- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

BVG India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

BVG India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

BVG India Limited

BVG India Limited is a leading integrated facility management (IFM) services provider in India, incorporated in 2004. The company operates across three primary verticals: IFM services, emergency response services (ERS), and environment and sustainability services (ESS). Its IFM offerings encompass soft services like housekeeping and security, hard services including mechanical, electrical, and plumbing (MEP) maintenance, and specialized services such as catering and fleet operations. BVG India has a pan-India presence, serving over 1,190 clients with a workforce of more than 85,000 employees. It is known for its longstanding relationships with prestigious clients, including Tata Motors, various government establishments, and major hospitals. (85 words)

BVG India Limited IPO Overview

The BVG India Limited IPO is a book-built issue comprising a fresh issue of equity shares aggregating up to ₹300.00 crores and an Offer for Sale (OFS) of up to 2.85 crore equity shares by the selling shareholders. The funds from the fresh issue are proposed to be utilized for the repayment of certain outstanding borrowings and for general corporate purposes. This IPO will provide the company with a capital infusion to strengthen its balance sheet and support its growth strategies. The equity shares are proposed to be listed on both the BSE and NSE, offering public investors an opportunity to participate in the growth story of a prominent player in India’s expanding facility management sector.

BVG India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹300.00 Cr; OFS: Up to 2.85 Cr shares |

| Fresh Issue | ₹300.00 Crores |

| Offer for Sale (OFS) | Up to 2,85,48,007 equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 12,85,51,940 shares |

| Shareholding post-issue | 13,32,24,040 shares |

BVG India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

BVG India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

BVG India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹15.96 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 15.18% |

| Net Asset Value (NAV) | ₹102.48 |

| Return on Equity (RoE) | 17.44% |

| Return on Capital Employed (RoCE) | 19.37% |

| EBITDA Margin | 11.03% |

| PAT Margin | 6.73% |

| Debt to Equity Ratio | 0.23 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment and/or pre-payment of certain outstanding borrowings | 2,500.00 |

| General corporate purposes* | [●] |

| Total Net Proceeds | [●] |

*Note: To be finalized upon determination of the Offer Price and will be updated in the Prospectus prior to the filing with the ROC.

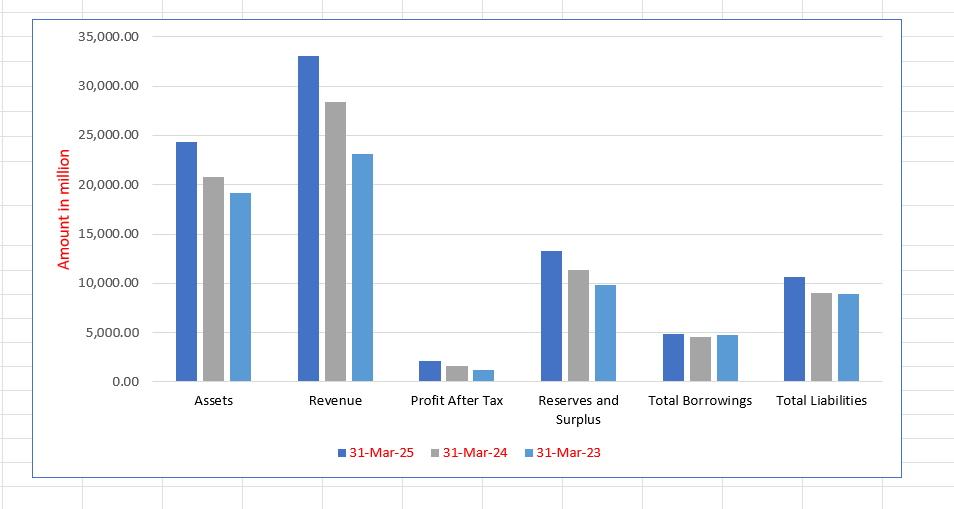

BVG India Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 24,341.80 | 20,823.55 | 19,203.84 |

| Revenue | 33,017.97 | 28,393.83 | 23,148.78 |

| Profit After Tax | 2,072.09 | 1,662.25 | 1,251.29 |

| Reserves and Surplus | 13,271.90 | 11,366.04 | 9,831.06 |

| Total Borrowings | 4,832.18 | 4,600.47 | 4,803.46 |

| Total Liabilities | 10,653.18 | 9,047.36 | 8,960.98 |

Financial Status of BVG India Limited

SWOT Analysis of BVG India IPO

Strength and Opportunities

- Leading integrated facility management (IFM) services provider in India.

- Diverse and prestigious client base across private and government sectors.

- Comprehensive portfolio of services spanning soft, hard, and specialized verticals.

- Strong financial performance with robust revenue growth and higher-than-industry EBITDA margins.

- Experienced promoter and a dedicated, trained management team with low senior attrition.

- Differentiated 'solution pricing' business model rather than cost-plus.

- Pan-India operational footprint with extensive geographical reach.

- Longstanding client relationships evidenced by high retention rates and referrals.

- Early-mover advantage in emergency police and medical response services.

- Significant growth opportunities from government initiatives like Swachh Bharat, railway modernization, and healthcare expansion.

Risks and Threats

- High dependency on the Indian market with no international diversification.

- The business is working capital intensive due to the nature of operations.

- Intense competition from both organized players and unorganized local providers.

- Vulnerability to macroeconomic cycles affecting client spending on facility management.

- Potential for labour disputes and challenges in managing a large, dispersed workforce.

- Pressure on margins from rising labour costs and inflationary pressures.

- Dependence on key clients, with the top 10 contributing a significant portion of revenue.

- Regulatory changes and compliance requirements across multiple states and sectors.

- Execution risks associated with managing a large number of concurrent projects.

- Threats from new technological disruptions that could alter the service delivery model.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About BVG India Limited

BVG India Limited IPO Strengths

Leading Market Position in Integrated Facility Management

BVG India Limited has established itself as a leading integrated facility management services provider in India. The company operates across a comprehensive range of services, including soft services, hard services, and specialized offerings. This integrated approach, combined with a pan-India presence and a large, diverse client base, provides a significant competitive edge and a strong platform for sustained growth in the expanding Indian IFM market.

Diverse and Prestigious Client Base

BVG India Limited boasts a diverse clientele comprising well-known private corporations and prestigious central and state government establishments. This diversification across sectors such as industrial, transport infrastructure, healthcare, and government insulates the business from sector-specific downturns. The company’s high client retention rate and long-standing relationships, some spanning over two decades, are a testament to the trust and excellence embedded in its service delivery.

Differentiated and Profitable Business Model

BVG India Limited operates on a differentiated ‘solution pricing’ model, focusing on output-based and fixed billing contracts rather than the conventional cost-plus basis. This model allows the company to charge for the value added by its services and provides flexibility in resource management. This strategy has enabled BVG India to achieve EBITDA margins significantly higher than the industry average, demonstrating operational efficiency and superior pricing power.

Experienced Leadership and Scalable Operations

The company is driven by an experienced promoter, Mr. Hanmantrao Gaikwad, with over three decades of industry experience, supported by a dedicated and stable management team. BVG India Limited has also built a scalable operational framework supported by technology platforms for human capital and contract management. This strong leadership and institutional knowledge are crucial for navigating market dynamics and executing future growth strategies.

More About BVG India Limited

BVG India Limited is a powerhouse in the Indian facility management sector, having grown from its inception in 2004 to become a fully integrated service provider. The company’s operations are strategically divided into three core verticals, each catering to essential national needs.

Integrated Facility Management (IFM) Services

This is the largest vertical, contributing approximately 70% to the company’s revenue in Fiscal 2025. It offers a wide array of services:

- Soft Services: Housekeeping, security, manpower supply, and office support.

- Hard Services: Mechanical, electrical, and plumbing (MEP) maintenance, city cleaning, and infrastructure upkeep.

- Specialized Services: Catering, logistics management, fleet operations, and paint-shop cleaning.

Emergency Response Services (ERS)

BVG India is a pioneer in this segment, being the first company in India to be awarded a contract for emergency police response. Its ERS vertical includes:

- Emergency Medical Services: Operating equipped ambulances with trained medical personnel.

- Emergency Police Response: Managing fleet and call centers for police departments.

Environment and Sustainability Services (ESS)

This vertical focuses on creating and maintaining sustainable environments through:

- Agriculture, horticulture, and garden development.

- Solid waste management, handling over 3,000 metric tons of waste per day.

- Farm management services.

Pan-India Presence and Clientele

With 28 offices across 29 states and union territories, BVG India services a remarkable 1,190+ clients in IFM, 9 in ERS, and 49 in ESS. Its client roster includes blue-chip companies like Tata Motors, Skoda Volkswagen, Hyundai, ONGC, and NTPC, as well as prestigious government institutions like the Parliament House and the Supreme Court. The company’s ability to retain clients for over a decade and achieve a 100% retention rate in recent years underscores its service reliability and quality.

Operational Excellence and Technology

BVG India employs over 85,000 personnel and leverages technology to enhance efficiency. It uses platforms like ‘PeopleWorks’ for recruitment, ‘BVG Lens’ for worker lifecycle management, and an AI-enabled attendance solution. The company’s focus on quality is validated by multiple certifications, including ISO 9001, ISO 14001, and ISO 45001.

Industry Outlook

The Indian facility management market is poised for robust growth, driven by rapid urbanization, infrastructure development, and a strategic shift towards outsourcing non-core activities by businesses and government entities.

Market Size and Growth Trajectory

The outsourced facility management market in India is estimated to grow at a compelling CAGR of 14.0% from Fiscal 2025 to Fiscal 2030, reaching a projected value of ₹ 936.5 billion. This growth is fueled by increasing investments in end-user segments such as commercial offices, airports, railways, healthcare, and education.

Key Growth Drivers

- Government Initiatives: Programs like ‘Swachh Bharat Abhiyan’ (Clean India Mission), ‘Smart Cities Mission’, and the massive modernization of railways and airports are creating significant outsourcing opportunities for professional facility management companies.

- Infrastructure Development: India’s push for world-class infrastructure, including the expansion of metro rail networks (the third largest globally), privatization of airports, and the National Electric Bus Programme (NEBP), is a major demand driver.

- Sectoral Expansion:

- Healthcare & Education: Rising investments in hospital infrastructure and the need for specialized sanitation are boosting demand.

- Industrial & Consumer: The growth of the automobile, oil & gas, and FMCG sectors necessitates specialized facility management.

- BFSI & IT/ITeS: The expansion of banking services and office spaces continues to drive demand for IFM.

Specific Service Verticals

- Emergency Response Services (ERS): The ERS market is anticipated to grow at a CAGR of 16.3% to ₹ 124.08 billion by Fiscal 2030, supported by increased government spending under the National Health Mission.

- Corporate Catering: This market is estimated to grow at a CAGR of 22.5% to ₹ 579.29 billion by Fiscal 2030, driven by changing lifestyles and growth in the office segment.

- Electric Bus Operations & Maintenance: The market for O&M of electric buses is expected to surge at a CAGR of 46.8% to ₹ 113.69 billion by Fiscal 2030.

How Will BVG India Limited Benefit

- Benefit from the overall expansion of the outsourced facility management market, projected to grow at 14% CAGR, providing a larger addressable market for its core IFM services.

- Capitalize on massive government spending on infrastructure modernization, including railways, metros, and airports, where BVG already has a established track record and existing contracts.

- Leverage its early-mover advantage and unique capabilities in the high-growth Emergency Response Services (ERS) sector, which is set to grow at 16.3% CAGR, by bidding for new state-level projects.

- Expand its Environment and Sustainability Services (ESS) vertical by securing more municipal solid waste management contracts, driven by the Swachh Bharat Mission’s focus on scientific waste management in over 4,000 towns.

- Grow its recently launched food services business by cross-selling to its vast existing client base across sectors like PSUs, education, and healthcare, tapping into the corporate catering market growing at 22.5% CAGR.

- Capture opportunities in the operation and maintenance of electric buses, a market growing at 46.8% CAGR, by leveraging its existing experience of managing over 1,150 EV buses across six cities.

- Deepen its penetration in the industrial and consumer sector, particularly in automotive and oil & gas, by offering specialized services like paint-shop cleaning and retail fuel outlet maintenance to a growing industrial base.

Peer Group Comparison

| Name of the Company | Revenue (₹ in million) | Face value (₹) | P/E Ratio (x) | EPS (Basic) (₹) | RoNW (%) | NAV (₹) |

| BVG India Ltd. | 33,017.97 | 2.00 | [●] | 15.96 | 15.18% | 102.48 |

| Peer Group | ||||||

| Updater Services | 27,360.63 | 10.00 | 13.83 | 17.74 | 12.36% | 143.38 |

| SIS Ltd. | 1,31,890.37 | 5.00 | 26.17 | 0.82 | 0.49% | 164.58 |

| Bluspring Enterprises | 34,835.72 | 10.00 | – | (11.55) | – | N.M. |

Key Strategies for BVG India Limited

Sector-Wise Focus to Capitalize on Industry Opportunities

BVG India Limited will strategically shift from a geography-based to a sector-focused approach to drive growth. This involves targeting specific high-potential sectors like oil & gas, transport infrastructure (railways, metros, airports), and healthcare by leveraging its existing expertise and relationships. The company aims to cross-sell its comprehensive service portfolio within these sectors, capitalizing on government initiatives and infrastructure expansion to secure large, long-term contracts and increase its market share organically.

Pan-India Expansion and Service Cross-Selling

The company intends to aggressively target pan-India and regional contracts, particularly in tier 2 and tier 3 cities, by leveraging its extensive operational footprint. BVG India Limited will focus on cross-selling its diverse service offerings—from soft and hard services to specialized catering and ESS—to its existing vast client base. This strategy aims to increase wallet share per client and position the company as a preferred one-stop-shop for all facility management needs in a market shifting towards integrated service models.

Enhancing Operational Efficiency and Margins

BVG India Limited will continue its focus on improving operational efficiency and profitability through increased digitization and process streamlining. This includes expanding the use of its proprietary CAFM solution ‘BVG Index’, AI-based attendance systems, and SAP HANA for better database management. The company will also pursue higher-margin opportunities in technical services, ERS, and waste management, while implementing best practices to reduce support function costs and optimize resource deployment across its projects.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On BVG India Limited IPO

How can I apply for BVG India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size and price band for the BVG India IPO?

The lot size and price band for the BVG India IPO will be announced closer to the IPO opening date.

What is the objective of the BVG India IPO?

The net proceeds will be used for repayment of borrowings and for general corporate purposes.

Which exchanges will BVG India shares be listed on ?

The equity shares of BVG India Limited will be listed on both the BSE and NSE.

Who are the promoters of BVG India Limited?

The promoter of BVG India Limited is Hanmantrao Gaikwad.