- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Ather Energy IPO

₹13/46 shares

Minimum Investment

IPO Details

28 Apr 25

30 Apr 25

₹13

46

₹304 to ₹321

NSE, BSE

₹2 Cr

06 May 25

Ather Energy IPO Timeline

Bidding Start

28 Apr 25

Bidding Ends

30 Apr 25

Allotment Finalisation

02 May 25

Refund Initiation

05 May 25

Demat Transfer

05 May 25

Listing

06 May 25

Ather Energy Limited

Ather Energy Limited, founded in 2013, is an Indian electric two-wheeler company specialising in in-house design, development, and assembly of EVs, batteries, and software. It sold 109,577 E2Ws in FY24. As of December 2024, it had 265 experience centres in India and a presence in Nepal and Sri Lanka. Its ecosystem includes Ather Grid and Atherstack. Manufacturing happens at its Hosur facility. The company holds 303 trademarks, 201 designs, and 45 patents, and operates with 2,454 employees as of March 2024.

Ather Energy’s IPO, worth ₹2,980.76 crores, includes a fresh issue of ₹2,626 crores and an offer for sale of ₹354.76 crores. The IPO opens on April 28, 2025, and closes on April 30, with allotment expected on May 2 and listing on BSE and NSE on May 6. Priced between ₹304–₹321 per share, the minimum lot for retail investors is 46 shares. Investors are advised to bid at the cutoff price to avoid oversubscription. Link Intime is the registrar.

Ather Energy Limited IPO Details

| Particulars | Details |

| IPO Date | April 28, 2025 to April 30, 2025 |

| Listing Date | May 6, 2025 |

| Face Value | ₹1 per share |

| Issue Price Band | ₹304 to ₹321 per share |

| Lot Size | 46 Shares |

| Total Issue Size | 9,28,58,599 shares (aggregating up to ₹2,980.76 Cr) |

| Fresh Issue | 8,18,06,853 shares (aggregating up to ₹2,626.00 Cr) |

| Offer for Sale | 1,10,51,746 shares of ₹1 (aggregating up to ₹354.76 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE, BSE |

| Share Holding Pre Issue | 29,06,43,469 shares |

| Share Holding Post Issue | 37,24,50,322 shares |

IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Net Issue |

| Retail | Not more than 10% of the Net Issue |

| NII (HNI) | Not more than 15% of the Net Issue |

Ather Energy Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 46 | ₹14,766 |

| Retail (Max) | 13 | 598 | ₹1,91,958 |

| S-HNI (Min) | 14 | 644 | ₹2,06,724 |

| S-HNI (Max) | 67 | 3,082 | ₹9,89,322 |

| B-HNI (Min) | 68 | 3,128 | ₹10,04,088 |

Ather Energy Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 52.67% |

| Post-Issue |

Ather Energy Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (47) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (194%) |

| Net Asset Value (NAV) | 24 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | (41.81%) |

| EBITDA Margin | (23%) |

| PAT Margin | (36.60%) |

| Debt to Equity Ratio | 0.97 |

Objectives of the Proceeds

- Capex for establishing an E2W factory in Maharashtra: ₹9,272 million

- Payment of certain borrowings: ₹3,782 million

- Investment in research and development: ₹7,500 million

- Expenditure on marketing initiatives: ₹3,000 million

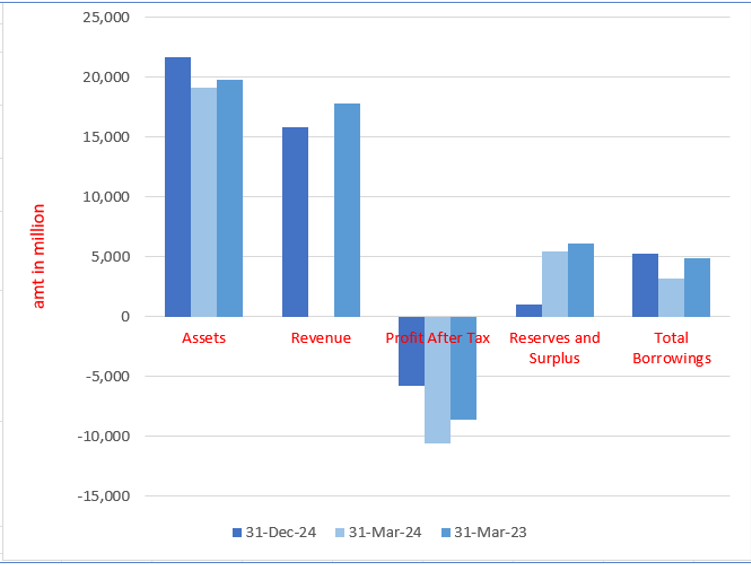

Key Financials (in ₹ million)

SWOT Analysis of Ather Energy IPO

Strength and Opportunities

- Strong R&D enables cutting-edge features like touchscreen dashboards and trip planners.

- Premium pricing supported by quality, attracting performance-focused customers.

- Expansion into performance and convenience scooters plus a motorcycle platform.

- Scaled manufacturing capacity boosts market readiness and cost efficiency.

- Increasing EV demand aligns with Ather’s urban-focused, innovative offerings.

- Government incentives like FAME II drive growth and expand market reach.

- Expansion into smaller towns taps new demand for eco-friendly mobility.

- Tech-driven features like mobile connectivity attract a young, urban customer base.

Risks and Threats

- Persistent negative cash flow due to high operational costs and investments.

- Heavy dependence on the Ather 450X model for sales and revenue.

- Narrow product portfolio limits appeal to diverse consumer needs.

- Reliance on key leadership creates risk if management changes occur.

- Uncertainty around government subsidies like EMPS could affect affordability.

- Intensifying competition from players like Ola Electric and Bajaj Chetak.

- Continued unprofitability raises concerns over financial sustainability.

- Heavy reliance on government policies increases vulnerability to regulatory shifts.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Ather Energy Limited IPO

IPO Strengths

- Ather aligns with the growing shift to eco-friendly mobility through innovative electric two-wheeler design and technology.

- Entering the market in 2018 with the Ather 450, the company quickly gained recognition for quality and sustainability.

- Strong in-house R&D across design, engineering, and software drives continuous innovation.

- The Ather 450 set new standards with India’s first E2W touchscreen dashboard, OTA updates, and high performance.

- Ather leads with fast charging, safety features like fall protection, and smart helmet development.

Peer Group Comparison

| Name of Company | Face Value (₹/Share) | Revenue

(₹ million) |

EPS Basic (₹) | P/E | RoNW (%) |

| Ather Energy | 1 | 17,538 | (47) | TBD | (194%) |

| Peer Groups | |||||

| Hero MotoCorp Limited | 2 | 377,886 | 187 | 20 | 21% |

| Bajaj Auto Limited | 10 | 448,704 | 273 | 29 | 29% |

| Ola Electric Mobility Limited | 10 | 50,098 | (4) | NA | (78%) |

| TVS Motors Limited | 1 | 391,447 | 36 | 68 | 26% |

| Eicher Motors Limited | 1 | 165,358 | 146 | 37 | 22% |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App