- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Augmont Enterprises IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Augmont Enterprises IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Augmont Enterprises Limited

Augmont Enterprises Limited is a prominent integrated player in India’s precious metals industry, primarily focused on gold and silver. Incorporated in 2012, the company operates across the entire value chain, including refining, minting, bullion trading, and selling in both physical and digital formats. It serves businesses and retail consumers through its technology-driven platforms, ‘Augmont SPOT’ for enterprise sales and ‘Augmont Gold For All’ for consumer-focused offerings. With a pan-India presence, a trusted brand, and a strong emphasis on quality and transparency, Augmont has established itself as a key participant in the bullion and gold investment ecosystem.

Augmont Enterprises Limited IPO Overview

Augmont Enterprises Limited has filed its Draft Red Herring Prospectus (DRHP) with SEBI to raise funds through an initial public offering (IPO). The IPO is a combination of a fresh issue and an offer for sale (OFS), aggregating up to ₹800.00 crores. The fresh issue component aims to raise ₹620.00 crores, while the OFS comprises shares worth ₹180.00 crores. The company plans to utilise the net proceeds from the fresh issue to fund its working capital requirements for inventory procurement and for general corporate purposes. The equity shares are proposed to be listed on both the BSE and NSE. This move is expected to enhance Augmont’s visibility, provide growth capital, and offer a public market for its shares.

Augmont Enterprises Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | [●] shares (aggregating up to ₹800.00 Cr) |

| Fresh Issue | [●] shares (aggregating up to ₹620.00 Cr) |

| Offer for Sale (OFS) | [●] shares (aggregating up to ₹180.00 Cr) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 93.38% (Promoters) |

| Shareholding post-issue | TBA |

Augmont Enterprises IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Augmont Enterprises Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

Augmont Enterprises Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.31 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 69.47% |

| Net Asset Value (NAV) | ₹52.21 |

| Return on Equity (RoE) | 74.19% |

| Return on Capital Employed (RoCE) | 70.10% |

| EBITDA Margin | 0.46% |

| PAT Margin | 0.34% |

| Debt to Equity Ratio | 0.05 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are proposed to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding future working capital requirements towards procurement, maintenance and scaling up of inventory and funding advance margin requirements for procurement of inventory by our Company | 4,650.00 |

| General corporate purposes* | [●] |

*Note: To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC.

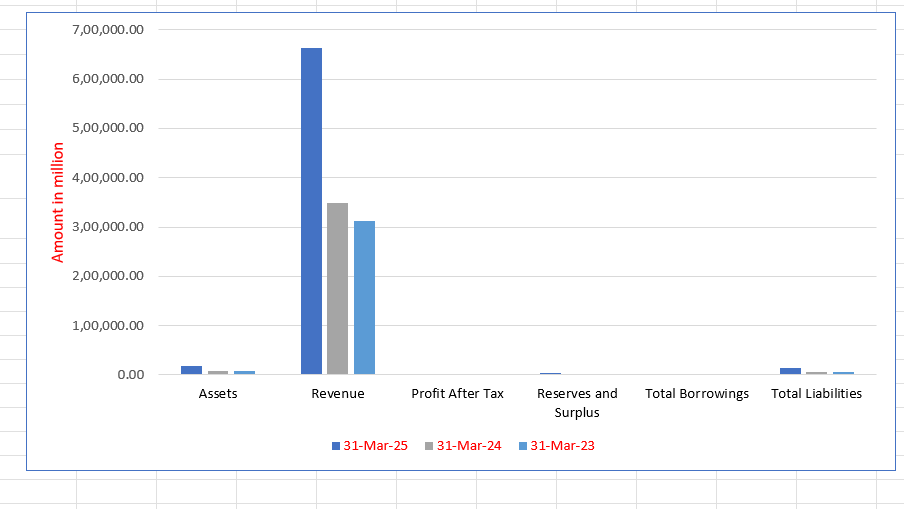

Augmont Enterprises Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 18,594.79 | 7,602.93 | 7,923.67 |

| Revenue | 662,307.79 | 349,214.93 | 312,893.11 |

| Profit After Tax | 2,271.88 | 759.66 | 436.87 |

| Reserves and Surplus | 3,984.58 | 1,803.86 | 1,057.56 |

| Total Borrowings | 215.43 | 548.64 | 1,928.87 |

| Total Liabilities | 14,448.12 | 5,730.85 | 6,812.32 |

Financial Status of Augmont Enterprises Limited

SWOT Analysis of Augmont Enterprises IPO

Strength and Opportunities

- Integrated business model across the precious metals value chain.

- Strong and trusted brand recognized with multiple industry awards.

- Efficient multi-source procurement system including dore bars.

- Extensive pan-India distribution and delivery network.

- Scalable, proprietary technology platforms for B2B and B2C sales.

- Consistent track record of strong financial performance.

- Experienced promoter and senior management team with deep industry knowledge.

- High entry barriers due to licenses, capital needs, and quality standards.

- Significant growth opportunity in the underpenetrated Indian gold market.

- Expansion potential in lab-grown diamonds and international markets.

Risks and Threats

- Reliance on the price volatility of gold and silver.

- Working capital intensive nature of the business.

- Intense competition in the bullion and jewellery market.

- Dependence on key management and promoter expertise.

- Regulatory risks associated with precious metals and import duties.

- Operational risks related to refining and inventory management.

- Potential global economic downturns affecting discretionary spending.

- Fluctuations in foreign exchange rates impacting import costs.

- Cybersecurity threats to its digital platforms and customer data.

- Any failure to maintain the quality and purity of its products.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Augmont Enterprises Limited

Augmont Enterprises Limited IPO Strengths

Integrated Precious Metals Platform

Augmont Enterprises Limited operates an integrated business model spanning the entire gold and silver value chain. Its operations include procurement, refining, bullion trading, digital offerings, and jewellery manufacturing. This vertical integration allows the company to capture synergies, control quality, and serve a diverse client base from large enterprises to retail consumers, creating a resilient and comprehensive business ecosystem.

Established and Trusted Brand

The ‘Augmont’ brand is associated with trust, quality, and reliability in the precious metals industry. The company’s products comply with stringent BIS and LBMA standards, providing assurance to customers. This strong brand recognition, validated by multiple awards from industry bodies, is a critical asset that alleviates consumer concerns about product authenticity and influences purchase decisions in a high-value market.

Efficient Procurement and Refining Operations

Augmont Enterprises Limited has established an efficient procurement system, sourcing from Indian and international banks, importing lower-duty doré bars, and acquiring scrap metal. Its two NABL-accredited refineries are certified under India Good Delivery standards, authorizing them to deliver bullion on major commodity exchanges. This robust supply chain ensures consistent quality, favorable pricing, and reliable product availability.

Scalable Technology Ecosystem

The company’s growth is powered by its proprietary, scalable technology platforms, ‘Augmont SPOT’ and ‘Augmont Gold For All’. Developed in-house, these platforms handle high transaction volumes, provide real-time price discovery, and offer a seamless user experience. This tech-enabled ecosystem enhances operational efficiency, supports business expansion, and allows for quick adaptation to market trends and customer needs.

Consistent and Profitable Financial Growth

Augmont Enterprises Limited has a demonstrated track record of strong financial performance. Between FY23 and FY25, its revenue grew at a CAGR of 45.49%, while its profit surged at a CAGR of 128.04%. This consistent and profitable growth, coupled with a sharp reduction in debt and high return ratios, underscores the company’s effective business model and prudent financial management.

More About Augmont Enterprises Limited

Augmont Enterprises Limited has positioned itself as a leading integrated platform for gold and silver in India. The company’s operations are strategically divided into two key verticals, each supported by a dedicated digital platform.

Business Verticals and Platforms

- Enterprise Sales (‘Augmont SPOT’): This B2B platform serves jewellers, bullion dealers, and manufacturers, offering transparent, real-time pricing and a robust price discovery mechanism. As of August 31, 2025, it had over 4,975 registered members. Orders are fulfilled through a network of 20 spot delivery centers across 13 states.

- Consumer-Focused Offerings (‘Augmont Gold For All’): This B2C platform enables individual customers to buy, sell, and store digital gold and silver, invest via SIPs, and purchase jewellery. The company has also partnered with over 180 third-party platforms and financial agents to expand its retail reach, serving over 42 million registered consumers.

Operational Infrastructure

The company’s strength is underpinned by its physical infrastructure:

- Refining: It operates two refining units in Rudrapur, Uttarakhand (144 MTPA capacity), and Mumbai, Maharashtra (140 MTPA capacity), both accredited by NABL and BIS.

- Manufacturing: It manufactures gold jewellery for international exports from its unit in the Sitapur SEZ, Jaipur.

- Procurement: Augmont diversifies its sourcing through domestic and international channels and has a subsidiary in GIFT City for direct import via the India International Bullion Exchange (IIBX).

Under the leadership of its experienced promoter, Ketan Bhawarlal Kothari, and a skilled management team, Augmont leverages its deep industry knowledge, technology, and extensive network to maintain its competitive edge and drive future growth.

Industry Outlook

The Indian precious metals industry is poised for significant growth, driven by deep-rooted cultural affinity, rising disposable incomes, and gold’s status as a secure investment.

Gold Market Overview

India is one of the world’s largest markets for gold, with demand consistently robust. The industry is becoming more organized and transparent, supported by government initiatives like the introduction of Hallmarking Unique Identification (HUID). The growth of digital gold platforms has further democratized access, allowing a new generation of investors to participate in the gold market easily.

Key Growth Drivers and Projections

- Market Size: The Indian lab-grown diamond jewellery retail market, though nascent, is projected to grow from ₹29.5 billion in Fiscal 2025 to ₹63.0 billion by Fiscal 2030, a CAGR of 16.4%.

- Organized Sector Growth: The shift from unorganized to organized players is accelerating, benefiting trusted brands like Augmont that offer quality assurance and transparent pricing.

- Digital Adoption: The increasing penetration of smartphones and internet services is fueling the adoption of digital gold and online bullion trading platforms.

- Investment Demand: In times of economic uncertainty, gold remains a preferred safe-haven asset, sustaining demand.

This positive industry outlook, characterized by formalization and digitalization, provides a strong tailwind for integrated and technology-enabled players like Augmont Enterprises Limited.

How Will Augmont Enterprises Limited Benefit

- Capital infusion will strengthen working capital, enabling larger inventory and better servicing of customer demand.

- Enhanced brand visibility and credibility from public listing will attract more business and retail customers.

- Funds will support the expansion of the delivery network into Tier 2, 3, and 4 cities, tapping into underserved markets.

- Listing provides a currency for future acquisitions, strategic partnerships, and employee incentivization through ESOPs.

- Financial flexibility to invest in advanced refining technology and expand into new growth areas like lab-grown diamonds.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Augmont Enterprises Limited

Expansion of Enterprise and International Sales

Augmont Enterprises Limited plans to expand its enterprise customer base, particularly in Tier 2-4 cities, by increasing its spot delivery network. It will also scale its international jewellery exports by operationalizing a new manufacturing unit and entering new geographies, leveraging its SEZ presence.

Diversification into Lab-Grown Diamonds

The company intends to capitalize on the growing lab-grown diamond market by facilitating its trading on the ‘Augmont SPOT’ platform. It will leverage its technology to provide AI-powered pricing tools and a seamless trading experience, tapping into this high-growth segment.

Scaling the Consumer Business

Augmont Enterprises Limited will deepen its retail penetration by expanding its network of asset-light ‘Gold-For-All’ centers in partnership with Finkurve. It will also enhance its platform with AI and data analytics to offer personalized customer experiences and drive higher engagement and retention.

Strengthening Core Operations

The strategy involves diversifying procurement sources, including scaling doré bar imports, and expanding refining capacity at existing units. Augmont aims to capture synergies between its refining and manufacturing operations to improve cost efficiency and supply chain resilience.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Augmont Enterprises Limited IPO

How can I apply for Augmont Enterprises Limited IPO?

You can apply via your broker’s platform using UPI-based ASBA (Application Supported by Blocked Amount).

What is the face value of Augmont Enterprises shares?

The face value of Augmont Enterprises Limited’s equity shares is ₹5 per share.

What is the total size of the Augmont Enterprises IPO?

The IPO aims to raise a total of ₹800.00 crores through a combination of fresh issue and offer for sale.

Where will Augmont Enterprises shares be listed?

The equity shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

What is the company's core business?

Augmont Enterprises is an integrated precious metals company engaged in gold and silver refining, trading, and digital offerings.