- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Caliber Mining and Logistics IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Caliber Mining and Logistics IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Caliber Mining and Logistics Limited

Caliber Mining and Logistics Limited (CMLL) ranks among the top 10 mining operators, specialising in overburden removal, coal extraction, and coal logistics as an integrated service provider. According to the CRISIL Report (December 2024), CMLL held a 3.5% market share in the contract mining sector in Fiscal 2024, up from less than 1% in Fiscal 2020. The company operates a robust fleet of 1,473 vehicles, including 600 tippers, 46 loaders, 96 excavators, and 447 tip trailers as of October 31, 2024.

CMLL’s revenue from operations grew at a CAGR of 60.05%, increasing from ₹37,208.38 lakhs in Fiscal 2022 to ₹95,311.60 lakhs in Fiscal 2024. The company offers end-to-end services such as coal extraction, overburden removal, transportation, and coordination of rail logistics, serving major customers like Western Coalfields Limited (WCL) and Northern Coalfields Limited (NCL). Operations span Maharashtra, Chhattisgarh, and Madhya Pradesh.

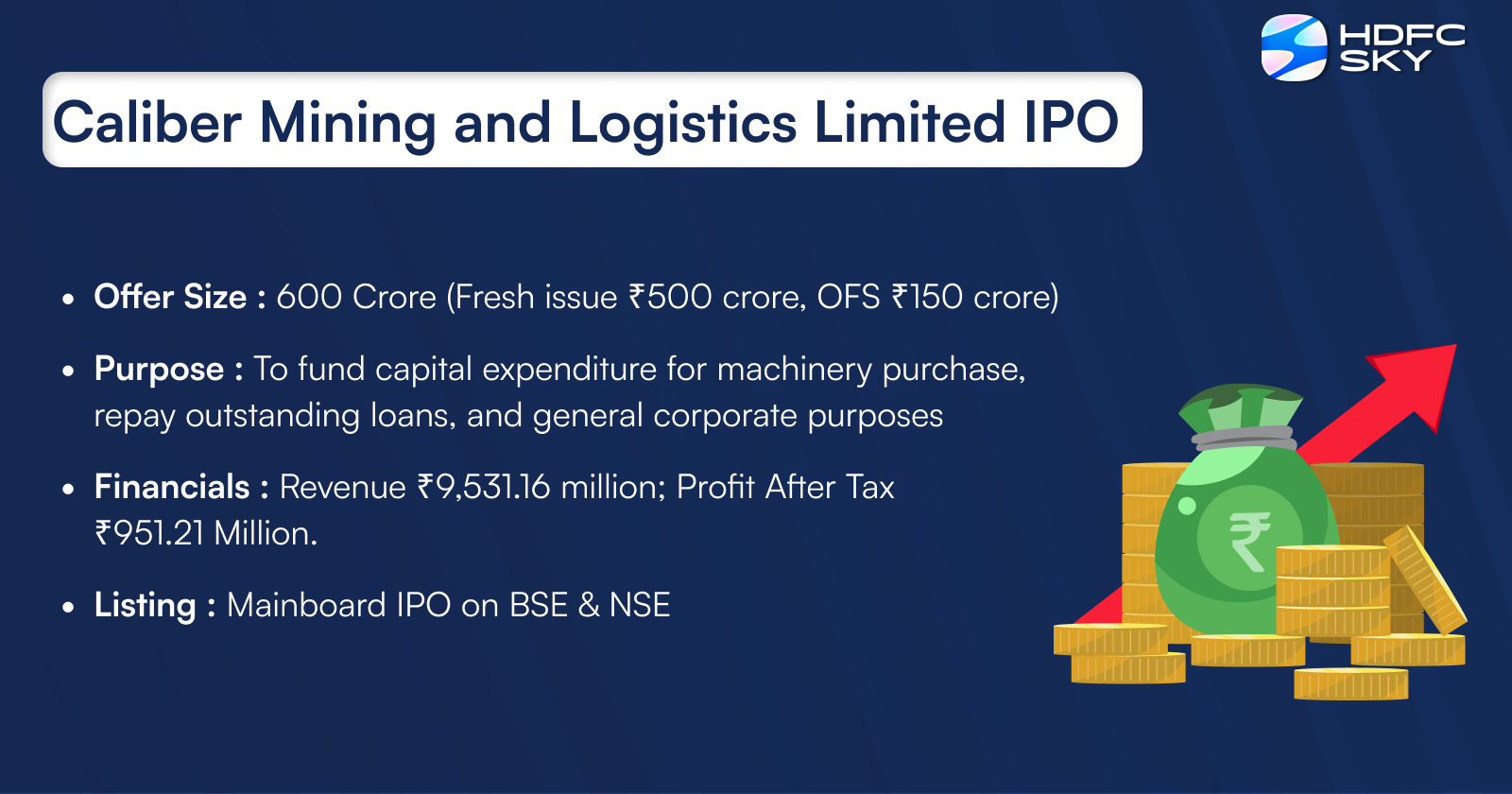

Caliber Mining and Logistics Limited IPO Overview

Caliber Mining IPO is a bookbuilding issue of ₹600.00 crore, consisting of a fresh issue of ₹500.00 crore and an offer for sale of ₹100.00 crore. The IPO dates, allotment date, and price bands are yet to be announced. DAM Capital Advisors Ltd (formerly IDFC Securities Ltd) is the book-running lead manager, and KFin Technologies Ltd is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹10 per share. As per the Draft Red Herring Prospectus (DRHP), the total issue size, lot size, and exact price band are yet to be disclosed. The company’s pre-issue shareholding stands at 5,35,83,333 shares, with promoters Mohit Satishkumar Chadda, Anuj Krishanlal Chadda, Manish Krishanlal Chadda, Rahul Roshanlal Chadda, and Priya Anuj Chadda holding 92.66% pre-issue. The DRHP was filed with SEBI on January 9, 2025.

Caliber Mining and Logistics Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹500 crore

Offer for Sale (OFS): ₹100 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,35,83,333 shares |

| Shareholding post -issue | TBA |

Caliber Mining and Logistics Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Caliber Mining and Logistics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Caliber Mining and Logistics Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 18.65 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 32.27% |

| Net Asset Value (NAV) | 57.81 |

| Return on Equity | 38.47% |

| Return on Capital Employed (ROCE) | 16.79% |

| EBITDA Margin | 25.41% |

| PAT Margin | 9.98% |

| Debt to Equity Ratio | 2.45 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure for purchase of machinery for contract requirements | 2000 |

| Repayment and / or prepayment, in part or in full, of certain outstanding loans | 1750 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

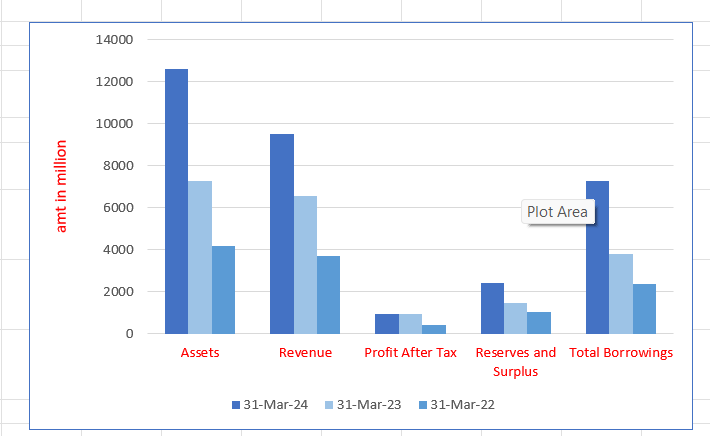

Caliber Mining and Logistics Limited Financials (in million)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 12599.39 | 7298.07 | 4176.03 |

| Revenue | 9531.16 | 6550.37 | 3720.84 |

| Profit After Tax | 951.21 | 931.95 | 443.09 |

| Reserves and Surplus | 2438.08 | 1486.93 | 1034.99 |

| Total Borrowings | 7255.98 | 3794.74 | 2395.95 |

| Total Liabilities | 9651.26 | 5301.13 | 3111.04 |

Financial Status of Caliber Mining and Logistics Limited

SWOT Analysis of Caliber Mining and Logistics IPO

Strength and Opportunities

- Extensive industry experience of over 35 years, establishing a strong market presence and credibility.

- Ranked among the top 10 mining operators in India, showcasing competitive advantage and industry recognition.

- Integrated service offerings, including coal extraction, overburden removal, and logistics, providing end-to-end solutions.

- Robust fleet of 1,473 vehicles, enhancing operational capacity and efficiency in project execution.

- Significant revenue growth with a CAGR of 60.05% from Fiscal 2022 to Fiscal 2024, indicating financial robustness.

- Strong leadership team with diverse expertise in operations, finance, logistics, and equipment management.

- Opportunities for expansion into other mineral sectors beyond coal, diversifying revenue streams.

- Potential to leverage technological advancements for operational efficiency and cost reduction.

- Growing demand for coal in India presents opportunities for increased contracts and long-term partnerships.

- Strategic location in Central India allows easy access to major mining sites and client locations.

- Commitment to corporate social responsibility enhances community relations and brand image.

Risks and Threats

- Dependence on a limited number of large clients, particularly subsidiaries of Coal India Limited, which may affect revenue stability.

- Fluctuations in coal demand due to economic cycles can impact operational continuity and profitability.

- Regulatory changes in mining and environmental policies could impose operational constraints and additional compliance costs.

- Environmental concerns and sustainability issues may lead to increased scrutiny and operational challenges.

- High operational costs associated with fleet maintenance and fuel can affect profit margins.

- Competition from other established mining operators may lead to price wars and reduced market share.

- Dependence on government policies and contracts exposes the company to political and bureaucratic risks.

- Delays in project approvals and clearances can lead to financial losses and project overruns.

- Volatility in global fuel prices can increase transportation costs, affecting overall profitability.

- Challenges in scaling operations rapidly to meet increasing demand without compromising quality and safety.

- Potential labor disputes and workforce management issues can disrupt operations and lead to financial setbacks.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Caliber Mining and Logistics Limited IPO

Caliber Mining and Logistics Limited ranks among the top 10 mining operators in India, excelling in overburden removal, coal extraction, and logistics as an integrated service provider. According to the CRISIL Report (December 2024), the company achieved a robust growth trajectory, with operational revenue increasing at a CAGR of 60.05%, from ₹37,208.38 lakhs in Fiscal 2022 to ₹95,311.60 lakhs in Fiscal 2024.

Key Highlights

- Fleet Strength

- Total vehicles: 1,473 (as of October 31, 2024)

- Key equipment includes:

- 600 tippers

- 46 loaders

- 96 excavators

- 447 tip trailers

- Services Provided

- Coal mining and overburden removal

- Coal loading and unloading

- Road and rail logistics

- Client Base

- Western Coalfields Limited (WCL)

- Northern Coalfields Limited (NCL)

Operational Reach

- Geographic Coverage

- Maharashtra: Ballarpur and Chandrapur areas

- Madhya Pradesh: Singrauli

- Chhattisgarh: Parsa

- Mining Sites and Activities

Caliber operates at multiple sites, including:

- Dhoptala OCM (Maharashtra): Coal extraction and overburden removal for WCL

- Jayant Open Cast Project (Madhya Pradesh): Overburden removal for NCL

- Parsa East Mine (Chhattisgarh): Overburden removal for Adani Power

Business Divisions

- Coal Mining Services

- Extraction and overburden removal under contract.

- Logistics Operations

- Handling coal and iron transportation.

- Rake Loading

- Loading coal onto rail rakes using specialised machinery.

- Rail Coordination

- Ensuring seamless coal transportation through Indian Railways.

- Coal Trading

- Facilitating buying and selling of coal.

Growth and Market Share

- Market Position

- Market share in contract mining increased from less than 1% in Fiscal 2020 to 3.5% in Fiscal 2024 (Source: CRISIL Report, December 2024).

- Future Projections

- India’s coal demand, as per CRISIL Research, is expected to grow at a CAGR of 3.5%, reaching 1,635 MT by Fiscal 2035.

Caliber Mining and Logistics Limited continues to establish itself as a leader in the industry through innovation, operational efficiency, and a client-centric approach.

Industry Outlook

Indian Coal Market Overview

- India is the second-largest coal producer globally, with an 11% production share and 13% consumption share in 2023.

- Coal production in India grew at a CAGR of 5.5% between 2020 and 2023, reaching 9,096 MT.

- India holds the fifth-largest coal reserves globally, with ~111,052 MT, accounting for 10% of the world’s proven reserves.

- Coal-based thermal power plants contribute to ~75% of India’s electricity generation, driving substantial demand for coal.

- Domestic coal production in India is dominated by CIL (78%) and SCCL (7%), supplying ~85% of total domestic coal.

- India consumed 13% of the world’s coal in 2023, more than twice its 6% share in global energy consumption.

- Global coal production rebounded to 9,096 MT in 2023, with India and China driving both production and consumption growth.

- Asia-Pacific dominated global coal production, with a 79% share in 2023, highlighting India and China’s pivotal roles.

- India’s coal reserves are expected to last for 75 years, based on current production rates and reserve estimates.

- Coal remains essential for power, steel, cement, sponge iron, and paper industries, sustaining India’s industrial growth.

- The reliance on imports for specific needs, such as steel and cement, indicates opportunities for production expansion.

Key Drivers of Coal Demand

- Rising power utilities demand fueled by population growth, urbanization, and industrialization ensures coal’s critical role in electricity generation, particularly in developing regions.

- Government-driven infrastructure projects boost coal demand in steel, aluminium, and cement industries, which heavily rely on coal for energy and raw materials.

- Limited alternatives to coal in captive power plants underscore its importance in industrial power generation, especially for aluminium, iron, steel, and cement production.

Government Initiatives for the Coal Sector

Vision 2030

- The Ministry of Coal (MoC) aims to produce 1.5 billion tonnes of coal by Fiscal 2030, with a focus on matching infrastructure development with production growth.

Vision 2047

- Coal is projected to remain a key energy source for India’s energy security.

- Coal India Limited (CIL) targets 1 billion tonnes of production by Fiscal 2027 and 1.3 billion tonnes by Fiscal 2035 to meet domestic demand.

Underground Vision Plan

- CIL plans to achieve 100 million tonnes of coal production by Fiscal 2030 from underground mines using Mass Production Technology (MPT).

Commercial Coal Mining

- The government allowed private players to engage in unrestricted coal mining and sales in Fiscal 2020.

- Nine tranches of commercial coal auctions have been completed, with further tranches underway to achieve economic growth targets.

Indian Mining Structural Reforms 2021

- The Mines and Minerals (Development and Regulation) Amendment Act, 2021, encourages private sector participation, increases domestic coal production, and reduces reliance on imports.

Mission Coking Coal

- Part of the Atmanirbhar Bharat initiative, this mission aims to achieve 129 million tonnes of domestic coking coal production by 2030.

Reopening of Discontinued Mines

- Mines with untapped reserves are being reopened under a revenue-sharing model, with 19 out of 34 abandoned mines reallocated by Fiscal 2024.

Coal Linkages for the Power Sector

- The SHAKTI Scheme facilitates transparent allocation of coal to power plants through auction-/tariff-based bidding, ensuring stable coal supplies.

Single Window for E-Auction

- Introduced in 2022, this mechanism consolidates coal e-auction windows, increasing efficiency and reducing market distortions.

Amendment to NCDP

- Enhances transparent sales of coal from closed or abandoned mines and promotes eco-friendly initiatives such as coal bed methane extraction and carbon capture.

Market Drivers and Opportunities

- Economic Growth: Rising power demand due to economic expansion, urbanisation, and industrialisation.

- Per Capita Energy Consumption: Increased electrification and appliance use, though still below global averages.

- Manufacturing Growth: Steel, aluminium, and cement production heavily rely on coal.

- Infrastructure Development: Coal remains critical for steel and cement production, vital for infrastructure growth.

Estimated Coal and Overburden (OB) Production by Fiscal 2030

Key Highlights

- Contract Mining Market Potential:

- Raw coal production through contract mining is expected to reach ~857 MT by Fiscal 2030.

- This accounts for a significant portion of the total projected raw coal production of 1,533 MT, including departmental mining.

- Overburden (OB) removal via contract mining is projected to grow to ~4,024 Mm³ by Fiscal 2030, out of a total of 5,195 Mm³, including departmental operations.

Overview of India’s Coal Logistics Industry

Infrastructure is key to India’s economic growth. The government’s focus on transportation, energy, and digital infrastructure, supported by reforms, has led to a Rs 11.11 trillion budget for 2024-25. Logistics, especially coal transport, plays a vital role in this growth, with roads and railways handling most freight.

The logistics industry is projected to grow at a CAGR of 10.2% from Fiscal 2024 to 2030, driven by rising domestic demand for minerals. The industry’s value, estimated at Rs 13,520,400 lakh in Fiscal 2024, is expected to reach Rs 24,212,400 lakh by Fiscal 2030. Coal will remain the dominant contributor, holding a 74% share in Fiscal 2030, followed by iron ore at 12%, with other minerals making up the remaining 14%.

How Will Caliber Mining and Logistics Limited Benefit?

- Coal Production Growth

With India’s increasing coal production target, CMLL’s role in contract mining will significantly expand, driving higher revenues from coal extraction and overburden removal, aligning with government initiatives and sector demand.

- Government Initiatives

CMLL stands to benefit from reforms like the Mines and Minerals Amendment Act and Vision 2030, which encourage private sector participation. These measures will boost CMLL’s ability to secure new contracts and enhance its market presence, fostering long-term growth.

- Infrastructure Development

Government investment in logistics infrastructure, particularly in coal transport, will support CMLL’s operations, improving efficiency and reducing costs in coal delivery. Expanding rail and road connectivity aligns with the company’s strategic goals of scaling operations across multiple regions.

- Coal Demand from Industries

As demand for coal continues to rise, especially in power, steel, and cement sectors, CMLL’s integrated services in mining, logistics, and coal trading will help capture a larger market share, especially in areas like Odisha and Jharkhand where production is growing.

- Expansion into New Regions

CMLL’s ongoing expansion into high-production areas like Odisha and Jharkhand will increase its footprint in India’s coal logistics market. This geographic diversification strengthens its position to cater to rising regional demand for coal and OB removal services.

- Private Sector Participation

The liberalisation of the coal sector through commercial mining and auctions creates an opportunity for CMLL to acquire more private-sector contracts, diversifying its revenue sources and reducing reliance on state-owned companies for its coal mining operations.

- Sustainability Focus

The government’s focus on eco-friendly initiatives, such as carbon capture and coal bed methane extraction, offers CMLL opportunities to implement green technologies. This aligns with environmental policies and positions the company as a sustainable player in the mining industry.

- Revenue Security

With a strong base of government clients, including CIL subsidiaries, CMLL enjoys stable long-term contracts. This ensures a reliable revenue stream, mitigating risks associated with market fluctuations while securing steady cash flows for reinvestment and growth.

Peer Group Comparison

| Name of the Company | Face Value per Share (₹) | P/E (Basic) | Revenue

(₹ Lakhs) |

EPS (Basic) (₹) | RoNW (%) | NAV

(₹) |

| Caliber Mining and Logistics Ltd | 10 | N.A. | 95,311.60 | 18.65 | 32.27% | 57.81 |

| Power Mech Projects Ltd | 10 | 15.56 | 4,20,665.00 | 162.13 | 13.51% | 1,162.69 |

| NCC Ltd | 2 | 5.02 | 20,84,496.00 | 11.32 | 11.15% | 105.75 |

| Sindhu Trade Links Ltd | 15 | 9.92 | 1,68,606.46 | 0.37 | 4.73% | 9.70 |

| Dilip Buildcon Ltd | 10 | 33.40 | 12,01,190.43 | 13.75 | 4.60% | 298.85 |

Key Insights

- Face Value per Share: Caliber Mining and Logistics Ltd has a face value of ₹10 per share, aligning with the industry standard. Power Mech Projects Ltd, NCC Ltd, and Dilip Buildcon Ltd also have a ₹10 face value, while Sindhu Trade Links Ltd has a slightly higher ₹15. The face value is typically used for accounting and dividend purposes, indicating a similar starting point for most of these companies.

- P/E (Basic): The Price-to-Earnings (P/E) ratio for Caliber Mining and Logistics Ltd is not available (N.A.), suggesting a lack of earnings or data to calculate it. Power Mech Projects Ltd’s P/E is 15.56, indicating moderate profitability, while NCC Ltd’s P/E of 5.02 reflects lower market expectations. Sindhu Trade Links Ltd’s 9.92 and Dilip Buildcon Ltd’s 33.40 indicate varying levels of investor confidence, with Dilip Buildcon’s higher ratio suggesting a premium valuation despite lower profitability.

- Revenue: Caliber Mining and Logistics Ltd has a revenue of ₹95,311.60 lakhs, which is significant but smaller than Power Mech Projects Ltd’s ₹4,20,665.00 lakhs, reflecting its larger scale. NCC Ltd also reports robust revenue of ₹20,84,496.00 lakhs. Sindhu Trade Links Ltd’s revenue of ₹1,68,606.46 lakhs is relatively modest compared to its peers, while Dilip Buildcon Ltd’s ₹12,01,190.43 lakhs points to considerable business size, though lower than Power Mech.

- EPS: Caliber Mining and Logistics Ltd has a high Earnings Per Share (EPS) of ₹18.65, indicating strong profitability per share. Power Mech Projects Ltd stands out with an exceptional EPS of ₹162.13, reflecting its superior earnings. NCC Ltd’s EPS of ₹11.32, though lower, still shows profitability. Sindhu Trade Links Ltd’s modest EPS of ₹0.37 is a concern, while Dilip Buildcon Ltd’s ₹13.75 is a solid, but not exceptional, performance.

- RoNW: Caliber Mining and Logistics Ltd leads with a Return on Net Worth (RoNW) of 32.27%, showcasing effective utilization of equity capital. Power Mech Projects Ltd follows with a RoNW of 13.51%, which is decent. NCC Ltd’s RoNW of 11.15% reflects moderate efficiency, while Sindhu Trade Links Ltd and Dilip Buildcon Ltd report lower RoNW figures, indicating less efficient use of equity capital, especially Dilip Buildcon Ltd’s 4.60%.

- NAV: Caliber Mining and Logistics Ltd has a Net Asset Value (NAV) per share of ₹57.81, providing a decent buffer for investors. Power Mech Projects Ltd’s NAV of ₹1,162.69 per share is exceptionally high, reflecting significant asset backing. NCC Ltd has an NAV of ₹105.75, indicating considerable asset value. Sindhu Trade Links Ltd’s ₹9.70 NAV is the lowest, suggesting limited asset backing, while Dilip Buildcon Ltd’s ₹298.85 indicates stronger asset support compared to some others in the group.

Caliber Mining and Logistics Limited IPO Strengths

- Fast-Growing Integrated Coal Mining and Logistics Provider

Caliber Mining and Logistics Limited has positioned itself as one of the top 10 mining operators in India, offering integrated services encompassing coal extraction, overburden removal, and logistics. By combining these services, the company has become a comprehensive solution provider in the coal industry. As per the CRISIL Report (December 2024), it has experienced rapid growth, improving its market share and revenue with a CAGR of 60.05% from ₹37,208.38 lakhs in Fiscal 2022 to ₹95,311.60 lakhs in Fiscal 2024.

- Robust Fleet and Asset Base

The company boasts a fleet of 1,473 vehicles, including 100 leased trucks, equipment, and machines, making it a prominent commercial fleet owner in central India. With equipment ranging from mining tippers to excavators and loaders, this extensive fleet supports the company’s coal mining and logistics operations. This significant asset base enables Caliber Mining and Logistics Limited to maintain efficient operations and ensure future growth within the mining contracting industry.

- Impressive Market Share Growth

In just a few years, Caliber Mining and Logistics Limited has made significant strides in the market, increasing its share of the contractual mining market from less than 1% in Fiscal 2020 to 3.5% in Fiscal 2024. This remarkable growth in market share, as highlighted by the CRISIL Report (December 2024), demonstrates the company’s ability to capture value in the highly competitive mining sector through its high-quality services and operational efficiency.

- Competitive Advantage Through Unique Service Offering

Caliber Mining and Logistics Limited has established a strong competitive advantage by offering integrated coal extraction, overburden removal, and logistics services at scale. This unique combination of services provides the company with excellent profit margins and return on equity, as confirmed by CRISIL Research. The company’s extensive capabilities and its ability to operate at such a scale in the coal mining sector allow it to stand out in the marketplace, providing a strong foundation for future expansion.

- Strong Client Relationships and Repeat Business

The company enjoys long-standing relationships with key clients, such as Coal India subsidiaries, WCL, and NCL, who consistently provide repeat business. In the fiscal periods ended June 30, 2024, and Fiscal 2024, Caliber Mining and Logistics derived more than 60% of its revenue from repeat customers. This loyalty is a testament to the company’s commitment to delivering exceptional service, earning industry recognition and awards, including accolades from Western Coalfields Limited and Tata Hitachi.

- Operational Efficiencies Driving Growth

Caliber Mining and Logistics has consistently improved its operational efficiencies, enabling it to offer competitive rates on new tenders. By focusing on reducing key operational costs, such as high-speed diesel and equipment maintenance, the company has positioned itself to maintain healthy profit margins. The company’s strategic operations within a 35km radius help to reduce both transportation and fuel costs, leading to significant savings. This efficient approach has been key to its growth and ability to secure new contracts.

- Strategic Focus on Cost Savings

The company has strategically minimized its high operational expenses by focusing on fuel procurement and maintenance. It purchases diesel in advance directly from local refineries, securing favorable rates and reducing vulnerability to fuel price fluctuations. Caliber Mining and Logistics has also invested in in-house maintenance and a comprehensive fleet servicing infrastructure, allowing for reduced maintenance costs. These cost-saving measures contribute to the company’s ability to maintain competitive pricing and profitable operations.

- Growing Market Presence and Customer Base

Caliber Mining and Logistics Limited has significantly expanded its customer base, securing key contracts with major players like Coal India subsidiaries. The company’s strong reputation, coupled with excellent service delivery, has facilitated its growth in both the mining and logistics sectors. As a result, the company’s revenue from operations has steadily increased, with repeat business playing a key role in its sustained success and market presence.

Key Insights from Financial Performance

- Assets: The company’s assets have shown substantial growth from ₹4,176.03 million in March 2022 to ₹12,599.39 million in March 2024. This indicates a strong expansion of the company’s resource base, enhancing operational and investment capabilities.

- Revenue: Revenue increased significantly, reaching ₹9,531.16 million in March 2024 compared to ₹3,720.84 million in March 2022. This steady growth demonstrates robust business performance, driven by effective strategies and rising customer demand.

- Profit After Tax: Profit after tax rose from ₹443.09 million in March 2022 to ₹951.21 million in March 2024. This reflects improved operational efficiency and cost management, contributing to higher net earnings over the period.

- Reserves and Surplus: Reserves and surplus have grown consistently, increasing from ₹1,034.99 million in March 2022 to ₹2,438.08 million in March 2024. This indicates a focus on building financial strength through reinvestment and profit retention.

- Total Borrowings: Borrowings escalated from ₹2,395.95 million in March 2022 to ₹7,255.98 million in March 2024. While this suggests increased debt to finance growth or expansion, it may also raise concerns about financial leverage.

- Total Liabilities: Total liabilities surged from ₹3,111.04 million in March 2022 to ₹9,651.26 million in March 2024. This reflects the company’s growing financial commitments, mainly from borrowings, which could impact long-term liquidity management.

Other Financial Details

- Purchases of stock in trade: Purchases of stock in trade increased significantly from ₹48.77 crore in 2022 to ₹56.92 crore in 2023, but dropped drastically to ₹4.69 crore in 2024, indicating substantial inventory management changes.

- OB removal, excavation, and transportation expenses: OB removal, excavation, and transportation expenses decreased from ₹70.21 crore in 2023 to ₹61.44 crore in 2024, reflecting possible cost-cutting or more efficient operations compared to the previous year’s expenses.

- Power & fuel expenses: Power and fuel expenses saw a substantial increase from ₹115.19 crore in 2022 to ₹252.01 crore in 2023, and further surged to ₹427.76 crore in 2024, showing a significant rise in energy costs.

- Employee Benefits Expenses: Employee benefits expenses sharply increased from ₹25.24 crore in 2022 to ₹49.67 crore in 2023, and further rose to ₹103.69 crore in 2024, indicating higher workforce-related costs, possibly due to growth.

- Finance Costs: Finance costs rose significantly from ₹9.98 crore in 2022 to ₹27.82 crore in 2023, and ₹51.45 crore in 2024, suggesting increased borrowing or higher interest rates during the period.

- Depreciation and Amortization Expense: Depreciation and amortization expenses increased sharply from ₹13.5 crore in 2022 to ₹33.94 crore in 2023 and ₹68.1 crore in 2024, reflecting higher asset depreciation or increased capital expenditure.

- Other Expenses: Other expenses more than doubled from ₹27.26 crore in 2022 to ₹55.61 crore in 2023, and ₹105.56 crore in 2024, highlighting a sharp rise in operational or miscellaneous costs over the years.

Key Strategies for Caliber Mining and Logistics Limited

- Focus on Cost Optimisation and Control

Caliber Mining and Logistics Limited emphasises cost optimisation through investments in efficient machinery and ERP solutions for streamlined operations. By procuring fuel at favourable rates, integrating mining and logistics, and enhancing management practices, the company reduces costs. Additionally, it aims to lower borrowings on equipment and machinery, improving profitability while maintaining a competitive edge in mining and logistics industries.

- Operational Excellence and Customer Service

Caliber Mining and Logistics Limited prioritises operational excellence through advanced equipment utilisation, process optimisation, and ERP-based vehicle tracking. The company ensures minimal downtime via robust maintenance facilities and skilled technical teams. Continuous workforce training, strategic supplier partnerships, and a focus on safety enable the delivery of superior customer service. These measures help improve productivity and maintain Caliber’s leadership in mining and logistics operations.

- Expansion into Iron Ore Logistics

Caliber Mining and Logistics Limited leverages its coal logistics expertise to expand into iron ore transport. With a large fleet, access to low-cost diesel, and strong maintenance capabilities, the company ensures efficient operations. It began iron ore logistics in Fiscal 2023, achieving significant growth by 2024, and plans to further diversify its customer base, targeting new opportunities in the evolving mineral transport sector.

- Geographical Expansion in Mining

Caliber Mining and Logistics Limited seeks to extend its mining footprint beyond Maharashtra, Madhya Pradesh, and Chhattisgarh into Odisha and Jharkhand. By participating in tenders and leveraging regional demand, the company aligns with national coal needs. Its strategic expansion plans aim to strengthen its presence in India’s key mining regions, contributing to sustained business growth while meeting the country’s energy supply demands.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the purpose of Caliber Mining and Logistics Limited's IPO?

The IPO aims to raise funds for repaying borrowings, purchasing machinery, and supporting general corporate purposes to fuel the company’s growth and expansion.

How much capital is Caliber Mining and Logistics Limited seeking to raise through the IPO?

The company intends to raise approximately ₹600 crore, consisting of a ₹500 crore fresh issue and a ₹100 crore offer for sale.

Who is the merchant banker managing Caliber Mining and Logistics Limited's IPO?

The merchant banker managing Caliber Mining and Logistics Limited’s IPO is Dam Capital Advisors Limited, formerly known as IDFC Securities Limited.

What is the face value of the shares in Caliber Mining and Logistics Limited's IPO?

The face value of each share in Caliber Mining and Logistics Limited’s IPO is ₹10, providing investors with a clear understanding of the underlying share value.

What is the allocation of shares for different investor categories in the IPO?

Details regarding the allocation of shares for various investor categories, including retail and institutional investors, will be disclosed once the final prospectus is made available.

How can investors apply for Caliber Mining and Logistics Limited's IPO?

Investors can apply for the IPO using UPI or ASBA through their bank accounts, making the application process straightforward and accessible.

When is Caliber Mining and Logistics Limited's IPO expected to open?

The IPO’s opening date has not been announced yet. Specific timelines for the offer will be disclosed in the final prospectus and other official communications.