- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is Breakout in Trading?

- Types of Breakout

- Breakout Trading Strategy

- How to Identify Breakouts in Trading

- How to Confirm Breakout in Trading

- How to Trade Using Breakout Strategy

- Advantages of a Breakout Strategy

- Disadvantages of a Breakout Strategy

- Factors to Watch During Breakout Trading

- Conclusion

- FAQs on Breakout Trading Strategies

- What is Breakout in Trading?

- Types of Breakout

- Breakout Trading Strategy

- How to Identify Breakouts in Trading

- How to Confirm Breakout in Trading

- How to Trade Using Breakout Strategy

- Advantages of a Breakout Strategy

- Disadvantages of a Breakout Strategy

- Factors to Watch During Breakout Trading

- Conclusion

- FAQs on Breakout Trading Strategies

What is Breakout Trading Strategies & How to Confirm Breakout in Trading

By HDFC SKY | Updated at: Sep 22, 2025 04:28 PM IST

Breakout trading strategies is a technique in technical analysis where traders aim to enter a trade when the price breaks above a resistance level or below a support level with increased volume. The idea behind breakout trading is to catch significant price moves at the early stages of a trend. These strategies can be applied in both upward and downward market conditions and are especially useful during periods of market consolidation. By identifying breakouts traders can position themselves for potential high-reward opportunities while managing risk with stop-loss orders placed near the breakout levels.

What is Breakout in Trading?

Breakout meaning in trading refers to the price of a stock or asset moving beyond a defined support or resistance level with increased volume. This movement indicates a potential trend reversal or continuation. Traders use breakouts as signals to enter or exit positions aiming to capitalise on the momentum that follows.

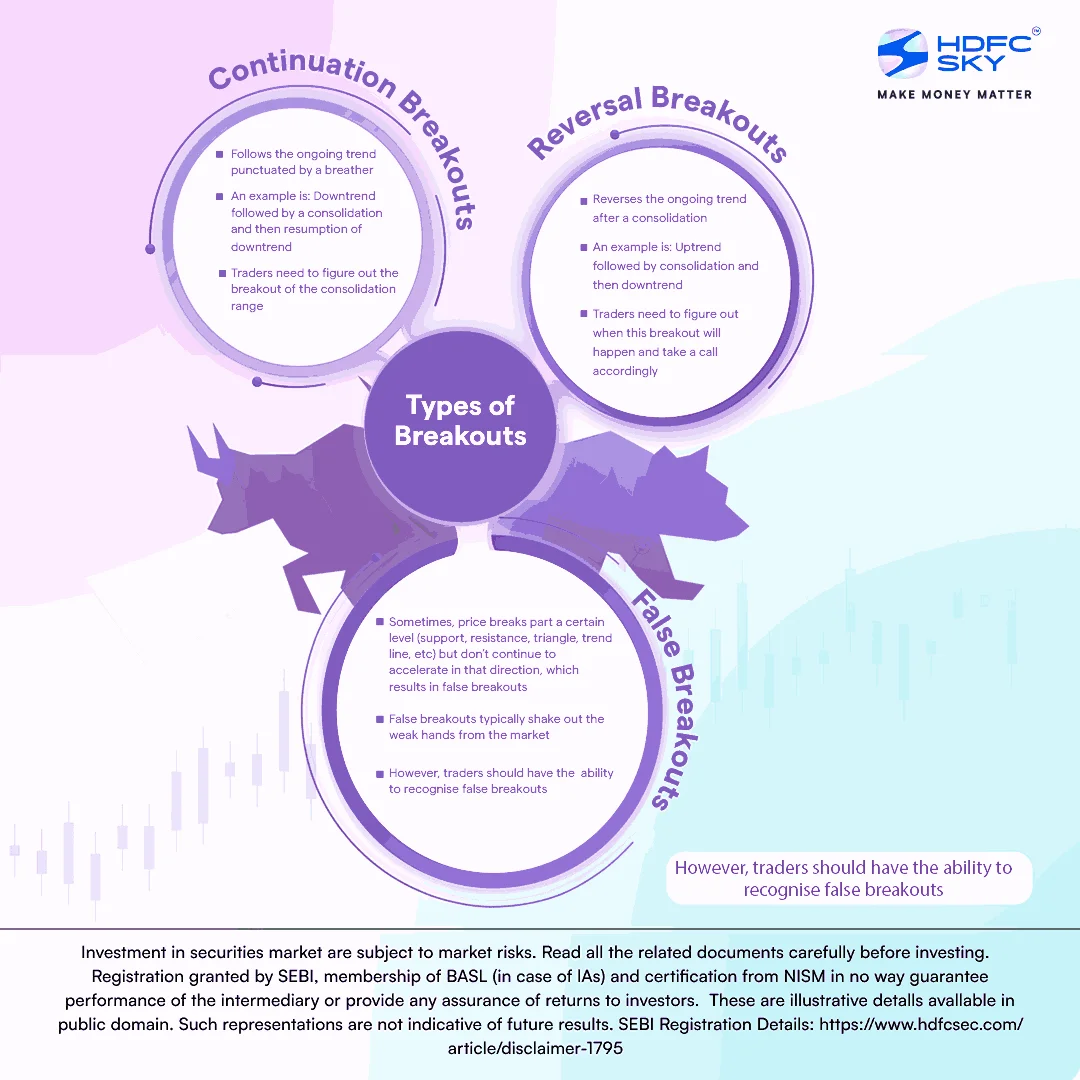

Types of Breakout

Breakout Trading Strategy

Breakout trading involves identifying price levels and entering trades when the price breaks out of these levels. It helps capture strong market momentum.

- Identify Support and Resistance Levels: Look for established levels where price has previously reversed.

- Use Volume Confirmation: Ensure the breakout is supported by higher-than-average volume for validity.

- Set Entry and Exit Points: Enter on a confirmed breakout and set stop-loss just below/above the breakout point.

- Watch for Retests: Sometimes price retests the breakout level before continuing this can offer a second entry.

- Avoid False Breakouts: Use technical indicators like RSI or MACD to filter out fake signals.

How to Identify Breakouts in Trading

Breakouts occur when the price moves beyond a defined support or resistance level with increased volume. Spotting them early can lead to strong trade opportunities.

- Chart Patterns: Look for patterns like triangles, flags or rectangles that indicate consolidation before a breakout.

- Support and Resistance Levels: Identify key price levels the asset has struggled to break in the past.

- Volume Analysis: A valid breakout is usually accompanied by a spike in volume confirming market interest.

- Moving Averages: Use indicators like the 50-day or 200-day MA; price breaking above/below them can signal breakouts.

- Candlestick Patterns: Long-bodied candles near key levels may hint at breakout strength.

- False Breakout Signals: Watch for quick reversals after breakouts these can be filtered using confirmation tools like RSI or MACD.

How to Confirm Breakout in Trading

Confirming a breakout helps traders avoid false signals and make informed decisions. It involves checking price action, volume and other indicators to ensure the breakout is genuine.

- Look for a decisive price move beyond resistance or support levels.

- Check for increased trading volume during the breakout, signaling strong interest.

- Wait for a retest of the breakout level where the price holds or bounces back.

- Use technical indicators like RSI or MACD to confirm momentum in the breakout direction.

- Avoid trading immediately after a breakout; allow time for confirmation to reduce risk.

How to Trade Using Breakout Strategy

Breakout trading involves entering a trade when the price breaks above resistance or below support with strong momentum. Here’s how to trade it effectively:

- Identify Key Levels: Mark support and resistance levels or consolidation zones on the chart.

- Wait for Confirmation: Ensure the breakout is accompanied by higher volume to avoid false signals.

- Set Entry Point: Enter the trade just above resistance (for breakout up) or below support (for breakout down).

- Use Stop-Loss Orders: Place a stop-loss just below the breakout point (for long trades) or above (for short trades) to manage risk.

- Set Targets: Use previous price swings, Fibonacci levels or measured moves to define profit targets.

- Avoid Chasing: Don’t enter late after the price has moved too far, wait for pullbacks if needed.

- Review the Trend: Breakouts in the direction of the prevailing trend tend to be more reliable.

Advantages of a Breakout Strategy

Breakout trading can offer high reward opportunities if executed correctly. Below are some key benefits:

- Early Entry into Trends: Allows traders to enter positions at the start of strong price movements.

- Clear Entry & Exit Points: Breakout levels provide defined zones for entries, stop-losses and profit targets.

- Momentum-Based: Trades are aligned with market momentum increasing the chance of quick profits.

- Works Across Markets: Effective in stocks, forex, commodities and crypto.

- Scalable Strategy: Can be used for intraday, swing or positional trading based on the trader’s style.

Disadvantages of a Breakout Strategy

While breakout trading offers potential it also carries risks. Here are some drawbacks:

- False Breakouts: Prices may break a level briefly and reverse, trapping traders and causing losses.

- Requires Quick Decisions: Timing is critical; delays in execution can lead to missed opportunities or poor entries.

- High Volatility: Breakouts often occur with volatility which can widen stop-losses and increase risk.

- Not Always Reliable in Sideways Markets: In low-trend environments, breakouts are less effective and more prone to failure.

- Needs Strong Risk Management: Without disciplined stop-loss placement, losses can mount quickly.

Factors to Watch During Breakout Trading

Successful breakout trading requires careful attention to certain key factors. Monitoring these can help confirm the breakout and avoid false signals.

- Volume Confirmation: Ensure there is a significant increase in trading volume to validate the breakout.

- Price Retest: Look for the price to retest the breakout level before continuing in the breakout direction.

- Market Trends: Consider the overall market trend to align your breakout trades with broader momentum.

- Volatility Levels: Higher volatility can lead to false breakouts so assess market volatility before entering.

- Support and Resistance: Identify strong support and resistance levels to gauge the strength of the breakout.

- News and Events: Be aware of any news or events that might influence sudden price movements.

- Stop-Loss Placement: Set appropriate stop-loss orders to manage risk if the breakout fails.

Conclusion

Breakout trading strategies rely on identifying critical support and resistance levels using multiple signals to confirm breakouts and employing effective risk management strategies. Traders must be vigilant in recognising false breakouts and have a well-defined exit strategy to safeguard their capital. By leveraging technical analysis, monitoring trading volumes and considering longer time periods traders can enhance their ability to capitalise on breakout strategy opportunities and achieve higher returns on their investments.

Related Articles

FAQs on Breakout Trading Strategies

Are there any situations in which traders should not use the breakout strategy?

Yes, traders should avoid using the breakout strategy in low-volume markets or during sideways (range-bound) trends, where false breakouts are more common.

What is a breakout trading strategy?

A breakout trading strategy involves identifying stocks that are about to breach a critical support or resistance level, trendline, or form a breakout pattern. The expectation is that the price will continue moving in the direction of the breakout, leading to potential trading opportunities.

What are support and resistance levels?

- Support Level: The lower level of a price range where stock prices generally do not fall below due to a flock of buying orders, limiting further downside.

- Resistance Level: The upper level of a price range that prevents the stock price from rising beyond it. At this level, the demand for the stock is less, and the sellers outpace the buyers.

What role do trading volumes play in identifying breakouts?

Trading volumes are crucial in identifying breakouts. Higher trading volumes on the day of the breakout increase the chances of a strong breakout. The higher the volumes, the higher the chances of a strong breakout.