- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Associated Power Structures IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Associated Power Structures IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Associated Power Structures Limited

Incorporated in 1996, Associated Power Structures Ltd. is an integrated manufacturing and EPC company specializing in designing and producing lattice structures for power transmission, distribution, renewable energy, and telecommunications. Its operations span three verticals: power transmission and distribution, renewable energy, and others, including telecom towers and steel fabrication. The company executes turnkey projects, handling up to 800kV transmission and 400kV substations. With 117 executed projects and experience in challenging regions like Rwanda and the DRC, it operates two manufacturing facilities in Vadodara, serving both government and private clients such as Suzlon Energy and LS Cable & System.

Associated Power Structures Limited IPO Overview

Associated Power Structures Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 27, 2025, aiming to raise funds through an Initial Public Offering (IPO). The company plans a Book Building Issue, which includes a fresh issue worth ₹400.00 crore along with an Offer for Sale (OFS) of up to 0.71 crore equity shares. The equity shares are proposed to be listed on both the NSE and BSE. While the book running lead manager is yet to be appointed, MUFG Intime India Pvt. Ltd. will act as the registrar of the issue. Key details such as IPO dates, price bands, and lot size are yet to be announced.

The IPO will have a face value of ₹2 per share and will follow a fresh capital-cum-offer for sale structure. The fresh issue will comprise shares aggregating up to ₹400.00 crore, while the OFS will include 71,42,860 shares of ₹2 each. Associated Power Structures Ltd.’s pre-issue shareholding consists of 5,00,00,000 shares, with promoters Ajay Mukund Patel, Parag Kothari, and Satish Desai holding 100% of the shares. The post-issue promoter holding will be updated following the completion of the IPO.

Associated Power Structures Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹400 crore |

| Offer for Sale (OFS) | 0.71 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,00,00,000 shares |

| Shareholding post-issue | TBA |

Associated Power Structures IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Associated Power Structures Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Associated Power Structures Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹12.66 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 20.67% |

| Net Asset Value (NAV) | ₹67.91 |

| Return on Equity (RoE) | 20.67% |

| Return on Capital Employed (RoCE) | 22.20% |

| EBITDA Margin | 9.69% |

| PAT Margin | 5.20% |

| Debt to Equity Ratio | 0.40 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by our Company | 3200 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

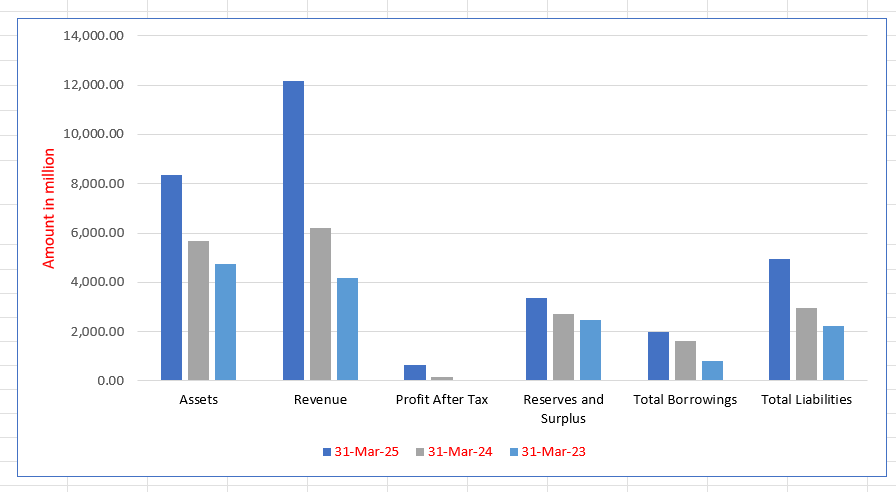

Associated Power Structures Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 8,341.53 | 5,693.50 | 4,737.24 |

| Revenue | 12,169.12 | 6,197.65 | 4,167.99 |

| Profit After Tax | 632.92 | 144.67 | 52.73 |

| Reserves and Surplus | 3,370.35 | 2,702.70 | 2,478.71 |

| Total Borrowings | 1,988.93 | 1,629.61 | 805.29 |

| Total Liabilities | 4,946.18 | 2,965.80 | 2,233.53 |

Financial Status of Associated Power Structures Limited

SWOT Analysis of Associated Power Structures IPO

Strength and Opportunities

- Established execution track record in transmission and EPC projects.

- Healthy order book providing medium term revenue visibility.

- Broad sector presence (power transmission, renewables, telecom).

- Opportunity from growing renewables and transmission infrastructure in India and abroad.

- Strong manufacturing base with integrated facilities and approvals.

- Ability to execute highvoltage projects (up to 800 kV transmission).

- Potential for export and international projects (Africa etc.).

- Growing demand for telecom towers and renewable energy infrastructure.

- Capability to leverage fresh capital (via IPO) for expansion and diversification.

Risks and Threats

- High working capital intensity typical of EPC operations.

- Vulnerability to raw material cost fluctuations impacting margins.

- Customer concentration and tender based business may lead to unpredictability.

- Market competition and pricing pressure in tower manufacturing and EPC segments.

- Dependence on project execution timelines; delays can hit cash flows.

- Macroeconomic and regulatory risks (steel, import duties, approvals).

- Large receivables and retention money tie up reduce liquidity.

- Regulatory and environmental compliance risks in manufacturing and large projects.

- Global supply chain disruptions or steel price volatility could erode margins.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Associated Power Structures Limited

Associated Power Structures Limited IPO Strengths

Integrated Manufacturing and EPC

Associated Power Structures Limited is an integrated manufacturing and EPC company with a diversified presence spanning the power transmission and distribution, wind energy, solar, and telecommunications sectors. Their offerings cover the design, manufacturing, and supply of various lattice structures, combined with the installation and construction of power lines, substations, and specialized foundations.

Proven End-to-End Execution

The company demonstrates proven end-to-end project execution capabilities, successfully managing complex and specialized projects. Their in-house capabilities allow them to handle everything from design, engineering, and foundation construction to tower erection and line stringing. This comprehensive approach has established them as one of the fastest-growing integrated players in India.

Strong Financial Performance

Associated Power Structures Limited has a track record of strong and consistent financial performance, driven by profitable growth and a robust Order Book. From Fiscal 2023 to 2025, their Revenue from Operations grew significantly at a CAGR of 70.87%. As of July 31, 2025, the company had a substantial Order Book of ₹37,900.70 million, positioning them well for future revenue.

Long-Standing Customer Relationships

The company maintains long-standing relationships with a diverse range of marquee government and private sector customers. These enduring associations are a testament to their commitment to quality, timely delivery, and ability to meet strict technical specifications. Their reputation for reliable execution has earned them vendor approval with various state and central utility boards.

Customized Design Competencies

Associated Power Structures Limited possesses proven competencies to deliver customized design-led manufacturing solutions. Their dedicated in-house design and engineering team utilizes advanced software (like PLS-Tower and AutoCAD) to model and develop lattice structures for projects up to 800kV. This integrated capability allows them to provide customized, high-quality, and cost-competitive engineering solutions.

Experienced Leadership

The company is guided by experienced Promoters and a strong senior management team with over 29 years of industry experience in engineering, manufacturing, and project operations. Their collective expertise in technical, financial, and management domains, combined with an execution-driven culture, enables the company to effectively implement business strategies and capitalize on market opportunities.

More About Associated Power Structures Limited

Associated Power Structures Limited is an integrated manufacturing and engineering, procurement, and construction (EPC) company, specialising in the design and manufacture of lattice structures for power transmission, distribution, wind energy, solar energy, and telecommunications. The company executes turnkey projects encompassing the supply, installation, erection, and commissioning of transmission and distribution towers, lines, and substation structures. It has demonstrated capabilities to undertake projects up to 800kV in transmission and 400kV in substations, including specialised foundations such as pile and well foundations.

Business Verticals

Power Transmission and Distribution

- End-to-end turnkey solutions, including design, fabrication, galvanisation, supply, erection, and commissioning of towers and substations.

- Capable of handling voltage levels from 66kV to 800kV.

- As of July 31, 2025, supplied 390,958.82 MT of lattice structures and executed 117 projects, covering 10,461.74 CKM of transmission lines.

- Experience in challenging environments, including Kutch district, Gujarat, and international projects in Rwanda and the Democratic Republic of Congo.

Renewable Energy

- Designs and manufactures wind turbine lattice structures, solar module mounting structures, and associated accessories.

- Supplied 314,247.40 MT of wind turbine structures and 8,287.00 MT of solar mounting structures as of July 31, 2025.

Others

- Supplies lattice structures for telecommunication towers and undertakes fabrication and galvanising of lattice steel.

- Delivered 126,884.25 MT of telecom towers and 54,980.38 MT of other lattice structures by July 31, 2025.

Manufacturing and Technology

- Operates two strategically located facilities in Manglej and Bamangam, Gujarat, with a combined installed capacity of 108,000 MT per annum.

- Facilities equipped with fabrication and galvanising plants, CNC machines, and stringent quality and safety standards, including ISO 9001, ISO 14001, ISO 45001, and EN certifications.

Experience and Customer Base

- Over 29 years in lattice structure manufacturing and 15 years in EPC operations.

- Strong relationships with government bodies, state electricity boards, central utilities, and private players, including long-term customers in power, renewable energy, and telecom sectors.

Management

- Led by promoters Ajay Mukund Patel, Parag Kothari, and Satish Desai, each with over 29 years of sector experience.

- Supported by a professionally qualified senior management team skilled in manufacturing, project management, and finance, positioning the company to leverage future growth opportunities.

Industry Outlook

India’s power transmission and distribution (T&D) sector is poised for steady growth. The Indian T&D market generated revenues of about USD 27,765.9 million in 2024, and is projected to reach USD 37,608.5 million by 2030, representing a CAGR of around 5.2% for 202530. At the same time, the powergrids equipment market, which underpins towers, lines, and substations, was valued at USD 10.72 billion in 2024, and is expected to grow to USD 18.52 billion by 2033, at a CAGR of about 5.8%.

Key growth drivers include increasing electricity demand due to urbanisation and industrialisation, the push to integrate large renewable energy capacity, and government programmes for grid modernisation, crossregion transmission expansion, and evacuation of green power. Challenges remain in aging infrastructure, project delays, and cost pressures, but the scale of opportunity is significant.

Outlook for Relevant Products (Towers, Lines & Structures)

For the specific equipment that Associated Power Structures manufactures:

- The Indian power transmission equipment market was valued at USD 11.58 billion in 2024, and is expected to reach USD 21.83 billion by 2033, at a CAGR of 6.8%.

- The solar module mounting structures market in India is forecast to grow from USD 276.9 million in 2025 to USD 807.4 million by 2035, reflecting a CAGR of 11.3%.

- Demand for lattice steel towers is driven by long distance transmission needs (400kV800kV), and the segment is expected to grow at a CAGR above 6% in India

Growth Drivers Specific to This Segment

- India’s target of 500 GW of nonfossil capacity by 2030 creates strong demand for highvoltage transmission and lattice towers.

- Remote wind and solar farms require advanced tower structures and specialised foundations.

- Policy support and investments in grid strengthening, including smart grids and HVDC corridors, further amplify the demand for T&D infrastructure.

How Will Associated Power Structures Limited Benefit

- Increasing electricity demand and grid expansion in India will drive higher orders for transmission and distribution towers.

- The government’s renewable-energy targets, including 500 GW of non-fossil capacity by 2030, will boost demand for wind and solar lattice structures.

- Expansion of long-distance, high-voltage transmission lines (400kV–800kV) aligns with the company’s expertise in customised lattice towers.

- Turnkey EPC capabilities, including specialised foundations and substation structures, position the company to capture complex projects.

- Strategically located manufacturing facilities in Gujarat provide efficient supply-chain access to key domestic and port locations.

- Established international operations allow the company to tap into growing global demand for transmission infrastructure.

- Strong relationships with government utilities and private renewable-energy players support repeat business and long-term contracts.

- Advanced design and engineering capabilities enable customised solutions, increasing competitive advantage.

- Industry growth supports higher order volumes and revenue diversification across power, renewables, and telecom segments.

Peer Group Comparison

| Name of the Company | Face Value per Equity Share (₹) | P/E | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV per Equity Share (₹) |

| Associated Power Structures Limited | 2 | [●]^1 | 12.66 | 12.66 | 20.67 | 67.91 |

| Peer Group | ||||||

| Kalpataru Projects International Limited | 235.22 | 35.53 | 35.53 | 35.53 | 8.70 | 378.80 |

| KEC International Limited | 240.55 | 21.80 | 21.80 | 21.80 | 12.10 | 200.88 |

| Bajel Projects Limited | 160.46 | 1.34 | 1.33 | 1.33 | 2.51 | 57.63 |

| Skipper Limited | 39.18 | 13.86 | 13.85 | 13.85 | 12.50 | 105.64 |

| Transrail Lighting Limited | 30.00 | 25.72 | 25.56 | 25.56 | 21.63 | 140.11 |

| Vikran Engineering Limited | 24.26 | 4.35 | 4.35 | 4.35 | 16.63 | 25.49 |

Key Strategies for Associated Power Structures Limited

Capitalize on Market Growth

Associated Power Structures Limited will leverage its core competencies and integrated model to pursue opportunities in the growing power sector. By focusing on its capabilities in 765kV projects and moving towards 1,200kV power transmission, the company aims to capitalize on the substantial growth and investment expected in the Extra High Voltage (EHV) segment and transmission network expansion.

Strategic Capacity Expansion

The company plans a strategic capacity expansion to support its rapidly growing Order Book and increasing capacity utilization. This involves acquiring industrial land to develop a new facility, positioning them to meet future demand. Additionally, Associated Power Structures Limited aims to introduce in-house tower testing capabilities to enhance efficiency and project timelines.

Focus on Renewable Energy

Associated Power Structures Limited will sustain its focus on the high-growth renewable energy sector, continuing to manufacture lattice structures for wind turbines and solar mounting structures. By capitalizing on strong government backing and aggressive tendering, the company intends to cross-sell and upsell its products to its existing large customer base to secure a long-term competitive advantage.

Opportunistic International Expansion

The company aims for geographical diversification and risk mitigation through an opportunistic presence in international markets. Associated Power Structures Limited will leverage its “Star Export House” status and initial foothold in regions like Europe and Africa to bid for new projects, expanding its revenue base by tapping into global infrastructure development opportunities.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Associated Power Structures Limited IPO

How can I apply for Associated Power Structures Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the purpose of the Associated Power Structures IPO?

The IPO aims to raise funds through fresh issue and offer for sale for debt repayment and corporate purposes.

What is the issue size of the IPO?

The IPO consists of a fresh issue of ₹400 crore and an OFS of up to 0.71 crore shares.

On which stock exchanges will the shares be listed?

Associated Power Structures shares are proposed to be listed on the NSE and BSE.

Who are the promoters of the company?

Ajay Mukund Patel, Parag Kothari, and Satish Desai are the promoters, holding 100% pre-IPO.

How is the IPO structured for different investor categories?

QIBs may apply for up to 50%, retail investors for at least 35%, and NIIs at least 15% of the net offer.