- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Ardee Engineering IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Ardee Engineering IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Ardee Engineering Limited

Ardee Engineering Ltd. is a leading integrated design, engineering, and manufacturing company in India, operating across three main segments. It offers comprehensive pre-engineered building (PEB) solutions, including design, manufacturing, and on-site project management, with a capacity of 44,144 metric tonnes annually. The company also designs and constructs customized material handling and processing systems. Additionally, it delivers engineering services focused on heavy structural and precision equipment, plus electrical instrumentation and automation. With five manufacturing units in Andhra Pradesh and Telangana, Ardee has completed projects in 13 states over 16 years.

Ardee Engineering Limited IPO Overview

Ardee Engineering’s IPO is a bookbuilding issue of ₹0.56 crore, consisting entirely of a fresh issue of 56.47 lakh shares. The IPO dates and price band are yet to be announced, with the allotment expected to be finalized soon. IIFL Securities Ltd and JM Financial Limited are the book running lead managers, while Bigshare Services Pvt Ltd acts as the registrar. The IPO will be listed on BSE and NSE. The face value per share is ₹5. Promoters include Chandra Sekhar Moturu, Ragdeep Moturu, Arundeep Moturu, and Krishna Kumari Moturu, holding 99.97% pre-issue.

Ardee Engineering Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 0.56 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Ardee Engineering Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Ardee Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Ardee Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 7.65 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 33.42% |

| Net Asset Value (NAV) | 21.77 |

| Return on Equity | 33.33% |

| Return on Capital Employed (ROCE) | 20.97% |

| EBITDA Margin | 9.74% |

| PAT Margin | 4.67% |

| Debt to Equity Ratio | 1.84 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the capital expenditure requirements of our Company towards setting up two new manufacturing facilities at Seetharampur, Telangana | 2796.30 |

| Funding the capital expenditure requirements of our Company towards setting up a new integrated manufacturing facility at Parawada, Andhra Pradesh | 448.43 |

| Prepayment or re-payment, in full or in part, of certain outstanding borrowings availed by our Company | 650 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

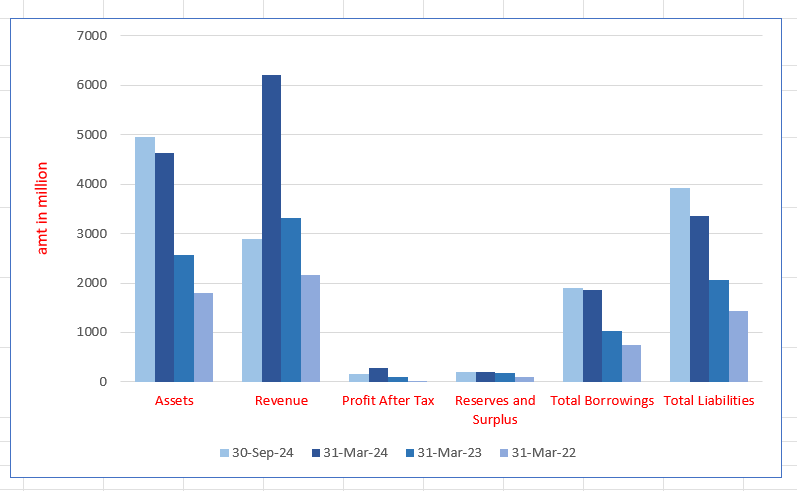

Ardee Engineering Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4949.90 | 4621.64 | 2567.22 | 1802.11 |

| Revenue | 2882.82 | 6209.90 | 3312.52 | 2168.64 |

| Profit After Tax | 155.97 | 291.05 | 109.13 | 12.86 |

| Reserves and Surplus | 200 | 200 | 190 | 90 |

| Total Borrowings | 1896.32 | 1850.59 | 1032.92 | 746.91 |

| Total Liabilities | 3918.93 | 3353.53 | 2057.93 | 1439.05 |

Financial Status of Ardee Engineering Limited

SWOT Analysis of Ardee Engineering IPO

Strength and Opportunities

- Established track record with over 15 years in engineering and manufacturing.

- Diversified product portfolio including PEBs, material handling systems, and engineering services.

- Strong presence in high-growth sectors like infrastructure and industrial projects.

- Experienced promoters with deep domain expertise.

- Long-standing relationships with marquee clients

- In-house design and engineering capabilities enhancing project customization.

- Vertically integrated manufacturing units in Andhra Pradesh and Telangana.

- Focus on executing complex projects, including first-of-its-kind initiatives.

- Opportunity to expand into emerging markets with infrastructure development.

- Potential for growth through upcoming IPO and capital infusion.

Risks and Threats

- High working capital requirements due to extended project cycles.

- Dependency on a limited number of large clients.

- Exposure to cyclical industries such as steel and cement.

- Vulnerability to fluctuations in raw material prices.

- Potential delays in project execution impacting profitability.

- Limited international market presence.

- Regulatory changes in construction and engineering sectors.

- Intense competition from both domestic and international players.

- Challenges in scaling operations rapidly to meet large-scale demands.

- Risk of technological obsolescence without continuous innovation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Ardee Engineering Limited

Ardee Engineering Limited IPO Strengths

- Deep Domain Expertise with Proven Execution Capability

Ardee Engineering Limited, with 16 years of experience across 13 states, excels in delivering complex, customised engineering projects. Backed by 175 skilled engineers, innovative solutions, and timely execution, it maintains a strong order book of ₹8,929.55 million and trusted partnerships with marquee clients, driving consistent growth across high-potential sectors.

- Robust Backward Integration with In-House Expertise

With five integrated manufacturing units in Andhra Pradesh and Telangana, Ardee Engineering ensures complete control across the product lifecycle. Supported by 175 experienced engineers and a 67-vehicle logistics fleet, it enables swift, cost-effective execution, reduced third-party reliance, and seamless delivery of complex engineering solutions with a total capacity of 44,144 MTPA.

- Diversified and Expanding Order Book

As of December 31, 2024, the company’s order book stood at ₹8,929.55 million, reflecting a well-diversified mix across pre-engineered buildings, material handling systems, and engineering services. With 74% from private clients and 26% from government entities, the company ensures revenue visibility and stable growth across sectors and regions.

- Experienced Promoters and Leadership Team

The company is driven by a seasoned leadership team led by ChandraSekhar Moturu and Ragdeep Moturu, each with 16 years of industry experience. With qualified engineers like Arundeep and Krishna Kumari Moturu steering strategic growth, the experienced board and technical teams strengthen governance, risk management, and execution capabilities.

More About Ardee Engineering Limited

Ardee Engineering Limited stands as one of the fastest-growing integrated design, engineering, and manufacturing companies in India based on revenue CAGR between Fiscal 2022 and Fiscal 2024, as reported by CARE. With a strong foothold in pre-engineered buildings (PEB), material handling systems (MHS), and engineering services, the company delivers end-to-end, tailor-made solutions across diverse industries and geographies.

Business Segments

Pre-Engineered Buildings (PEB): Ardee offers comprehensive PEB solutions encompassing design, engineering, manufacturing, and project management for installation. Notable clients include:

- JK Cement, RVR Projects, and a leading e-commerce firm.

- Over 100 PEB projects delivered across India, including manufacturing units, logistics infrastructure, schools, and data centres.

Material Handling Systems (MHS): The company provides custom-engineered solutions to automate and streamline bulk material handling processes. Key achievements include:

- ₹1,670 million coal loading system in Nagpur for RVR Projects.

- ₹150 TPH dry tails filtration plant for ArcelorMittal Nippon Steel in Chhattisgarh.

Engineering Services: Focusing on heavy structural and precision equipment and electrical-instrumentation with automation, Ardee has expanded into niche sectors like defence and aerospace. Projects include:

- Electrical works for weaving sheds in Telangana.

- Power plant structures for a Maharatna PSU.

Capabilities and Strengths

- Founded in 2008, transitioned into a company in 2020.

- A team of 175 engineers, backed by 30 project managers and 362 skilled workers.

- Operates five manufacturing units in Andhra Pradesh and Telangana with an installed capacity of 44,144 MTPA.

- Owns 67 logistics vehicles for faster mobilisation.

- Investments in automation via Ardee Yantrik Private Limited enhance productivity.

Trusted by Industry Leaders

Ardee’s clientele includes renowned names like AM/NS, Udaipur Cement, and Navayuga Engineering. Its ability to deliver quality within deadlines has earned it project completion bonuses and repeat orders.

As of September 30, 2024, Ardee Engineering Limited reported an aggregate Order Book of ₹7,612.81 million, showcasing its industry reputation and future growth potential.

Industry Outlook

India’s engineering and manufacturing landscape is poised for significant growth, driven by rapid industrialization, infrastructure development, and technological advancements. Key sectors such as Pre-Engineered Buildings (PEB), Material Handling Systems (MHS), and Engineering Services are at the forefront of this transformation.

Pre-Engineered Buildings (PEB)

- Market Size & Growth: The Indian PEB market was valued at USD 2.01 billion in 2024 and is projected to reach USD 6.33 billion by 2033, growing at a CAGR of 12.5% during 2025-2033.

- Growth Drivers:

- Rapid urbanization and infrastructure expansion.

- Increased demand from e-commerce and logistics sectors.

- Government initiatives like “Make in India” and the Smart Cities Mission.

- Technological advancements enhancing construction efficiency.

Material Handling Systems (MHS)

- Market Size & Growth: The Indian material handling equipment market reached USD 10.57 billion in 2024 and is expected to grow at a CAGR of 8.08% to USD 22.48 billion by 2033.

- Growth Drivers:

- Expansion of manufacturing and industrial sectors.

- Growth in e-commerce leading to increased warehousing needs.

- Adoption of automation and advanced technologies in logistics.

- Government support through initiatives like the Production-Linked Incentive (PLI) scheme.

Engineering Services

- Market Potential: India’s engineering services outsourcing market is witnessing robust growth, with increasing demand for digital engineering solutions, sustainability, and green engineering practices.

- Growth Drivers:

- India’s vast talent pool and expertise in simulation, PLM, and virtual prototyping.

- Global shift towards sustainable and eco-friendly engineering solutions.

- Government emphasis on clean energy and green technologies

How Will Ardee Engineering Limited Benefit

- Positioned strongly to capitalise on India’s booming PEB market, expected to grow at a CAGR of 12.5%.

- Proven track record with over 100 PEB projects across varied sectors ensures credibility and demand.

- Likely to benefit from the expanding MHS sector with its ₹1,670 million and ₹150 TPH landmark projects.

- Government initiatives like “Make in India” and PLI schemes align with Ardee’s manufacturing focus.

- In-house capabilities across design, engineering, and execution provide an edge in delivering turnkey solutions.

- Increasing demand for automation and green practices aligns with Ardee’s investments in Ardee Yantrik.

- Diversified client base and repeat orders reflect strong market confidence.

- Backed by a skilled team and extensive manufacturing infrastructure to meet growing demand efficiently.

- Experience in niche engineering segments like defence and aerospace positions it well for premium projects.

- A robust order book of ₹7,612.81 million signals long-term revenue visibility and business scalability.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ in million) |

EPS (₹) | NAV (₹) | P/E | RoNW (%) |

| Ardee Engineering Limited | 5.00 | 6,209.90 | 7.65 | 21.77 | [●] | 33.42% |

| Peer Groups | ||||||

| Pennar Industries Limited | 5.00 | 31,305.70 | 7.29 | 64.73 | 25.12 | 11.26% |

| Everest Industries Limited | 10.00 | 15,754.52 | 11.42 | 378.76 | 40.70 | 3.01% |

| Capacite Infraprojects Limited | 10.00 | 19,316.38 | 16.09 | 179.23 | 21.95 | 7.94% |

| PSP Projects Limited | 10.00 | 25,057.89 | 34.16 | 254.16 | 18.46 | 13.44% |

| Ahluwalia Contracts (India) Limited | 2.00 | 38,552.98 | 55.95 | 238.80 | 14.50 | 23.43% |

| ISGEC Heavy Engineering Limited | 1.00 | 62,193.37 | 33.14 | 335.44 | 29.71 | 10.33% |

| Interarch Building Products Limited | 10.00 | 12,933.02 | 58.68 | 306.11 | 25.32 | 19.54% |

Key insights

- Face Value: Ardee Engineering’s face value stands at ₹5, aligning with Pennar Industries but lower than most peers at ₹10. This reflects its share structure, which is moderate compared to companies with lower or higher face values.

- Revenue (₹ in million): With ₹6,209.90 million revenue, Ardee operates on a smaller scale than listed peers like ISGEC and Ahluwalia. However, its niche expertise and high RoNW suggest efficient revenue utilisation and potential for significant growth.

- Earnings Per Share (EPS): Ardee’s EPS of ₹7.65 outperforms Pennar but is modest compared to high EPS companies like Interarch and Ahluwalia. This indicates Ardee’s earnings potential is steady, with room to grow as operations scale up.

- Net Asset Value (NAV): Ardee’s NAV of ₹21.77 is notably lower than its peers, particularly compared to Everest and ISGEC. This suggests Ardee is at an earlier stage in capital accumulation but still demonstrates healthy returns on equity.

- Price-to-Earnings Ratio (P/E): While Ardee’s P/E is undisclosed, peers range from 14.50 to 40.70. A moderate P/E for Ardee would indicate balanced market expectations, while a lower P/E would enhance its attractiveness as a value stock.

- Return on Net Worth (RoNW): Ardee’s RoNW of 33.42% is the highest among all peers, indicating exceptional efficiency in utilising shareholder capital. This strong metric reinforces investor confidence and highlights Ardee’s superior profitability and financial performance.

Key Strategies for Ardee Engineering Limited

- Capitalising on PEB and MHS Industry Growth

Ardee Engineering Limited aims to expand its market share by leveraging the growing demand for PEB and MHS in India. With a strong track record, integrated facilities, and robust project capabilities, the company is well-positioned to benefit from infrastructure-led growth and increasing industry tailwinds.

- Strengthening Geographical Presence Across Strategic Markets

Ardee Engineering Limited seeks to expand its geographical footprint across India and international markets. By leveraging past project experience, government initiatives, and demand trends, the company plans new manufacturing units and consulting services to broaden its market reach and diversify risk for long-term stability.

- Expanding Customer Base and Increasing Wallet-Share

Ardee Engineering Limited is focused on growing its client base and increasing wallet-share from existing customers. Through precision engineering, sector diversification, and cross-selling, the company targets high-margin sectors like defence and aerospace, supported by a data-driven strategy and dedicated teams for sales, marketing, and development.

- Enhancing Design Capabilities and Driving Automation

Ardee Engineering Limited plans to deepen design and engineering strengths while implementing advanced automation and robotics. This dual approach will improve efficiency, lower operational costs, and enable agile, high-quality production. The company remains committed to innovation, talent development, and aligning with emerging market needs and technologies.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Ardee Engineering Limited IPO

How can I apply for Ardee Engineering Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Ardee Engineering Limited's IPO?

The IPO comprises ₹500 crore as a fresh issue and ₹80 crore as an offer for sale.

Who is the promoter selling shares in the offer for sale?

Promoter Chandra Sekhar Moturu is offering shares worth ₹80 crore in the offer for sale component.

How will the proceeds from the IPO be utilized?

Funds will be used for setting up new manufacturing facilities, repaying debts, and general corporate purposes.

On which stock exchanges will Ardee Engineering's shares be listed?

The equity shares are proposed to be listed on both BSE and NSE stock exchanges.

Who are the lead managers for the Ardee Engineering IPO?

IIFL Capital Services Limited and JM Financial Limited are the book-running lead managers for the issue.