- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Brigade Hotel Ventures IPO

₹14/166 shares

Minimum Investment

IPO Details

24 Jul 25

28 Jul 25

₹14

166

₹85 to ₹90

NSE, BSE

₹759.60 Cr

31 Jul 25

Brigade Hotel Ventures IPO Timeline

Bidding Start

24 Jul 25

Bidding Ends

28 Jul 25

Allotment Finalisation

29 Jul 25

Refund Initiation

29 Jul 25

Demat Transfer

30 Jul 25

Listing

31 Jul 25

About Brigade Hotel Ventures Limited

Brigade Hotel Ventures Limited, a wholly-owned subsidiary of Brigade Enterprises Limited, develops and owns hotels across South India. As of March 31, 2025, it is among the top private hotel asset owners in the region with over 1,604 rooms. The company operates nine hotels in cities like Bengaluru, Chennai, Kochi, Mysuru, and GIFT City. Partnering with global brands like Marriott, Accor, and IHG, these hotels offer premium amenities including restaurants, MICE venues, spas, pools, and fitness centres.

Brigade Hotel Ventures Limited IPO Overview

The Brigade Hotel Ventures IPO is a book-built issue with a total size of ₹759.60 crores, comprising entirely of a fresh issue of 8.44 crore equity shares. The IPO will open for subscription on July 24, 2025, and close on July 28, 2025. The basis of allotment is expected to be finalised on Tuesday, July 29, 2025, and the shares are likely to be listed on both the BSE and NSE on Thursday, July 31, 2025.

The price band for the IPO is set at ₹85 to ₹90 per share. Investors can apply in lots of 166 shares, with the minimum investment for retail investors amounting to ₹14,110. For non-institutional investors, the minimum application for sNII (small NII) is 14 lots or 2,324 shares, requiring an investment of ₹2,09,160. For bNII (big NII), the minimum is 67 lots or 11,122 shares, translating to ₹10,00,980.

JM Financial Limited is acting as the book-running lead manager for the issue, and Kfin Technologies Limited has been appointed as the registrar

Brigade Hotel Ventures IPO Details

| Particulars | Details |

| IPO Date | 24 July 2025 to 28 July 2025 |

| Listing Date | 31 July 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹85 to ₹90 per share |

| Lot Size | 166 Shares |

| Total Issue Size | 8,44,00,000 shares (₹759.60 Cr) |

| Fresh Issue | 8,44,00,000 shares (₹759.60 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 29,54,30,000 shares |

| Share Holding Post Issue | 37,98,30,000 shares |

Brigade Hotel Ventures IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Offer size |

| Retail | Not more than 10% of the Offer |

| NII (HNI) | Not more than 15% of the Offer |

Brigade Hotel Ventures IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 166 | ₹14,940 |

| Retail (Max) | 13 | 2,158 | ₹1,94,220 |

| S-HNI (Min) | 14 | 2,324 | ₹2,09,160 |

| S-HNI (Max) | 66 | 10,956 | ₹9,86,040 |

| B-HNI (Min) | 67 | 11,122 | ₹10,00,980 |

Brigade Hotel Ventures IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 95.26% |

| Post-Issue | 74.09% |

Objectives of the Proceeds

- Repayment or prepayment of borrowings – ₹468.14 Crore

- Purchase of undivided land share from BEL – ₹107.52 Crore

- Inorganic growth and general corporate purposes – Amount not specified

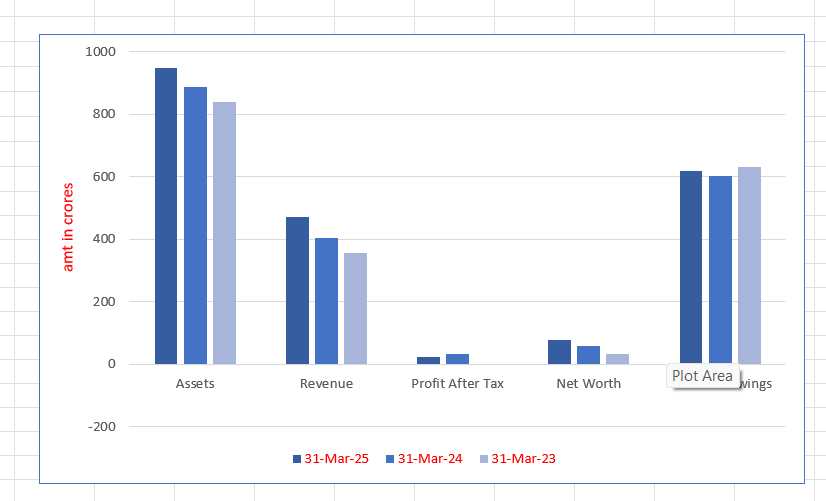

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 947.57 | 886.78 | 840.67 |

| Revenue | 470.68 | 404.85 | 356.41 |

| Profit After Tax | 23.66 | 31.14 | -3.09 |

| Net Worth | 78.58 | 58.74 | 33.81 |

| Total Borrowings | 617.32 | 601.19 | 632.50 |

Brigade Hotel Ventures IPO Valuation Overview

| KPI | Value |

| EPS (Pre-IPO) | ₹0.72 |

| P/E Ratio | 125 |

| RoNW (%) | 30.11% |

| ROCE (%) | 13.62% |

| PAT Margin (%) | 5.03% |

| EBITDA Margin (%) | 35.45% |

| Debt/Equity Ratio | 7.40 |

| Price/Book Value | 32.26 |

SWOT Analysis of Brigade Hotel Ventures IPO

Strength and Opportunities

- Strong presence in South India’s premium hotel segment.

- Partnerships with global hotel brands ensures credibility.

- Rising demand for MICE and luxury stays across Tier-1 cities.

- Strategic location in commercial zones and GIFT City expansion.

Risks and Threats

- High debt-to-equity ratio affects financial strength.

- Business sensitive to seasonal tourism trends.

- Competitive pressure from established hotel chains.

- Relies on a few cities for major revenue.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Brigade Hotel Ventures Limited

Brigade Hotel Ventures IPO Strengths

- Strategically located award-winning hotels in South India ensure high footfalls and brand visibility.

- Strong asset management practices drive operational efficiency and consistent financial performance reviews.

- Focused ESG initiatives reduce energy usage through data-driven sustainable procurement and practices.

- Backed by Brigade Group’s expertise, ensuring timely, cost-effective, and quality hotel development.

- Industry tailwinds and tourism growth offer robust demand for upper-tier and chain-affiliated hotels.

- Experienced leadership with hospitality and real estate domain expertise drives business and revenue growth.

- Consistent financial track record with rising revenues and above-market hotel occupancy performance.

Peer Group Comparison (as of March 31, 2025)

| Company Name | EPS | NAV | P/E | RoNW (%) |

| Brigade Hotel Ventures Limited | 0.72 | 2.79 | 125.0 | 30.11 |

| Peer Groups | ||||

| The Indian Hotels Company Ltd | 13.40 | 87.22 | 56.06 | 16.42 |

| Chalet Hotels Limited | 6.53 | 139.42 | 136.6 | 4.68 |

| Lemon Tree Hotels Limited | 2.48 | 22.59 | 62.04 | 13.59 |

| EIH Limited | 11.82 | 75.86 | 32.20 | 16.23 |

| Juniper Hotels Limited | 3.20 | 122.55 | 99.48 | 2.61 |

| Samhi Hotels Limited | 3.88 | 51.63 | 62.75 | 7.49 |

| Apeejay Surrendra Park Hotels Ltd | 3.92 | 60.17 | 42.05 | 6.51 |

| Ventive Hospitality Ltd | 6.83 | 252.88 | 115.58 | 0.82 |

| ITC Hotels Ltd | 3.05 | 51.55 | 78.20 | 5.94 |

| Schloss Bangalore Ltd | 1.97 | 107.95 | 229.34 | 1.32 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Brigade Hotel Ventures IPO

How can I apply for Brigade Hotel Ventures IPO?

You can apply via brokers like HDFC Sky using UPI-based ASBA process.

What is the minimum investment required for this IPO?

The minimum application requires ₹14,940 for 166 shares.

Who is the lead manager for Brigade Hotel Ventures IPO?

JM Financial Limited is the Book Running Lead Manager.

What is the listing date of Brigade Hotel Ventures IPO?

The tentative listing date is scheduled for 31 July 2025.