- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Asset Reconstruction Company IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Asset Reconstruction Company (India) Limited

Asset Reconstruction is a prominent Asset Reconstruction Company (ARC) in India, focused on acquiring and resolving stressed financial assets. It purchases non-performing assets (NPAs) from banks and financial institutions, executing resolutions via restructuring, enforcement of securities, and settlements. The company operates through three verticals: corporate loans, SME loans, and other/retail loans. As of March 31, 2025, it manages total assets of Rs 168,525.70 million, with 75.48% corporate, 16.31% retail, and 8.22% SME loans. It is the second-largest ARC by AUM and net worth, with 201 registered valuers, 163 collection agents, 13 offices across 12 states, and 193 personnel.

Asset Reconstruction Company (India) Limited IPO Overview

Asset Reconstruction Co. (India) Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on August 1, 2025, marking a key step towards its Initial Public Offering (IPO). Promoted by Avenue India Resurgence Pte Ltd and State Bank of India, the company currently holds 89.68% of shares pre-issue. The IPO is structured as a Book Building Issue, consisting entirely of an Offer for Sale of up to 10.55 crore equity shares, proposed to be listed on both NSE and BSE. IIFL Capital Services Ltd. is appointed as the book running lead manager, with MUFG Intime India Pvt. Ltd. as the registrar. Key IPO details, including price band, dates, and lot size, are yet to be announced. The face value of each share is ₹10, with a total issue size aggregating to over 10.54 crore shares. Shareholding remains unchanged post-issue at 32.48 crore shares.

Asset Reconstruction Company (India)Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 10.55 crore equity shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 10.55 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Asset Reconstruction Company (India) Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Asset Reconstruction Company (India) Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹10.94 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.59% |

| Net Asset Value (NAV) | ₹81.97 |

| Return on Equity (RoE) | 12.95% |

| Return on Capital Employed (RoCE) | 14.97% |

| EBITDA Margin | 82.28% |

| PAT Margin | 57% |

| Debt to Equity Ratio | 0.11 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

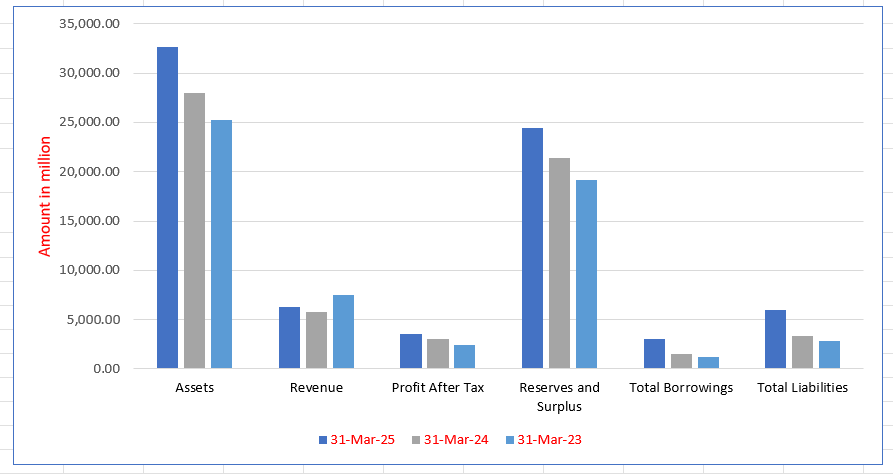

Asset Reconstruction Company (India) Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 32,638.16 | 27,953.36 | 25,237.96 |

| Revenue | 6,233.99 | 5,741.06 | 7,537.11 |

| Profit After Tax | 3,553.19 | 3,053.41 | 2,391.24 |

| Reserves and Surplus | 24,429.01 | 21,376.14 | 19,148.46 |

| Total Borrowings | 3,059.86 | 1,499.47 | 1,180.13 |

| Total Liabilities | 5,960.18 | 3,328.25 | 2,840.53 |

Financial Status of Asset Reconstruction Company (India)Limited

SWOT Analysis of Asset Reconstruction Company IPO

Strength and Opportunities

- Established as India's first ARC with nearly two decades of operational experience.

- Backed by strong sponsors: Avenue Capital Group (70%) and State Bank of India (20%).

- Gross Assets Under Management (AUM) of ₹16,926 crore as of December 2024, with a target to reach ₹25,000 crore by 2030.

- Cumulative recoveries to acquisitions ratio improved to 72% in FY2024, indicating effective asset resolution.

- Healthy capitalization with a net worth of ₹2,663 crore and low gearing of 0.1 times as of December 2024.

- Operational support from Avenue Capital Group enhances strategic capabilities.

- Plans to expand into the retail segment, diversifying the asset base and reducing risk concentration.

- Strong pan-India presence with over 200 collection agents, facilitating efficient asset recovery.

- Adoption of co-investment models to mitigate risk and enhance returns.

Risks and Threats

- Vulnerability to regulatory changes impacting asset acquisition and recovery processes.

- Dependence on the performance of Security Receipts (SRs), which can be volatile.

- High exposure to distressed real estate accounts, constituting 30-35% of AUM.

- Limited supply of stressed corporate assets due to improved banking sector health.

- Potential challenges in maintaining profitability amid fluctuating recovery ratings.

- Increased competition from other ARCs and financial institutions.

- Economic downturns could lead to higher default rates, impacting asset quality.

- Prolonged resolution timelines in complex corporate cases may affect cash flow predictability.

- Potential conflicts of interest in co-investment arrangements

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Asset Reconstruction Company (India) Limited

Asset Reconstruction Company (India) Limited IPO Strengths

- Pioneering Market Position with Strong AUM

ARCIL is India’s first ARC, incorporated in 2002, and holds the second-largest AUM (₹152,300.31 million as of March 31, 2024). It ranks among the top ARCs in profitability, net worth, and operational revenue. Its early entry provided deep regulatory expertise, enabling compliance with RBI norms, including the Net Owned Fund requirement, positioning it as a leader in stressed asset resolution.

- Disciplined Acquisition Strategy & Risk Management

ARCIL follows a structured credit assessment process, leveraging data analytics and proprietary tools for portfolio evaluation. Its diversified acquisitions (₹39,758.71 million in Fiscal 2025) and increasing SR investments (32.23% in Fiscal 2025) reflect a disciplined, risk-aware approach. Strong relationships with banks and financial institutions enhance its ability to source and structure deals efficiently.

- Robust Resolution & Collections Framework

ARCIL employs multiple resolution strategies, including IBC, settlements, and restructuring, supported by specialized teams for corporate, SME, and retail loans. Its digital collections platform, extensive agent network, and collaborations with third-party agencies ensure high recovery rates. The cumulative SR redemption ratio stood at 51.79% as of March 31, 2025, demonstrating effective asset monetization.

- Consistent Financial Performance & Strong Balance Sheet

ARCIL maintains strong profitability (PAT of ₹3,053.41 million in Fiscal 2024) and operational efficiency, with high return ratios (11.48% ROA in Fiscal 2024). Its prudent financial management is reflected in a robust net worth (₹27,677.98 million standalone as of March 31, 2025) and low debt-to-equity ratio (0.06), ensuring long-term stability.

- Experienced Leadership & Marquee Investors

ARCIL’s board and management comprise industry veterans with expertise in banking and stressed assets. Promoters include Avenue Capital Group (69.73%) and State Bank of India (19.95%), providing strategic direction and credibility. The leadership’s deep domain knowledge drives innovation in acquisitions and resolutions, reinforcing ARCIL’s market leadership.

More About Asset Reconstruction Company (India) Limited

Asset Reconstruction Company (India) Limited (ARCIL) is a pioneering asset reconstruction company operating across India. The company specialises in acquiring stressed assets from banks and financial institutions and implementing resolution strategies through restructuring, enforcement of rights on underlying securities, and settlements, aimed at maximising recovery and optimising the value of such assets. Incorporated as India’s first ARC on August 29, 2003, under the SARFAESI Act, ARCIL completed its first acquisition of stressed assets in December 2003 and has operated successfully for over two decades.

Financial Performance

As of Fiscal 2024, ARCIL was the second most profitable ARC in India, reporting a standalone profit of ₹3,053.41 million. It also ranked as the second largest ARC in terms of assets under management (AUM) at ₹152,300.31 million and had the second largest net worth among private ARCs at ₹24,625.11 million. Total revenue from operations (excluding unrealised fair value changes) stood at ₹5,701.41 million.

Operations and Presence

ARCIL operates through 13 offices across 12 states, employing 193 personnel. The company collaborates with 201 registered valuers, 163 collection agents, and 950 empanelled lawyers. Its operations span three verticals: Corporate Loans, SME & Other Loans, and Retail Loans. The retail segment has grown significantly, with AUM rising from ₹15,591.07 million in 2023 to ₹27,478.80 million in 2025, reflecting a CAGR of 20.79%.

Strategic Advantages

ARCIL benefits from its first-mover advantage and extensive experience navigating India’s regulatory landscape. The company maintains Net Owned Funds exceeding regulatory requirements, allowing it to act as a ‘resolution applicant’ under the Insolvency and Bankruptcy Code (IBC). ARCIL acquires stressed assets via multiple deal structures, including cash acquisitions, co-investor acquisitions, ordinary security receipts, and structured acquisitions. These strategies generate both fee income and investment income.

Technology and Expertise

The company leverages proprietary technology platforms for asset tracking, case management, and compliance monitoring. These tools assist in due diligence, asset valuation, recovery probability assessment, and litigation management.

Promoters and Management

ARCIL is promoted by Avenue India Resurgence Pte. Ltd (affiliate of Avenue Capital Group) and the State Bank of India. The management team, led by CEO and MD Pallav Mohapatra, brings decades of expertise in banking and stressed asset management.

Industry Outlook

Industry Growth Prospects

- Acquisition Surge: In FY25, ARCs acquired ₹16.1 lakh crore worth of bad loans, a 60% increase from the previous year, driven by the transfer of legacy assets from the Stressed Assets Stabilisation Fund (SASF).

- AUM Trends: The assets under management (AUM) of ARCs, measured through outstanding security receipts (SRs), are projected to decline by 4-6% to approximately ₹1.05 lakh crore in FY26, following a 15% drop in FY25.

Growth Drivers

- Regulatory Support: The Reserve Bank of India (RBI) has mandated that ARCs achieve a net worth of ₹300 crore by March 2026, encouraging consolidation and capital infusion.

- Market Evolution: ARCs are evolving into resolution managers, focusing on restructuring and turnaround strategies rather than merely acquiring distressed assets.

Strategic Shifts

- Diversification: With the shrinking pool of non-performing assets (NPAs), ARCs are exploring alternative avenues such as retail loan portfolios and co-investment models to sustain growth.

- Technology Integration: The adoption of advanced analytics and digital platforms is enhancing ARCs’ capabilities in asset management and recovery processes.

Company-Specific Outlook: Asset Reconstruction Company (India) Limited (ARCIL)

- Retail Loan Focus: ARCIL has strategically increased its retail loan portfolio, with assets under management growing from ₹1,559.1 crore in FY23 to ₹2,747.9 crore in FY25, reflecting a compound annual growth rate (CAGR) of 20.79%.

- Financial Performance: In FY2024, ARCIL reported a profit after tax (PAT) of ₹304 crore, with a gross balance sheet size of ₹2,872 crore and AUM of ₹15,230 crore.

How Will Asset Reconstruction Company (India) Limited Benefit

- ARCIL can capitalise on the growing stressed asset market in India, increasing its portfolio and revenue streams.

- The company’s strong focus on retail loans allows it to tap into a high-growth segment with rising stress levels.

- Regulatory support and compliance with RBI’s net worth requirements position ARCIL to act as a resolution applicant under the IBC, expanding acquisition opportunities.

- Diversification across corporate, SME, and retail segments mitigates risks and enhances portfolio stability.

- Technology-driven processes improve asset tracking, recovery efficiency, and due diligence, boosting operational effectiveness.

- ARCIL’s first-mover advantage and established relationships with banks and financial institutions enable preferential access to high-value stressed assets.

- Co-investment and structured acquisition models provide both fee income and investment income, optimising returns.

- The company’s experienced management and professional team strengthen its capacity to manage complex resolutions and maximise recoveries.

- Expansion of AUM in retail and non-corporate segments enhances long-term growth potential and market positioning

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Asset Reconstruction Company (India) Limited

Increasing Retail and SME Loans

Asset Reconstruction Company (India) Limited intends to grow its portfolio of retail, small, and medium enterprise (SME) loans. The company has increased its assets under management in these segments and believes its robust collection infrastructure and technology platform position it to capitalize on market growth.

Expanding the Corporate Loans Business

The company will continue expanding its corporate loans business by acquiring stressed assets, focusing on credit-worthy mid-sized companies and commercial real estate. Asset Reconstruction Company (India) Limited leverages its expertise and strategic partnerships to identify and resolve these high-potential assets.

Leveraging Technology and Data Analytics

The company continues to enhance its operational efficiency through technology and data analytics. It uses proprietary platforms and data-driven tools for portfolio acquisition, risk assessment, and collections, which allows it to scale its operations without a proportionate increase in costs.

Strengthening Retail Loan Collection

The company is strengthening its collection capabilities for retail loans through a robust infrastructure combining in-house managers and external agencies. It leverages technology like geo-tracking, heat maps, and AI models to optimize recovery strategies and accelerate the resolution of stressed assets.

Pursuing New Business Opportunities

The company is actively pursuing new opportunities by offering collection services to banks for a fee and acquiring stressed assets from Microfinance Institutions (MFIs). This strategy allows it to unlock new revenue streams and capitalize on a growing demand for micro-lending in India.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Asset Reconstruction Company (India) Limited IPO

How can I apply for Asset Reconstruction Company (India) Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What type of IPO is ARCIL offering?

ARCIL IPO is a Book Building Offer for Sale, with up to 10.55 crore shares offered by existing shareholders.

When will ARCIL’s shares be listed?

The IPO proposes listing on NSE and BSE; specific IPO and listing dates are yet to be announced.

Who are the promoters of ARCIL?

Avenue India Resurgence Pte Ltd and the State Bank of India are the company’s promoters.

What is the face value and price band of the IPO?

The face value is ₹10 per share; the final price band and lot size will be announced later.

What are the objectives of the IPO?

The IPO aims to enable listing of equity shares on stock exchanges, providing liquidity to selling shareholders.