- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Belrise Industries IPO

₹14/166 shares

Minimum Investment

IPO Details

21 May 25

23 May 25

₹14

166

₹85 to ₹90

NSE, BSE

₹2 Cr

28 May 25

Belrise Industries IPO Timeline

Bidding Start

21 May 25

Bidding Start

23 May 25

Bidding Start

26 May 25

Bidding Start

27 May 25

Bidding Start

27 May 25

Bidding Start

28 May 25

Belrise Industries Limited

Established in 1988, Belrise Industries Limited is a leading automotive component manufacturer in India. The company specialises in safety-critical systems and engineering solutions for two-wheelers, three-wheelers, four-wheelers, commercial, and agricultural vehicles. Its diverse product portfolio includes metal chassis systems, polymer parts, suspension systems, body-in-white components, and exhaust systems. Belrise serves renowned clients such as Bajaj, Honda, Hero, Jaguar Land Rover, Royal Enfield, Tata Motors, and Mahindra. As of June 30, 2024, it caters to 27 OEMs globally and operates 15 manufacturing facilities across nine Indian cities.

Belrise Industries Limited IPO Overview

Belrise Industries is launching an IPO through a book-building process worth ₹2,150.00 crores, consisting entirely of a fresh issue of 23.89 crore equity shares. The IPO opens for subscription on May 21, 2025, and closes on May 23, 2025. The allotment is expected to be finalised by May 26, with a tentative listing date on BSE and NSE scheduled for May 28, 2025. The price band is set at ₹85 to ₹90 per share.

Retail investors must apply for a minimum of 166 shares, requiring ₹14,110; however, bidding at the cutoff price would amount to ₹14,940 to avoid oversubscription issues. The minimum lot size for sNII is 14 lots (2,324 shares) at ₹2,09,160, and for bNII, it is 67 lots (11,122 shares) at ₹10,00,980. Axis Capital, HSBC Securities, Jefferies India, and SBI Capital Markets are the lead managers, with Link Intime India as the registrar.

Belrise Industries Limited IPO Details

| Particulars | Details |

| IPO Date | 21 May 2025 to 23 May 2025 |

| Listing Date | 28 May 2025 |

| Face Value | ₹5 per share |

| Issue Price Band | ₹85 to ₹90 per share |

| Lot Size | 166 Shares |

| Total Issue Size | 23,88,88,888 shares (aggregating up to ₹2,150.00 Cr) |

| Fresh Issue | 23,88,88,888 shares (aggregating up to ₹2,150.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE BSE |

| Share Holding Pre Issue | 65,09,90,304 shares |

| Share Holding Post Issue | 88,98,79,192 shares |

Belrise Industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Belrise Industries Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 166 | ₹14,940 |

| Retail (Max) | 13 | 2,158 | ₹1,94,220 |

| S-HNI (Min) | 14 | 2,324 | ₹2,09,160 |

| S-HNI (Max) | 66 | 10,956 | ₹9,86,040 |

| B-HNI (Min) | 67 | 11,122 | ₹10,00,980 |

Belrise Industries Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 99.81% |

| Post-Issue | TBD |

Belrise Industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.78 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.33% |

| Net Asset Value (NAV) | 35.94 |

| Return on Equity | 14.18% |

| Return on Capital Employed (ROCE) | 14.83% |

| EBITDA Margin | 12.54% |

| PAT Margin | 4.15% |

| Debt to Equity Ratio | 0.97 |

Objectives of the Proceeds

- Repayment/pre-payment (in full or in part) of certain outstanding borrowings availed by the Company – ₹16,181.27 million

- General corporate purposes

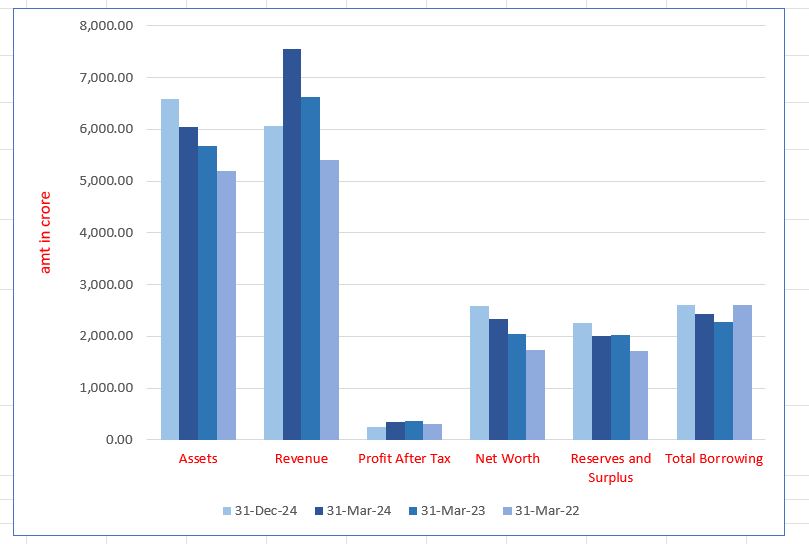

Belrise Industries Limited Financial Information (₹ Crore)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 6,587.69 | 6,041.65 | 5,679.15 | 5,196.07 |

| Revenue | 6,064.76 | 7,555.67 | 6,620.78 | 5,410.68 |

| Profit After Tax | 245.47 | 352.70 | 356.70 | 307.24 |

| Net Worth | 2,577.55 | 2,331.92 | 2,038.20 | 1,734.45 |

| Reserves and Surplus | 2,252.24 | 2,014.43 | 2,024.16 | 1,715.31 |

| Total Borrowing | 2,599.80 | 2,440.98 | 2,271.40 | 2,597.96 |

SWOT Analysis of Belrise Industries IPO

Strength and Opportunities

- Leading manufacturer in precision automotive parts.

- Strong relationships with 27 OEMs globally.

- EV-agnostic product portfolio supports future growth.

- Vertically integrated manufacturing capabilities.

- Positioned to benefit from India’s EV market expansion.

Risks and Threats

- Highly competitive automotive component industry.

- Revenue decline noted in FY2024.

- Borrowings remain high, impacting leverage.

- Dependence on automotive sector cyclicality.

- Market fluctuations could affect profitability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Belrise Industries Limited IPO

IPO Strengths

- Market leader in precision sheet metal pressing in the growing automotive components sector.

- Innovation-driven development and process engineering capabilities.

- Vertically integrated manufacturing offering diverse product range.

- Strong, longstanding customer relationships with OEMs.

- EV-agnostic product portfolio positioned for India’s electric vehicle growth.

- Experienced promoters and management team.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹/share) | P/E (x) | RoNW (%) | P/BV Ratio |

| Belrise Industries Limited | 4.78 | 4.78 | 35.94 | TBD | 13.33 | — |

| Bharat Forge Ltd. | 20.43 | 20.43 | 153.90 | 58.94 | 13.84 | 7.38 |

| UNO Minda Limited | 15.36 | 15.34 | 91.71 | 62.19 | 21.68 | 7.52 |

| Motherson Sumi Wiring India Ltd. | 1.44 | 1.44 | 3.79 | 39.42 | 42.45 | 22.00 |

| JBM Auto Ltd. | 15.12 | 15.12 | 98.75 | 45.52 | 22.21 | 18.41 |

| Endurance Technologies Ltd. | 48.38 | 48.38 | 353.86 | 44.76 | 16.24 | 5.18 |

| Minda Corporation Ltd. | 9.65 | 9.49 | 82.84 | 51.32 | 13.99 | 5.09 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Belrise Industries Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the IPO date for Belrise Industries Limited?

The IPO opens on 21 May 2025 and closes on 23 May 2025.

What is the minimum investment required for retail investors?

Retail investors must invest ₹14,940 for one lot of 166 shares at the cutoff price.

When will Belrise Industries Limited be listed on the stock exchanges?

The company is scheduled to be listed on BSE and NSE on 28 May 2025.

What is the size and structure of the Belrise IPO?

The IPO is afresh issueof ₹2,150 crore comprising23.88 crore equity shares