthem plans to pursue both organic and inorganic growth by acquiring complementary businesses and enhancing technical capabilities. Additionally, the company is committed to implementing sustainable manufacturing practices, including increasing the use of renewable energy, to align with green chemistry goals and continue developing advanced, high-quality products in a cost-effective and environmentally responsible manner.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Anthem Biosciences IPO

What is the expected opening date and closing date for the Anthem Biosciences IPO?

The IPO opening date is 14 July 2025 and its closing date is 16 July 2025

What is the issue size of the Anthem Biosciences IPO?

The IPO aims to raise ₹3,395 crore through an Offer for Sale (OFS), where the selling shareholders will receive the full proceeds, minus their share of expenses and applicable taxes.

On which stock exchanges will the Anthem Biosciences shares be listed?

Anthem Biosciences’ shares will be listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) upon successful completion of the IPO.

Who are the lead managers for the Anthem Biosciences IPO?

The lead managers handling the Anthem Biosciences IPO are prominent financial institutions, including JM Financial Limited, Citigroup, J.P. Morgan, and Nomura Financial Advisory and Securities.

What is the minimum investment amount for retail investors in the IPO?

Retail investors can expect the minimum investment amount to be around ₹14,820, and the lot size is 26 shares

When is the listing date for the Anthem Biosciences IPO?

The listing date for Anthem Biosciences is on 21 July 2025, following the successful completion of the offer and allotment process.