- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Aye Finance IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Aye Finance IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Aye Finance Limited IPO

Incorporated in 1993, Aye Finance Limited is an NBFC that provides secured and unsecured small business loans for working capital, including mortgage loans and ‘Saral’ Property Loans, primarily targeting micro-scale MSMEs. The company offers business loans secured by working assets or property to support expansion across manufacturing, trading, service, and allied agriculture sectors. Serving 508,224 active customers across 18 states and three union territories, it manages significant assets. Aye Finance operates a ‘phygital’ model, combining personalised service through 499 branches with advanced digital capabilities to reach customers nationwide as of September 30, 2024. Its offerings include Mortgage Loans, ‘Saral’ Property Loans, and both secured and unsecured Hypothecation Loans.

Aye Finance Limited IPO Overview

The Securities and Exchange Board of India (SEBI) approved the Initial Public Offering (IPO) of Aye Finance Ltd. on April 3, 2025. Following this approval, valid for 12 months, the company will move forward with the IPO launch, subject to market conditions and any other necessary approvals. The IPO will follow a book-building process, with the equity shares proposed for listing on both the NSE and BSE. Axis Capital Ltd. is appointed as the book running lead manager, and Kfin Technologies Ltd. will act as the registrar. Details such as IPO dates, price band, and lot size are yet to be announced. The IPO will include a fresh issue of shares aggregating up to ₹885 crore and an offer for sale of shares aggregating up to ₹565 crore, with each share having a face value of ₹2. The pre-issue shareholding stands at 19,17,41,570 shares. For further details, the Aye Finance IPO DRHP can be referred to, which was filed with SEBI on December 16, 2024, and received approval on April 3, 2025.

Aye Finance Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1450 crore |

| Fresh Issue | ₹885 crore |

| Offer for Sale (OFS) | ₹565 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 19,17,41,570 shares |

| Shareholding post-issue | TBA |

Aye Finance IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Aye Finance Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Aye Finance Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹10.62 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 17.22% |

| Net Asset Value (NAV) | ₹88.42 |

| Return on Equity (RoE) | 17.22% |

| Return on Capital Employed (RoCE) | 10.33% |

| EBITDA Margin | 20.82% |

| PAT Margin | 15.57% |

| Debt to Equity Ratio | 2.83 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Augmenting the capital base to meet the Company’s future capital requirements arising out of growth of the business and assets. | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

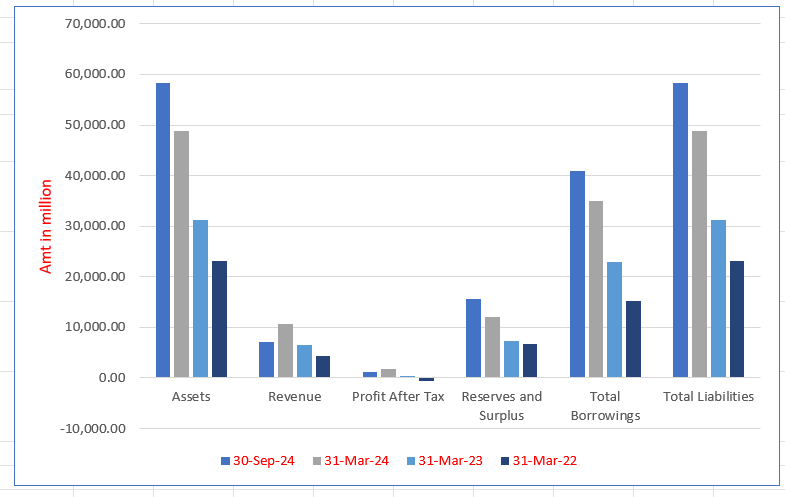

Aye Finance Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 58,225.05 | 48,730.52 | 31,294.58 | 23,156.43 |

| Revenue | 7,170.45 | 10,717.50 | 6,433.35 | 4,434.90 |

| Profit After Tax | 1,078.00 | 1,716.79 | 438.53 | (513.50) |

| Reserves and Surplus | 15,588.45 | 11,961.75 | 7,274.99 | 6,749.52 |

| Total Borrowings | 40,831.01 | 34,989.90 | 22,961.61 | 15,207.40 |

| Total Liabilities | 58,225.05 | 48,730.52 | 31,294.58 | 23,156.43 |

Financial Status of Aye Finance Limited

SWOT Analysis of Aye Finance IPO

Strength and Opportunities

- Strong “phygital” model combining branch network and digital reach

- Use of technology, AI, and data analytics to underwrite loans and improve efficiencies

- Diversified funding sources and strong investor confidence

- Large underserved MSME and micro business market in India

- Regulatory and government push for financial inclusion and MSME credit

- Ability to launch new products and tailor services such as specialised loans

- Opportunity to expand into adjacent segments like small enterprise and supply chain finance

- Strategic technology partnerships to strengthen collections and operations

- Growing demand for digital lending and contactless credit solutions

Risks and Threats

- High credit risk because of lending to micro-enterprises with volatile incomes

- Asset quality vulnerability due to fluctuations in NPAs and gross stage-3 assets

- Execution risk in scaling operations while maintaining quality

- Intense competition from NBFCs and fintechs targeting MSMEs

- Dependence on stable interest rates and macroeconomic environment

- Cybersecurity and data breach risks from increased digital dependence

- Regulatory changes or stricter NBFC norms could increase compliance burden

- Reputation risk if defaults or customer grievance issues escalate

- Macroeconomic downturns, inflation, or SME business stress may increase defaults

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Aye Finance Limited

Aye Finance Limited IPO Strengths

Deep Market Understanding and Competitive Advantage

Aye Finance Limited possesses a deep understanding of micro-scale businesses, which grants it a significant competitive advantage by addressing a customer segment largely underserved by rivals. Its diversified product offerings and extensive market coverage across over 70 industrial and business clusters in the MSME sector give it a unique position.

Strong Portfolio Granularity and Scale

The company maintains a granular loan portfolio with a small Average Ticket Size (ATS) on disbursement of approximately ₹0.15 million, which mitigates credit risk through affordability and diversification. Furthermore, Aye Finance Limited holds the largest active customer base in India among its peers, reaching 508,224 as of September 30, 2024.

Diversified Pan-India Presence and Robust Growth

Aye Finance Limited’s strategic expansion across 499 branches in 387 districts of India, spanning all four zones, makes it the only diversified pan-India player in the micro-enterprise lending segment among its peers. This extensive, non-concentrated geographic footprint insulates its portfolio from regional business or operational disruptions.

Efficient Sourcing, High Retention, and Repeat Business

The company relies exclusively on in-house, branch-led origination, ensuring high quality of sourcing and stronger customer relationships. This strategy supports remarkable efficiency, achieving the highest loans per employee among peers. A high customer retention rate and substantial repeat loan business (42.25% of AUM) enhance long-term portfolio stability and growth.

Pioneering Effective Underwriting Methodology

Aye Finance Limited has pioneered a unique ‘business cluster’-based underwriting methodology, leveraging specific knowledge of over 70 clusters and proprietary data science. This ‘phygital’ approach allows for reliable cash flow assessment for MSMEs with limited documentation, giving it a crucial competitive edge that is difficult for new entrants to replicate.

Robust, Data-Driven Collection Capabilities

The firm’s multi-tiered, in-house collection infrastructure is supported by advanced Machine Learning models for default prediction and tailored communication. This robust system ensures tight management of overdue accounts, evidenced by the lowest Stage 2 assets to total gross loans ratio (1.67% as of September 30, 2024) among Peer MSME Focused NBFCs.

Building Resilience Through Technological Prowess

Aye Finance Limited employs a resilient ‘phygital’ business model that integrates its physical presence with a cloud-based technology stack and an in-house Data Science/AI team. This allows for automated, paperless, and cashless operations, significantly improving efficiency, enabling centralized underwriting, and providing customers with a seamless mobile application experience.

Access to Diversified and Cost-Effective Financing

The company has successfully built a diversified lender base, accessing capital from 83 different lenders as of September 30, 2024, including various banks and multilateral agencies. This large base provides access to liquidity and helps mitigate risk, resulting in a historically declining average cost of borrowings and stable, cost-effective funding.

Experienced Leadership and Committed Investor Base

Aye Finance Limited is led by an experienced professional management team, including its founder and Managing Director, with deep industry knowledge. This leadership is backed by investments from marquee investors like Elevation Capital and CapitalG, underscoring strong confidence and positioning the company to leverage their expertise for future growth.

More About Aye Finance Limited

Aye Finance Limited is a middle-layer Non-Banking Financial Company (NBFC-ML) that provides loans to micro, small, and medium enterprises (MSMEs) across India. The company focuses on micro-scale businesses in manufacturing, trading, services, and allied agriculture sectors, offering loans for both working capital and business expansion. As of September 30, 2024, it had 508,224 active customers across 18 states and three union territories, with Assets Under Management (AUM) of ₹49,797.64 million (Source: CRISIL Report).

Core Strengths

- Product Range: Aye Finance offers small-ticket business loans, averaging ₹0.15 million, through secured, partly secured, and unsecured formats.

- Underwriting Expertise: Its unique cluster-based underwriting methodology evaluates cash flows of over 70 business clusters, enabling accurate risk assessment even with limited credit history.

- ‘Phygital’ Model: The company blends branch-based “high touch” services with digital platforms, supported by data science and AI-driven processes for sourcing, underwriting, disbursement, and collections.

Growth and Scale

- Rapid Expansion: AUM grew at a CAGR of 60.69% between FY22 and FY24, making Aye Finance one of the fastest-growing MSME-focused NBFCs.

- Geographic Diversification: No single state contributes more than 15% of its AUM, with operations distributed across North (34.91%), East (25.99%), West (22.49%), and South (16.61%).

- Branch Network: By September 2024, the company had 499 branches, reflecting a pan-India presence and strong regional penetration.

Financial Performance

- Return on Average Total Assets (ROTA) stood at 4.03% (annualised) as of September 30, 2024.

- Return on Equity (RoE) improved significantly, rising from (7.05)% in FY22 to 17.22% in FY24, with 15.22% reported in H1 FY25.

- Debt-to-equity ratio was 2.56 as of September 2024, reflecting a balanced capital structure.

Industry Outlook

The Indian MSME lending industry is witnessing robust expansion, supported by rising credit demand from micro and small businesses. The MSME credit market is estimated at around ₹35 trillion, but a large credit gap of nearly ₹28 lakh crore remains unmet. Between FY21 and FY24, NBFCs increased their MSME loan book at a CAGR of 32%, outpacing both private and public sector banks. Looking ahead, the sector is projected to grow at about 14% annually over FY25–FY26, while the micro loan-against-property segment may grow at an even faster pace of nearly 25%.

Growth Drivers

- Digital Underwriting: Use of AI, machine learning, and alternative data is enabling NBFCs to serve micro enterprises with limited credit histories.

- Government Push: Credit guarantee schemes, Udyam registration, and formalisation drives are expanding the pool of enterprises eligible for formal finance.

- Phygital Expansion: Combining branch networks with digital models allows NBFCs to reach semi-urban and rural markets at lower cost.

- Co-lending and Funding: Partnerships with banks and rising capital inflows are strengthening balance sheets and expanding reach.

- Small Ticket Demand: A large share of MSMEs require loans below ₹0.5 million, representing a huge untapped opportunity.

Product-Level Outlook

Micro loans, small-ticket business loans, and hypothecation-based working capital credit are expected to see the strongest growth. Secured lending against property will remain steady, while unsecured products are likely to expand rapidly, albeit with higher credit risk.

How Will Aye Finance Limited Benefit

- Aye Finance Limited is positioned to benefit from the large credit gap in the MSME sector, where demand for small-ticket loans far exceeds supply from formal lenders.

- Its expertise in underwriting micro-scale businesses through cluster-based models aligns with the growing need for alternative credit assessment methods.

- The company’s diversified presence across regions reduces concentration risks and allows it to capture opportunities in semi-urban and rural markets.

- Expansion of government initiatives for MSMEs, including credit guarantee schemes, strengthens the ecosystem in which Aye Finance operates.

- Rising adoption of digital lending and “phygital” models supports its strategy of combining branch networks with data-driven technology.

- Strong growth prospects in micro loans and loan-against-property products match closely with the company’s existing product portfolio.

- Access to a large untapped customer base ensures consistent scalability and sustainable financial performance in the coming years.

Peer Group Comparison

| Name of the Company | Face Value

(₹ ) |

Revenue (₹ million) | EPS (₹) | NAV (₹) | P/E Ratio FY 2024 |

| Aye Finance | 2 | 10,402.18 | 10.62 (Basic)

10.50 (Diluted) |

76.47 (Basic)

75.63 (Diluted) |

NA |

| Peer Group | |||||

| SBFC Finance Limited | 10 | 10,186.40 | 2.35 (Basic)

2.30 (Diluted) |

27.49 (Basic)

26.90 (Diluted) |

40.10 |

| Five-Star Business Finance Limited | 16 | 21,828.47 | 28.64 (Basic)

28.39 (Diluted) |

178.05 (Basic)

176.50 (Diluted) |

22.85 |

Key Strategies for Aye Finance Limited

Expanding Asset Under Management Per Branch

Aye Finance Limited intends to increase its Asset Under Management (AUM) per branch by deepening penetration within its target micro-business segment, leveraging the estimated $53 to $55 trillion credit gap. The firm will utilize its offering of secured and unsecured loans, focusing on upselling mortgage loans to existing customers and allowing newer branches to mature, which historically boosts average AUM. It plans to reduce the pace of new branch openings to focus on maturing the current network.

Strategic Growth in Mortgage Loan Portfolio

Aye Finance Limited is committed to scaling its mortgage loan portfolio to enhance overall stability and long-term profitability by increasing the average tenure of its assets. The strategy involves building decentralized mortgage teams within the existing branch network to tap new lending opportunities. The firm’s differentiated sourcing approach combines open market acquisition with upselling to its current hypothecation loan customer base to improve portfolio quality.

Utilizing Technology and Data Science for Efficiency

Aye Finance Limited plans to leverage technology and data science to significantly enhance operational productivity and scalability. Key initiatives include incorporating surrogate data and image recognition to improve underwriting and straight-through processing. For collections, the firm will utilize geolocation-based analytics and digital footprints. Furthermore, it will upgrade its core systems and employ Generative AI and RPA to streamline internal processes and develop new paperless customer loan journeys.

Enhancing Operating Leverage

Aye Finance Limited aims to reduce operating expenditure while simultaneously improving functionality and efficacy. This will be achieved by improving staff productivity through process automation and training, building on the increased efficiency already observed. The firm will also leverage its increased share of mortgage loans for their larger ticket size and longer tenor to inherently reduce the cost-to-income ratio, supplemented by automation of routine tasks.

Optimizing Borrowing Costs and Diversifying Funding

Aye Finance Limited is focused on optimizing its borrowing costs and diversifying its lender base to ensure stable funding for continued growth. The strategy includes enhancing its credit rating through strong risk management and technology investments. The firm intends to prioritize long-term borrowings to maintain a positive Asset-Liability Management (ALM) position and will strengthen co-lending/securitization arrangements with its over 83 counterparties to secure capital at optimal costs.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Aye Finance Limited IPO

How can I apply for Aye Finance Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Aye Finance Ltd.’s IPO type?

Aye Finance IPO is a Book Building Issue, with shares proposed to list on NSE and BSE.

When did SEBI approve the Aye Finance IPO?

SEBI approved the IPO on April 3, 2025, valid for 12 months, subject to market conditions.

What is the face value and issue structure of the IPO?

Face value is ₹2 per share, with a Fresh Issue and Offer for Sale component.

Who is managing the Aye Finance IPO?

Axis Capital Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar.

What are the IPO objectives for Aye Finance?

The IPO proceeds aim to augment capital base to support business growth and future asset requirements.