- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What is Arbitrage in Stock Market?

By HDFC SKY | Updated at: May 21, 2025 11:37 AM IST

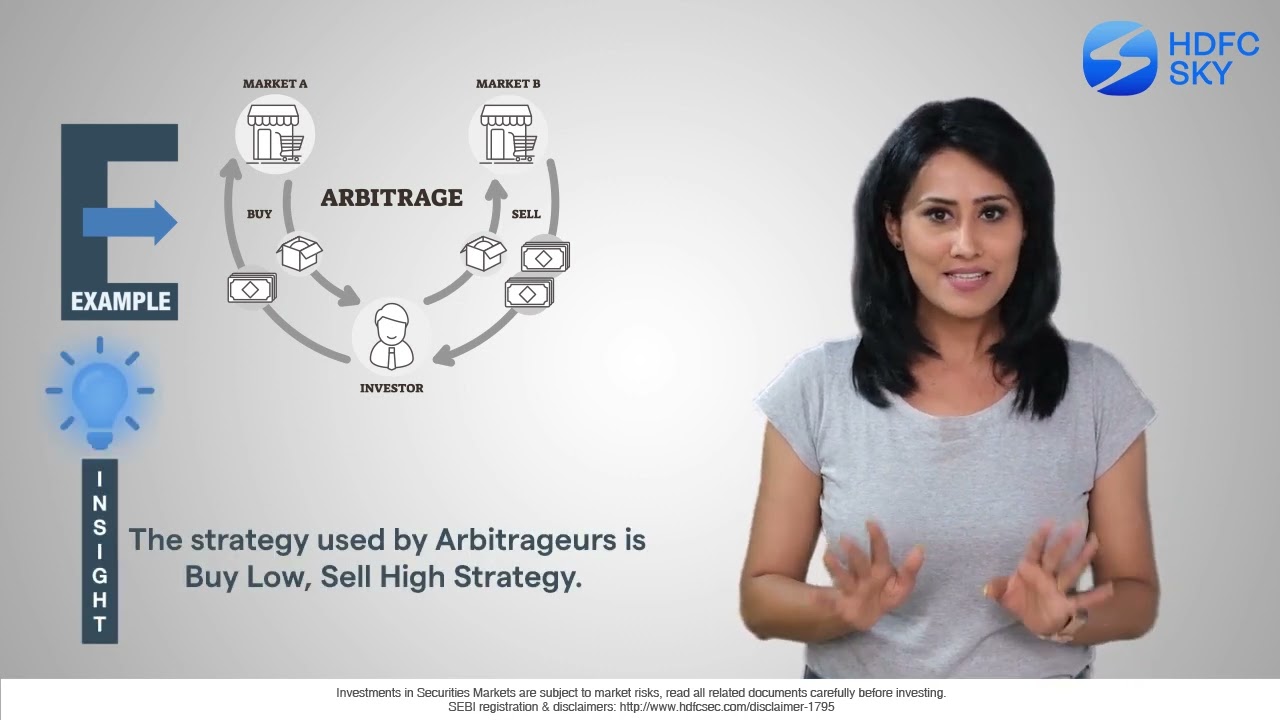

Arbitrage in the stock market involves the simultaneous purchase and sale of the same or similar asset in different markets to profit from small price differences. This strategy exploits market inefficiencies, allowing traders to make risk-free profits by buying low in one market and selling high in another. Such arbitrage opportunities arise when price discrepancies exist between markets.

Arbitrageurs aim to earn riskless profit by exploiting mispricing in the market. They do so by taking opposite positions in different markets for the same underlying. Identifying arbitrage opportunities quickly is crucial to capitalise on these price differences before they disappear.

How Does Arbitrage Works

Example of Arbitrage in Share Market

Suppose Stock A trades on two different exchanges, Stock Exchange A and Stock Exchange B.

Let’s say the stock is currently trading for Rs 100 on exchange A and Rs 98 on exchange B.

An Arbitrage would involve short selling stock A for Rs 100 on exchange A and using those proceeds to buy the same stock on Exchange B for Rs 98.

This gives the trader an instant gain of Rs 2 per share. In this case the trader has simply used a Buy Low and Sell High Strategy.

Arbitrage opportunities like the one explained above usually do not stay for long as the mispricing is exploited by traders and prices adjust swiftly.

Before moving on to Arbitrage in the context of a futures contract, let’s understand how futures contract are priced.

How Futures Contract are Priced.

Futures contract is priced using the cost of carry model.

Futures Contract = Spot Price x (1 + Risk free rate)^t + Storage Costs – Convenience yield

The spot price of the underlying is compounded until the maturity date using the risk-free rate and this price is adjusted for any storage costs incurred and benefits gained.

Convenience yields refers to any benefit that one gains by holding an underlying. In the case of a stock, dividends are referred to as convenience yields.

Storage Costs refers to any cost one must incur to hold an underlying.

For simplicity reasons we will calculate the futures price assuming that there are no storage costs or convenience yields.

Suppose that stock U is currently trading for INR 100 in the market and the risk-free rate is 5%.

The 3-month futures price will be computed as-

Futures price = 100 x (1.05)^(3/12) = 101.23

Arbitrage opportunities in the futures market arise when there is a difference between the futures price quoted in the market and the futures price attained using the cost of carry model.

- Let’s say the Futures price for stock C is quoted at Rs 150 and the Futures price derived from the cost of carry model is Rs 140. In this case the futures contract is said to be overpriced.

- An arbitrage in this case would involve going long the underlying stock and shorting the futures contract, exploiting the arbitrage opportunities available

- Alternatively, if the futures price for stock C were quoted at Rs 150 and the futures price derived from the cost of carry model were Rs 160. The futures contract would’ve been said to be under-priced.

- An arbitrage in this case would involve going short the underlying stock and going long the futures contract.

In conclusion, arbitrage in the stock market is a strategy that exploits price discrepancies between different markets to achieve risk-free profits. By simultaneously buying and selling the same or similar assets, traders can capitalize on these inefficiencies. Understanding how futures contracts are priced and identifying mispricing opportunities are key to successful arbitrage trading.

Related Articles

FAQs on

How does arbitrage work in the share market?

For example, if Stock A trades at Rs 100 on Exchange A and Rs 98 on Exchange B, an arbitrageur can short sell Stock A on Exchange A and buy it on Exchange B, gaining Rs 2 per share instantly.