- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

APPL Containers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

APPL Containers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

APPL Containers Limited IPO

Appl Containers Ltd., based in Bhavnagar, Gujarat, operates a 59,115 sq. mt. manufacturing facility with an annual capacity of 15,000 containers. Established in 2021, the company produces ISO-standard and specialised containers, including BESS, coil, and cement tank variants. In 2026, it ventured into container leasing services and, through its subsidiary Aawadkrupa Plastomech Pvt. Ltd., began producing plastic extrusion and rope-making machinery. As of August 31, 2025, Appl Containers has manufactured 13,101 units and holds an order book of 802 containers worth ₹2,834.27 lakh, along with 170 service orders.

APPL Containers Limited IPO Overview

Appl Containers Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 25, 2025, to raise funds through an Initial Public Offering (IPO). The proposed book-built issue comprises 0.38 crore equity shares, including a fresh issue of up to 0.13 crore shares and an offer for sale (OFS) of up to 0.26 crore shares. The equity shares are proposed to be listed on both NSE and BSE. Cumulative Capital Pvt. Ltd. will act as the book running lead manager, while Bigshare Services Pvt. Ltd. is the registrar to the issue. Key details such as IPO dates, price band, and lot size are yet to be disclosed. The company’s promoters include Hasmukhbhai Meghjibhai Viradiya, Vallabhbhai Meghjibhai Viradiya, Vaibhav Vallabhbhai Viradiya, and others, with a pre-issue holding of 96.12%.

APPL Containers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 0.38 crore equity shares |

| Fresh Issue | 0.13 crore equity shares |

| Offer for Sale (OFS) | 0.26 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,37,28,570 shares |

| Shareholding post-issue | 1,49,78,570 shares |

APPL Containers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

APPL Containers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

APPL Containers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹26.26 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 59.86% |

| Net Asset Value (NAV) | ₹43.87 |

| Return on Equity (RoE) | 85.45% |

| Return on Capital Employed (RoCE) | 55.66% |

| EBITDA Margin | 64.82% |

| PAT Margin | 46.57% |

| Debt to Equity Ratio | 0.36 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of incremental working capital requirements of the Company | 550 |

| Pre-payment or re-payment, in full or in part, of all or a portion of certain outstanding borrowings availed by our Company | 160 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

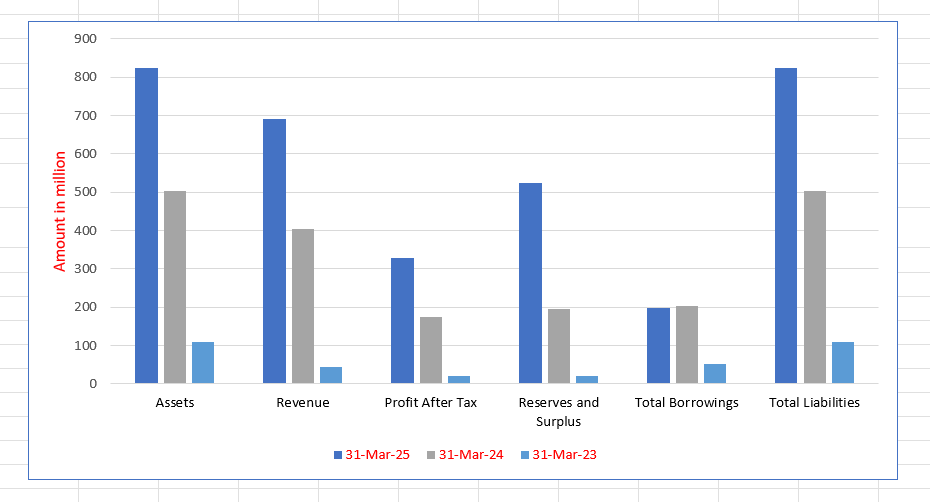

APPL Containers Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 822.75 | 503.04 | 108.70 |

| Revenue | 690.26 | 403.94 | 45.28 |

| Profit After Tax | 328.25 | 173.88 | 20.83 |

| Reserves and Surplus | 523.35 | 194.91 | 20.79 |

| Total Borrowings | 197.80 | 203.49 | 52.85 |

| Total Liabilities | 822.75 | 503.04 | 108.70 |

Financial Status of APPL Containers Limited

SWOT Analysis of APPL Containers IPO

Strength and Opportunities

- Established in 2021 with a vision to become a leading shipping container provider globally.

- Supports the "MAKE IN INDIA" initiative, aligning with national manufacturing goals.

- Inaugurated by Hon'ble PM Shri Narendra Modi, enhancing credibility.

- Impressive production capacity of 15,000 containers annually, indicating robust operational capabilities.

- Offers a diverse range of containers, including specialized types like Battery Energy Storage Systems (BESS).

- Operates in Bhavnagar, Gujarat, a strategic location for manufacturing and export.

- Focuses on client satisfaction with quick turnaround times and high-quality products.

- Emphasizes environmental responsibility and sustainability in manufacturing processes.

- Potential for growth in the international market, contributing to India's prominence in global logistics.

Risks and Threats

- Relatively new entrant in the highly competitive container manufacturing industry.

- Limited brand recognition compared to established global competitors.

- High dependency on the logistics and shipping industry, which is susceptible to global economic fluctuations.

- Potential challenges in scaling operations to meet increasing demand.

- Limited information on financial performance and profitability.

- Potential supply chain disruptions due to global trade uncertainties.

- Possible challenges in maintaining consistent quality as production scales.

- Regulatory challenges and compliance requirements in international markets.

- Vulnerability to geopolitical tensions affecting international trade routes.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About APPL Containers Limited

APPL Containers Limited IPO Strengths

Positioned to Exploit High Demand

The company is strategically positioned to capitalize on the high global and domestic growth in the shipping container market, driven by expanding trade and logistics infrastructure. With the Indian market alone projected to grow at a CAGR of to FY2034, APPL’s manufacturing capabilities are set to benefit from this strong, policy-backed demand surge.

Experienced Promoters and Management

The company is led by Promoters with over two decades of experience in the fabrication and manufacturing industry, including founder and Managing Director, Hasmukhbhai Meghjibhai Viradiya. They are actively involved in strategic decisions, manufacturing, and innovation. This leadership, supported by a professional management team, provides the domain knowledge necessary to scale operations and navigate industry complexities.

Strategically Located and Efficient Facility

APPL’s manufacturing facility in Bhavnagar, Gujarat, is strategically located with ample access to skilled labor and transport. The facility incorporates modern, automated equipment, such as welding robots and a laser cutting machine. This commitment to manufacturing efficiency and a large land parcel supports scalability and future capacity expansion.

Focus on Product Advancement and Technology

The company’s manufacturing emphasizes automation and precision assembly to ensure consistent product reliability and cost-effectiveness. APPL is focused on modernizing its containers by adopting design features that enable integration of GPS-based tracking systems and temperature monitoring. This provides enhanced traceability and meets the evolving technological demands of global logistics.

More About APPL Containers Limited

APPL Containers Limited is a Gujarat-based manufacturing company, primarily focused on the production of shipping and specialised containers. Established in 2021 under the Government of India’s “Make in India” initiative, the company operates a modern manufacturing facility in Bhavnagar, spread across 59,115 sq. mt., with an annual capacity of 15,000 containers. Since inception, APPL Containers has produced over 13,101 containers and, as of August 31, 2025, maintains an order book of 802 containers valued at ₹2,834.27 lakhs alongside a service order book of 170 containers.

Product Portfolio

The company offers a wide range of containers, including:

- ISO Standard Shipping Containers:

- Dry containers: 10ft, 20ft, 40ft standard; 20ft, 40ft high cube

- Other types: Cement tank, 20ft diagonal door, 20ft centre door, open-top, and both-end open containers

- Specialised Containers: Coil containers, lashing bin containers, and Battery Energy Storage System (BESS) containers

Prototypes of 40ft coil containers, cement tank containers, and BESS containers have also been developed, expanding future offerings. In Fiscal 2026, APPL Containers introduced container leasing services, providing flexible solutions to clients.

Subsidiary and Diversification

Through its wholly-owned subsidiary, Aawadkrupa Plastomech Private Limited, acquired in August 2025, the company has expanded into plastic extrusion plants and ropemaking machinery. This strategic integration allows operational synergies, streamlined logistics, and enhanced efficiency, leveraging over 20 years of expertise in machinery and manufacturing.

Operational Excellence and Certifications

APPL Containers has invested in automation, with 16 robots installed in its Bhavnagar facility to enhance productivity and reduce manpower costs. The company follows stringent quality protocols and adheres to international standards. Recognitions include:

- ISO 9001:2015 certification for design, manufacture, export, and supply of containers

- Registration of container code per ISO 6346

- Multiple Type Approval certificates issued by Bureau Veritas

Leadership and Industry Recognition

The company is led by promoters Hasmukhbhai Meghjibhai Viradiya and Vallabhbhai Meghjibhai Viradiya, each with over 20 years of experience. APPL Containers has received awards such as the Certificate of Appreciation by the Ministry of Finance, Greater Business Icon Award, and recognition from district and regional chambers of commerce.

Tender Participation and Revenue

APPL Containers actively participates in public and private tenders, leveraging the GeM Portal and TenderWizard platforms. In Fiscal 2025, the company generated ₹6,902.56 lakh in revenue, predominantly from domestic operations, with international exports beginning in the same year.

Industry Outlook

The Indian container manufacturing industry is experiencing significant growth, driven by increasing international trade, government initiatives, and evolving logistics needs. The India container market was valued at USD 9.12 billion in 2024 and is projected to grow at a CAGR of 2.7% from 2025 to 2030. This growth is attributed to the rising demand for efficient cargo transportation solutions and the expansion of port infrastructure.

Growth Drivers

- Government Initiatives: The “Make in India” initiative has bolstered domestic manufacturing capabilities, encouraging companies to produce containers locally.

- Infrastructure Development: The establishment of container manufacturing clusters, such as the one in Bhavnagar, Gujarat, has enhanced production capacities and reduced dependency on imports.

- E-commerce Expansion: Rapid growth of e-commerce has increased demand for packaging and shipping solutions, driving the need for various container types.

- Port Modernization: Upgrades to port facilities have improved logistics efficiency, supporting the growth of containerized cargo handling.

Market Segments

- Shipping Containers: Dry containers, including 10ft, 20ft, and 40ft standard and high cube sizes, are widely used in global trade.

- Specialized Containers: Products like coil containers, lashing bin containers, and Battery Energy Storage System (BESS) containers cater to specific industry needs.

- Container Leasing: The container leasing market in India reached USD 0.66 billion in 2024 and is expected to grow at a CAGR of 11.2% by 2033.

Future Outlook

The Indian container manufacturing industry is poised for continued growth, supported by favorable government policies, infrastructure development, and increasing demand across various sectors. Companies like APPL Containers Limited are well-positioned to capitalize on these trends through their diverse product offerings and strategic initiatives.

How Will APPL Containers Limited Benefit

- APPL Containers can leverage the “Make in India” initiative to strengthen its domestic manufacturing presence.

- The company’s Bhavnagar facility benefits from container manufacturing clusters, improving production efficiency and reducing logistics costs.

- Growing demand from e-commerce and shipping sectors increases sales opportunities for both standard and specialised containers.

- Expansion into container leasing services provides recurring revenue and flexible solutions for clients.

- Diversification through its subsidiary into plastic extrusion plants and ropemaking machinery enhances product portfolio and revenue streams.

- Automation and robotics at the manufacturing facility improve productivity and reduce operational costs.

- International exports allow APPL Containers to gradually expand its global footprint and capture new markets.

- Strategic tender participation via government and private portals increases contract opportunities and strengthens client relationships.

- Industry certifications and quality standards reinforce credibility, facilitating trust with domestic and international clients.

- Operational synergies with the subsidiary optimize resource utilization and strengthen overall competitiveness.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for APPL Containers Limited

Diversify into Container Leasing

The company is strategically diversifying into the container leasing business in Fiscal 2026 to establish a recurring and stable revenue stream. By building a leasing fleet and leveraging its in-house manufacturing capabilities, APPL aims to capitalize on the strong growth projected in the Indian container leasing market.

Enhance Customization and Flexibility

APPL is focused on offering tailor-made and specialized container solutions to meet specific customer requirements. This includes the capability to design and manufacture advanced products like Battery Energy Storage System (BESS) containers. This approach is designed to build long-term relationships and encourage repeat mass orders.

Strengthen Core Specialized Solutions

The company aims to leverage the global shift towards sustainable energy and logistics by focusing on specialized containers. APPL is investing in R&D to finalize offerings such as BESS containers for grid stabilization and standardized tank containers for safe chemical transport, positioning itself as a preferred clean energy logistics partner.

Optimize Efficiency and Scale Production

APPL’s operational strategy is to improve cost efficiency and output quality through process optimization and automation. The company intends to streamline workflows, invest in advanced fabrication technologies, and utilize quality control systems like arm welding robots to fulfill large-volume orders while maintaining competitive pricing and international standards.

Expand Market Reach and Distribution

The company plans to increase its market presence internationally by focusing on exports to mature and high-demand markets like the European Union and North America. Simultaneously, APPL will target emerging economies and enhance brand visibility through participation in key global industry events and focused communication efforts.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On APPL Containers Limited IPO

How can I apply for APPL Containers Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of APPL Containers Limited IPO?

The IPO comprises 38.10 lakh shares, including a fresh issue of 12.50 lakh and OFS of 25.60 lakh shares.

When will APPL Containers IPO be listed and on which exchanges?

The IPO is proposed to be listed on BSE and NSE; exact listing date is yet to be announced.

Who are the lead managers and registrars for the IPO?

Cumulative Capital Pvt. Ltd. is the book running lead manager, and Bigshare Services Pvt. Ltd. is the registrar.

What is the face value and price band of the IPO?

The face value is ₹10 per share, while the issue price band and lot size are yet to be announced.

What is the objective of raising funds through this IPO?

Funds will be used for working capital, repayment of borrowings, and general corporate purposes to support growth.