- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Borana Weaves IPO

₹14,145/69 shares

Minimum Investment

IPO Details

20 May 25

22 May 25

₹14,145

69

₹205 to ₹216

NSE, BSE

₹144.89 Cr

27 May 25

Borana Weaves IPO Timeline

Bidding Start

20 May 25

Bidding Ends

22 May 25

Allotment Finalisation

23 May 25

Refund Initiation

26 May 25

Demat Transfer

26 May 25

Listing

27 May 25

Borana Weaves Limited

Incorporated in 2020, Borana Weaves Limited is based in Surat, Gujarat, and specialises in manufacturing unbleached synthetic grey fabric, widely used as a base for further processing such as dyeing and printing in sectors like fashion, home decor, traditional and technical textiles, and interior design. The company also produces polyester textured yarn (PTY Yarn) from polyester oriented yarn (POY Yarn), which is used in grey fabric production. Operating three manufacturing units in Surat, it utilises advanced technologies and, as of September 30, 2024, runs 15 texturizing machines, 6 warping machines, 700 water jet looms, and 10 folding machines.

Borana Weaves Limited IPO Overview

Borana Weaves IPO is a book-built issue amounting to ₹144.89 crores, consisting entirely of a fresh issue of 0.67 crore equity shares. The IPO opens for subscription on May 20, 2025, and closes on May 22, 2025, with the allotment expected to be finalised on May 23, 2025. The shares are proposed to be listed on both BSE and NSE, with a tentative listing date set for May 27, 2025. The price band is fixed between ₹205 to ₹216 per share.

Retail investors are required to apply for a minimum lot size of 69 shares, amounting to ₹14,145; however, bidding at the cutoff price is advised to avoid the risk of oversubscription, bringing the investment to approximately ₹14,904. For sNII investors, the minimum investment is 14 lots (966 shares) worth ₹2,08,656, while for bNII, it is 68 lots (4,692 shares) valued at ₹10,13,472. Beeline Capital Advisors Pvt Ltd is the book-running lead manager, and Kfin Technologies Limited serves as the registrar to the issue.

Borana Weaves Limited IPO Details

| Particulars | Details |

| IPO Date | 20 May 2025 to 23 May 2025 |

| Listing Date | 27 May 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹205 to ₹216 per share |

| Lot Size | 69 Shares |

| Total Issue Size | 67,08,000 shares (aggregating up to ₹144.89 Cr) |

| Fresh Issue | 67,08,000 shares (aggregating up to ₹144.89 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE BSE |

| Share Holding Pre Issue | 1,99,37,295 shares |

| Share Holding Post Issue | 2,66,45,295 shares |

Borana Weaves Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Net Issue |

| Retail | Not more than 10% of the Net Issue |

| NII (HNI) | Not more than 15% of the Net Issue |

Borana Weaves Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 69 | ₹14,904 |

| Retail (Max) | 13 | 897 | ₹1,93,752 |

| S-HNI (Min) | 14 | 966 | ₹2,08,656 |

| S-HNI (Max) | 67 | 4,623 | ₹9,98,568 |

| B-HNI (Min) | 68 | 4,692 | ₹10,13,472 |

Borana Weaves Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 87.19% |

| Post-Issue | – |

Borana Weaves Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 11.83 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 49.77% |

| Net Asset Value (NAV) | 23.77 |

| Return on Equity | 49.45% |

| Return on Capital Employed (ROCE) | 27.42% |

| EBITDA Margin | 20.68% |

| PAT Margin | 11.85% |

| Debt to Equity Ratio | – |

Objectives of the Proceeds

- Proposing to finance the cost of establishing a new manufacturing unit to expand grey fabric production in Surat, Gujarat – ₹713.48 million

- Funding incremental working capital requirements – ₹265.00 million

- General corporate purposes

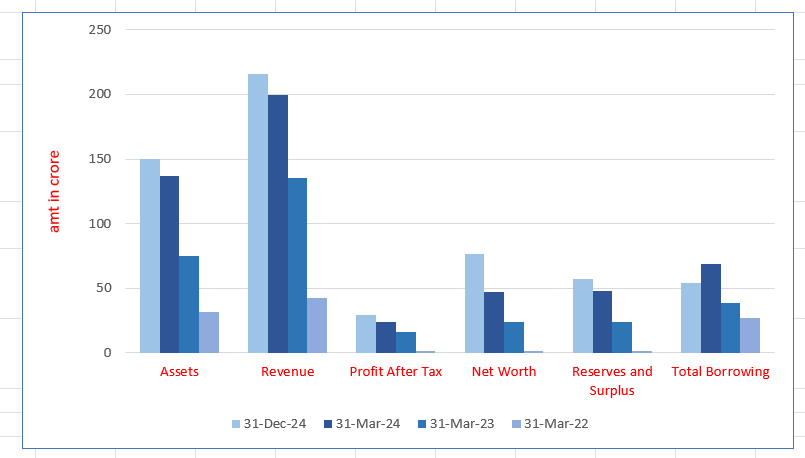

Key Financials (in ₹ crore)

| Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 149.67 | 137.05 | 74.98 | 31.90 |

| Revenue | 215.71 | 199.60 | 135.53 | 42.36 |

| Profit After Tax | 29.31 | 23.59 | 16.30 | 1.80 |

| Net Worth | 76.55 | 47.39 | 24.11 | 1.81 |

| Reserves and Surplus | 56.87 | 47.66 | 24.07 | 1.80 |

| Total Borrowing | 54.03 | 69.10 | 38.89 | 27.31 |

SWOT Analysis of Borana Weaves IPO

Strength and Opportunities

- Advanced manufacturing with 700 water jet looms enhancing production efficiency.

- Significant growth in revenue and profitability since inception.

- Strong customer retention with 98% repeat orders indicating high satisfaction.

- Sustainable practices, including recycling millions of litres of water annually.

- Expansion plans with Unit 4 adding 112.75 million meters capacity by June 2025.

Risks and Threats

- High dependency on key raw materials like POY, subject to price volatility.

- Operates in a highly competitive and fragmented textile industry.

- Limited bargaining power with major suppliers due to lack of long-term agreements.

- Vulnerability to regulatory changes and environmental compliance requirements.

- Risks associated with unregistered trademarks and intellectual property protection.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Borana Weaves Limited IPO

IPO Strengths

- Proposing to finance the cost of establishing a new manufacturing unit to expand production capabilities for grey fabric in Surat, Gujarat – ₹713.48 million

- Funding incremental working capital requirements – ₹265.00 million

- General corporate purposes

Peer Group Comparison

As per the DRHP, there are no comparable listed peer of the company and therefore information related to peer is not provided

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Borana Weaves Limited IPO

How can I apply for Borana Weaves Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the opening and closing date of the Borana Weaves IPO?

The IPO opens on May 20, 2025, and closes on May 22, 2025.

What is the minimum investment required for retail investors?

Retail investors must invest a minimum of ₹14,904 for 69 shares at the cutoff price.

When will Borana Weaves IPO shares be listed on stock exchanges?

The shares are tentatively scheduled to list on BSE and NSE on May 27, 2025.

What is the issue size and type of the Borana Weaves IPO?

The IPO is a book-built issue of ₹144.89 crore, consisting entirely of a fresh issue.