- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Arjun Jewellers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Arjun Jewellers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Arjun Jewellers Limited IPO

Arjun Jewellers Limited, headquartered in Rajkot, Gujarat, is a retail-focused jewellery company specialising in gold, silver, platinum, diamond, and precious stone jewellery. It operates three showrooms—two in Rajkot and one in Jamnagar—covering 7,019.91 sq. ft. and serving customers across Saurashtra. With over 100 SKUs sourced from trusted vendors in Gujarat and Maharashtra, the company blends traditional craftsmanship with modern design. Through its cluster-based expansion, data-driven inventory, and customer initiatives like the “Arjun Dream Plan,” it strengthens brand loyalty and regional leadership.

Arjun Jewellers Limited IPO Overview

Arjun Jewellers Ltd. submitted its Draft Red Herring Prospectus (DRHP) to the Securities and Exchange Board of India (SEBI) on September 29, 2025, with the aim of raising ₹180 crore through an Initial Public Offer (IPO). The IPO will be a Book Build Issue comprising only a fresh issue of shares, with no offer for sale component. The company plans to list its equity shares on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). While the book-running lead manager is yet to be announced, MUFG Intime India Pvt. Ltd. will serve as the registrar of the issue. Key IPO details such as the issue dates, price band, and lot size are yet to be disclosed.

According to the DRHP, the issue has a face value of ₹10 per share and will be offered through the book-building process. The total issue size will consist of shares aggregating up to ₹180 crore, and the post-listing shares will trade on both BSE and NSE. Before the issue, the company’s shareholding stood at 2,59,46,240 shares.

The promoters of Arjun Jewellers Ltd. are Mr. Manishbhai Nathubhai Ghadiya and Mrs. Ghadiya Raswanti Manish, who currently hold a 96.29% stake in the company before the issue. The post-issue shareholding of the promoters will be determined after the IPO concludes. Investors are advised to refer to the Arjun Jewellers Ltd. DRHP for further details.

Arjun Jewellers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹180 crore |

| Fresh Issue | ₹180 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,59,46,240 shares |

| Shareholding post-issue | TBA |

Arjun Jewellers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Arjun Jewellers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Arjun Jewellers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.09 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 78.69% |

| Net Asset Value (NAV) | ₹10.77 |

| Return on Equity (RoE) | 78.69% |

| Return on Capital Employed (RoCE) | 23.92% |

| EBITDA Margin | 6.39% |

| PAT Margin | 3.97% |

| Debt to Equity Ratio | 2.64 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding Inventory cost towards setting-up of three new stores in Saurashtra | 1538 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

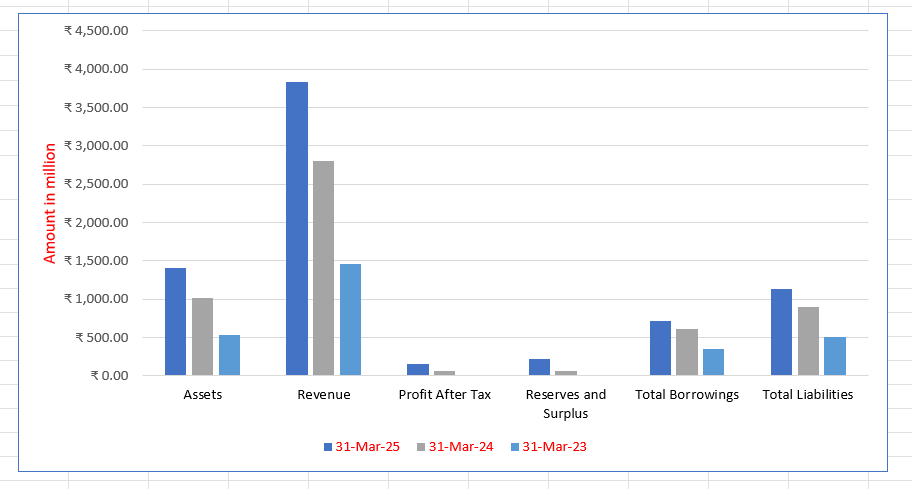

Arjun Jewellers Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | ₹1,402.00 | ₹1,022.19 | ₹527.14 |

| Revenue | ₹3,833.35 | ₹2,803.17 | ₹1,458.76 |

| Profit After Tax | ₹152.15 | ₹61.69 | ₹0.72 |

| Reserves and Surplus | ₹219.33 | ₹67.36 | ₹5.67 |

| Total Borrowings | ₹710.33 | ₹608.71 | ₹353.88 |

| Total Liabilities | ₹1,132.67 | ₹904.83 | ₹501.47 |

Financial Status of Arjun Jewellers Limited

SWOT Analysis of Arjun Jewellers IPO

Strength and Opportunities

- Strong regional presence in Saurashtra with three showrooms in Rajkot and Jamnagar.

- Diverse product portfolio covering gold, silver, platinum, diamond, and precious-stone jewellery.

- Offers over 100 SKUs across multiple metals and styles, appealing to both traditional and contemporary tastes.

- BIS-hallmarked jewellery builds consumer trust and confidence.

- Cluster-based retail expansion model allows supply chain efficiency and stronger local insights.

- Growing luxury and premium segments (platinum, diamond) offer opportunities for premiumisation.

- Integrated digital marketing and loyalty programmes like the “Arjun Dream Plan” enhance customer engagement.

- Opportunity to expand into new markets in Gujarat and other states, leveraging a strong regional base.

- Strong supplier network across Maharashtra and Gujarat ensures flexible sourcing and timely availability.

Risks and Threats

- High concentration in a limited geographic area may restrict national scale growth.

- Heavy reliance on the gold segment, which is subject to price volatility and import duties.

- Margins may be squeezed by competition in lower-ticket jewellery and pressure on making charges.

- Smaller brand compared with national players may lack marketing scale and recognition.

- Limited showrooms may constrain customer reach and brand visibility.

- Volatile raw material prices (gold, diamonds) and forex exposure pose cost risks.

- Threat from increasing online jewellery competition and shifts in consumer buying behaviour.

- Regulatory changes in hallmarking, import duties, or jewellery policies may increase compliance costs.

- Currency fluctuations and global diamond supply constraints may affect inventory and profitability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Arjun Jewellers Limited

Arjun Jewellers Limited IPO Strengths

Extensive and Trend-Aligned Jewellery Collection

Arjun Jewellers, based in Saurashtra, Gujarat, is a key retailer known for its unique and wide-ranging jewellery designs. The product portfolio features over 32 gold, 51 silver, 6 platinum, and 14 diamond designs, available at various price points for all occasions. The company’s local insight allows it to tailor offerings to specific aesthetic needs and current fashion trends.

Value-Added Customer Engagement and Loyalty

The company offers diverse schemes, such as the ‘Arjun Dream Plan,’ to foster customer loyalty and repeat engagement. Arjun Jewellers provides exchange and buyback options, along with structured loyalty programs that offer rate-based discounts and concessions on making charges. These value-added programs are central to the brand’s retention strategy.

Strategic Cluster-Based Store Expansion

Arjun Jewellers employs a cluster-based store expansion strategy across high-traffic areas in Rajkot and Jamnagar, Gujarat. This approach maximizes brand visibility, allows for a deeper understanding of local market needs, and facilitates efficient inventory rotation. It also optimizes marketing spend and human resource utilization across nearby locations.

Targeted Multi-Channel Marketing Initiatives

The company implements targeted marketing and promotional campaigns across traditional media, digital platforms, and OTT channels to boost brand recall. Arjun Jewellers engages a third-party agency to manage content, influencer collaborations, and outdoor advertising. This specialized effort has resulted in a significant social media following and increased brand visibility.

Experienced and Founder-Led Management Team

Arjun Jewellers is led by co-founder and Promoter Manishbhai Nathubhai Ghadiya, who has over 8 years of industry experience. The leadership team, which includes a total of 6 Directors (3 of whom are Independent), provides a strong competitive advantage. Their collective vision and experience in the gems and jewellery sector drive robust business growth.

More About Arjun Jewellers Limited

Arjun Jewellers Limited is a retail-focused jewellery company engaged in marketing and selling gold, silver, platinum, diamond, and other precious stone jewellery through its exclusive chain of retail stores. Headquartered in Rajkot, Gujarat, the company offers a wide assortment of necklaces, earrings, rings, bracelets, pendants, and bridal jewellery — each reflecting a perfect balance of traditional artistry and modern design aesthetics.

Presence in the Saurashtra Market

Arjun Jewellers Limited has established a strong foothold in the Saurashtra region, with three showrooms — two in Rajkot and one in Jamnagar — collectively spanning 7,019.91 sq. ft. These stores cater to a diverse customer base seeking BIS-hallmarked, authentic jewellery. The company has built its reputation through ethical business practices, a customer-centric approach, and consistency in delivering high-quality products.

Product Portfolio

Arjun Jewellers offers a diverse collection of over 103 SKUs, making it a preferred destination for both traditional and contemporary jewellery buyers.

- Gold Jewellery: 32 designs

- Silver Jewellery: 51 designs

- Platinum Jewellery: 6 designs

- Diamond & Precious Stone Jewellery: 14 designs

Each piece is carefully curated to suit regional tastes and modern lifestyles, ranging from daily wear to bridal and festive jewellery. The pricing structure spans from affordable pieces (₹913) to high-value luxury items, catering to customers across income levels.

Operations and Sourcing

The company sources finished jewellery primarily from trusted vendors in Maharashtra and Gujarat, ensuring quality, variety, and timely stock availability. Its data-driven inventory management enables efficient responses to changing consumer preferences. In FY 2025, 2024, and 2023, Arjun Jewellers’ purchases of stock-in-trade amounted to ₹3,788.22 million, ₹2,920.88 million, and ₹1,461.75 million, respectively.

Marketing and Customer Engagement

Arjun Jewellers employs an integrated marketing strategy, combining digital outreach via Instagram, Facebook, and OTT advertising with traditional media like newspapers, radio, and outdoor hoardings. In FY 2025, advertising and promotional expenses stood at ₹113.38 million. The company also runs customer loyalty schemes such as the “Arjun Dream Plan”, encouraging repeat engagement and long-term brand association.

Strategic Retail Expansion

Following its transformation from a partnership firm in 2017 to a private limited company in 2020, Arjun Jewellers diversified into diamond and platinum segments and expanded regionally with a new Jamnagar showroom in 2025. Its cluster-based retail model enhances operational efficiency, strengthens brand visibility, and ensures personalised shopping experiences — positioning Arjun Jewellers as a leading jewellery brand in Saurashtra.

Industry Outlook

Market Size & Growth Projections

- The Indian gems and jewellery industry was valued at approximately US $78.50 billion in FY 2021.

- Forecasts indicate strong growth ahead:

- The market is projected to expand from US $100.94 billion in 2024 to US $168.62 billion by 2030, registering a CAGR of about 8.9%.

- Another estimate suggests it will reach US $227.66 billion by 2033, at a CAGR of nearly 9.2% during 2025-33.

- A more conservative forecast places it at US $89.65 billion in 2024, rising to US $153.77 billion by 2033, with a CAGR of around 6.3%.

Key Growth Drivers

- Rising disposable incomes and a growing middle-class population are increasing jewellery consumption.

- India’s deep cultural affinity for gold and diamond jewellery continues to drive sustained demand.

- The growing shift toward branded and hallmarked jewellery has strengthened consumer confidence.

- Rapid digitalisation and omni-channel retail are transforming buying patterns, with online jewellery sales gaining pace while offline stores remain dominant.

- The rise of lab-grown diamonds (LGDs) represents an exciting segment, expected to reach around US $1.2 billion by 2033, growing at roughly 15% CAGR.

Segment Outlook (Relevant to Arjun Jewellers)

Arjun Jewellers markets a diverse range of gold, silver, platinum, diamond, and precious stone jewellery, aligning with key growth areas in the industry.

- Gold jewellery remains the largest segment, accounting for nearly 86% of total jewellery consumption in India.

- Diamond and precious stone jewellery is projected to grow at a CAGR of around 6.6% from 2024 to 2030, supported by rising luxury demand.

- Silver and platinum jewellery are emerging as alternative premium segments, appealing to younger and affluent consumers.

- Popular product categories such as necklaces, rings, earrings, and pendants continue to drive significant revenue growth.

Outlook Summary & Implications

The Indian gems and jewellery industry is poised for sustained expansion, with expected CAGR ranging between 6% and 10% in the coming years. For regional retail-focused players like Arjun Jewellers Limited, this growth offers substantial opportunity—particularly in markets where hallmarked, certified, and design-driven products are in demand.

To capture this potential, jewellers are focusing on brand building, product diversification, supply chain authenticity, and digital engagement. While challenges such as metal price volatility and intensifying competition persist, companies with strong regional presence, trust-based relationships, and a blend of traditional craftsmanship and modern aesthetics are well-positioned to thrive in India’s evolving jewellery landscape.

How Will Arjun Jewellers Limited Benefit

- Arjun Jewellers Limited is well-positioned to benefit from the industry’s projected CAGR of 6–10%, supported by India’s rising demand for gold and diamond jewellery.

- Its focus on BIS-hallmarked and certified jewellery aligns with the growing consumer preference for authenticity and trust.

- The company’s diverse product portfolio—spanning gold, silver, platinum, and diamond—allows it to tap into multiple high-growth segments.

- With increasing consumer spending on luxury and bridal jewellery, Arjun Jewellers can leverage its regional brand strength in Saurashtra to expand market share.

- Its cluster-based retail model and data-driven inventory management enable cost-efficient scalability in emerging tier-2 and tier-3 cities.

- The company’s digital marketing initiatives and customer loyalty programs position it to attract younger buyers and repeat customers, enhancing brand visibility and long-term profitability

Peer Group Comparison

| Name of the Company | Face Value (₹) | Total Revenue (₹ in million) | EPS (₹) | NAV (₹) | P/E Ratio | RoNW (%) | PAT Margin (%) |

| Arjun Jewellers Limited* | 10.00 | 3,833.35 | 6.09 | 10.77 | [●]# | 78.69% | 3.97% |

| Peer Group | |||||||

| Motisons Jewellers Limited | 1.00 | 4,621.12 | 0.44 | 4.20 | 44.07 | 10.44% | 9.34% |

| Thangamayil Jewellery Ltd | 10.00 | 49,105.80 | 42.00 | 39.00 | 52.10 | 10.77% | 2.42% |

| Senco Gold Limited | 5.00 | 63,280.72 | 10.09 | 12.47 | 37.17 | 8.09% | 2.52% |

| Radhika Jeweltech Ltd | 2.00 | 5,877.87 | 5.09 | 2.73 | 18.13 | 18.63% | 10.23% |

| Tribhovandas Bhimji Zaveri Ltd | 10.00 | 26,204.84 | 10.25 | 9.85 | 18.24 | 10.41% | 2.61% |

Key Strategies for Arjun Jewellers Limited

Strategic Store Network Expansion

Arjun Jewellers plans to strengthen its market position by expanding its store network within Saurashtra, Gujarat. The strategy includes opening new, strategically located showrooms in Rajkot (Twin Tower and University Road) and establishing a presence in Morbi to target various income segments and capitalize on the region’s anticipated growth.

Diversify and Expand Product Offerings

The company will diversify its product portfolio by focusing on high-demand, trend-responsive categories. This includes launching the new ‘AEVUM’ brand for lightweight, fashion-forward jewellery and introducing an exclusive line of accessories for men, aiming to attract a broader, younger demographic and mitigate product concentration risk.

Invest Continuously in Brand Building

Arjun Jewellers intends to increase its investment in marketing initiatives and brand building to enhance visibility and revenue growth. The company will continue using targeted advertising across local media, digital platforms, and in-store events to strengthen brand recall and establish relationships with its target customers in the competitive Saurashtra market.

Augment Inventory for New Showrooms

To support the planned expansion in Saurashtra, the company will augment its inventory investment. A significant portion of the proposed Issue proceeds, ₹1,538 million, is intended to be allocated toward inventory requirements for the new showrooms. This is essential to sustain growth and ensure adequate product appeal for a broader market reach.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Arjun Jewellers Limited IPO

How can I apply for Arjun Jewellers Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Arjun Jewellers Limited IPO?

The Arjun Jewellers IPO aims to raise ₹180 crore through a fresh issue of equity shares.

On which exchanges will Arjun Jewellers shares be listed?

The equity shares of Arjun Jewellers Limited are proposed to be listed on both NSE and BSE.

What type of issue is the Arjun Jewellers IPO?

It is a Book Build Issue consisting entirely of a fresh issue with no offer-for-sale component.

Who are the promoters of Arjun Jewellers Limited?

The company’s promoters are Mr. Manishbhai Nathubhai Ghadiya and Mrs. Ghadiya Raswanti Manish.

How will the IPO proceeds be utilised?

Funds will be used for inventory costs for three new stores and general corporate purposes.