- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

BMW Ventures IPO

₹14,194/151 shares

Minimum Investment

IPO Details

24 Sep 25

26 Sep 25

₹14,194

151

₹94 to ₹99

NSE, BSE

₹231.66 Cr

01 Oct 25

BMW Ventures IPO Timeline

Bidding Start

24 Sep 25

Bidding Ends

26 Sep 25

Allotment Finalisation

29 Sep 25

Refund Initiation

29 Sep 25

Demat Transfer

30 Sep 25

Listing

01 Oct 25

BMW Ventures Limited

Incorporated in 1994, BMW Ventures Limited has built a strong presence in steel distribution across various regions of Bihar, India. The company boasts an extensive dealer network and has expanded into manufacturing PVC pipes, pre-engineered buildings, and steel girders. Its focus on the infrastructure, construction, and automotive sectors drives sustained demand for its products.It deals in various steel products like TMT bars, GI sheets, HR sheets, Wire rods, Galvanized Color Coated sheets, Doors, GP sheets, Pipes, Hollow Sections, Screws, and more. Under the leadership of seasoned promoters like Bijay Kumar Kishorepuria, BMW Ventures has demonstrated resilience and growth, adapting through market fluctuations.

BMW Ventures Limited IPO Overview

BMW Ventures IPO is a book-built issue worth ₹231.66 crores, comprising a fresh issue of 2.34 crore shares. The IPO will open for subscription on September 24, 2025, and close on September 26, 2025. The basis of allotment is expected to be finalized on September 29, 2025, with the company’s shares scheduled to list on both BSE and NSE on October 1, 2025. The price band for the IPO has been set between ₹94 and ₹99 per share. Investors can apply with a minimum lot size of 151 shares, requiring an investment of ₹14,949 at the upper price band. For non-institutional investors, the lot size investment stands at 14 lots (2,114 shares) amounting to ₹2,09,286 for sNII, and 67 lots (10,117 shares) amounting to ₹10,01,583 for bNII. The book running lead manager of the issue is Sarthi Capital Advisors Pvt. Ltd., while Cameo Corporate Services Ltd. is serving as the registrar. According to the DRHP filed with SEBI, the net proceeds from the IPO will primarily be allocated toward funding the company’s working capital needs (approximately Rs 17,500 lakh) and general corporate purposes.

Post-IPO, promoter Nitin Kishorepuria’s stake will reduce from 27.79% to 20.29%, while the stakes of Sabita Devi, Rachna, and Bijay Kumar Kishorepuria will decrease to 6.69%, 5.15%, and 4.57%, respectively.

The firm plans to allocate shares to Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs). According to the prospectus, no more than 50% of the total issue will be designated for QIBs, while at least 35% will be reserved specifically for retail investors. Additionally, a portion of the offering will be made available to domestic mutual funds.

BMW Ventures Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 2,34,00,000 shares (aggregating up to ₹231.66 Cr) |

| Offer for Sale: NIL | |

| IPO Dates | 24 September 2025 to 26 September 2025 |

| Price Bands | ₹94 to ₹99 per share |

| Lot Size | 151 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 6,33,15,000 shares |

| Shareholding Post Issue | 8,67,15,000 shares |

BMW Ventures IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 151 | ₹14,949 |

| Retail (Max) | 13 | 1,963 | ₹1,94,337 |

| S-HNI (Min) | 14 | 2,114 | ₹2,09,286 |

| S-HNI (Max) | 66 | 9,966 | ₹9,86,634 |

| B-HNI (Min) | 67 | 10,117 | ₹10,01,583 |

BMW Ventures IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

BMW Ventures Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.73 (Basic) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 16.03% |

| Net Asset Value (NAV) | 29.49 |

| Return on Equity (ROE) | 16.03% |

| Return on Capital Employed (ROCE) | 17.32% |

| EBITDA Margin | 3.74% |

| PAT Margin | 1.54% |

| Debt to Equity Ratio | 2.12 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding working capital requirements of the company | 17500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

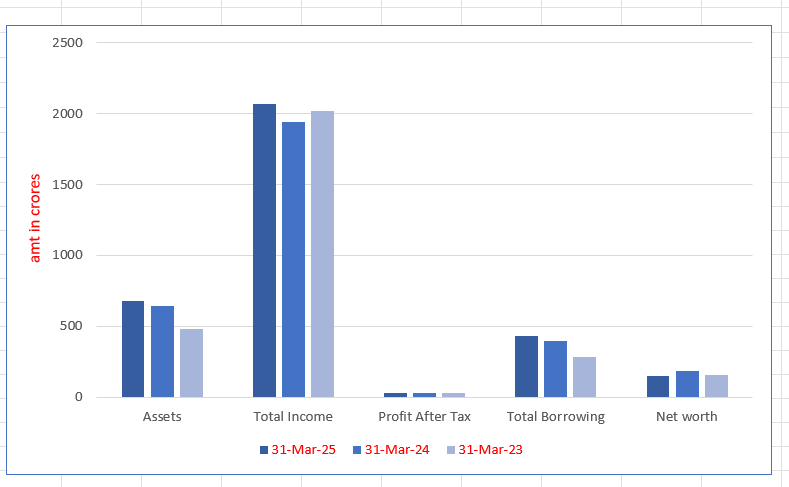

BMW Ventures Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 676.09 | 646.15 | 481.79 |

| Total Income | 2,067.33 | 1,942.03 | 2,018.12 |

| Profit After Tax | 32.82 | 29.94 | 32.66 |

| Total Borrowing | 428.39 | 395.30 | 283.50 |

| Net worth | 146.80 | 186.71 | 156.48 |

SWOT Analysis of BMW Ventures IPO

Strength and Opportunities

- BMW Ventures holds exclusive distribution rights for long and flat steel products, reaching over 900 dealers in Bihar. This strong network secures a solid customer base, boosting market penetration and long-term growth prospects.

- BMW Ventures captures about 20% of Bihar’s TMT bar market as of fiscal 2023, showing significant regional influence and financial resilience.

- Focus on quality control, quick turnarounds, and customized customer solutions enhances reputation and competitive edge through reliable service.

- Expansion opportunities beyond Bihar could reduce dependency on one state, enabling BMW Ventures to enter new markets, increase market share, and build a more resilient business.

Risks and Threats

- The company is heavily dependent on a single primary supplier, making it vulnerable to supply disruptions that could impact production and profitability.

- Raw material price volatility and global supply-demand shifts pose risks to margins, requiring strategic management of resources to maintain profitability.

- Heavy reliance on third-party manufactured products creates revenue dependency; a decline in demand from major intermediaries could impact sales and profitability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About BMW Ventures Limited

BMW Ventures Limited IPO Strengths

Healthy Financial Risk Profile

As of March 31, 2023, the company’s net worth was estimated at a robust ₹156 crore, which underpins its capital structure. The gearing ratio was approximately 1.8 times in fiscal 2023, with a total outside liabilities to a total net worth ratio of 2.1 times.

Diverse Product Range

The company boasts an extensive product portfolio that includes everything from Tata Steel products to John Deere tractors. This diversity enables it to meet the varied demands of customers and dealers effectively.

Comprehensive Sales and Distribution Network

The company has established a wide-ranging sales and distribution network that serves a diverse customer base in Bihar. It leverages dedicated sales and marketing teams to enhance its marketing arrangements and reach.

Strong Industry Relationships

The company’s customer base spans multiple industries, including agriculture and real estate. Major customers are identified based on the sales value of the products supplied over the past year.

Expansion into Manufacturing

The company has diversified into manufacturing pre-engineered building solutions and has set up a registered manufacturing unit to support this initiative.

Land Bank for Future Growth

The company maintains a land bank that positions it for future expansion opportunities, further enhancing its operational capabilities and market presence.

More About BMW Ventures Limited

Founded in 1994, BMW Ventures Limited has established itself as a key player in the steel industry, specializing in the manufacturing and distribution of various steel products. The company operates a strong distribution network across 29 out of 38 districts in Bihar, with over 900 dealers. BMW Ventures also operates four stockyards, with three located in Patna and one in Purnea, to streamline product distribution.

Diverse Product Portfolio

- Steel Products: BMW Ventures’ primary focus is on manufacturing and distributing steel products, where it has built a robust market presence. The company’s network and infrastructure allow it to deliver quality products across Bihar.

- Pre-Engineered Buildings (PEB): The company has expanded into manufacturing pre-engineered buildings, offering solutions suited to industrial and commercial warehousing needs. These structures are designed for quick installation and high durability, supporting growth in warehousing and factory development.

- Steel Girders: BMW Ventures is the first company in Bihar to receive Research Design and Standards Organization (RDSO) approval for its steel girder manufacturing unit, enabling it to supply essential steel components to Indian Railways for bridge construction projects.

- PVC Pipes and Coloured Sheets: In addition to its steel products, BMW Ventures produces polyvinyl chloride (PVC) pipes and colored sheets on a small scale. These products further diversify its offerings and cater to the region’s construction needs.

Tractor Engine Distribution

The company has diversified into the distribution of tractor engines and spare parts, providing these products to dealers across its established network. Tractor engine distribution contributed 0.89%, 1.24%, and 2.07% to the company’s Revenue from Operations in fiscal years 2024, 2023, and 2022, respectively. This revenue stream supports BMW Ventures’ overall business resilience and market reach.

Business Segments Overview

- Marketing and Distribution: BMW Ventures markets and distributes steel products, tractors, and tractor spare parts across Bihar.

- Pre-Engineered Steel Sheds and Units: The company manufactures pre-engineered sheds and units for use in warehousing and factory settings, fulfilling demand in the infrastructure sector.

- Steel Girders for Railways: Through its RDSO-approved facility, BMW Ventures fabricates steel girders specifically designed for railway bridge construction, meeting stringent industry standards.

- PVC and Coloured Sheets Manufacturing: As a complementary product line, the company manufactures and trades PVC pipes and coloured sheets to support the local construction industry, offering additional value to its customers.

Industry Outlook

Domestic steel demand has experienced a notable compound annual growth rate (CAGR) of 5.7% from fiscal years 2018 to 2023. During the period from fiscal 2018 to 2020, the industry maintained a consistent CAGR of 5.1%. However, in fiscal 2021, the sector encountered a 5.3% decline year-on-year due to the impact of the pandemic.

Demand rebounded in fiscal 2022, growing by 11.4% year-on-year, fuelled by a resurgence in industrial activities, the release of pent-up demand, and growth in key end-use sectors. Overall, steel demand surged from 90.7 million tonnes (MT) in fiscal 2018 to 119.9 MT in fiscal 2023, marking a 13.4% increase.

This growth is attributed to an expected CAGR of approximately 6.5-7.5% by fiscal 2028, projecting a rise to between 164.3 and 172.1 MT, driven by sectors such as automobile, infrastructure, and construction, despite the market volatility experienced during the pandemic.

Key Growth Drivers:

- Government Initiatives and Investment: Schemes like ‘Make in India,’ the Pradhan Mantri Awas Yojana (PMAY), and the National Steel Policy aim to boost steel production to 300 million tonnes by 2030 and attract investments to improve domestic production capacity.

- Urbanisation and Smart City Development: Urbanisation trends are creating a surge in demand for housing, industrial projects, and urban infrastructure, fuelling demand for quality steel products for construction.

- Transportation and Railways Expansion: Significant investments are planned in railway infrastructure, roadways, and bridges, offering opportunities for steel manufacturers, especially those approved by the Research Designs & Standards Organisation (RDSO) for producing girders and construction materials.

How Will BMW Ventures Limited Benefit?

- BMW Ventures benefits from rising steel demand with exclusive distribution and 900+ dealers in Bihar, expanding its market reach.

- Its RDSO-approved facility enables steel girder supply for railways, capitalizing on infrastructure and high-speed rail growth.

- Growing warehousing and factory needs boost BMW Ventures’ pre-engineered buildings segment, driven by e-commerce and supply chain upgrades.

- Diversification into PVC pipes and tractor engine distribution broadens revenue streams, supported by infrastructure and rural development projects.

Peer Group Comparison

| Companies | Face Value (₹) | Sales (₹ in Lakhs) | PAT (₹ in Lakhs) | EPS (₹) | P/E Ratio | RoNW (%) |

| BMW Ventures Limited | 10 | 194,203.15 | 2,993.54 | 4.73 | – | 16.03% |

| Peer Groups | ||||||

| Shiv Aum Steel Limited | 10 | 54,952.00 | 1,017.00 | 7.48 | 39.30 | 9.60% |

Key Strategies for BMW Ventures Limited

Diversification into Fabrication

The company has diversified its operations to include the fabrication of pre-engineered building solutions. It has also successfully set up a facility, officially registered and approved by the Research Design and Standards Organization (RDSO), for the production of Composite & Other Steel Plate Girder. Both fabrication units are located inPurnea. Leveraging its experience and fabrication capabilities, the company aims to deliver superior steel girder solutions to the market. The company’s dedication to quality, adherence to industry standards, and commitment to strengthening partnerships will drive its growth, enabling it to leverage its expertise, resources, and market insights to expand its footprint and capture new market segments.

Increase in the distribution of Steel Products in Bihar

The company intends to increase the size of its distribution network in Bihar, where it maintains an advantage as a sole distributor of Primary Supplier in the state. By expanding its distribution network and reaching other districts of Bihar, the company aims to increase its market presence. Currently, the company is present in 29 districts out of 38.

Achieving Economies of Scale

The company has expanded its operations into the fabrication of Pre-Engineered Steel Buildings and Steel Girders. This move positions the company favorablе in terms of sourcing primary raw materials, which will be readily available at a cost-effective price. Leveraging its core business as the distributor of Steel Products, integral to the production of Pre-Engineered Steel Buildings and Steel Girders, affords the company an advantage in the procurement of raw materials and facilitates the realization of economies of scale. This arrangement is controlled to enhance the company’s overall operational efficiency and competitiveness in the market.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On BMW Ventures IPO

How can I apply for the BMW Ventures IPO?

You can apply through stockbrokers or online trading platforms, using ASBA (Application Supported by Blocked Amount) to block funds.

What is the issue price of the BMW Ventures IPO?

The issue price of the BMW Ventures IPO is ₹94 to ₹99 per share.

What is the lot size for the BMW Ventures IPO?

The lot size of BMW Ventures IPO is 151 Shares.

Who are the promoters and management team behind BMW Ventures?

The prospectus will list details about the promoters, key executives, and their experience in real estate and infrastructure.