- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

ArMee Infotech IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

ArMee Infotech IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

ArMee Infotech Limited

ArMee Infotech Limited (AIL), founded in 2003, is an IT infrastructure and system integrator company under the ArMee Group. Headquartered in Ahmedabad, Gujarat, it operates across 14 locations in India, catering to government, corporate, BFSI, and education sectors. AIL specialises in IT hardware, software installation, smart classrooms, ICT labs, and digital infrastructure for public distribution systems. It provides IT-managed services, including technical manpower and maintenance, often through its subsidiary, ArMee Technology Services Private Limited. Its services follow defined contracts and service-level agreements.

ArMee Infotech Limited IPO Overview

The IPO will consist entirely of a fresh issue, with no offer-for-sale component, as stated in the DRHP filed on February 25. The company has increased its offer size from 250 crore to a higher amount of ₹300 crore compared to the previous filing. In June 2024, the company submitted the draft red herring prospectus to SEBI. Khandwala Securities and Saffron Capital Advisors have been appointed as the merchant bankers for the IPO.

ArMee Infotech filed its Draft Red Herring Prospectus (DRHP) with SEBI on Thursday, March 6, 2025. The company is promoted by Ami Ridhish Patel, Kiritkumar Chimanbhai Patel, and Ridhish Kiritbhai Patel. As per the DRHP, the promoters hold a pre-issue shareholding of 92.72%. The post-issue shareholding will be determined based on equity dilution, calculated by subtracting the post-issue shareholding from the pre-issue figure.

ArMee Infotech Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹300 crore

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 23,73,138 shares |

ArMee Infotech IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

ArMeeInfotech IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

ArMee Infotech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 21.12 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 52.67% |

| Net Asset Value (NAV) | 40.11 |

| Return on Equity | 70.67% |

| Return on Capital Employed (ROCE) | 57.55% |

| EBITDA Margin | 7.01% |

| PAT Margin | 4.91% |

| Debt to Equity Ratio | 0.29 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements | 600 |

| Prepayment/repayment of certain outstanding loans availed by the company | 89.90 |

| Expansion of business by procuring new government/PSU projects | 1550 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

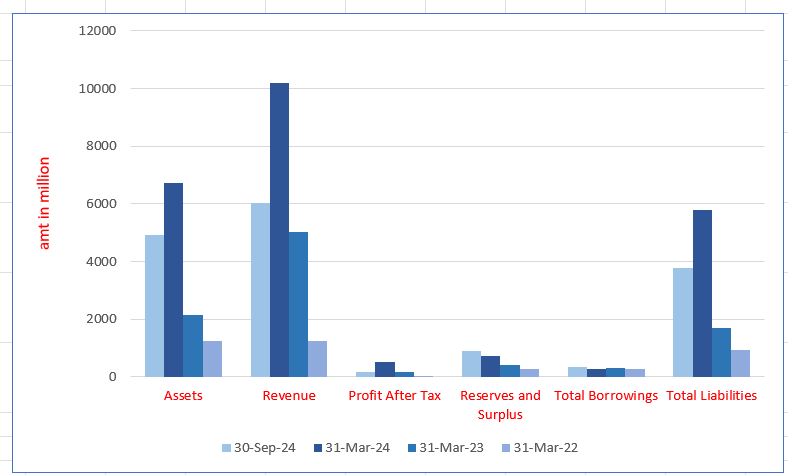

ArMee Infotech Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4909.67 | 6735.01 | 2160.46 | 1244.15 |

| Revenue | 6044.05 | 10,205.75 | 5026.95 | 1251.79 |

| Profit After Tax | 182.10 | 501.30 | 165.74 | 33.64 |

| Reserves and Surplus | 896.54 | 714.44 | 427.42 | 261.31 |

| Total Borrowings | 348.06 | 272.56 | 320.82 | 258.10 |

| Total Liabilities | 3775.81 | 5783.24 | 1693.48 | 943.28 |

Financial Status of ArMee Infotech Limited

SWOT Analysis of ArMee Infotech IPO

Strength and Opportunities

- Proven track record in executing projects for Government and PSU clients.

- Consistent financial performance demonstrating stability and reliability.

- Expertise in providing end-to-end IT solutions across various sectors.

- Experienced Board of Directors and management with extensive domain knowledge.

- Presence in over 14 locations across India, ensuring prompt service delivery.

- Specialisation in large-scale system integration and end-to-end IT infrastructure projects.

- Recognition as "Best National SI – Highest Revenue Government Business" by Acer India.

- Ability to deliver comprehensive IT facility management services, ensuring optimised performance.

- Commitment to environmental sustainability by deploying green solutions.

Risks and Threats

- High dependence on government and PSU projects, leading to potential revenue fluctuations.

- Intense competition in the IT infrastructure sector affecting market share.

- Rapid technological changes requiring continuous adaptation and investment.

- Potential challenges in scaling operations while maintaining service quality.

- Dependence on third-party service providers for certain project activities.

- Vulnerability to policy changes affecting government contracts.

- Financial risks associated with high fund-based utilisation.

- Challenges in maintaining a skilled workforce amid industry talent shortages.

- Exposure to cybersecurity threats impacting client trust and operational integrity.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About ArMee Infotech Limited IPO

ArMee Infotech Limited IPO Strengths

- Proven Expertise in Government and PSU Projects

ArMee Infotech Limited excels in executing IT infrastructure projects for Government and PSU clients, securing contracts through competitive bidding. Contributing to initiatives like E-Gram Vishwagram and Samagra Shiksha Abhiyan, the company ensures cost-effective, timely execution, generating substantial revenue while enhancing government digitisation efforts across multiple states.

- Strong Financial Performance and Growth

ArMee Infotech Limited has demonstrated consistent revenue and profitability growth, maintaining a strong balance sheet. With a significant CAGR in revenue and net profit, the company ensures financial stability. Its positive cash flows support expansion opportunities while enabling efficient management of operational needs and unanticipated financial variations.

- Versatile Service Capabilities Across Multiple Sectors

ArMee Infotech Limited delivers IT infrastructure and managed services across diverse sectors, including education, healthcare, and rural development. Its sector-agnostic approach enhances adaptability, mitigating industry-specific risks. Expanding into renewable energy and Experience Zones, the company seamlessly integrates technology solutions while effectively executing government and private sector projects.

- Experienced Leadership Driving Growth

Led by seasoned promoters and a skilled management team, ArMee Infotech Limited benefits from extensive industry expertise. Its leadership ensures strategic expansion, strong client relationships, and operational efficiency. Supported by qualified professionals, the company remains well-positioned to capitalise on growth opportunities and sustain its competitive advantage.

More About ArMee Infotech Limited

ArMee Infotech Limited is an IT infrastructure and managed services company headquartered in Ahmedabad, Gujarat. Expanding beyond core IT services, the company has ventured into retail sales through Experience Zones, offering IT products, consumer electronics, gaming merchandise, and renewable energy via solar EPC and PPAs.

Client Base and Revenue

The company serves both government/public sector undertakings (PSUs) and private sector clients across various industries, with a majority of revenue generated from government/PSU projects.

IT Infrastructure Services

Under IT infrastructure, ArMee Infotech Limited provides:

- IT hardware and software, including computers, servers, and interactive panels

- Installation and integration based on client requirements

- Maintenance of installed infrastructure under contract

- Functional training for seamless client transition

Key projects include:

- ICT lab setup and smart classrooms

- Digital Infrastructure for the Public Distribution System under NFSA 2013

- IT hardware supply and installation for government entities

IT Managed Services

Expanding beyond infrastructure, IT-managed services include:

- Technical manpower and skill development training

- Annual maintenance services

- On-site and off-site operational support

These services are provided under service level agreements (SLAs) with payments at predefined intervals.

Renewable Energy Expansion

ArMee Infotech Limited has entered the renewable energy sector, leveraging India’s rapid solar growth. The company has secured its first turnkey solar EPC contract for a 50 MW photovoltaic plant in Maharashtra.

Retail Expansion – Experience Zones

The company launched its first Experience Zone in Ahmedabad (November 2024) under an Acer Re-Seller Agreement. Plans are underway to establish up to 60 exclusive Experience Zones, including a second outlet in Bengaluru.

Growth Factors for Experience Zones:

- Evolving consumer preferences for engaging shopping experiences

- Higher disposable income, increasing demand for premium products

- Digital integration, bridging online and offline retail

Project Portfolio and Workforce

As of September 30, 2024, the company manages:

- 20 ongoing projects (11 IT infrastructure, 9 IT managed services)

- 183 completed projects with active warranty periods

- 1,772 skilled employees, with 693 additional contractual staff

With a proven track record in IT services, a strategic retail expansion, and a strong entry into renewable energy, ArMee Infotech Limited is poised for sustained growth and diversification.

Industry Outlook

Market Overview

The Indian IT services market is experiencing robust growth, driven by increasing demand for digital transformation, cloud computing, artificial intelligence (AI), and cybersecurity solutions. In 2024, the market was valued at USD 25.59 billion and is projected to reach USD 51.05 billion by 2030, reflecting a CAGR of 12.03% during this period.

Growth Drivers

- Digital Transformation Initiatives: Organisations across sectors are investing in digital technologies to enhance efficiency and customer engagement.

- Cloud Adoption: The shift towards cloud computing is fueling demand for IT infrastructure and managed services.

- Cybersecurity Concerns: With increasing cyber threats, companies are prioritising managed security services for data protection.

Key Figures

- Managed Services Market Revenue (2023): USD 14,906.6 million, expected to reach USD 41,260.5 million by 2030.

- CAGR (2024-2030):15.7%

- Top Segments:

- Managed Data Center Services: Leading revenue generator

- Managed Security Services: Fastest-growing segment

Renewable Energy Sector: Solar EPC in India

Market Overview

India’s solar energy market is rapidly expanding, supported by government policies and private sector investments. The market is expected to grow from USD 9.87 billion in FY2024 to USD 33.09 billion by FY2032, registering a CAGR of 16.33%.

Growth Drivers

- Government Initiatives: Programs like the National Solar Mission are boosting solar capacity.

- Cost Competitiveness: Declining solar panel prices make solar power more accessible.

- Environmental Concerns: The drive to reduce carbon emissions is accelerating renewable energy adoption.

Key Figures

- Solar Power Market Size (Global): USD 253.69 billion in 2023, projected to reach USD 436.36 billion by 2032.

- Solar EPC Market Value: USD 249.16 billion in 2024, expected to hit USD 459.8 billion by 2035 at a CAGR of 7%.

How Will ArMee Infotech Limited Benefit

- ArMee Infotech Limited is set to benefit from the booming IT services market, leveraging increased demand for digital transformation, cloud computing, and cybersecurity solutions.

- The company’s strong government and PSU client base ensures consistent revenue streams and long-term contracts.

- Its IT-managed services segment is poised for high growth, with businesses increasingly outsourcing technical manpower, maintenance, and operational support.

- Expansion into retail through Experience Zones allows diversification, tapping into India’s rising demand for premium consumer electronics and gaming merchandise.

- The company’s entry into the solar EPC sector positions it to capitalise on India’s renewable energy push, securing government-backed projects and private-sector investments.

- The 50 MW solar EPC project in Maharashtra strengthens its credibility in the renewable energy market.

- A growing workforce and project portfolio enhance operational efficiency and service delivery, ensuring sustained business growth and diversification across sectors

Peer Group Comparison

| Name of the Company | Face Value (₹) | Total Revenue (₹ in million) | EPS (₹) (Basic) | NAV (₹ per share) | P/E Ratio | RoNW (%) | PAT Margin (%) |

| ArMee Infotech Limited | 10.00 | 10205.74 | 21.12 | 40.11 | [●] | 52.67% | 4.91% |

| Peer Groups | |||||||

| Dynacons Systems & Solutions Limited | 10.00 | 10244.63 | 42.41 | 124.22 | 29.35 | 34.13% | 5.25% |

| Orient Technologies Limited | 10.00 | 6028.92 | 11.80 | 49.93 | 37.44 | 23.64% | 6.87% |

Key insights

- Face Value:All three companies, including ArMee Infotech Limited, have a face value of ₹10 per equity share, ensuring a standard base for valuation. This uniformity makes it easier to compare stock performance across the peer group.

- Total Revenue: ArMee Infotech Limited reported ₹10,205.74 million in revenue, slightly lower than Dynacons Systems & Solutions Limited (₹10,244.63 million) but significantly higher than Orient Technologies Limited (₹6,028.92 million), indicating stronger market positioning.

- Earnings Per Share: ArMee Infotech Limited recorded an EPS of ₹21.12, considerably lower than Dynacons (₹42.41) but higher than Orient Technologies (₹11.80). A higher EPS generally signals greater profitability per share, favouring investors.

- Net Asset Value: With a NAV of ₹40.11, ArMee Infotech Limited ranks lowest among the three. Dynacons (₹124.22) leads, indicating stronger asset backing, while Orient Technologies (₹49.93) holds a mid-range position.

- Price-to-Earnings (P/E): The P/E ratio for ArMee Infotech Limited is undisclosed. Dynacons (29.35) and Orient Technologies (37.44) show that investors are willing to pay higher multiples for these stocks, expecting future earnings growth.

- Return on Net Worth: With a RoNW of 52.67%, ArMee Infotech Limited outperforms Dynacons (34.13%) and Orient Technologies (23.64%), suggesting superior capital efficiency and higher profitability in relation to shareholder equity.

- Profit After Tax: ArMee Infotech Limited’s PAT margin of 4.91% is lower than Orient Technologies (6.87%) and Dynacons (5.25%), indicating lower net profitability despite strong revenues, possibly due to higher costs or investment expenses.

Key Strategies for ArMee Infotech Limited

- Diversifying Product and Service Offerings

ArMee Infotech Limited continuously expands its product and service portfolio by integrating IT Infrastructure and IT Managed Services. The company leverages technological advancements in experience zones, payment devices, and data migration while capitalising on the growing demand for renewable energy through solar EPC projects and power purchase agreements (PPAs).

- Expanding Experience Zones for Consumer Engagement

The company enhances brand-consumer interactions through experience zones—interactive spaces that engage all five senses. These zones differentiate brands, highlight product features, and create lasting impressions. With rising urbanisation and a tech-savvy population, ArMee Infotech plans to expand beyond its Ahmedabad Experience Zone, with discussions underway for a Bengaluru location.

- Strengthening Presence in Digital Payments

With India witnessing rapid growth in digital payments due to government initiatives, ArMee Infotech has undertaken projects integrating PoS devices and automating fair price shops. The company plans to expand in this sector, recognising its role in financial inclusion and economic transformation.

- Growing Data Migration Capabilities

The shift from physical storage to cloud-based solutions has increased demand for data migration services. ArMee Infotech provides these services alongside IT infrastructure and managed solutions. As businesses embrace digital transformation, the company intends to scale its data migration projects to meet market needs.

- Advancing into Renewable Energy Solutions

India’s solar power capacity is growing at a rapid pace, driven by sustainability goals. ArMee Infotech aims to establish itself as an EPC service provider in the solar sector and enter PPAs, offering cost-effective energy solutions. The company has already bid for projects in Uttar Pradesh and Maharashtra.

- Enhancing STEM and Atal Tinkering Labs

With the increasing importance of technology in education, ArMee Infotech has experience in setting up STEM and Atal Tinkering Labs. These labs foster hands-on learning in robotics, electronics, and 3D printing, and the company plans to explore further opportunities in this sector.

- Expanding Geographic Footprint

Currently operating in Gujarat with branch offices in Haryana, Karnataka, and Maharashtra, ArMee Infotech plans nationwide expansion. With India’s growing demand for IT infrastructure and managed services, the company actively bids for projects across various states to increase its presence and market reach.

- Balancing Government and Private Sector Clients

A significant portion of ArMee Infotech’s revenue comes from government and PSU projects under various models, including O&M, BOO, and BOOT. While continuing its focus on public sector contracts, the company seeks to expand its private client base to ensure a balanced revenue mix.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On ArMee Infotech Limited IPO

How can I apply for ArMee Infotech Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is ArMee Infotech Limited's IPO issue size?

The IPO is a fresh issue of ₹300 crore, with no offer-for-sale component.

What is the price band for ArMee Infotech Limited's IPO?

The price band has not been announced yet; details will be provided closer to the IPO date.

How will the funds from the IPO be utilised?

Funds aim to enhance working capital, reduce debt, and for general corporate purposes.

When will ArMee Infotech Limited's IPO open and close?

The subscription dates are yet to be announced; stay updated through official channels.

How can investors apply for ArMee Infotech Limited's IPO?

Investors can apply online via UPI or ASBA through their respective banks or brokers.