- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Benefits of ETFs for Portfolio Diversification: ETF Strategies for a Diversified Portfolio

By Shishta Dutta | Updated at: May 18, 2025 11:59 PM IST

Portfolio diversification is one of the biggest plus points of ETFs for investors. Investors can benefit from Exchange-Traded Funds (ETFs) if they are looking for diversification, risk reduction, and better returns in the long term.

Having a diverse investment portfolio means that the overall risks are spread across different asset classes, effectively reducing the risk. An ETF can be thought of as a ‘basket of securities’ that contains diverse asset classes like company stocks, bonds, commodities, etc. So, purchasing an ETF naturally leads to a more diversified portfolio.

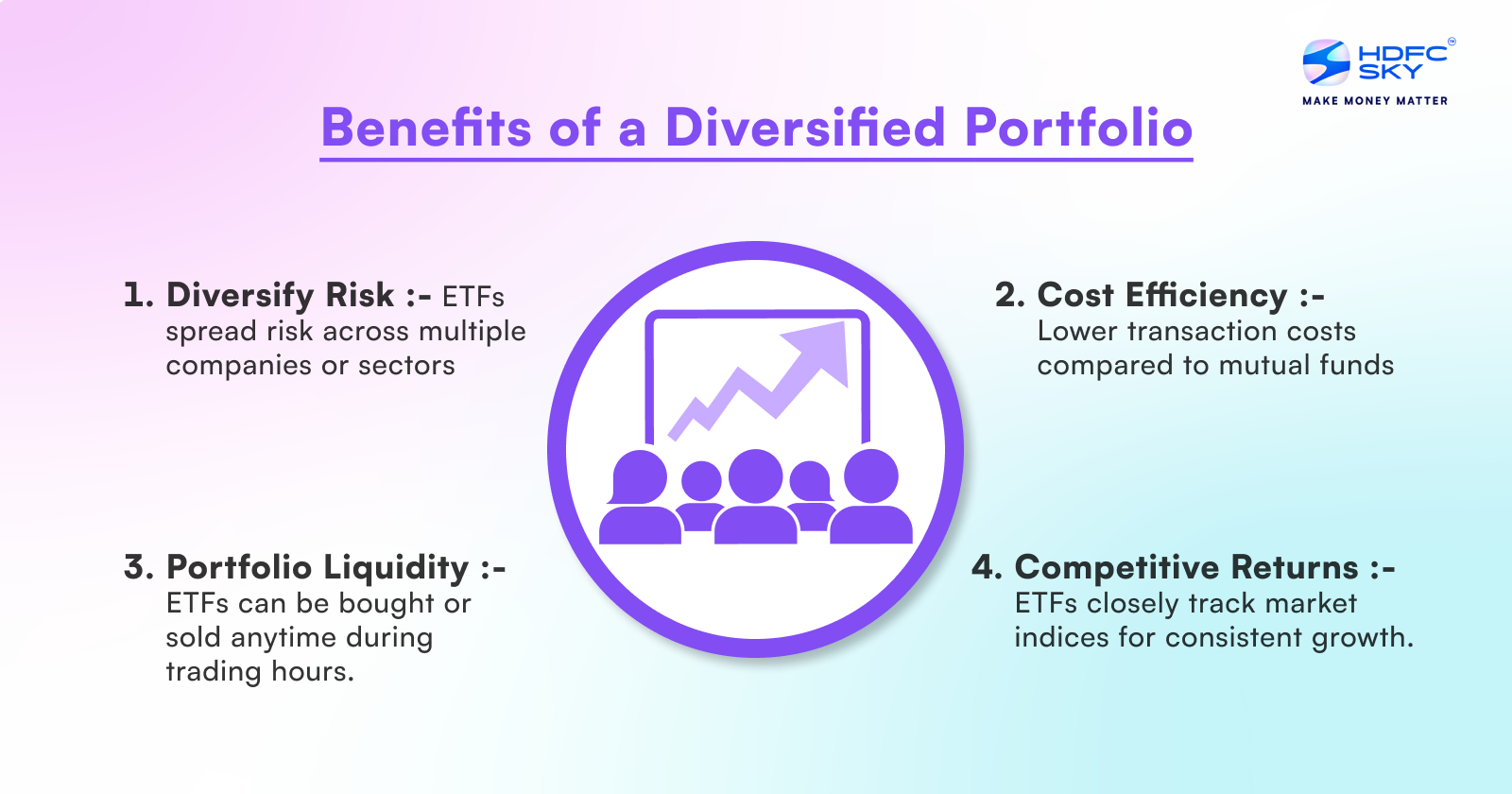

Benefits of a Diversified Portfolio

There are numerous benefits to investing in ETFs, but the most important one is having a portfolio with diverse asset classes. But what exactly are the benefits of having such diversity?

- Diversify Risk

The benefits of ETF investments primarily stem from their ability to diversify risk effectively. For example, when you purchase an ETF like the Nifty 50 or the Sensex, you will find that the fund invests in many companies in a particular sector (known as sector ETFs) or across multiple sectors. This spreads and diversifies your risk exposure, which may reduce it significantly.

As a result, if one of the companies in the ETF underperforms, the overall loss is reduced because some other company/companies in the same ETF may overperform. This is the same as the concept of not putting all your eggs in one basket’. In this way such benefits of ETFs can be a powerful ETF investment strategy.

- Cost Efficiency

Another benefit of ETFs for portfolio diversification is affordability. Unlike mutual funds that are actively managed, ETFs have a lower transaction cost (the cost of selling and buying) and they are a great form of low-cost investing.

If you plan to diversify your investment portfolio, you would be looking for investment instruments that cost less but simultaneously help spread potential risks. In such cases, you could consider ETFs.

- Portfolio Liquidity

One of the advantages of exchange-traded funds (ETFs) that more seasoned investors look at is liquidity. ETFs are highly liquid, meaning you can buy or sell them anytime within the current trading day.

So, if you find that many of the ETFs in your portfolio are underperforming (effectively increasing your risk), you can sell some of them and purchase others.

When the market abruptly changes, having a diverse portfolio of ETFs means you can easily respond to these fluctuations by buying and selling your ETF holdings.

This will allow you to maintain an optimal asset allocation in your portfolio at all times, generating long-term gains.

- Competitive Returns

The ETF advantages also include the potential for competitive returns in the long term. This is only possible when the risks in your portfolio are shared across different asset classes. ETFs are a better option for retail investors looking for competitive gains.

Although ETFs generally aim to replicate an index’s performance rather than beat it, aligning returns closely with well-established market indices has been historically rewarding. This could be beneficial for you if you are looking for steady growth in your investment portfolio.

ETF Investment Strategies for a Diversified Portfolio

ETF investment strategies can be deployed with a diversified portfolio.

- Invest in Broad Market ETFs: By leveraging ETFs that track major indices or sectors, you can align themselves with broad market performance while diversifying your portfolios.

- Invest in ETFs Instead of Index Funds: Investing in ETFs instead of index funds can be a good option since both these instruments mirror their respective market indices. However, unlike index funds, the benefits of ETFs are that they can be traded throughout the day.

- Prioritise Balanced Asset Allocation: Since the advantages of exchange-traded funds are that they invest in various asset classes, purchasing these funds can lead to better asset allocation. Using this strategy, you will have a diversified portfolio and a balance of low, medium, and high-risk/return assets.

Conclusion

From risk diversification to aiming for competitive returns, ETFs can be an all-inclusive way of building your wealth over time. Moreover, whether your investment goal is to reduce risk, increase capital gains, or be able to rapidly respond to market changes, ETFs offer an effective way to do them.

Related Articles

FAQs on Benefits of ETFs

How can ETFs help reduce investment risk in a portfolio?

These funds invest in a diverse range of asset classes and sectors. So, when one asset class underperforms, another asset class is likely to compensate.

What are the key benefits of using ETFs for diversification compared to individual stocks?

Individual stocks depend on the performance of one particular company. In contrast, ETFs contain stocks of different companies traded on the exchange. So, if one stock incurs losses, it can be covered up by the profits from another.