- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Bonbloc Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Bonbloc Technologies IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Bonbloc Technologies Limited

Bonbloc Technologies Limited is an AI-native enterprise technology firm that creates next-generation AI-powered SaaS and IoT solutions focused on intelligence, safety, and compliance. Serving both B2B and B2G sectors, it offers services in application development, business intelligence, cloud, cybersecurity, and compliance—particularly in supply chain and food safety. Its Onelign platform provides AI-SaaS solutions like Onelign Traceability, Food Compliance, and iBOTZ for digital trust, transport, and monitoring. Operating in India and the USA, the company serves 46 clients and owns two subsidiaries specialising in AI and digital transformation.

Bonbloc Technologies Limited IPO Overview

Bonbloc Technologies Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 28, 2025, to raise funds through an Initial Public Offer (IPO). The proposed IPO will be a Book-Build Issue, comprising a fresh issue of shares worth ₹230 crore and an offer for sale (OFS) of up to 3 crore equity shares. The company plans to list its equity shares on both the NSE and BSE. While the book-running lead manager is yet to be announced, Kfin Technologies Ltd. has been appointed as the registrar of the issue. Key details such as the IPO opening and closing dates, price band, and lot size are yet to be disclosed.

According to the DRHP, the IPO will include a fresh issue aggregating up to ₹230 crore and an OFS of 3 crore equity shares of ₹1 each. The face value of each share is ₹1, and the issue type will follow the book-building process. The company currently has a pre-issue shareholding of 19,31,86,380 shares. Bonbloc Technologies’ DRHP was officially filed with SEBI on September 28, 2025.

The promoters of the company are Durai Appadurai, Sourirajan, and Bonbloc Inc., who collectively hold 97.49% of the company’s shares before the issue. The post-issue promoter holding details are yet to be confirmed. For more comprehensive information, investors can refer to the Bonbloc Technologies IPO DRHP document.

Bonbloc Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹230 crore |

| Offer for Sale (OFS) | 3 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 19,31,86,380 shares |

| Shareholding post-issue | TBA |

Bonbloc Technologies Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Bonbloc Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Bonbloc Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.78 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 68.17% |

| Net Asset Value (NAV) | ₹2.58 |

| Return on Equity (RoE) | 68.17% |

| Return on Capital Employed (RoCE) | 118.82% |

| EBITDA Margin | 43.59% |

| PAT Margin | 32.31% |

| Debt to Equity Ratio | 0.01 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in the development of the products and platforms; | 1360.2 |

| Purchase of laptops | 129.2 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

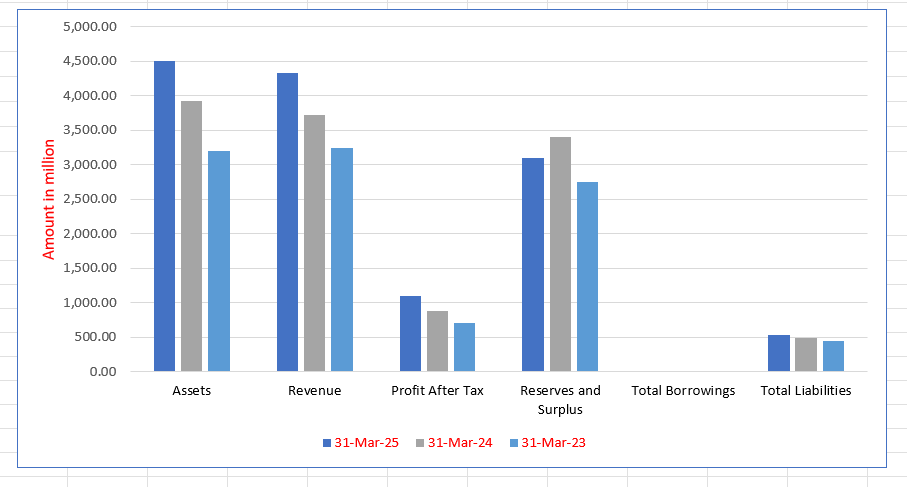

Bonbloc Technologies Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 695.27 | 115.00 | 46.36 |

| Revenue | 1,033.72 | 372.32 | 198.12 |

| Profit After Tax | 334.87 | 54.17 | 21.07 |

| Reserves and Surplus | 489.98 | 84.36 | 27.81 |

| Total Borrowings | 6.12 | 0.00 | 0.00 |

| Total Liabilities | 204.03 | 29.39 | 17.30 |

Financial Status of Bonbloc Technologies Limited

SWOT Analysis of Bonbloc Technologies IPO

Strength and Opportunities

- Strong foundation in AI, IoT, blockchain, and data science enabling advanced solutions.

- Clear positioning in B2B and B2G markets, enabling large-scale enterprise and institutional engagements.

- Holds key certifications such as ISO 9001, ISO 27001, ISO 20000-1, and CMMI, reflecting operational excellence.

- Focused on high-growth sectors such as supply chain traceability, food safety, and compliance technology.

- Expanding infrastructure with new development hubs indicates strong geographic growth potential.

- Rising global demand for digital transformation, cloud, and cybersecurity solutions provides growth opportunities.

- Proven success with enterprise clients through measurable results in compliance and traceability projects.

- Customisable services like ERP, cloud engineering, and digital solutions support long-term client retention.

- Planned IPO and capital infusion present opportunities for innovation, diversification, and global reach.

Risks and Threats

- Heavy reliance on emerging technologies that demand high R&D investment and carry execution risk.

- Operates in a niche segment, which may limit audience reach and growth speed.

- Faces scalability and brand recognition challenges when compared to large global competitors.

- Rapid technological change and evolving regulations may render current solutions obsolete if innovation slows.

- Expansion brings operational complexity, increased costs, and higher resource management risks.

- Intense competition from established global and domestic tech companies could pressure margins.

- Dependence on a few key clients or industry segments may create revenue concentration risks.

- Custom service delivery may limit scalability compared to standardised product-based offerings.

- Market volatility or unfavourable IPO conditions could impact valuation and investor sentiment.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Bonbloc Technologies Limited

Bonbloc Technologies Limited IPO Strengths

Focused AI-SaaS Product Innovation

Bonbloc Technologies Limited excels in focused product innovation, delivering end-to-end tailored AI-SaaS solutions through its flagship Onelign platform. These solutions, built with blockchain, AI, and IoT, include platforms for Digital Trust, public transportation, and smart environment monitoring. This approach provides customers with full value chain visibility and real-time data tracking for complex operational and regulatory challenges.

Driving Innovation Across Emerging Technologies

The company showcases constant innovation through its Onelign platform, which unifies blockchain, AI, ML, IoT, and data analytics in a modular, cloud-based architecture. This design effectively serves both enterprise and government clients by enabling use cases like end-to-end supply chain traceability and recall management. Bonbloc’s focus on edge data management and tangible benefits positions it to capture opportunities in high-growth technology markets.

Advanced Regulatory and Compliance Alignment

A core strength is the regulatory alignment and compliance orientation of its platforms. Onelign is specifically engineered for highly regulated sectors, such as pharmaceuticals and finance, to help clients meet stringent global mandates (e.g., FSMA, DSCSA). By embedding features like immutable audit trails and maintaining certifications such as ISO 27001, Bonbloc supports customers in risk mitigation and achieving operational resilience.

Established Record of Innovation and Investment

Bonbloc has a proven record of innovation, driven by a structured Product and Platform Development (PPD) framework. This iterative methodology ensures that its core platform, Onelign, and client-specific solutions are rooted in regulatory foresight and customer-inclusive development, as seen by high PPD activity costs. This consistent investment supports the company’s ability to develop compliance-driven, customer-aligned technology solutions.

Track Record of Growing Profitability

The company has demonstrated a consistent track record of strong financial performance. Revenue from operations achieved a CAGR of 128.42% from Fiscal 2023 to Fiscal 2025. Furthermore, the EBITDA margin increased from 16.51% to 43.59%, and the PAT margin grew from 10.63% to 32.31% in the same period. This sustained financial growth, coupled with strong cash flows, underscores its ability to effectively scale the business.

Experienced Management Team and Personnel

Bonbloc benefits from an experienced management team and qualified personnel, including its Promoters, with significant industry expertise in the IT sector. This leadership group possesses technical expertise in enterprise applications, SaaS platforms, and global regulatory compliance. Their collective background enables them to effectively develop and scale the Onelign platform, positioning the company to capitalize on the increasing demand for AI-driven compliance technology.

More About Bonbloc Technologies Limited

Bonbloc Technologies Limited is an Artificial Intelligence (AI)-native enterprise technology company focused on developing next-generation AI-powered SaaS and Internet of Things (IoT) products that drive intelligence, safety, and compliance on a global scale. The company delivers industry-specific AI-SaaS platforms, digital transformation services, and intelligent data solutions, integrating AI, blockchain, machine learning (ML), and IoT into its core architecture.

Strategic Focus and Capabilities

Bonbloc Technologies positions itself as a strong enabler for both business-to-business (B2B) and business-to-government (B2G) sectors. Its offerings cover:

- Application development, business intelligence, digital and cloud services

- Cybersecurity and regulatory compliance solutions

- ERP implementation, custom web and mobile apps, and cloud engineering

These services aim to help enterprises modernise operations, enhance efficiency, and accelerate secure digital adoption across industries such as supply chain and food safety.

Technology Strength and Innovation

The company’s flagship platform, Onelign, integrates AI, ML, blockchain, and IoT into an edge-to-cloud ecosystem that enables predictive analytics, real-time decision-making, and automated responses. Recognised as a Great Place to Work for three consecutive years, Bonbloc leverages deep expertise in emerging technologies to enhance visibility, traceability, and operational control across complex environments.

Product Portfolio Highlights

- AI-SaaS Platforms for Digital Trust: Onelign Traceability, Food Compliance, ESG dashboards, and civic governance modules.

- AI-Enabled Public Transport Solutions: iBOTZ systems offering predictive safety and commuter advisories.

- Pattern Recognition & Anomaly Detection: AI-driven predictive maintenance and quality assurance.

- Smart Environment Monitoring: IoT-enabled sensing for agriculture, waste management, and precision manufacturing.

- Telemetry Embedded Platforms: Real-time fleet tracking systems for regulated industries like pharmaceuticals and food.

Market Presence and Centres of Excellence

Operating across India and the USA, Bonbloc Technologies serves 46 clients, including global corporations and public sector enterprises. It is backed by three Centres of Excellence—AI and Data Analytics, IoT and Blockchain, and Digital Transformation—focused on innovation, process automation, and secure connected ecosystems

Industry Outlook

India’s digital economy is fuelling rapid growth in enterprise technology, especially in Software-as-a-Service (SaaS), Artificial Intelligence (AI), and Internet of Things (IoT) platforms. The surge is driven by rising enterprise digitisation, automation, and regulatory compliance needs.

- The Indian SaaS industry is projected to expand from around US$ 7.18 billion in 2023 to approximately US$ 62.93 billion by 2032, recording a CAGR of about 27.3%.

- The Indian AI market is estimated at nearly US$ 6.8 billion in 2024 and expected to reach around US$ 27.7 billion by 2032, growing at a CAGR of 19.2%.

- The global AI-in-IoT market is valued at about US$ 60.7 billion in 2025 and is projected to touch US$ 168.7 billion by 2030, with a CAGR of 22.7%.

- India’s IoT market was worth roughly US$ 1.4 billion in 2024 and is likely to grow to US$ 3.6 billion by 2033, at a CAGR of 10.2%.

These figures highlight significant potential for firms offering integrated AI-SaaS and IoT solutions.

Growth Drivers

- Strong government push for digital transformation, smart industry initiatives, and compliance automation.

- Increasing enterprise investments in AI/ML, automation, and traceability to enhance transparency and efficiency.

- Growing demand for sector-specific solutions in areas like supply chain, manufacturing, and food safety.

- Accelerated cloud adoption and convergence of AI, IoT, and blockchain technologies.

- Expanding domestic startup ecosystem, with India’s software market expected to reach around US$ 100 billion by 2035.

Opportunity for Specific Platforms (AI-SaaS + IoT)

- AI-SaaS is expected to reach nearly US$ 50 billion by 2030, fuelled by AI-enabled innovation and vertical specialisation.

- IoT and AI-integrated platforms are likely to experience strong adoption, particularly in sectors demanding data-driven compliance.

- Domain-specific applications such as traceability, ESG compliance, and environment monitoring are gaining traction due to regulatory alignment and high business value.

Key Figures & Values

- Indian SaaS: US$ 62.93 billion by 2032; CAGR ~27.3%.

- Indian AI: US$ 27.7 billion by 2032; CAGR ~19.2%.

- Indian IoT: US$ 3.6 billion by 2033; CAGR ~10.2%.

- Global AI-in-IoT: US$ 168.7 billion by 2030; CAGR ~22.7%

Firms operating at the intersection of AI, SaaS, and IoT stand to gain substantially. With expertise in AI-driven compliance, traceability, and smart infrastructure, companies like Bonbloc Technologies are well-positioned to capitalise on this momentum. The expanding demand for intelligent, secure, and scalable digital ecosystems presents a long-term growth opportunity in both enterprise and public-sector domains.

How Will Bonbloc Technologies Limited Benefit

- Bonbloc Technologies Limited is strategically positioned to benefit from India’s accelerating AI, SaaS, and IoT adoption, aligning with national priorities in digital transformation and automation.

- The company’s AI-powered SaaS platforms and IoT-driven products directly address the growing enterprise demand for compliance, traceability, and smart governance solutions.

- Expanding market size across AI and IoT verticals opens new opportunities for Bonbloc to scale its Onelign platform and related solutions globally.

- With expertise in AI, ML, and blockchain integration, Bonbloc can serve industries seeking data integrity, predictive analytics, and automated workflows.

- Increased government and enterprise spending on digital ecosystems enhances Bonbloc’s potential in B2G and B2B contracts.

- Rising global emphasis on ESG compliance and sustainable supply chains supports the adoption of Bonbloc’s AI-driven traceability tools.

- The company’s dual presence in India and the USA provides access to high-value markets and cross-border innovation opportunities.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | EPS (Basic) (₹) | EPS (Diluted) (₹) | NAV (₹) | P/E Ratio | RoNW (%) |

| Bonbloc Technologies Limited | 1.00 | 1,033.72 | 1.78 | 1.78 | 2.58 | [●] | 68.17 |

| Peer group | |||||||

| Happiest Minds Technologies Limited | 2.00 | 20,608.40 | 12.26 | 12.26 | 104.94 | 45.43 | 11.73 |

| Newgen Software Technologies Limited | 10.00 | 14,868.79 | 22.53 | 21.89 | 107.85 | 40.39 | 20.85 |

| Saksoft Limited | 1.00 | 8,830.09 | 8.21 | 8.21 | 48.70 | 26.24 | 17.57 |

Key Strategies for Bonbloc Technologies Limited

Expanding AI-SaaS and Diversifying Solutions

Bonbloc Technologies Limited aims to evolve its Onelign platform into a leading AI-SaaS portfolio for industries with complex compliance needs. This involves market-led product development, leveraging the modular architecture, and forging partnerships to accelerate adoption and diversify its revenue base across new high-growth sectors.

Deepening Customer Relationships and Reach

The company focuses on transforming existing point solutions into integrated trust infrastructures across client organizations. It will leverage established relationships and expand its presence into high-growth geographies like the Middle East and South America, utilizing collaborative development and the platform’s interoperability to maximize wallet share and embeddedness.

Enhancing Centres for Excellence and Capabilities

Bonbloc is committed to strengthening its Centres for Excellence (CoEs) to act as hubs for research and innovation in AI/ML, blockchain, and IoT. This strategy embeds regulatory foresight into the innovation pipeline, accelerates the development of modular, compliant solutions, and utilizes co-creation models with customers to ensure market-aligned and scalable offerings.

Achieving Operational Excellence and Cost Efficiency

The company is focused on maintaining agility, margin scalability, and delivery consistency through disciplined cost management. Key initiatives include utilizing platform modularity and automation to reduce overhead, optimizing the delivery mix with a strong India-based presence, and aligning support under shared delivery standards for consistent, cost-efficient growth.

Pursuing Strategic Acquisitions for Growth

Bonbloc intends to pursue strategic, value-focused acquisitions to complement its existing platforms and fill technology or market gaps. Acquisitions aim to add niche capabilities (e.g., edge intelligence), deepen presence in regulated industries, and expand into new geographies to build a resilient, scalable, and compliance-aligned technology business.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Bonbloc Technologies Limited IPO

How can I apply for Bonbloc Technologies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Bonbloc Technologies Limited’s IPO about?

Bonbloc Technologies Limited plans to raise funds through a ₹230 crore fresh issue and an Offer for Sale of 3 crore shares.

When was Bonbloc Technologies Limited’s DRHP filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 28, 2025.

On which stock exchanges will Bonbloc Technologies shares be listed?

The equity shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

What will the IPO proceeds be used for?

Funds will be utilised for product development, purchase of laptops, acquisitions, and other strategic and corporate purposes.

Who are the promoters of Bonbloc Technologies Limited?

The company’s promoters are Durai Appadurai, Sourirajan, and Bonbloc Inc.