- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Ardee Industries IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Ardee Industries IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Bidding Start

TBA

Bidding Start

TBA

Bidding Start

TBA

Ardee Industries Limited

Ardee Industries Limited is a prominent player in India’s circular economy, specializing in the environmentally responsible recycling of end-of-life energy storage products and non-ferrous scrap. The company manufactures high-purity pure lead and various lead alloys at its 104,025 MTPA capacity plant in Tirupati, Andhra Pradesh. With ISO-accredited processes, Ardee serves a diverse customer base, including Amara Raja Energy & Mobility, and has rapidly expanded its export footprint to over seven countries. The company demonstrates strong financial growth, with a revenue CAGR of 34.30% from FY23 to FY25, underpinned by strategic location advantages and robust risk management practices.

Ardee Industries Limited IPO Overview

Ardee Industries Limited has filed its draft red herring prospectus with SEBI for its upcoming IPO. The issue will include a fresh issue of up to ₹320 crore and an offer for sale of up to 37.65 million equity shares by existing promoters. The shares are expected to be listed on NSE and BSE. The public issue will consist of two components: a fresh issue of equity shares up to ₹320 crore and an offer for sale (OFS) by promoters. According to the DRHP, the net proceeds will primarily be used to fund incremental working capital requirements of ₹2,200 million and repay or prepay borrowings of ₹220 million, with the balance allocated for general corporate purposes.

Ardee Industries Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹320 crore |

| Offer for Sale (OFS) | Up to 37,650,000 Equity Shares (Aggregating up to ₹ [●] Million) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Ardee Industries IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Ardee Industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Ardee Industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 1.31 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 53.15% |

| Net Asset Value (NAV) | ₹ 2.46 |

| Return on Equity (RoE) | 53.15% |

| Return on Capital Employed (RoCE) | 25.17% |

| EBITDA Margin | 8.88% |

| PAT Margin | 4.48% |

| Debt to Equity Ratio | 2.65 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements | 2200 |

| Repayment / prepayment of certain borrowings | 220.00 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

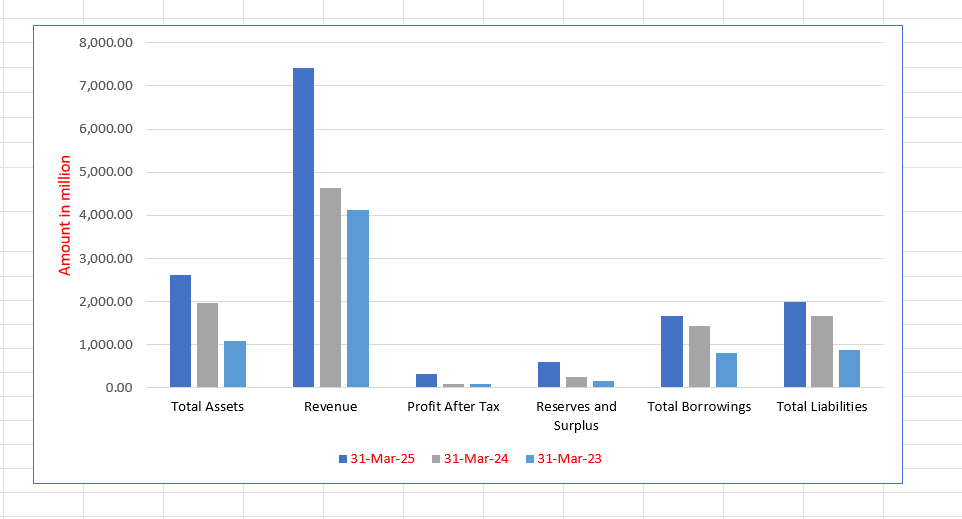

Ardee Industries Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 2,620.60 | 1,961.19 | 1,080.01 |

| Revenue | 7,427.35 | 4,629.59 | 4,117.78 |

| Profit After Tax | 332.71 | 89.54 | 85.67 |

| Reserves and Surplus | 594.16 | 260.64 | 170.32 |

| Total Borrowings | 1,657.66 | 1,423.60 | 809.08 |

| Total Liabilities | 1,994.59 | 1,668.70 | 877.84 |

SWOT Analysis of Ardee Industries IPO

Strength and Opportunities

- Leading player in India's circular economy for lead recycling.

- Strategically located manufacturing facility near ports and key customers.

- Proven operational stability and rapid capacity expansion.

- Diversified product portfolio of pure lead and high-value lead alloys.

- Strong and growing export footprint across multiple international markets.

- Robust raw material sourcing network from over 49 countries.

- Implementation of advanced hedging mechanisms to manage price volatility.

- Consistent track record of strong financial growth and profitability.

- Experienced promoters and a professional management team.

- Application for LME listing to enhance global brand credibility and reach.

Risks and Threats

- High dependency on commodity price cycles of lead.

- Significant working capital requirements straining liquidity.

- High debt levels leading to substantial finance costs.

- Relatively low PAT margins compared to industry peers.

- Intense competition from established domestic and global recyclers.

- Regulatory risks associated with import licenses and environmental compliance.

- Customer concentration risk with a limited number of large buyers.

- Operational risks related to handling and recycling of hazardous materials.

- Fluctuations in foreign exchange rates impacting export realizations.

- Dependence on key personnel for strategic direction and operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Ardee Industries Limited

Ardee Industries Limited IPO Strengths

Leading Player in the Circular Economy

Ardee Industries Limited has established itself as one of India’s leading players in the circular economy. The company specializes in the environmentally responsible recovery and recycling of end-of-life energy storage products and non-ferrous scrap, reclaiming critical resources from waste streams and contributing to domestic resource security while minimizing the environmental footprint of industrial growth.

Strategic Location and Manufacturing Capabilities

Ardee Industries Limited benefits from a strategically located manufacturing facility in Tirupati, Andhra Pradesh. This location provides proximity to major ports like Chennai, Kattupalli, and Ennore for efficient import-export operations and is near large battery manufacturers, enabling short turnaround times, logistical cost savings, and access to regular orders from key customers.

Robust Risk Management through Hedging

Ardee Industries Limited employs a disciplined, board-approved hedging strategy to mitigate commodity price risks. The company utilizes a back-to-back pricing model for imports/exports and enters into futures contracts on the London Metal Exchange (LME), effectively insulating its margins from the volatility of lead prices and ensuring financial stability.

Strong and Diversified Customer Base

Ardee Industries Limited has cultivated a strong customer base of over 50 clients, including reputable names like Amara Raja Energy & Mobility. The company demonstrates high customer retention, with repeat customers contributing over 83% of revenue in FY25, and has rapidly expanded its international presence to seven countries, reflecting the trust in its product quality and reliability.

Proven Financial Performance and Growth

Ardee Industries Limited exhibits a compelling track record of robust financial growth. It is one of the fastest-growing companies in its peer group, with revenue CAGR of 34.30% and PAT CAGR of 97.07% from FY23 to FY25. This consistent performance is supported by improving profitability metrics and a strengthened balance sheet.

More About Ardee Industries Limited

Business Model and Operations

Ardee Industries Limited is a key contributor to India’s circular economy, specializing in the sustainable recycling of end-of-life energy storage products and non-ferrous scrap. The company transforms this waste into high-value products, primarily pure lead and lead alloys, at its advanced manufacturing facility in Tirupati, Andhra Pradesh.

- Product Portfolio:

- Pure Lead: With purity levels ranging from 99.97% to 99.985%, conforming to international standards.

- Lead Alloys: Including lead calcium, lead antimony, lead tin, lead silver, and lead cadmium, each catering to distinct industrial applications requiring properties like corrosion resistance and durability.

Manufacturing and Sustainability

The company’s 7.61-acre facility has an installed capacity of 104,025 MTPA, which was significantly expanded from 54,750 MTPA in FY23. The plant is equipped with advanced machinery like rotary furnaces and refining kettles and is accredited with ISO 9001:2015 (Quality), ISO 14001:2015 (Environmental), and ISO 45001:2018 (Health & Safety) certifications. Ardee integrates sustainability into its core operations by using oxygen enrichment to reduce furnace oil consumption and utilizing green fuel derived from end-of-life tyres, thereby optimizing costs and reducing its environmental impact.

Market Reach and Key Clients

Ardee Industries Limited has a formidable market presence both domestically and internationally.

- Domestic: Products are sold in ten states across India.

- International: The company exports to seven countries, including Singapore, Hong Kong, South Korea, and Switzerland. Export revenue has grown at a staggering CAGR of 521.22% from FY23 to FY25.

- Key Customers: Its clientele includes leading industry players such as Amara Raja Energy & Mobility Limited and Sebang Metal Trading Co. Ltd.

Industry Outlook

The outlook for the Indian lead recycling industry is highly positive, driven by the push towards a circular economy and growing demand from end-use sectors.

Market Growth and Drivers

The Indian lead recycling market is poised for significant growth, primarily fueled by the automotive battery replacement market and the expansion of the telecommunication and UPS sectors. Government initiatives like the Battery Waste Management Rules, 2022, promote formal recycling and create a favorable regulatory environment. The emphasis on “Make in India” and reducing dependency on primary metal imports further bolsters the domestic secondary lead industry.

Key Figures and Projections

- The Recycled Lead Ingots market in Southeast Asia and South Korea was valued at $1.92 Billion in CY 2024 and is projected to reach $2.75 Billion by CY 2030, growing at a CAGR of 6.2%.

- Indian manufacturers on the eastern coast, including Ardee Industries, are strategically positioned to cater to this demand.

- For by-products, India recycled 10.5 million tonnes of plastic waste in FY25, projected to grow to 19 million tonnes by 2030 (CAGR of 12.6%).

- Demand for tin metal in India is projected to grow at a CAGR of 4% from 14.33 KT in FY25 to 17.44 KT in 2030.

- Copper demand in India was 1,764 KT in FY25 and is projected to reach 2,592 KT by 2030, growing at a CAGR of 8%, driven by renewable energy and EV targets.

How Will Ardee Industries Limited Benefit

- Benefit from the strong government push towards a formal circular economy and stringent battery recycling rules, ensuring a steady supply of raw materials.

- Capitalize on the growing demand for recycled lead from the automotive, telecommunications, and renewable energy sectors, both in India and internationally.

- Leverage its strategic location near ports to efficiently serve the high-growth recycled lead markets in Southeast Asia and South Korea.

- Utilize its proven recycling capabilities and expanded capacity to capture a larger market share in the rapidly growing domestic lead recycling industry.

- Diversify into high-growth derivative segments like plastic granules, tin, and copper recycling, tapping into new and expanding revenue streams.

- Enhance its global competitiveness and pricing power through the potential listing of its ‘Ardee Lead 9997’ brand on the London Metal Exchange (LME).

Peer Group Comparison

| Name of the Company | Face Value (₹) | Market Price (₹) | EPS (Basic) (₹) | P/E Ratio | RoNW (%) | RoCE (%) |

| Ardee Industries Limited | 2.00 | [●] | 1.31 | [●] | 53.15 | 25.17 |

| Peer Group | ||||||

| Gravita India Limited | 2.00 | 1,662.05 | 45.11 | 36.84 | 15.12 | 15.17 |

| Pondy Oxides and Chemicals Limited | 5.00 | 1,325.85 | 22.03 | 62.90 | 9.79 | 13.27 |

Key Strategies for Ardee Industries Limited

Portfolio Diversification and Capacity Expansion

Ardee Industries Limited plans to expand its sustainably driven product portfolio by diversifying into plastic granules and refining tin and copper waste. This will be supported by acquiring additional land and utilizing the expanded installed capacity of its manufacturing facility. The strategy aims to maximize value from by-products, minimize waste, and capitalize on the high growth projected in the plastic, tin, and copper recycling markets, thereby strengthening its circular economy model.

Geographical Expansion to Broaden Customer Base

Ardee Industries Limited intends to aggressively expand its geographical footprint by deepening its presence in existing international markets like Hong Kong, Switzerland, and Japan. The strategy involves offering its existing high-quality products to both new and existing customers in these regions. This expansion is aimed at diversifying revenue sources, broadening the customer base, and capturing a larger share of the growing global demand for recycled lead and lead alloys.

Global Brand Enhancement via LME Listing

A key strategic initiative for Ardee Industries Limited is securing a listing for its ‘Ardee Lead 9997’ brand on the London Metal Exchange (LME). This move is designed to establish global credibility, provide transparent international price benchmarking, and enable risk management for international customers. The LME listing is expected to significantly enhance the company’s export capabilities and reinforce its position as a high-quality, compliant producer in the global lead recycling ecosystem.

Debt Profile Optimization and Financial Strengthening

Ardee Industries Limited plans to improve its debt profile by utilizing a portion of the IPO proceeds for the repayment of certain borrowings. This strategic move is expected to reduce outstanding indebtedness, lower debt servicing costs, and improve key financial metrics like Return on Capital Employed (ROCE). An improved leverage ratio will enhance financial flexibility, allowing the company to fund future growth opportunities and invest internal accruals back into the business.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Ardee Industries Limited IPO

How can I apply for Ardee Industries Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size for the Ardee Industries IPO?

The lot size and the number of shares per lot will be announced closer to the IPO date (TBA).

What will the company use the IPO funds for?

The net proceeds will fund working capital needs, repay borrowings, and be used for general corporate purposes.

Where will Ardee Industries shares be listed?

The equity shares will be listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Is this IPO an Offer for Sale (OFS) or a Fresh Issue?

The IPO comprises both a Fresh Issue of shares worth ₹3,200 million and an Offer for Sale (OFS) by selling shareholders.