- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

BlueStone Jewellery and Lifestyle IPO

₹14,268/29 shares

Minimum Investment

IPO Details

11 Aug 25

13 Aug 25

₹14,268

29

₹492 to ₹517

NSE, BSE

₹1 Cr

19 Aug 25

BlueStone Jewellery and Lifestyle IPO Timeline

Bidding Start

11 Aug 25

Bidding Ends

13 Aug 25

Allotment Finalisation

14 Aug 25

Refund Initiation

18 Aug 25

Demat Transfer

18 Aug 25

Listing

19 Aug 25

BlueStone Jewellery Limited

BlueStone Jewellery and Lifestyle Limited is engaged in the manufacturing and retailing of diamond, gold, platinum, and studded jewellery under its flagship brand, BlueStone. As of March 31, 2025, the company operates a widespread retail network across India, with 275 stores located in 117 cities across 26 states and union territories, serving over 12,600 PIN codes nationwide. This network includes 200 company-owned outlets and 75 franchisee stores, covering a total retail space of more than 605,000 square feet. BlueStone offers a diverse jewellery portfolio that includes rings, earrings, necklaces, pendants, solitaires, bangles, bracelets, and chains—designed to cater to a broad range of customer preferences and price points. By the same date, the brand had launched 91 themed collections, each comprising jewellery designs crafted around a specific concept or style.

BlueStone Jewellery IPO Overview

The BlueStone Jewellery IPO is a book-built issue amounting to ₹1,540.65 crores, comprising a fresh issue of approximately 1.59 crore equity shares worth ₹820.00 crores and an offer for sale (OFS) of around 1.39 crore shares aggregating to ₹720.65 crores. The IPO will open for subscription on August 11, 2025, and close on August 13, 2025. Allotment of shares is expected to be finalised on August 14, 2025, and the shares are proposed to be listed on both BSE and NSE, with a tentative listing date of August 19, 2025.

The price band for the IPO is fixed between ₹492 and ₹517 per share, with a lot size of 29 shares. For retail investors, the minimum investment required is ₹14,268 for one lot. For small non-institutional investors (sNII), the minimum application is 14 lots (406 shares) amounting to ₹2,09,902, while for big non-institutional investors (bNII), it is 67 lots (1,943 shares) totalling ₹10,04,531.

Axis Capital Limited is acting as the book-running lead manager for the issue, and Kfin Technologies Limited is the appointed registrar.

BlueStone Jewellery IPO Details

| Particulars | Details |

| IPO Date | 11 August 2025 to 13 August 2025 |

| Listing Date | 19 August 2025 |

| Face Value | ₹1 per share |

| Issue Price Band | ₹492 to ₹517 per share |

| Lot Size | 29 Shares |

| Total Issue Size | 2,97,99,798 shares (aggregating to ₹1,540.65 Cr) |

| Fresh Issue | 1,58,60,735 shares (aggregating to ₹820.00 Cr) |

| Offer for Sale | 1,39,39,063 shares (aggregating to ₹720.65 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 13,54,59,637 shares |

| Share Holding Post Issue | 15,13,20,372 shares |

BlueStone Jewellery IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Offer |

| Retail | Not more than 10% of the Offer |

| NII (HNI) | Not more than 15% of the Offer |

BlueStone Jewellery IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 29 | ₹14,993 |

| Retail (Max) | 13 | 377 | ₹1,94,909 |

| S-HNI (Min) | 14 | 406 | ₹2,09,902 |

| S-HNI (Max) | 66 | 1,914 | ₹9,89,538 |

| B-HNI (Min) | 67 | 1,943 | ₹10,04,531 |

BlueStone Jewellery IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 18.28% |

| Post-Issue | 16.07% |

BlueStone Jewellery IPO Valuation Overview

| KPI | Value |

| EPS (Basic) | -79.74 |

| EPS (Diluted) | -79.74 |

| Price/Earnings (P/E) Ratio | — |

| Return on Net Worth (RoNW) | -24.45% |

| Net Asset Value (NAV) | ₹66.94 |

| Return on Equity (ROE) | -34.53% |

| Return on Capital Employed | -3.67% |

| EBITDA Margin | 4.13% |

| PAT Margin | -12.53% |

| Debt to Equity Ratio | 0.80 |

Objectives of the Proceeds

- Funding working capital requirements – ₹750.00 crore

- General corporate purposes

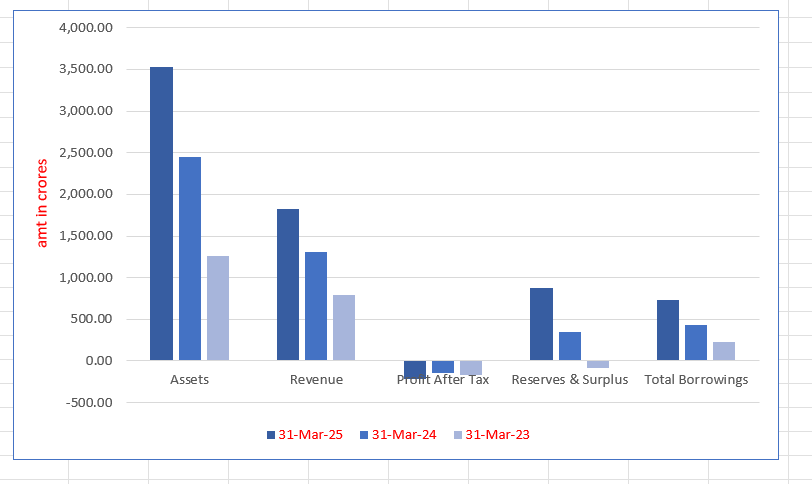

Key Financials (in ₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,532.28 | 2,453.49 | 1,255.49 |

| Revenue | 1,830.04 | 1,303.49 | 787.89 |

| Profit After Tax | -221.84 | -142.24 | -167.24 |

| Reserves & Surplus | 877.12 | 346.28 | -81.06 |

| Total Borrowings | 728.62 | 430.43 | 228.42 |

SWOT Analysis of BlueStone Jewellery and Lifestyle IPO

Strength and Opportunities

- Leading digital-first jewellery brand offering omni-channel retail experience across India.

- Robust in-house technology driving all major operational and retail aspects.

- Strong design innovation with 91 thematic jewellery collections as of March 2025.

- Wide store network across 117 cities including Tier-I, II and III locations.

- Vertically integrated manufacturing ensuring better control over quality and delivery.

- Supported by a professional management team and backed by marquee investors.

Risks and Threats

- Continued losses and negative PAT margins over multiple financial years.

- High debt burden with rising total borrowings.

- Negative return on equity and capital employed, indicating poor shareholder returns.

- Intense competition from established players like Titan, Senco, and Kalyan Jewellers.

- Lack of consistent profitability despite increasing revenue.

- Lower promoter shareholding post-issue may reduce control.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About BlueStone Jewellery Limited

BlueStone Jewellery IPO Strengths

- One of India’s leading digital-first jewellery brands, providing a seamless omni-channel shopping experience.

- Operates on a robust in-house tech platform that powers end-to-end business functions efficiently.

- Follows a distinctive product and design philosophy that sets it apart from competitors.

- Equipped with advanced manufacturing infrastructure and a fully integrated operational model.

- Maintains a strong retail presence across Tier-I, II, and III cities with sound unit-level economics.

- Led by its founder and supported by an experienced management team, with backing from marquee investors.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| BlueStone Jewellery & Lifestyle | -79.74 | -79.74 | 66.94 | — | -24.45% | — |

| Peer Groups | ||||||

| Titan Company | 37.62 | 37.61 | 130.93 | 88.14 | 28.71% | 25.50 |

| Kalyan Jewellers India | 6.93 | 6.93 | 46.57 | 84.10 | 14.87% | 12.65 |

| Senco Gold | 10.09 | 10.08 | 120.37 | 31.17 | 8.09% | 2.62 |

| Thangamayil Jewellery | 42.00 | 42.00 | 354.66 | 45.47 | 11.07% | 5.39 |

| PC Jeweller | 1.13 | 0.66 | 9.46 | 22.70 | 9.33% | 1.67 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On BlueStone Jewellery IPO

How can I apply for BlueStone Jewellery IPO?

You can apply via HDFC Sky using UPI through the ASBA facility.

What is the minimum investment for BlueStone Jewellery IPO?

Minimum investment for retail investors is ₹14,993 for 29 shares.

When will BlueStone Jewellery IPO shares list on exchanges?

Shares are expected to list on BSE and NSE on 19 August 2025.

What is the price band for BlueStone Jewellery IPO?

The IPO price band is ₹492 to ₹517 per equity share.