- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Atlanta Electricals IPO

₹13,642/19 shares

Minimum Investment

IPO Details

22 Sep 25

24 Sep 25

₹13,642

19

₹718 to ₹754

NSE, BSE

₹687.34 Cr

29 Sep 25

Atlanta Electricals IPO Timeline

Bidding Start

22 Sep 25

Bidding Ends

24 Sep 25

Allotment Finalisation

25 Sep 25

Refund Initiation

26 Sep 25

Demat Transfer

26 Sep 25

Listing

29 Sep 25

Atlanta Electricals Limited

Atlanta Electricals Limited, a three-decade-old organization, operates in the 220 kV Class Transformers sector. As a leading manufacturer of Power, Auto, and Inverter Duty Transformers, the company has an aggregate capacity of 16,740 MVA. It manages three advanced manufacturing facilities—two in Anand, Gujarat, and one in Bengaluru, Karnataka—spanning 3,21,451.39 sq ft. Adhering to ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 standards, its products meet IS and IEC specifications. With a diversified customer base of 208, key clients include Gujarat Energy Transmission Corporation Limited (GETCO), Adani Green Energy Limited, TATA Power, and SMS India.

Atlanta Electricals Limited IPO Overview

Atlanta Electricals is coming out with an IPO worth ₹687.34 crores through the book-building route. The offer includes a fresh issue of 0.53 crore shares amounting to ₹400 crores and an offer for sale of 0.38 crore shares worth ₹287.34 crores. The IPO will open for subscription on September 22, 2025, and close on September 24, 2025. The basis of allotment is likely to be finalised on September 25, 2025, with the shares scheduled to list on both BSE and NSE on September 29, 2025.

The price band has been fixed between ₹718 and ₹754 per share. The minimum application size is 19 shares, requiring a retail investment of ₹14,326 at the upper price. For non-institutional investors, the minimum is 14 lots (266 shares) costing ₹2,00,564 for small NII and 70 lots (1,330 shares) costing ₹10,02,820 for big NII. Motilal Oswal Investment Advisors Ltd. is the lead manager of the issue, while MUFG Intime India Pvt. Ltd. is acting as the registrar. Investors are advised to check the RHP of Atlanta Electricals IPO for detailed information.

Atlanta Electricals Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 53,05,039 shares (aggregating up to ₹400.00 Cr)

Offer for Sale (OFS): 38,10,895 shares of ₹2 (aggregating up to ₹287.34 Cr) |

| IPO Dates | TBA |

| Price Bands | ₹718 to ₹754 per share |

| Lot Size | 19 shares |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 7,15,84,800 shares |

| Shareholding post -issue | 7,68,89,839 shares |

Atlanta Electricals IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 19 | ₹14,326 |

| Retail (Max) | 13 | 247 | ₹1,86,238 |

| S-HNI (Min) | 14 | 266 | ₹2,00,564 |

| S-HNI (Max) | 69 | 1,311 | ₹9,88,494 |

| B-HNI (Min) | 70 | 1,330 | ₹10,02,820 |

Atlanta Electricals Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Atlanta Electricals Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 8.87 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.80% |

| Net Asset Value (NAV) | 31.92 |

| Return on Equity | 27.80% |

| Return on Capital Employed (ROCE) | 42.34% |

| EBITDA Margin | 14.20% |

| PAT Margin | 7.32% |

| Debt to Equity Ratio | 0.31 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Re-payment/ pre-payment, in full or in part, of certain outstanding borrowings availed by our Company | 791.20 |

| Funding working capital requirements of our Company | 2100 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

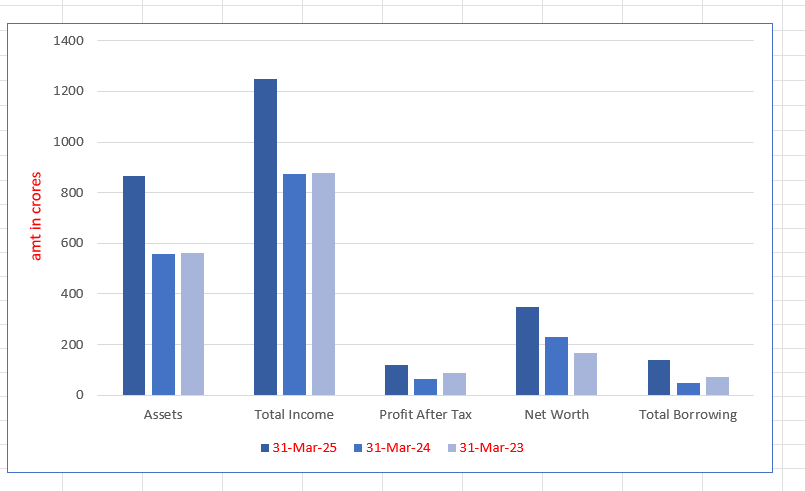

Atlanta Electricals Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 866.19 | 559.25 | 560.76 |

| Total Income | 1,250.49 | 872.05 | 876.66 |

| Profit After Tax | 118.65 | 63.36 | 87.54 |

| Net Worth | 349.90 | 228.47 | 164.90 |

| Total Borrowing | 141.03 | 48.60 | 73.09 |

Financial Status of Atlanta Electricals Limited

SWOT Analysis of Atlanta Electricals IPO

Strength and Opportunities

- Over 30 years of experience in transformer manufacturing.

- Three fully functional manufacturing facilities in Anand, Gujarat, and Bengaluru, Karnataka.

- Aggregate production capacity of 16,740 MVA per annum.

- ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certified facilities.

- NABL-accredited test labs for IS and IEC standard compliance.

- Diversified customer base, including major companies like GETCO, Adani Green, and TATA Power.

- Growing demand for power transformers due to rising infrastructure and renewable energy projects.

- Expansion opportunities in international markets through exports.

- Government initiatives promoting electrification and grid modernization.

- Technological advancements enabling product innovation and efficiency improvements.

Risks and Threats

- High working capital requirements due to the nature of operations.

- Intense competition in a fragmented transformer manufacturing industry.

- Dependency on a limited number of key customers for significant revenue.

- Susceptibility to risks related to tender-based business.

- Fluctuations in raw material prices affecting profitability.

- Regulatory delays in project approvals impacting timelines.

- Economic downturns affecting capital expenditure in the power sector.

- Foreign exchange risks impacting export profitability.

- Challenges in maintaining a skilled workforce amid industry competition.

- Potential supply chain disruptions affecting timely project execution.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Atlanta Electricals Limited IPO

Atlanta Electricals Limited IPO Strengths

- Leading Transformer Manufacturer in India

Atlanta Electricals Limited is a leading manufacturer of power, auto, and inverter duty transformers in India. With over 30 years of experience, it has expanded across 19 states and three union territories, ensuring high-quality solutions through innovation, stringent quality standards, and a strong market presence.

- Broad and Diversified Product Portfolio

Atlanta Electricals Limited offers a diverse product portfolio tailored to meet customer requirements. As of September 30, 2024, the portfolio includes power, auto, inverter duty, furnace, generator, and special duty transformers. The company specializes in customized solutions, catering to challenging operational environments while ensuring innovation, quality, and comprehensive after-sales support.

- Strong Order Book and Diversified Customer Base

Atlanta Electricals Limited has a robust order book and a well-diversified customer base. As of September 30, 2024, it has relationships with 208 customers, including 21 public sector undertakings and 187 private sector players. The company’s order book reached ₹12,833.21 million, supported by strong demand across transmission, renewables, and infrastructure sectors.

- Advanced Manufacturing Capabilities with Emphasis on Quality and Compliance

Atlanta Electricals Limited operates three advanced manufacturing facilities with an upcoming unit in Gujarat. With 35 winding machines, NABL-accredited labs, and an installed capacity of 16,740 MVA, the company ensures precision, compliance, and ISO-certified quality. Rigorous testing and strict process controls uphold industry standards and operational excellence.

- Experienced Leadership and Skilled Professionals

Atlanta Electricals Limited is led by a seasoned management team with decades of expertise. Key leaders, including Mr. Krupeshbhai Patel and Mr. Tanmay Patel, bring extensive experience in transformers and electrical manufacturing. Supported by 301 professionals, the team’s strategic vision drives operational excellence and business expansion.

- Strong Financial Performance and Market Leadership

With a proven track record of profitability, Atlanta Electricals Limited reported ₹5,701.41 million in revenue for the six-month period ending September 30, 2024. Maintaining a disciplined financial approach with a 0.31 debt-to-equity ratio, the company ensures stability, operational efficiency, and sustained growth in a competitive industry.

More About Atlanta Electricals Limited

Industry Leadership

- Atlanta Electricals Limited is a key player in India’s power, auto, and inverter duty transformer manufacturing sector.

- Among the few companies producing transformers up to 200 MVA capacity and 220 kV voltage (Source: CRISIL Report).

- Rapid revenue growth from ₹ 6,256.62 million in Fiscal 2022 to ₹ 8,675.53 million in Fiscal 2024 at a CAGR of 38.66%.

Growing Market Demand

- Expansion in data centres, EV charging networks, and high-speed railways is driving transformer demand.

- India’s renewable energy sector targets 500 GW non-fossil fuel capacity by 2030, increasing demand for compact and robust transformers.

- Successfully supplied eight 80 MVA, 220/33 kV power transformers for Ultra Mega Solar Park, Andhra Pradesh.

Comprehensive Product Portfolio

Atlanta Electricals Limited manufactures a wide range of transformers:

- Auto Transformer: 66 kV to 220 kV

- Inverter Duty Transformer: 0.60 kV to 33 kV

- Furnace Transformer: 0.43 kV to 66 kV

- Power Transformer: 11 kV to 220 kV

- Generator Transformer: 3.30 kV to 220 kV

- Special Duty Transformer: 0.43 kV to 132 kV

Strong Market Presence

- Customer base across 19 states and three union territories.

- Supplied 4,000 transformers totaling 78,000 MVA to national grids and private sectors.

- Order book valued at ₹ 12,833.21 million as of September 30, 2024.

Manufacturing Excellence

- Three operational facilities in Anand (Gujarat) and Bengaluru (Karnataka), with a new facility under construction in Vadod, Gujarat.

- Combined capacity of 47,280 MVA across all four facilities.

- NABL-accredited labs ensuring quality control with ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certifications.

Established Industry Relationships

- Strong collaborations with key players like GETCO, Adani Green Energy, TATA Power, and SMS India.

- Diversified customer base of 208 companies, reinforcing its position as a trusted transformer supplier in India.

Industry Outlook

Market Growth and CAGR

- The Indian power transformer market was valued at approximately USD 2.13 billion in 2023 and is projected to reach USD 4.12 billion by 2032, exhibiting a CAGR of 7.20% during 2024-2032.

- The combined power and distribution transformer market in India is expected to grow at a CAGR of around 10.84% between 2024 and 2030, with market size increasing from USD 3.97 billion in 2023 to approximately USD 8.41 billion by 2030.

Key Growth Drivers

- Infrastructure Development: Rapid urbanization and industrialization necessitate the expansion and modernization of power transmission and distribution networks.

- Renewable Energy Integration: The incorporation of renewable energy sources, such as solar and wind power, into the national grid requires advanced transformer technologies to manage variable power loads.

- Government Initiatives: Programs like the Integrated Power Development Scheme (IPDS) and increased budgets for renewable energy projects are propelling demand for transformers.

- Grid Modernization: Efforts to upgrade aging power infrastructure to enhance efficiency and reliability are driving the need for new transformers.

Future Outlook

The Indian transformer market is set for robust growth, driven by increasing electricity demand, supportive government policies, and the integration of renewable energy sources. Companies like Atlanta Electricals Limited are well-positioned to capitalize on these opportunities by providing essential components for the evolving power sector.

How Will Atlanta Electricals Limited Benefit

- Industry Leadership: Atlanta Electricals Limited, a leader in high-capacity transformers, will capitalize on India’s expanding power sector with its expertise in manufacturing transformers up to 200 MVA and 220 kV.

- Growing Market Demand: With India’s push for 500 GW renewable capacity and the rise of EV charging and data centres, Atlanta’s transformers will be essential for meeting increasing power infrastructure needs.

- Comprehensive Product Portfolio: Its diverse transformer offerings, including auto, inverter duty, and furnace transformers, position Atlanta to cater to a broad range of industrial and power sector applications.

- Strong Market Presence: Operating across 19 states and three union territories, Atlanta has supplied 4,000 transformers totaling 78,000 MVA, ensuring steady demand and reinforcing its nationwide footprint.

- Manufacturing Excellence: With facilities in Anand, Bengaluru, and Vadod, and a combined capacity of 47,280 MVA, Atlanta ensures high-quality, large-scale production to meet growing market requirements.

- Established Industry Relationships: Collaborations with industry leaders like GETCO, Adani, and TATA Power provide Atlanta with a competitive edge, securing consistent orders and enhancing its market credibility.

Atlanta Electricals Limited IPO Overview

Atlanta Electricals Ltd, a Gujarat-based transformer manufacturer, has filed IPO papers with SEBI to raise funds. The IPO includes a fresh issue of ₹400 crore and an offer for sale of 0.38 crore shares by promoters and other stakeholders. The issue features a reservation for eligible employees. Motilal Oswal Investment Advisors Ltd and Axis Capital Ltd are the book-running lead managers, while Link Intime India Pvt Ltd is the registrar. The shares have a face value of ₹2 each.

Atlanta Electricals Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹400 crore

Offer for Sale (OFS): 0.38 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Atlanta Electricals IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | TBA |

| IPO Close Date | TBA |

| Basis of Allotment Date | TBA |

| Refunds Initiation | TBA |

| Credit of Shares to Demat | TBA |

| IPO Listing Date | TBA |

Atlanta Electricals IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Atlanta Electricals Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 8.87 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.80% |

| Net Asset Value (NAV) | 31.92 |

| Return on Equity | 27.80% |

| Return on Capital Employed (ROCE) | 42.34% |

| EBITDA Margin | 14.20% |

| PAT Margin | 7.32% |

| Debt to Equity Ratio | 0.31 |

Peer Group Comparison

| Name of the Company | Revenue

(₹ million) |

Face Value (₹) | P/E | EPS (₹) | RoNW (%) | NAV (₹) |

| Atlanta Electricals Limited | 8,675.53 | 2.00 | NA | 8.87 | 27.80% | 31.92 |

| Peer Groups | ||||||

| Voltamp Transformers Limited | 16,162.23 | 10.00 | 27.51 | 303.80 | 22.71% | 1,337.94 |

| Transformers and Rectifiers India Ltd | 12,946.76 | 1.00 | 274.26 | 3.24 | 8.48% | 38.89 |

| Danish Power Limited | 3,324.76 | 10.00 | 34.16 | 26.04 | 46.36% | 510.36 |

Key Insights

- Revenue: Atlanta Electricals Limited reported revenue of ₹8,675.53 million, positioning it between Transformers and Rectifiers India Ltd (₹12,946.76 million) and Danish Power Limited (₹3,324.6 million). Voltamp Transformers Limited leads the group with ₹16,162.23 million in revenue. This indicates that Atlanta Electricals is a mid-sized player, with strong revenue generation but still growing compared to Voltamp. The company’s revenue performance suggests a solid market presence and growth potential.

- Face Value: Atlanta Electricals Limited has a face value of ₹2.00, lower than Voltamp (₹10.00) and Danish Power (₹10.00), but higher than Transformers and Rectifiers India Ltd (₹1.00). Face value does not impact stock price directly but affects stock splits and investor perception. A lower face value often allows for easier liquidity and accessibility for investors, making Atlanta’s offering more attractive in certain market conditions.

- Price-to-Earnings (P/E) Ratio: The P/E ratio for Atlanta Electricals Limited is unavailable (NA), while its peers vary significantly. Transformers and Rectifiers India Ltd has the highest P/E at 274.26, followed by Danish Power Limited at 34.16, and Voltamp Transformers at 27.51. A high P/E suggests premium valuation, possibly due to high growth expectations or strong investor confidence. Atlanta’s future P/E will be crucial in determining its market positioning post-IPO.

- Earnings Per Share: Atlanta Electricals Limited has an EPS of ₹8.87, which is higher than Transformers and Rectifiers India Ltd (₹3.24) but significantly lower than Danish Power Limited (₹26.04) and Voltamp Transformers (₹303.80). A higher EPS generally indicates better profitability per share. Atlanta’s EPS suggests strong earnings potential but is still developing compared to Voltamp’s well-established earnings performance.

- Return on Net Worth: Atlanta Electricals Limited has an RoNW of 27.80%, higher than Voltamp (22.71%) and Transformers and Rectifiers India Ltd (8.48%), but lower than Danish Power Limited (46.36%). RoNW indicates how efficiently a company is utilizing its net worth to generate profits. Atlanta’s strong RoNW suggests efficient capital utilization, making it a competitive player in the industry.

- Net Asset Value: Atlanta Electricals Limited has a NAV of ₹31.92, lower than Voltamp (₹1,337.94) and Danish Power Limited (₹510.36), but close to Transformers and Rectifiers India Ltd (₹38.89). NAV represents the company’s book value per share, with higher values indicating stronger financial stability. Atlanta’s NAV suggests a growing asset base, but it is still developing compared to its larger peers like Voltamp.

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Re-payment/ pre-payment, in full or in part, of certain outstanding borrowings availed by our Company | 791.20 |

| Funding working capital requirements of our Company | 2100 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Atlanta Electricals Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 6725.30 | 5592.51 | 5607.60 | 4145.83 |

| Revenue | 5701.41 | 8675.53 | 8738.83 | 6256.62 |

| Profit After Tax | 512.78 | 633.62 | 875.41 | 552.54 |

| Reserves and Surplus | 2690.77 | 2141.55 | 1505.78 | 633.80 |

| Total Borrowings | 881.35 | 485.96 | 730.93 | 758.90 |

| Total Liabilities | 3891.36 | 3307.79 | 3958.65 | 3368.86 |

Key Strategies for Atlanta Electricals Limited

- Capital Expenditure for Capacity Expansion and Backward Integration

Atlanta Electricals Limited is investing in capital expenditure to expand capacity and enhance backward integration by manufacturing key transformer components. This approach optimizes costs, improves production efficiency, strengthens supply chains, and increases operational control to enhance competitiveness and profitability.

- Expanding Global Customer Base and Increasing Wallet Share

Atlanta Electricals Limited aims to expand its global footprint by targeting emerging markets, entering high-voltage segments, and leveraging strategic partnerships. By offering innovative transformer solutions and enhancing after-sales support, the company seeks to strengthen customer relationships and increase wallet share.

- Increasing Market Share Through Enhanced Utilization Levels

Atlanta Electricals Limited is optimizing capacity utilization by improving operational efficiency, increasing production volumes, and leveraging digital tools. Through strategic expansions and financial discipline, the company aims to reduce costs, enhance product quality, and capture a larger share of the transformer market.

- Strengthening Brand Presence with Targeted Marketing Initiatives

Atlanta Electricals Limited is enhancing brand visibility through multi-channel marketing, direct customer engagement, and promotional activities. By reinforcing its reputation for innovation and reliability, the company aims to differentiate itself from competitors and establish itself as a leader in the transformer industry.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Atlanta Electricals IPO

What is the structure of the Atlanta Electricals IPO?

The IPO includes a fresh issue of ₹400 crore and an offer-for-sale ₹287.34 crore

Who are the promoters of Atlanta Electricals Limited?

The company’s promoters are KrupeshbhaiNarharibhai Patel, Niral Patel, Amish Patel, and associated family trusts.

What is the face value of shares in the Atlanta Electricals IPO?

The face value of each equity share is ₹2.00.

What are the primary objectives of the Atlanta Electricals IPO?

The IPO aims to raise funds for operational support and repayment of existing borrowings.

Has Atlanta Electricals Limited filed official documents for the IPO?

Yes, the company has submitted the Draft Red Herring Prospectus (DRHP) to SEBI for approval.