- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What is Buying on Margin? How It's Done, Risks and Rewards

By HDFC SKY | Updated at: Apr 30, 2025 01:45 PM IST

Suppose you have your eye on a stock that you believe will skyrocket in value. You have some capital, but not enough to buy as many shares as you’d like. Instead of waiting to accumulate more funds, you borrow money from your broker to buy more shares than your available cash allows.

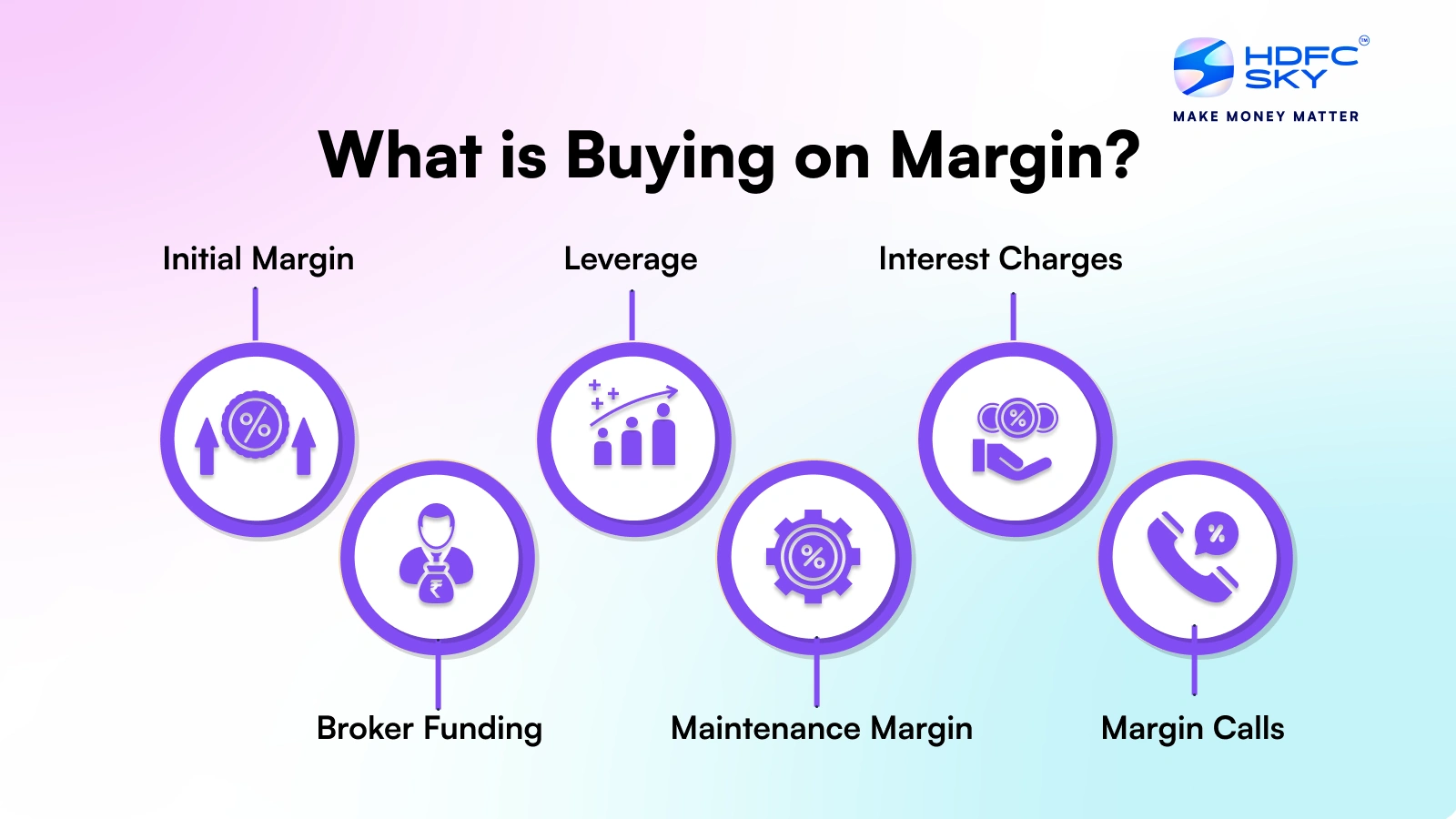

This strategy is called buying on margin, a high-risk, high-reward trading approach that can ramp up both gains and losses. Understanding what is buying on margin, how does buying on margin work in the Indian context, its associated procedures, benefits, and especially its significant risks is crucial before considering this strategy. This buying on margin explained guide aims to provide clarity on the topic.

What is Margin Trading in Stock Market?

Buying on margin is like trading with borrowed money. You invest more than what’s in your account, hoping to maximise returns. It’s a strategy where your broker lends you funds to buy stocks or other securities so that you can control a larger position with less capital upfront. However, this loan comes at a cost, and you will be charged interest on the borrowed amount, and the shares purchased are typically held by the broker as collateral for the loan.

If the stock price goes up, your profits multiply because you’re trading with more money than you actually own. But there’s a catch. If the stock price falls, losses also increase, and you may have to add funds to your account to meet the broker’s margin requirements.

Margin trading can be a powerful tool, especially in a bull market, but it comes with risks. Understanding how leverage, margin calls, and interest costs work is essential before diving in. For traders who can manage the risks, buying on margin opens up bigger opportunities, but it also demands a higher level of caution and strategy.

How Does Buying on Margin Work?

Engaging in margin trading gives traders greater purchasing power to control a larger position just their own capital. But how does buying on margin work within India’s regulated environment? Here’s the mechanism:

The process works as follows:

- Initial Margin: When you buy with margin, SEBI and stock exchanges mandate a minimum ‘Initial Margin’. This is the percentage of the total trade value that you must contribute from your own funds (your equity). Brokers calculate this based on factors like Value at Risk (VaR) and Extreme Loss Margin (ELM) for stocks, ensuring sufficient cover against potential price swings. You must deposit cash or pledge approved securities to meet this requirement before placing the margin trade.

- Broker Funding: The broker provides the remaining funds (up to the permissible limit, which depends on the initial margin percentage) to complete the purchase.

- Leverage: This process creates leverage. If the initial margin is 40%, you can control ₹100 worth of stock with only ₹40 of your own capital (plus borrowed funds).

- Maintenance Margin: After initiating the position, you must maintain a minimum equity level in your account, known as the ‘Maintenance Margin’ (usually a lower percentage than the initial margin, e.g., 25-30%). Your account equity is the current market value of your securities minus the loan amount.

- Margin Calls: If the market value of your margined stocks falls, your equity decreases. If your equity drops below the maintenance margin level, your broker issues a ‘Margin Call‘, requiring you to deposit additional funds or securities immediately to restore the required equity level. Failure to meet a margin call can lead to the broker forcibly liquidating your positions.

- Interest Charges: You are charged interest on the borrowed amount (the margin loan). These charges accrue daily and are typically debited from your account monthly, adding to the cost of holding the position.

Note: Margin trading offers increased profit potential, but it also magnifies losses, making it a strategy suited for experienced investors.

How to Buy on Margin

Here are the practical steps on how to buy on margin in Indian equity markets:

- Open & Activate Margin Account: Ensure you have an active Demat and Trading account with a SEBI-registered broker. Apply to activate the margin trading facility (sometimes called MTF – Margin Trading Facility). This involves reviewing and signing the margin agreement and rights & obligations documents provided by the broker. Some broker’s keep this option available for all their customers.

- Assess Eligibility & Limits: Understand the broker’s criteria, the list of stocks eligible for margin trading, the applicable initial and maintenance margin percentages for specific stocks, and the maximum margin funding available.

- Deposit Funds/Collateral: Ensure you have sufficient clear funds or approved securities (after haircut) in your account to meet the initial margin requirement for the trade you intend to place.

- Place Margin Order: When placing your buy order through the broker’s trading platform (e.g., HDFC Sky’s app or website), select the specific product type designated for margin trades (e.g., ‘Margin’, ‘MTF’, ‘E-Margin’ ‘Pay Later’- the terminology varies between brokers). This distinguishes it from a standard delivery (CNC) order.

- Monitor Your Position: After the trade execution, diligently track the market value of your margined stock(s) and your account’s margin level (available equity percentage).

- Manage Margin Calls: Be prepared to add funds immediately if you receive a margin call.

- Account for Interest: Factor in the daily accruing interest cost on the borrowed amount.

Buying on Margin Example

Let’s say an investor wants to buy shares of a company but has only ₹50,000. With buying stocks at margin, they can borrow ₹50,000 from their broker and purchase ₹1,00,000 worth of shares.

Scenario 1: The Stock Price Rises

- If the stock price increases by 10%, the total value becomes ₹1,10,000.

- The investor repays the ₹50,000 loan and keeps the remaining ₹60,000, earning a 20% return on their initial investment instead of just 10%.

Scenario 2: The Stock Price Falls

- If the stock price drops by 10%, the total value reduces to ₹90,000.

- After repaying the ₹50,000 loan, the investor is left with ₹40,000, meaning they lost 20% of their own money, instead of just 10%.

Advantages and Disadvantages of Buying on Margin

Here are the advantages and disadvantages on margin stock buying:

Advantages

- Greater Buying Power: Traders can control a larger investment with less capital.

- Higher Potential Returns: Profits are amplified when stock prices rise.

- Portfolio Diversification: Margin allows investors to spread their investments across different stocks.

- Flexibility: Provides flexibility to invest in opportunities without needing to sell existing long-term holdings immediately.

Disadvantages

- Magnified Losses: If the stock price drops, losses exceed the initial investment.

- Margin Calls: If account equity falls below the maintenance margin, traders must add funds or sell holdings.

- Interest Costs: Borrowed money comes with interest fees, reducing overall gains.

- Increased Overall Risk: Buying on margin inherently increases the risk profile of your investment activities significantly.

While margin trading boosts profits in bull markets, it also increases exposure to risk, making it unsuitable for beginners.

Risks of Buying on Margin

- Market Volatility: A sudden downturn can wipe out account equity and trigger forced liquidations.

- Margin Calls: As mentioned earlier, if account value drops below the required margin, traders must add more funds or face liquidation.

- Compounding Interest Costs: The longer a position is held, the higher the interest charges on the borrowed funds.

- Psychological Pressure: Trading with borrowed money adds stress, making emotional decision-making more likely.

Due to these risks, margin trading is best suited for experienced traders who can manage leverage effectively.

Who Should Buy on Margin?

Margin trading is best suited for:

- Experienced Traders: Those who understand market trends and risk management.

- Short-Term Traders: Margin is often used for quick trades rather than long-term investing.

- Investors with High Risk Tolerance: Those who can handle market volatility and potential margin calls.

For beginners or conservative investors, margin trading can be risky, and it’s advisable to stick to cash trading until they fully understand leverage and market risks.

Conclusion

Buying on margin can be a powerful tool for traders looking to increase their market exposure. It allows investors to purchase more stocks than they could with just their own capital, leading to higher potential gains. However, it also amplifies losses, making risk management crucial. Before engaging in margin trading, investors should understand how margin works and the risks involved. They should further monitor their margin account regularly to avoid margin calls. Investors should also actively use stop-loss strategies to limit potential losses. While buying on margin can be profitable in the right conditions, it requires discipline, experience, and careful financial planning to be successful.

Related Articles

FAQs on Buying on Margin

Why is buying on margin risky?

While margin trading can boost profits, it also comes with risks. If stock prices decline, losses are magnified, and traders may face a margin call. They might be required to deposit more funds or liquidate holdings at a loss, making it riskier than cash trading.

How does buying on margin boost returns in bull markets?

In a bull market, prices tend to rise, and buying on margin enables traders to control a larger position with less capital. As stock prices increase, profits multiply, leading to higher returns than using only personal funds. However, if prices drop, losses are also magnified.

What happens during a margin call?

A margin call occurs when a trader’s account equity falls below the required maintenance margin. The broker will demand additional funds to restore the balance. If the trader doesn’t deposit funds or sell assets, the broker may automatically liquidate some positions to cover the shortfall.

Can I withdraw margin money?

Margin money is not withdrawable like regular cash balances. It serves as collateral for borrowed funds. However, if a trader sells securities at a profit, the realized gains can be withdrawn, provided the remaining margin requirement is still met.

What are the opportunities for gains when buying on margin?

Buying on margin allows traders to amplify their gains by using borrowed funds to invest more than their available capital. If stock prices rise, profits are magnified as traders benefit from the larger position size. However, this approach works best in bull markets where prices are steadily increasing.

Is it legal to buy on margin?

Yes, margin trading is legal and regulated by financial authorities like SEBI in India. However, brokers and exchanges have strict margin requirements, and traders must comply with the rules set by their jurisdiction to engage in margin trading.

Is there a fee for buying on margin?

Yes, brokers charge interest on the borrowed amount, which varies based on the brokerage firm and market conditions. Additional fees may include margin maintenance fees and costs related to forced liquidations if margin calls are not met.