- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Billionbrains Garage Ventures (Groww) IPO

₹14,250/150 shares

Minimum Investment

IPO Details

04 Nov 25

07 Nov 25

₹14,250

150

₹95 to ₹100

NSE, BSE

₹6,632.30 Cr

12 Nov 25

Billionbrains Garage Ventures (Groww) IPO Timeline

Bidding Start

04 Nov 25

Bidding Ends

07 Nov 25

Allotment Finalisation

10 Nov 25

Refund Initiation

11 Nov 25

Demat Transfer

11 Nov 25

Listing

12 Nov 25

Billionbrains Garage Ventures Limited (Groww)

Incorporated in 2017, Groww is a Bengaluru-based fintech company that offers a direct-to-customer digital investment platform, enabling retail investors to create wealth through various financial products and services. The platform allows investments in mutual funds, stocks, F&O, ETFs, IPOs, digital gold, and U.S. stocks, with its mobile app being particularly popular among mutual fund investors. Groww also provides value-added services such as Margin Trading Facility (MTF), algorithmic trading, New Fund Offers (NFOs), and credit solutions. Its business model focuses on growing its customer base and deepening customer relationships, offering broking services and products like Mutual Funds, MTF, Credit, and Groww AMC. As of June 30, 2025, the company employed 1,415 people

Billionbrains Garage Ventures Limited (Groww) IPO Overview

Groww is set to launch its Initial Public Offering (IPO) worth ₹6,632.30 crore through a book-building process. The issue consists of a fresh issue of 10.60 crore equity shares, raising ₹1,060.00 crore, along with an offer for sale (OFS) of 55.72 crore shares amounting to ₹5,572.30 crore. The subscription for the Groww IPO will open on November 4, 2025, and close on November 7, 2025. The allotment of shares is expected to be finalised on November 10, 2025, while the listing on both the BSE and NSE is tentatively scheduled for November 12, 2025.

The price band has been fixed between ₹95 and ₹100 per share, with an application lot size of 150 shares. For retail investors, the minimum investment required, based on the upper price band, stands at ₹15,000 for one lot. The sNII category can apply for a minimum of 14 lots (2,100 shares) worth ₹2,10,000, while the bNII category requires a minimum of 67 lots (10,050 shares), amounting to ₹10,05,000. Kotak Mahindra Capital Co. Ltd. is the book running lead manager for the issue, and MUFG Intime India Pvt. Ltd. will act as the registrar.

Billionbrains Garage Ventures Limited (Groww) Upcoming IPO Details

| Particulars | Details |

| IPO Date | November 4, 2025 to November 7, 2025 |

| Listing Date | To be announced |

| Face Value | ₹2 per share |

| Issue Price Band | ₹95 to ₹100 per share |

| Lot Size | 150 Shares |

| Sale Type | Fresh Capital-cum-Offer for Sale |

| Total Issue Size | 66,32,30,051 shares (aggregating up to ₹6,632.30 Cr) |

| Fresh Issue | 10,60,00,000 shares (aggregating up to ₹1,060.00 Cr) |

| Offer for Sale | 55,72,30,051 shares of ₹2 (aggregating up to ₹5,572.30 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding (Pre Issue) | 6,06,75,96,631 shares |

| Share Holding (Post Issue) | 6,17,35,96,631 shares |

Billionbrains Garage Ventures Limited (Groww) IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 150 | ₹15,000 |

| Retail (Max) | 13 | 1,950 | ₹1,95,000 |

| S-HNI (Min) | 14 | 2,100 | ₹2,10,000 |

| S-HNI (Max) | 66 | 9,900 | ₹9,90,000 |

| B-HNI (Min) | 67 | 10,050 | ₹10,05,000 |

Billionbrains Garage Ventures Limited (Groww) IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Billionbrains Garage Ventures Limited (Groww) IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.34 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 37.57% |

| Net Asset Value (NAV) | ₹10.47 |

| Return on Equity (RoE) | 37.58% |

| Return on Capital Employed (RoCE) | 49.28% |

| EBITDA Margin | 59.11% |

| PAT Margin | 44.92% |

| Debt to Equity Ratio | 0.12 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Expenditure towards cloud infrastructure | 1525 |

| Brand building and performance marketing activities | 2250 |

| Investment in one of the Material Subsidiaries, GCS, an NBFC, for augmenting its capital base | 2050 |

| Investment in one of the Material Subsidiaries, GIT, for funding its MTF business | 1675 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

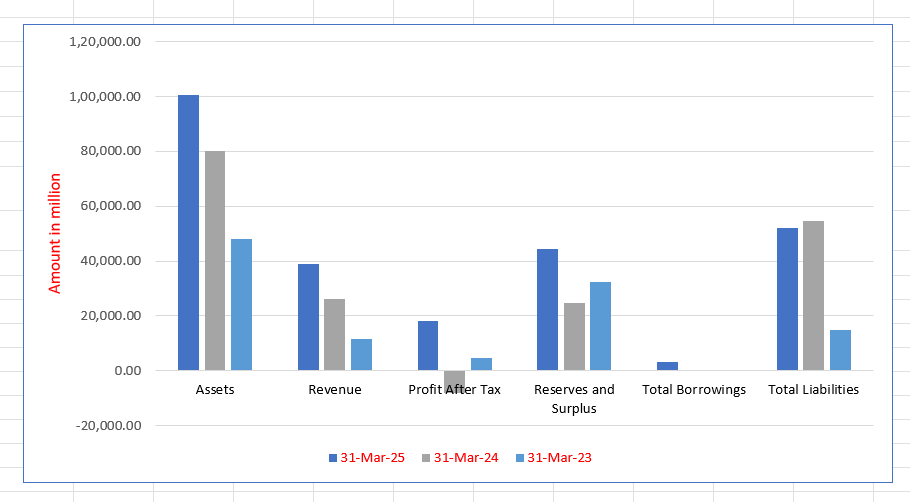

Billionbrains Garage Ventures Limited (Groww) Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,00,773.14 | 80,179.67 | 48,077.78 |

| Revenue | 39,017.23 | 26,092.81 | 11,415.26 |

| Profit After Tax | 18,243.73 | (8,054.50) | 4,577.17 |

| Reserves and Surplus | 44,456.25 | 24,777.61 | 32,519.21 |

| Total Borrowings | 3,019.78 | 240.64 | – |

| Total Liabilities | 52,218.69 | 54,752.84 | 14,910.06 |

Financial Status of Billionbrains Garage Ventures Limited (Groww)

SWOT Analysis of Billionbrains Garage Ventures (Groww) IPO

Strength and Opportunities

- User-friendly platform with intuitive UI for beginners.

- Diverse investment options including mutual funds, stocks, ETFs, and IPOs.

- Strong brand recognition and trust among Indian investors.

- Over 13 million active clients as of April 2025.

- Recent net profit surged to ₹1,819 crore in FY25, with revenue at ₹4,056 crore.

- Approved for an IPO aiming to raise up to ₹7,000 crore.

- Expansion into international markets, including US stocks.

- Cross-selling opportunities across financial products.

- Backed by prominent investors and mentors, including Y Combinator.

Risks and Threats

- Decline in active client base between February and August 2025.

- Increased competition from smaller, newer rivals in the industry.

- Risk of cybersecurity threats and platform reliability issues.

- Potential impact of regulatory changes on margin and compliance norms.

- Possible impact of market downturns on trading volumes.

- Competitive pricing pressure from peers.

- Potential curbs on Futures & Options (F&O) affecting activity levels.

- Vulnerability to economic downturns affecting investor sentiment.

- Dependence on digital infrastructure, making it susceptible to tech disruptions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Billionbrains Garage Ventures Limited (Groww)

Billionbrains Garage Ventures Limited (Groww) IPO Strengths

Strong and Preferred Brand Presence

Groww is a highly visible and preferred investment brand across Indian cities, towns, and villages. It boasts the highest search interest among the top ten brokers, according to a Redseer report for Fiscal 2025. This popularity is demonstrated by a low-cost, organic customer acquisition rate exceeding 80% and Active Users spanning 98.36% of India’s pin codes.

High Customer Engagement and Price Inelasticity

The company maintains high customer retention and engagement, with 77.70% of three-year cohorts remaining Active Users. Groww successfully deepens customer relationships by providing relevant content and personalized updates. Notably, demand for its products remains resilient despite price increases, as shown by the sustained high share of net new NSE active users after a fee hike in October 2024.

Focus on Customer-Friendly Design

Groww prioritizes a simple, transparent, and swift user experience via its creatively designed platform. The app’s user-friendliness is its most praised feature on Google Play reviews. Its design ethos, which includes using visual cues, clear information hierarchy, and easily accessible support, caters to both new investors and power traders, ultimately enhancing the overall investing experience.

Proprietary and Scalable Technology Stack

The platform is built on a mostly in-house technology stack, enabling the company to rapidly innovate and respond to regulatory changes. This system has high bandwidth, capable of handling approximately 50 million concurrent users and daily orders. Investing in this low-latency technology translates into lower marginal cost of serving incremental customers, enhancing operational efficiency and scale.

Entrepreneurial and Ownership-Driven Culture

Groww is driven by a Promoter-led vision and an entrepreneurial, ownership-driven culture. The organization utilizes lean, cross-functional teams to ensure fast product development and updates. This culture is fostered by an ESOP plan covering over 77% of employees and reinforced by initiatives that immerse teams in customer interactions to ensure the business is always focused on “doing the right thing for the customer.”

Sustainable Growth with Strong Unit Economics

The company’s business model is founded on three principles: customer-first, technology-led, and asset-light. This approach ensures high customer retention and revenue-per-customer while keeping the adjusted cost to operate low and largely fixed. This strategy, characterized by declining operating costs as a percentage of revenue, successfully converts profit into free cash flow for reinvestment and sustained growth.

More About Billionbrains Garage Ventures Limited (Groww)

Billionbrains Garage Ventures Limited, popularly known as Groww, is a leading digital investment platform in India, focused on empowering individuals to build financial assets through capital market investments. Since its inception, Groww has witnessed significant growth, driven by its commitment to a seamless and user-friendly investing experience.

Customer Base

Groww caters to a diverse audience across India, spanning cities, towns, and villages. As of June 30, 2025, the platform served users in 98.36% of Indian pin codes. Its customers are predominantly young, with approximately 45% under 30 years and 21% aged between 31-35. Women represent 3.3 million active users, while professionals, business owners, farmers, housewives, and public sector employees form part of its varied user base.

Customers are classified based on total assets:

- Aspirational Users: Assets under ₹2.5 million, typically younger with smaller initial investments.

- Affluent Users: Assets of ₹2.5 million or more, older, generating higher Average Revenue Per User (AARPU).

Approximately 5.70 million active users engage with more than one product on the platform, reflecting Groww’s ability to expand customer relationships beyond a single investment type.

Growth Trajectory

From Fiscal 2023 to Q1 FY2025, Groww achieved a CAGR of 52.74% in active users. Organic acquisitions via word-of-mouth and referrals remain the primary growth driver, reducing marketing costs and shortening payback periods. Total customer assets grew at a CAGR of 91.09% over the same period, with stocks and mutual funds forming the majority of investments.

Platform Engagement

Groww prioritizes deep customer engagement, providing financial literacy content, blogs, newsletters, and market insights. Users who utilize multiple products demonstrate higher retention and activity levels, with AARPU for multi-product users 1.32x higher than platform averages. Cohort analysis indicates that users generate increasing revenue over time, reflecting the platform’s success in fostering long-term investment relationships.

Revenue Model

The company generates revenue primarily through fees, commissions, and interest on fixed deposits, personal loans, and margin trading facilities. For FY2025, total revenue reached ₹39,017.23 million, with significant contributions from both new and existing users, highlighting the platform’s sustainable growth.

Groww continues to solidify its position as one of India’s highest-rated investment apps, maintaining top rankings on Google Play and the App Store, and remaining a preferred choice for investors seeking simplicity, reliability, and growth.

Industry Outlook

India’s fintech sector is poised for significant expansion, expected to grow from USD 121.4 billion in 2024 to USD 550.9 billion by 2033, reflecting a CAGR of 17.4%. Within this, the online investment platform market is projected to reach USD 362.2 million by 2030, growing at a CAGR of 15.5% between 2023 and 2030.

Growth Drivers

- Digital Infrastructure: Widespread adoption of UPI, Aadhaar, and affordable internet access has democratized financial services, enabling more individuals to participate in digital investments.

- Regulatory Support: Government initiatives and policies continue to encourage innovation, enhance consumer protection, and promote fintech adoption.

- Investor Trends: There is a growing shift toward passive investment strategies, with passive funds’ share in mutual fund assets under management (AUM) more than doubling in recent years.

Key Figures and Trends

- Mutual Fund AUM: India’s mutual fund industry reached a record high of ₹75.19 lakh crore in August 2025, a 12.7% increase from the previous year.

- Equity Inflows: Equity mutual funds saw record inflows of ₹42,702 crore in July 2025, an 81% increase year-over-year.

- Unclaimed Funds: Unclaimed money in mutual funds rose by 21% in FY 2024-25, totaling ₹3,452 crore, indicating growing investor participation and the need for greater awareness.

How Will Billionbrains Garage Ventures Limited (Groww) Benefit

- Groww is well-positioned to capture the expanding fintech market as more individuals adopt digital financial services.

- Rising interest in passive investment strategies aligns with Groww’s mutual fund and portfolio offerings, driving higher customer engagement.

- The growing mutual fund AUM and record equity inflows provide opportunities to expand product offerings and cross-sell additional financial services.

- Its user-friendly platform and educational resources help attract and retain a diverse and young customer base across India.

- Increasing investor participation and awareness create potential for long-term customer relationships, higher transaction volumes, and revenue growth.

- Organic growth through referrals and word-of-mouth reduces customer acquisition costs while improving payback periods.

- Engagement across multiple products enhances Average Revenue Per User (AARPU) and strengthens customer loyalty.

- The platform’s scalability allows it to accommodate growing Total Customer Assets efficiently, supporting sustainable growth.

- Overall industry growth trends provide a favourable environment for Groww to consolidate its market leadership and expand nationwide

Peer Group Comparison

| Name of the company | Face value (₹) | P/E (number of times) | Revenue (₹ in million) | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV(₹) |

| Groww | 2 | TBD | 39,017.23 | 3.34 | 3.19 | 37.57% | 8.89 |

| Peer Group | |||||||

| Domestic Peers | |||||||

| Angel One Limited | 10 | 17.52 | 52,383.79 | 130.05 | 126.82 | 20.85% | 623.72 |

| Motilal Oswal Financial Services Limited | 1 | 22.39 | 83,390.50 | 41.83 | 41.00 | 22.64% | 185.24 |

| 360 One WAM Limited | 1 | 40.98 | 32,950.90 | 27.14 | 26.08 | 14.37% | 188.89 |

| Nuvama Wealth Management Limited | 10 | 23.99 | 41,582.69 | 276.66 | 268.54 | 28.22% | 979.11 |

| Prudent Corporate Advisory Services Limited | 5 | 59.40 | 11,035.61 | 47.25 | 47.25 | 29.30% | 161.25 |

| Global Peers | |||||||

| Robinhood Markets, Inc. | 0.01 | 73.74 | 244,933.00 | 132.80 | 129.48 | 17.70% | 750.95 |

| Interactive Brokers Group, Inc. | 0.83 | 36.77 | 430,355.00 | 580.17 | 575.19 | 17.64% | 3,258.99 |

| Nordnet AB (publ) | N.A | 25.23 | 43,790.30 | 92.31 | 92.23 | 35.45% | 268.47 |

Key Strategies for Billionbrains Garage Ventures Limited (Groww)

Sustain Brand Strength and Market Share

Groww plans to solidify its position as an all-India “pull” brand through focused marketing campaigns centered on trust, inclusivity, and empowerment. This strategy aims to expand its customer base and promote multi-product adoption, which will ultimately yield operating leverage by scaling revenue without a proportional increase in marketing expenses.

Expand Product Offerings and Services

The company intends to introduce new products, services, and features based on customer demand, profitability, and differentiated experience. Recent launches include MTF, commodity derivatives, and API trading. Groww is also developing its “W by Groww” brand for affluent clients, offering wealth management and products like Loans Against Security (LAS) and Bonds.

Continuous Investment in Technology

Groww will continue to invest in its in-house technology stack to provide a seamless investing experience and benefit from operating leverage. A focus remains on speed, scalability, and simplified access. The company is leveraging AI and data analytics for personalized insights and real-time intelligence, while also ensuring technology solutions meet evolving regulatory compliance requirements.

Execute Strategic Acquisitions and Investments

The strategy includes pursuing strategic acquisitions to efficiently introduce new products, enter adjacent businesses, and increase Average Revenue Per User (AARPU). Notable examples include the acquisition of Indiabulls AMC to launch Groww AMC and the planned acquisition of a wealth management firm for “W by Groww.” The company also makes minority strategic investments.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Billionbrains Garage Ventures Limited (Groww) IPO

How can I apply for Billionbrains Garage Ventures Limited (Groww) IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Groww’s IPO?

The IPO includes a fresh issue of ₹1,060 crore and an offer for sale of 57.42 crore shares.

On which stock exchanges will Groww’s shares be listed?

The equity shares are proposed to be listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Who are the lead managers and registrar for the IPO?

Kotak Mahindra Capital Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

What are the objectives of Groww’s IPO proceeds?

Proceeds will fund cloud infrastructure, brand marketing, subsidiaries’ capital, MTF business, acquisitions, and general corporate purposes.

Who are the promoters of Billionbrains Garage Ventures Limited?

Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh are the company’s promoters overseeing strategic direction.