- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Behari Lal Engineering IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Behari Lal Engineering IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Behari Lal Engineering Limited IPO

Behari Lal Engineering Ltd. is a fully integrated iron and steel manufacturer providing customised engineering solutions. The company produces precision-engineered components for critical industrial applications, including metal rolls, engineering castings, alloy steel products, and forged materials. Its products cater to diverse industries such as steel, mining, power, and sugar. As of March 31, 2025, the company has served 1,681 domestic and international customers, including BMW Industries, Shyam Metallics, and Metso India. It operates two manufacturing units in Mandi Gobindgarh, Punjab, with a combined installed capacity of 119,464 MT.

Behari Lal Engineering Limited IPO Overview

Behari Lal Engineering Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 26, 2025, to raise funds through an Initial Public Offer (IPO). The IPO will be a Book-Build Issue comprising a fresh issue of ₹110 crore and an offer for sale (OFS) of up to 78,54,521 equity shares. The equity shares are proposed to be listed on both NSE and BSE. While the book-running lead manager is yet to be announced, MUFG Intime India Pvt. Ltd. has been appointed as the registrar of the issue. Details such as IPO opening and closing dates, price band, and lot size will be disclosed later. The company’s promoters include Parkash Chand Garg, Rajesh Garg, Dinesh Garg, Lovlish Garg, and Bhuvnesh Garg, who collectively held an 88.51% stake before the issue. The IPO involves a face value of ₹10 per share and a combined sale type of fresh capital and offer for sale. Before the IPO, the total shareholding stood at 3,90,39,325 shares. For comprehensive information, investors can refer to the Behari Lal Engineering IPO DRHP.

Behari Lal Engineering Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹110 crore |

| Offer for Sale (OFS) | 0.79 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,90,39,325 shares |

| Shareholding post-issue | TBA |

Behari Lal Engineering IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Behari Lal Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Behari Lal Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹13.56 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 21.92% |

| Net Asset Value (NAV) | ₹61.89 |

| Return on Equity (RoE) | 24.31% |

| Return on Capital Employed (RoCE) | 28.24% |

| EBITDA Margin | 16.01% |

| PAT Margin | 10.43% |

| Debt to Equity Ratio | 0.03 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement for: purchase and installation of new equipment / machinery (including computers, printers and computer peripherals) along with civil work for such installation at Manufacturing Facility 1 | 242.88 |

| Purchase and installation of new roof-top solar panels at Manufacturing Facility 1 | 39 |

| Purchase and installation of new equipment / machinery along with civil work for such installation at Manufacturing Facility 2 | 438.81 |

| Purchase and installation of new roof-top solar panels at Manufacturing Facility 2 | 39 |

| Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the Company | 7 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

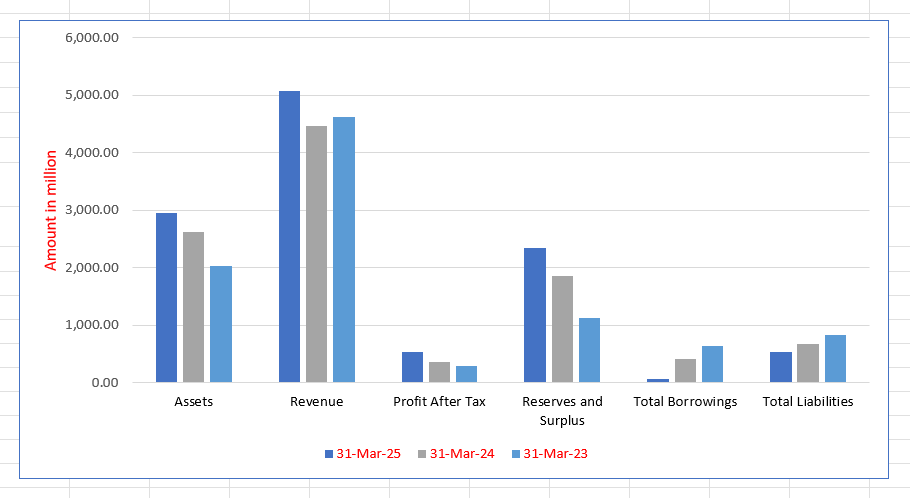

Behari Lal Engineering Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,959.77 | 2,620.81 | 2,032.45 |

| Revenue | 5,079.12 | 4,460.84 | 4,629.28 |

| Profit After Tax | 529.51 | 357.91 | 288.01 |

| Reserves and Surplus | 2,338.08 | 1,861.33 | 1,126.45 |

| Total Borrowings | 75.77 | 412.13 | 636.39 |

| Total Liabilities | 543.62 | 681.41 | 836.51 |

Financial Status of Behari Lal Engineering Limited

SWOT Analysis of Behari Lal Engineering IPO

Strength and Opportunities

- Strong integrated manufacturing setup with melt shop, foundry, rolling mills, and heat treatment facilities.

- Diversified product portfolio covering metal rolls, engineering castings, alloy steel bars, and forgings.

- Established presence in critical industrial sectors such as steel, mining, power, and infrastructure.

- Strong financial position with low borrowings and a healthy net worth.

- Expanding export potential and opportunity to strengthen global footprint.

- Ability to leverage India’s infrastructure growth and “Make in India” initiative.

- Robust R&D and quality assurance systems for customised and high-value steel products.

- Potential for vertical integration and value-added alloy expansion.

- Experienced promoters with long-standing market relationships.

Risks and Threats

- Modest scale of operations compared to large global steel producers, reducing bargaining power.

- Vulnerable to fluctuations in raw material and energy costs, which may affect profitability.

- Exposure to cyclical demand trends in steel and heavy-engineering industries.

- Dependence on a limited customer base, leading to concentration risk.

- Intense competition from domestic and international steel and engineering companies.

- Subject to environmental and regulatory challenges in steel manufacturing.

- Risk of technological obsolescence due to emerging advanced materials.

- Global trade uncertainties and fluctuating demand may impact revenue stability.

- Raw material supply constraints and logistics disruptions can affect operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Behari Lal Engineering Limited

Behari Lal Engineering Limited IPO Strengths

Diverse Product Portfolio and Customisation Ability

Behari Lal Engineering Limited possesses a diverse product portfolio encompassing Alloy Steel Products, Metal Rolls, Engineering Castings, and Forging Ingots/Forged Shafts/Blocks, which allows them to serve a vast array of industries. BLEL’s extensive product line, including the ability to customise products according to specific customer requirements, is a significant strength. This flexibility and breadth of offerings, supported by a focus on technology, enable them to meet varied industrial application needs and contribute to stable revenue generation across different segments.

Strategically Located Manufacturing Facilities and Robust Processes

BLEL benefits from its strategically located manufacturing facilities in Mandi Gobindgarh, a steel manufacturing hub, providing seamless connectivity via major highways, dry ports, and an international airport for efficient logistics. Furthermore, the company’s facilities utilize advanced equipment and robust, overlapping manufacturing processes (SMS and Foundry Division, Rolling Mill) which are fungible, resulting in consistently high capacity utilisation (e.g., 90.30% in Fiscal 2025).

Robust Presence and Experienced Management Team

Behari Lal Engineering Limited leverages an experience of over two decades in the steel industry and a strong foundation built by its promoters, who have substantial experience (up to 30 years). The company’s rich legacy and domain expertise of the management team—including the chairman, vice chairman, and managing director—have facilitated the development of robust processes, fostered trusted customer relationships, and allowed them to clear rigorous audits, creating high entry barriers for competitors. (54 words)

Track Record of Consistent Financial Growth

The company demonstrates a track record of consistent growth in its financial performance, supported by an expanding customer base and effective operations. Key financial indicators show significant improvement, such as a rise in Revenue from Operations from $4,629.28$ million in Fiscal 2023 to $5,079.12$ million in Fiscal 2025. Furthermore, the EBITDA Margin has improved from $10.66\%$ to $16.01\%$, and the Debt Equity Ratio has reduced from $0.53$ to a strong $0.03$, indicating robust financial health.

More About Behari Lal Engineering Limited

Behari Lal Engineering Limited is an integrated iron and steel manufacturing company that focuses on customised engineering solutions. Recognised by CRISIL as one of India’s largest metal roll producers, the company accounted for around 10% of the nation’s demand in FY 2024. With over two decades of industry experience, it has established advanced facilities, including a digital steel melting shop, foundry, rolling mills, and heat treatment units.

Product Portfolio

Behari Lal Engineering Limited produces a wide range of precision-engineered components for critical industrial applications:

- Metal Rolls: Manufactured across various grades such as alloy cast steel, adamite, and graphitic steel, used in producing TMT rebar and structural steel.

- Engineering Castings: Special-grade castings weighing from 500 kg to 20 MT, catering to steel, mining, power, and sugar industries.

- Alloy Steel Products: Carbon, alloy, and stainless steel bars in multiple shapes and sizes, including tool and valve steel.

- Forging Ingots and Forged Shafts/Blocks: Semi-finished steel products for heavy industries such as automotive, aerospace, and oil & gas.

Market Presence and Performance

The company’s customer base spans across 15 countries and 1,681 clients as of March 2025. Its top customers include leading names like BMW Industries, Shyam Metallics, and Laxcon Steels. In FY 2025, the company reported revenue of ₹5,079.12 million and profit after tax of ₹529.51 million, reflecting a CAGR of over 35% since FY 2023.

Technology and Quality Excellence

Behari Lal Engineering Limited uses advanced machinery such as CNC lathes, VTLs, and roll grinders. The company maintains stringent quality control systems and holds ISO 9001, ISO 14001, ISO 45001, and BIS certifications.

Leadership and Sustainability

Led by Chairman Parkash Chand Garg and Vice Chairman Rajesh Garg, the company promotes eco-friendly operations, using recycled steel, solar energy, and green manufacturing practices. Its strong management and skilled workforce continue to drive innovation and operational excellence.

Industry Outlook

India is one of the world’s largest steel producers, with crude-steel output reaching around 137 million tonnes in FY25 and finished steel consumption of approximately 111 million tonnes. Domestic steel demand is projected to grow by 9-10% in FY25, supported by strong infrastructure and manufacturing activity. The broader steel-market volume growth is expected to maintain a CAGR of around 8-10% over FY25-27. Government initiatives such as expanding capacity to 300 million tonnes by 2030 and the “Make in India” programme further strengthen the industry’s growth potential.

Growth Drivers

- Rising infrastructure investment in highways, housing, and smart-city projects is significantly increasing steel consumption.

- Rapid expansion of the automotive sector, including electric vehicles, is boosting demand for high-strength, precision steel components.

- Policies promoting domestic production, import substitution, and capacity expansion are creating favourable market dynamics.

- Increased urbanisation and industrialisation continue to drive sustained demand for construction steel and related products.

Segment Outlook – Castings, Bars & Rolls

Within the precision-engineering segment, which produces metal rolls, engineering castings, and alloy bars:

- The Indian metal-casting market was valued at about USD 13.2 billion in 2024 and is expected to reach USD 21.9 billion by 2033, growing at a CAGR of 5.5%.

- The hot-rolled and cold-rolled steel market is projected to expand from USD 171 billion in 2024 to approximately USD 270 billion by 2030, reflecting a CAGR of about 7.8%.

Implications for Product Categories

- Metal Rolls and Alloy Steel Bars: Growing downstream steel manufacturing and milling activities are expected to boost the demand for rolls and alloy bars, in line with the overall steel CAGR of 8-10%.

- Engineering Castings and Forgings: These segments are set to grow at 5-7% CAGR, driven by increased demand from heavy machinery, mining, infrastructure, and power sectors.

- Export and Value-Added Segments: With rising global competitiveness, India’s production of tool steel, special-alloy forgings, and precision-engineered components is likely to see higher export volumes.

Key Figures at a Glance

- Steel consumption growth: ~9-10% in FY25

- Steel-market size forecast: 148 million tons in 2025, expected to reach 230 million tons by 2030 (~9.2% CAGR)

- Metal-casting market: USD 13.2 billion in 2024, growing at 5.5% CAGR till 2033

Overall, India’s integrated steel and precision-engineering components industry is poised for steady expansion, supported by industrial modernisation, infrastructure growth, and rising global demand for high-quality steel products.

How Will Behari Lal Engineering Limited Benefit

- Behari Lal Engineering Limited is strategically positioned to benefit from India’s rising steel demand, projected to grow at 9–10% annually.

- The company’s diversified portfolio across metal rolls, alloy bars, and engineering castings aligns with the expanding infrastructure and manufacturing sectors.

- Increasing investment in highways, housing, and smart cities will boost the need for structural and high-strength steel, directly enhancing its sales volume.

- Growth in the automotive and aerospace industries will drive demand for precision-engineered alloy steel products and forged components.

- The rise in heavy machinery, mining, and power projects will create opportunities for engineering castings and forged shafts.

- Export growth across 15 countries positions the company to capture global demand for high-grade steel components.

- Government initiatives like “Make in India” and increased capacity expansion support domestic manufacturing, strengthening Behari Lal Engineering Limited’s market presence and revenue outlook.

Peer Group Comparison

| Name of Company | Face Value (₹) | P/E | Basic EPS (₹) | Diluted EPS (₹) | RoNW (%) | NAV (₹) | Total Income (₹ million) |

| Behari Lal Engineering Limited (Standalone) | 10 | NA | 13.56 | 13.56 | 21.92 | 61.89 | 5,079.12 |

| Peer Group | |||||||

| Jayaswal Neco Industries Limited (Standalone) | 10 | 59.92 | 1.16 | 1.16 | 4.71 | 24.47 | 60,123.60 |

| AIA Engineering Limited (Consolidated) | 227.49 | 113.14 | 113.14 | 113.14 | 15.28 | 743.36 | 46,190.72 |

| Steelcast Limited (Standalone) | 55.75 | 35.67 | 35.67 | 35.67 | 24.09 | 161.00 | 3,806.14 |

| RHI Magnesita India Limited (Consolidated) | 148.04 | 9.81 | 9.81 | 9.81 | 15.06 | 193.64 | 37,005.66 |

| Vardhman Special Steel Limited (Consolidated) | 102 | 4.42 | 11.40 | 11.37 | 11.67 | 97.62 | 17,935.23 |

| IFGL Refractories Limited (Consolidated) | 10 | 20.27 | 11.93 | 11.93 | 3.88 | 307.17 | 16,704.42 |

Key Strategies for Behari Lal Engineering Limited

Expansion of Installed Capacity and Efficiency

Behari Lal Engineering Limited plans to augment its manufacturing capacity in anticipation of future business growth. The company is establishing additional production facilities in Mandi Gobindgarh, Punjab, including purchasing land and upgrading machinery with advanced CNC and VTL machines. This strategic expansion aims to meet increasing market demand, leverage economies of scale, and improve overall operational efficiency.

Focus on High-Value and Value-Added Products

Behari Lal Engineering Limited is actively optimizing its product portfolio to concentrate on higher-value products like engineering castings, metal rolls, and specific alloy steel grades. This shift is expected to improve operational profit margins and enhance the company’s profitability. Future plans include installing forging presses and hammers to manufacture high-value forged products and reduce outsourcing costs.

Broadening Market Base and Export Reach

Behari Lal Engineering Limited intends to expand its end-user industries base and increase its presence in the export market. The company will target new sectors like oil and gas, plastic moulding, and forging, leveraging its precision engineering capabilities. With a growing global demand for Indian steel, the company is poised to capitalize on opportunities and bid for high-value tenders, including in the defence sector.

Enhancing Customer Share with New Product Grades

Behari Lal Engineering Limited is aiming to increase its “wallet share” with existing customers by introducing new, high-grade products like Indefinite Chilled Double Pour (ICDP) rolls and High Speed Steel (HSS) rolls. Manufacturing these specialized, higher-margin grades, along with High Temperature/Creep Resistant Grade Steels, is expected to generate higher revenues and improve operating profitability for the company

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Behari Lal Engineering Limited IPO

How can I apply for Behari Lal Engineering Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When was Behari Lal Engineering Ltd. IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 26, 2025.

What is the structure of the Behari Lal Engineering IPO?

It is a Book Building Issue with a fresh issue of ₹110 crores and an Offer for Sale of 0.79 crore shares.

On which stock exchanges will the IPO be listed?

The equity shares are proposed to be listed on both the NSE and BSE.

What is the face value and sale type of the IPO?

Each share has a face value of ₹10, and the IPO is a Fresh Capital-cum-Offer for Sale.

How is the IPO allocation divided among investor categories?

QIBs will get up to 50%, retail investors at least 35%, and non-institutional investors at least 15% of the offer.