- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

BLS Polymers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

BLS Polymers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

BLS Polymers Limited

BLS Polymers is a prominent manufacturer of custom-formulated polymer compounds serving critical infrastructure sectors including telecommunications, power, railways, water, and oil & gas distribution. Its extensive product range comprises HDPE, MDPE, LLDPE, XLPE, HFFR compounds, PVC, cable filling compounds, and adhesive coating compounds. With a strong presence across 24 states and union territories in India, the company served 113 repeat and 53 new customers in Fiscal 2025. It operates domestically and exports to countries like Bangladesh, Egypt, Oman, Saudi Arabia, Turkey, UAE, USA, and Zambia, with 91.57% revenue from India. The Goa manufacturing facility spans 24,220 sq. ft. and is equipped with advanced machinery.

BLS Polymers Limited IPO Overview

BLS Polymers Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on August 6, 2025, to raise funds through its Initial Public Offer (IPO). The IPO is a book-built issue comprising solely a fresh issue of up to 1.70 crore equity shares, proposed to be listed on NSE and BSE. Unicon Capital Services Pvt. Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar. Key details, including IPO dates, price band, and lot size, are yet to be announced. The IPO will increase the company’s total shares from 4.50 crore pre-issue to 6.20 crore post-issue, with promoters currently holding 98.53% of shares.

BLS Polymers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.70 crore equity shares |

| Fresh Issue | 1.70 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,50,31,834 shares |

| Shareholding post-issue | 6,20,31,834 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

BLS Polymers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

BLS Polymers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.69 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 31.11% |

| Net Asset Value (NAV) | ₹15.09 |

| Return on Equity (RoE) | 36.83% |

| Return on Capital Employed (RoCE) | 25.46% |

| EBITDA Margin | 12.08% |

| PAT Margin | 6.44% |

| Debt to Equity Ratio | 1.11 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Financing the capital expenditure requirement towards expansion of our Manufacturing Facility by increasing the manufacturing capacity of certain of our existing products | 698.4 |

| Funding working capital requirements of our Company | 750 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

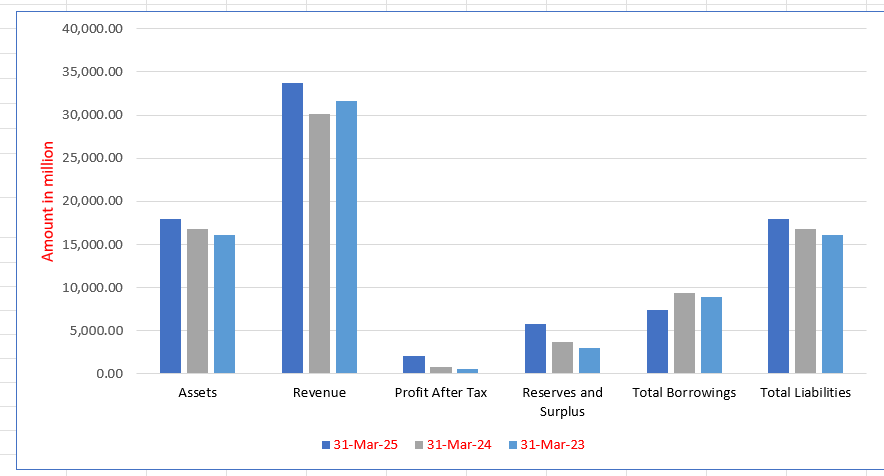

BLS Polymers Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 17,914.16 | 16,848.95 | 16,126.44 |

| Revenue | 33,669.82 | 30,150.44 | 31,677.55 |

| Profit After Tax | 2,113.60 | 752.20 | 624.98 |

| Reserves and Surplus | 5,834.02 | 3,722.55 | 2,965.58 |

| Total Borrowings | 7,392.23 | 9,376.69 | 8,959.97 |

| Total Liabilities | 17,914.16 | 16,848.95 | 16,126.44 |

Financial Status of BLS Polymers Limited

SWOT Analysis of BLS Polymers IPO

Strength and Opportunities

- Only domestic producer and approved supplier of pipe-coating grade polymers.

- Over two decades of expertise in tailor-made polymer compounds

- Broad product portfolio: PE, PVC, XLPE, masterbatches

- In-house formulation, testing, and R&D capabilities

- Serves critical cable segments—power, telecom, automotive, signaling

- Manufacturing aligned with global quality standards

- Strategic headquarters in Delhi ensures administrative reach

- Scope to expand overseas where it already competes with global players

- Opportunity to scale capacity and diversify into related downstream polymers

Risks and Threats

- Heavy reliance on specialized niche products may limit diversification potential

- Dependence on raw material volatility (e.g., PE, PVC) could impact margins

- Scale comparatively modest (capacity ~30,000 MT) may constrain competitiveness

- Geographically concentrated manufacturing (Goa) could be operational risk

- Facing intense competition from global polymer giants in exports

- Market shifts (e.g., new materials or regulations) may disrupt demand

- Emerging alternatives (wireless, non-plastic solutions) threaten core markets

- Dependency on cable industry cycles may affect revenue stability

- Increasing environmental scrutiny and regulatory pressure on plastics

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About BLS Polymers Limited

BLS Polymers Limited IPO Strengths

Pre-Approved Product Portfolio with Government Agencies

BLS Polymers holds pre-approved enlistments for its products with prominent government and public sector enterprises, including a Maharatna and a Navratna CPSE. This rigorous certification process validates the company’s technical competence and product quality, serving as a significant barrier to entry and enabling its participation in critical infrastructure projects across power, telecom, and oil & gas sectors.

Diversified and Differentiated Product Range

The company manufactures a wide array of polymer compounds, offering 127 grades across six product categories. This diversified portfolio serves critical applications in wire & cable insulation and protective pipeline coatings for industries like power, telecommunications, railways, oil, and gas. Such variety allows for deep customer customization and strengthens cross-selling opportunities.

Long-Standing and Loyal Customer Base

BLS Polymers has fostered enduring relationships with a diversified client base, serving 166 customers in Fiscal 2025. A high customer retention rate is evidenced by repeat customers contributing over 93% of recent revenue. This loyalty, built over three decades, demonstrates the company’s commitment to quality, reliability, and meeting stringent customer requirements.

Extensive Pan-India Market Presence

The company boasts a formidable domestic footprint, having sold its products across 24 states and union territories in the last three fiscal years. This widespread geographic reach allows BLS Polymers to effectively serve a broad and diverse customer base, nurture local relationships, and capitalize on regional growth opportunities and infrastructure developments nationwide.

Integrated Product Development Capabilities

BLS Polymers maintains an in-house R&D team dedicated to developing new polymer compositions to meet evolving market demands. This capability has successfully led to the diversification of its product portfolio, including the development and certification of specialized pipe coating adhesives, allowing the company to enter new application areas and value-added markets.

Experienced Leadership and Management Team

The company is guided by promoters and a management team with deep, decades-long expertise in the polymer industry. Their collective knowledge in operations, business development, and sales and marketing enables strategic decision-making, effective customer relationship management, and the ability to capitalize on emerging market opportunities for sustained growth.

More About BLS Polymers Limited

BLS Polymers Limited is a manufacturer of multiple grades of custom-formulated polymer compounds. Its products cater to critical industries such as:

- Telecommunication

- Power

- Railways

- Water

- Oil and Gas distribution

Polymer compounds produced by the company are vital raw materials for sheathing, jacketing, and insulation of wires and cables, as well as for protective coatings of underground pipelines. These compounds safeguard infrastructure from corrosion and harsh environmental factors.

Product Portfolio

The company has a well-diversified product line designed to meet varied industrial requirements. Its portfolio includes:

- PE Compounds (HDPE, MDPE, LLDPE, CFC, HFFR, MB, PP): Used in wire and cable insulation, jacketing, and sheathing.

- XLPE, HFFR, PVC, CFC: Provide strength, fire resistance, moisture resistance, and high-voltage insulation.

- Adhesive Coating Compounds: Integral to the 3LPE coating system for oil, gas, and water pipelines, ensuring durability and corrosion protection.

In total, the company manufactures and sells over 127 grades of compounds.

Revenue Contribution

Over the last three fiscals, revenue has been derived mainly from two divisions:

- Wire and Cables: 81.59% in FY25, 80.49% in FY24, and 94.32% in FY23.

- Industrial Pipelines: 18.41% in FY25, 19.51% in FY24, and 5.68% in FY23.

Product-wise, PE compounds contributed the largest share, followed by XLPE and specialised products.

Market Presence

BLS Polymers has a PAN-India footprint across 24 states/UTs and exports to countries including the USA, UAE, Saudi Arabia, Turkey, Egypt, and Bangladesh. The company has also entered into a distribution agreement in the UAE to further expand its exports in the Middle East and North Africa.

Approvals and Enlistments

According to the CRISIL Report, regulatory enlistment is mandatory in industries such as power transmission and telecommunications. BLS Polymers has secured approvals with Maharatna, Navratna, and Miniratna CPSEs, which:

- Confirm technical competence

- Ensure regulatory compliance

- Establish credibility

- Create significant barriers for new entrants

Strategic Advantage

Backed by the BLS Group, which has over three decades of experience across diverse industries, BLS Polymers benefits from strong brand recognition and group synergies. Guided by experienced promoters and an expert management team, the company continues to strengthen its market position while expanding globally

Industry Outlook

The Indian plastic industry is projected to grow from USD 26.61 billion in 2025 to USD 44.59 billion by 2030, recording a CAGR of 10.9%. Polyethylene remains the dominant product, holding nearly 34% share. India is also witnessing significant petrochemical investments worth USD 87 billion over the next decade, expected to increase production capacity from 30 to 46 million metric tons by 2030.

Plastic Compounding Market

The Indian plastic compounding market stood at USD 4,016 million in 2023 and is forecast to reach USD 7,797 million by 2030, growing at a 9.9% CAGR. Polypropylene dominates the market, while thermoplastic vulcanizates (TPV) are emerging as the fastest-growing segment.

Key Product Outlook

- HDPE (High-Density Polyethylene): Demand projected to grow at 6.8–7.7% CAGR through 2030, reaching around 5,500 thousand tonnes.

- XLPE (Cross-Linked Polyethylene): Expected to grow at a 7.5% CAGR, driven by increasing electrification and infrastructure projects.

- PVC and HFFR Compounds: Growth supported by demand for flame-retardant and eco-friendly products in construction, telecom, and power sectors.

- Polymer Additives: Market expected to rise from USD 100 million in 2024 to USD 230 million by 2033, with a 5.4% CAGR.

Growth Drivers

- Expanding infrastructure and urbanisation fueling wire, cable, and pipeline demand.

- Government initiatives in power transmission, irrigation, and telecom networks.

- Rising environmental regulations encouraging halogen-free and flame-retardant compounds.

- Growth of packaging and consumer industries under the “Make in India” push.

How Will BLS Polymers Limited Benefit

- Rising demand for wires and cables driven by power transmission, electrification, and telecom expansion will directly strengthen BLS Polymers’ market presence.

- Growing adoption of XLPE and HFFR compounds ensures strong demand for specialised products catering to safety and eco-friendly needs.

- Rapid urbanisation and infrastructure projects are creating opportunities in irrigation, housing, and industrial pipelines where HDPE and PVC compounds are key materials.

- The Indian plastic compounding market’s projected 9.9% CAGR ensures steady expansion opportunities for BLS Polymers across diverse end-user sectors.

- Increasing government focus on renewable energy and smart grids is boosting demand for durable, high-performance polymer compounds.

- Expansion in the packaging and consumer goods industry provides an additional revenue stream beyond industrial use.

- With USD 87 billion petrochemical investments increasing raw material availability, BLS Polymers is positioned for cost efficiency and scalability.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ in lakhs) | Basic EPS (₹) | P/E | Return on Net Worth (%) | NAV

(₹) |

| BLS Polymers Limited | 10 | 32,843.59 | 4.69 | [●] | 31.11 | 15.09 |

| Peer Group | ||||||

| Kingfa Science & Technology (India) Ltd | 10 | 1,74,469.06 | 126.21 | 25.41 | 20.98 | 601.61 |

| DDev Plastiks Industries Limited | 1 | 2,60,332.37 | 17.93 | 16.41 | 22.22 | 80.67 |

| Plastiblends India Limited | 5 | 78,045.35 | 12.87 | 14.61 | 7.82 | 164.51 |

Key Strategies for BLS Polymers Limited

Expansion of Production and Global Reach

BLS Polymers Limited plans to expand its manufacturing capacity for PE and XLPE compounds at its Goa facility. This will enable the company to improve production efficiency, meet growing international demand, and capitalize on new growth opportunities in both domestic and international markets.

Product Portfolio Diversification

The company intends to develop new products like semi-conductive compounds, peroxide crosslinkable compounds, and halogen-free flame retardant compounds. By diversifying its product base, BLS Polymers aims to cater to a wider range of end-use industries beyond wires, cables, and infrastructure, ensuring a stable revenue stream.

Global Market Penetration

BLS Polymers aims to deepen its presence in existing international markets like the Middle East and expand into new regions such as Tunisia, Algeria, and Nigeria. The company will leverage strategic partnerships and appoint local sub-agents to enhance market access, diversify its revenue base, and improve profitability.

Strengthening Domestic Customer Relationships

The company plans to increase its share of business with existing domestic customers by offering a broader portfolio of products. BLS Polymers will continue to focus on providing high-quality products at competitive prices and developing new products that align with evolving customer requirements.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On BLS Polymers Limited IPO

How can I apply for BLS Polymers Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When was the DRHP for BLS Polymers Limited IPO filed with SEBI?

The Draft Red Herring Prospectus (DRHP) was filed with SEBI on August 6, 2025.

What is the issue size of BLS Polymers Limited IPO?

The IPO consists of a fresh issue of up to 1.70 crore equity shares.

Where will the shares of BLS Polymers Limited IPO be listed?

The equity shares are proposed to be listed on both NSE and BSE.

How will the company utilise the IPO proceeds?

The proceeds will be used for capacity expansion, working capital requirements, and general corporate purposes.

Who are the promoters of BLS Polymers Limited?

The promoters include Vinod Aggarwal, Sushil Aggarwal, Madhukar Aggarwal, Diwakar Aggarwal, and Karan Aggarwal.