- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Bombay Coated & Special Steels IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Bombay Coated & Special Steels IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Bombay Coated & Special Steels Limited IPO

Bombay Coated & Special Steels is a leading steel processing centre in India, specialising in converting steel coils into high-quality products such as slit coils, blanks, and sheets through slitting, cut-to-length, shearing, and embossing. Its products serve OEMs and ODMs across industries including home and commercial appliances and general engineering sectors like automotive components and ventilation systems. An authorised service partner of JSW Steel since 2021, the company sources steel from multiple suppliers and processes it with modern machinery. Its units in Wada, Bhiwandi, Ghiloth, and Sricity span 42,209 sq. meters, with the Rajasthan facility GEM 4-certified for green manufacturing, supporting an installed capacity of 350,411 MTPA.

Bombay Coated & Special Steels Limited IPO Overview

Bombay Coated & Special Steels Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 26, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a book-built issue comprising a fresh issue of up to 1.50 crore equity shares, which are proposed to be listed on the NSE and BSE. Smart Horizon Capital Advisors Pvt. Ltd. is the book running lead manager, while Kfin Technologies Ltd. is the registrar. Key details such as the IPO dates, price band, and lot size are yet to be announced. The issue, with a face value of ₹10 per share, will increase the company’s shareholding from 3,95,99,920 pre-issue shares to 5,45,99,920 post-issue shares. The promoters—Vijaykumar Himatrai Gupta, Nitin Vijaykumar Gupta, and Bhawna Nitin Gupta—currently hold 100% of the company, with their post-IPO holding to be updated accordingly.

Bombay Coated & Special Steels Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | 1.50 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,95,99,920 shares |

| Shareholding post-issue | 5,45,99,920 shares |

Bombay Coated & Special Steels IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Bombay Coated & Special Steels Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Bombay Coated & Special Steels Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.2 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 41.76% |

| Net Asset Value (NAV) | ₹34.54 |

| Return on Equity (RoE) | 41.76% |

| Return on Capital Employed (RoCE) | 18.78% |

| EBITDA Margin | 7.02% |

| PAT Margin | 2.72% |

| Debt to Equity Ratio | 3.33 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or in part, of certain borrowings availed by our Company | 1200 |

| Financing the cost towards acquisition of capital equipment under existing lease arrangements with Siemens Financial Services Private Limited; and | 150 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

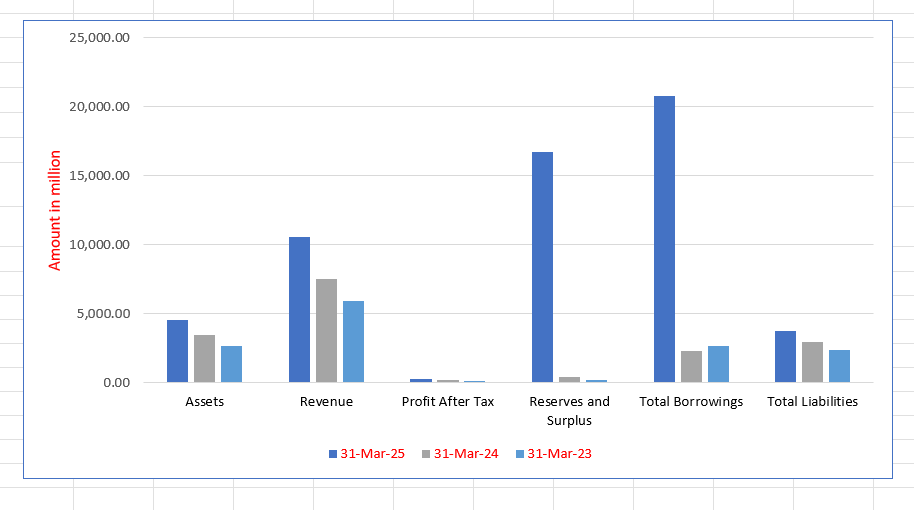

Bombay Coated & Special Steels Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,582.05 | 3,502.08 | 2,707.26 |

| Revenue | 10,557.07 | 7,552.59 | 5,908.75 |

| Profit After Tax | 286.72 | 211.38 | 156.66 |

| Reserves and Surplus | 16,731.47 | 444.59 | 233.44 |

| Total Borrowings | 20,769.61 | 2,341.61 | 2,686.33 |

| Total Liabilities | 3,751.58 | 2,958.50 | 2,382.82 |

Financial Status of Bombay Coated & Special Steels Limited

SWOT Analysis of Bombay Coated & Special Steels IPO

Strength and Opportunities

- Established expertise in slitting and cut-to-length steel processing.

- Advanced automated lines with precision tolerances of ±0.1mm.

- Strategic plant locations in Maharashtra, NCR, and Andhra Pradesh.

- Strong focus on quality control and fast turnaround times.

- Capacity to process high volumes, including 48,000 MT of embossed PPGI.

- In-house fleet for just-in-time delivery, enhancing customer satisfaction.

- Commitment to innovation in steel processing technologies.

- Upcoming IPO indicates growth aspirations and potential capital infusion.

- Strong financial growth with increasing EBITDA and net worth.

Risks and Threats

- Limited brand recognition outside core industrial regions.

- Dependence on a few key customers in automotive and appliance sectors.

- Relatively short operational history since incorporation in 2019.

- Exposure to fluctuations in raw material prices and steel demand cycles.

- Potential vulnerability to supply chain disruptions affecting steel inputs.

- Limited geographic presence outside India, restricting international market reach.

- Challenges in scaling operations to meet increasing market demand.

- Intense competition from larger, established steel processing firms.

- Risks associated with regulatory changes in the manufacturing sector.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Bombay Coated & Special Steels Limited

Bombay Coated & Special Steels Limited IPO Strengths

Established Supplier Relationship with JSWCPL

The company maintains an authorized service partnership with JSW Steel Coated Products Limited (JSWCPL) since 2021, ensuring a reliable, consistent supply of galvanized, color-coated, and galvalume steel coils. This arrangement, including technical support and joint quality control, strengthens their supply chain, enhances product quality, and boosts their market credibility among OEMs/ODMs.

Strategic Location of Manufacturing Facilities

Bombay Coated & Special Steels Limited operates four strategically located processing centers in Wada, Bhiwandi, Ghiloth, and Sri City. Their proximity to major OEM/ODM manufacturing hubs across Western, Northern, and Southern India facilitates just-in-time delivery, offering significant logistical agility and cost competitiveness for the business and its customers.

High Precision Manufacturing Operations

The company utilizes an existing setup with high-precision slitting, cut-to-length, shearing, and embossing lines procured from global and domestic suppliers. All facilities are ISO 9001:2015 certified, demonstrating a technological edge in processing various steel coils into custom-sized products, meeting the stringent dimensional and quality specifications of the appliances and general engineering sectors.

Long-Term Relationships with Key Customers

The company has built long-standing relationships with 252 customers, including major OEMs and ODMs like Haier and Dixon, achieving repeat orders from over 90% of its clientele annually. This customer-centric approach, based on precision products, tailored solutions, and just-in-time delivery, provides the company with strong revenue visibility and industry goodwill.

High Industry Entry Barriers

Bombay Coated & Special Steels Limited benefits from high barriers to entry stemming from its established supplier arrangements, particularly with JSWCPL. Moreover, the industry requires substantial capital investment in specialized, geographically dispersed facilities and requires navigating lengthy vendor qualification and quality audit cycles from major OEM/ODM customers, protecting its market position.

Experienced Promoters and Management Team

The company is led by Promoters with up to four decades of experience in steel trading and processing, bringing deep industry knowledge and established relationships. This expertise, combined with a professional management team skilled in operations, technology, and finance, positions the company to effectively manage current growth and execute future expansion plans.

More About Bombay Coated & Special Steels Limited

Bombay Coated & Special Steels Limited (BCSSL) is one of India’s prominent steel processing centres, specialising in converting Steel Coils into a wide range of Processed Steel Products. The company’s core expertise lies in slitting, cut-to-length, shearing, and embossing, producing slit coils and blanks/sheets that cater to both Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs). These products are engineered to precise technical specifications, enabling their application across diverse industries.

Industry Applications

BCSSL’s Processed Steel Products find extensive use in the Home and Commercial Appliances sector, including air conditioners, refrigerators, washing machines, and water heaters. In the General Engineering sector, the products are applied in the manufacture of automotive components, pharmaceutical cleanrooms, electrical components, and air ventilation systems.

Role as a Steel Processing Centre

As a Steel Processing Centre (SPC), BCSSL acts as a vital intermediary between steel producers and end-users, providing value-added services such as:

- Precision slitting and cut-to-length processing

- Shearing and embossing of steel coils

- Processing of coated and non-coated steel coils for varied industrial applications

- Efficient inventory management and just-in-time delivery

The company maintains strong supplier relationships, including an authorised service partnership with JSW Steel Coated Products Limited (JSWCPL) since 2021, ensuring stable sourcing and reliable supply to customers.

Manufacturing Facilities

BCSSL operates modern processing facilities across India, strategically located in the West, North, and South. These facilities cover 42,209 square meters and are ISO 9001:2015 certified, while the Ghiloth facility in Rajasthan is recognised as a GEM 4-certified green facility. Each facility is equipped with:

- Slitting lines

- Cut-to-length lines

- Shearing lines

- Embossing lines

Operations may function independently or in an integrated cycle depending on customer requirements.

Capacity and Growth

As of March 31, 2025, BCSSL’s installed capacity of 350,411 MTPA is utilised efficiently across all processes, achieving a 63–74% utilisation. With a robust 18% CAGR between FY 2023 and FY 2025 and a longstanding partnership with JSWCPL, the company is well-positioned for continued growth and leadership in the steel processing sector.

Industry Outlook

The Steel Processing Centre (SPC) industry in India is witnessingstrong growth, driven by rising steel consumption across automotive, construction, infrastructure, consumer durables, and general manufacturing sectors. SPCs act as a critical intermediary between steel producers and end-users, offering services such as slitting, cut-to-length, blanking, splitting, inventory management, and timely distribution. These services enable industries to access steel in precise forms and quantities, optimising supply chains and reducing waste.

India’s increasing focus on just-in-time (JIT) delivery systems, particularly in the automotive sector, has further reinforced the importance of SPCs. Continuous production lines rely on the timely supply of high-quality steel, making customised processing services indispensable. By eliminating the need for large-scale in-house processing investments, SPCs improve operational efficiency and productivity for manufacturers.

Growth of Key Service Segments:

- Cut-to-Length: Grew at a CAGR of 8.8% from CY20 to CY24 (USD 1,605 million), projected to reach USD 2,437 million by CY30 (CAGR 7.2%).

- Slitting: Grew at a CAGR of 9.1% (USD 1,405 million), expected USD 2,184 million by CY30 (CAGR 7.6%).

- Blanking: Grew at 9.2% CAGR (USD 836 million), projected USD 1,303 million by CY30 (CAGR 7.7%).

- Splitting: Grew at 9.3% CAGR (USD 355 million), expected USD 554 million by CY30 (CAGR 7.7%).

Key Growth Drivers:

- Rising demand from construction, automotive, and consumer appliance sectors.

- Technological advancements in steelmaking and processing.

- Increased utilisation of steel across engineering, energy, and biotech sectors.

- Expansion of local manufacturing and industrialisation in India.

- Growth in the consumer electronics and appliances sector, driving demand for high-quality steel components.

With these dynamics, the SPC industry is poised for continued growth, supporting India’s industrial ecosystem while creating opportunities for companies like Bombay Coated & Special Steels Limited.

How Will Bombay Coated & Special Steels Limited Benefit

- Increased demand across automotive, construction, and consumer appliance sectors will expand the company’s market opportunities.

- Growth in key service segments such as cut-to-length, slitting, blanking, and splitting enables BCSSL to capture higher revenue from specialised steel processing.

- Rising adoption of just-in-time (JIT) delivery systems enhances BCSSL’s value proposition, leveraging its efficient inventory management and timely distribution capabilities.

- Technological advancements in steel processing allow BCSSL to improve operational efficiency and reduce production costs.

- Expansion of local manufacturing and industrialisation increases demand for processed steel products in regional markets.

- Growth of the consumer electronics and appliances sector drives need for high-quality steel components, aligning with BCSSL’s core product offerings.

- The company’s strategic partnerships with JSW Steel Coated Products Limited ensure stable raw material supply to meet rising industry demand.

- Enhanced focus on customised solutions allows BCSSL to differentiate itself from competitors and strengthen client relationships.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Bombay Coated & Special Steels Limited

Ghiloth Facility Expansion

The company is expanding its Ghiloth Facility by acquiring adjoining land and installing an additional cut-to-length line. This investment is designed to enhance overall throughput capacity, reduce customer lead times, and secure a larger market share by improving operational efficiency and service delivery in the Northern region.

Debt Reduction and Profile Improvement

Bombay Coated & Special Steels Limited proposes to utilize ₹1,200 million from net proceeds to fully or partially repay certain borrowings. This strategy is expected to reduce outstanding debt, lower servicing costs, improve the Return on Capital Employed (ROCE), and enhance future financial flexibility for strategic growth investments.

Diversify and Expand Market Reach

To mitigate seasonal demand fluctuations, the company intends to increase supply of processed steel to the water heater, washing machine, and General Engineering sectors. This diversification strategy aims to broaden the customer base, improve capacity utilization, reduce reliance on core appliance segments, and enhance long-term profitability.

Sustained Capacity Expansion

To leverage the steel service industry’s projected growth, the company plans to continuously expand its existing processing capacities. This initiative is designed to efficiently meet evolving customer demands, improve capacity utilization across its four facilities, and generate operational efficiencies through economies of scale.

Enhance Operational Efficiency and Cost Management

The company focuses on improving profitability through scale and process efficiencies, including yield optimization and lean inventory management. Key initiatives involve logistics rationalization and installing a 500 KWP solar rooftop plant at the Wada Facility to significantly reduce energy costs and improve cost competitiveness.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Bombay Coated & Special Steels Limited IPO

How can I apply for Bombay Coated & Special Steels Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Bombay Coated & Special Steels Ltd. IPO?

It is a book building IPO to raise funds through a fresh issue of 1.50 crore shares.

When will the IPO be listed?

The equity shares are proposed to be listed on both NSE and BSE; listing dates are yet to be announced.

Who are the lead managers and registrar for the IPO?

Smart Horizon Capital Advisors Pvt. Ltd. is the lead manager, and Kfin Technologies Ltd. is the registrar.

What will the IPO proceeds be used for?

Funds will repay borrowings, finance capital equipment acquisition, and support general corporate purposes.

What is the face value and issue size of the IPO?

The face value is ₹10 per share, with a total issue of 1.50 crore equity shares.